EPF DIVIDEND, EPF

|

|

Jan 4 2024, 02:53 PM Jan 4 2024, 02:53 PM

Return to original view | Post

#1

|

Senior Member

8,363 posts Joined: Feb 2014 |

CommodoreAmiga liked this post

|

|

|

|

|

|

Jan 5 2024, 03:13 PM Jan 5 2024, 03:13 PM

Return to original view | Post

#2

|

Senior Member

8,363 posts Joined: Feb 2014 |

QUOTE(batman1172 @ Jan 5 2024, 09:08 AM) The returns from UT include or exclude management fees? Pick the UT that is passively managed? I’m not sure the Malaysian market have or not that’s why ended up with EPF QUOTE(prophetjul @ Jan 5 2024, 09:10 AM) Exactly what Suraya also tweeted. |

|

|

Jul 3 2024, 12:12 PM Jul 3 2024, 12:12 PM

Return to original view | Post

#3

|

Senior Member

8,363 posts Joined: Feb 2014 |

QUOTE 1. Having RM1 mil in EPF has huge benefits. If you achieve it before 55, EPF allows you to withdraw any excess savings anytime. This makes it a flexible fund that is 2-3 times better compared to traditional fixed deposits. 2. EPF’s historic returns are impressive. It averaged 5.52% per year in the past 5 years. With RM1 mil, you’ll receive RM55,000 in dividends, or RM4,583 per month. This is more than enough to retire right now according to the Belanjawanku Study. 3. How difficult is it to achieve RM1 mil, really? If you started working at 22, you’ll hit this milestone by 55 if you: • Earn a salary of RM2,400, and • Manually save RM400 every month 4. Your manual savings is not the only factor helping you achieve RM1 mil. • Your mandatory EPF contributions: 11%. • Employer’s mandatory EPF contributions: 13%. Combined with your manual savings, you will accumulate RM386,496 in 33 years. 5. The remaining RM700k is interest earned. Read that again. It's in those final years that you really see your funds start to compound. So start saving as soon as possible, no matter how small the amount. 6. “But I’m not so young anymore. How??” The table below shows the monthly contributions you require to achieve RM1 mil by 55. If you have higher savings than the average, and, your monthly contributions are within or exceed the range, Congratulations! 🎉 You will most certainly hit RM1 mil by 55. |

|

|

Nov 15 2024, 12:52 PM Nov 15 2024, 12:52 PM

Return to original view | Post

#4

|

Senior Member

8,363 posts Joined: Feb 2014 |

Did you know that at age 50, you can withdraw a portion of your Employees Provident Fund (EPF) savings, even though 75 per cent remains reserved for retirement?

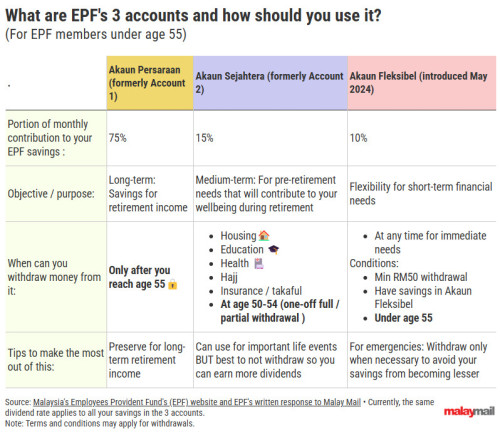

So, what do these numbers mean, and how does it work? First, you need to know that your EPF savings are grouped into three accounts: Akaun Persaraan (retirement account), Akaun Sejahtera (wellbeing account), and Akaun Fleksibel (flexible account). This means: 75 per cent of your EPF savings will be in Akaun Persaraan (locked until age 55 for retirement), 15 per cent in Akaun Sejahtera (locked until age 50 for a one-time withdrawal OR pre-retirement needs such as housing and education before you reach age 50), 10 per cent in Akaun Fleksibel (you can withdraw the money at any time for emergencies). Let it grow! If you can, don’t make any withdrawals So, you’ve reached the 50-year milestone — Happy Birthday! Now the question is, should you withdraw the full amount or just a portion of your Akaun Sejahtera savings? How would you decide? (Remember, you can only apply one time during age 50 to 54 to withdraw from your Akaun Sejahtera.) Here’s what EPF told Malay Mail: When making this decision, EPF said there are two aspects to consider, namely Akaun Sejahtera’s purpose, and a 50-year-old individual’s financial needs. “Akaun Sejahtera is designed to support the life cycle needs of individuals, contributing to their wellbeing during retirement. “At the age of 50, if an individual is still employed, earning a steady income and has no immediate financial obligations requiring a withdrawal from Akaun Sejahtera, it is advisable to leave the savings untouched for retirement. “These savings in the Akaun Sejahtera will continue to grow through dividends and benefit from the power of compounding,” it said. Tips to get the biggest benefits from the three accounts in your EPF savings EPF explained that the three accounts are designed to help EPF members plan effectively for retirement by balancing their short-, medium- and long-term financial needs. To recap, the purpose of the three accounts are: Akaun Persaraan (to accumulate savings that will serve as a source of income during retirement); Akaun Sejahtera (to address pre-retirement needs in your life cycle which will contribute to your overall wellbeing during retirement); Akaun Fleksibel (to allow withdrawals any time depending on immediate requirements for short-term financial needs.) If you want to make the most of these three accounts, EPF told Malay Mail that its members should use their savings “strategically based on their financial priorities”: “Akaun Persaraan should primarily be preserved for long-term retirement income. “Akaun Sejahtera can be tapped into for important life events or needs during retirement, but it is advisable to leave these savings untouched to continue growing with dividends. “Akaun Fleksibel provides the flexibility to meet short-term financial needs, but members should withdraw only when necessary to avoid diminishing their overall savings.” What’s the best thing about not taking out money from your EPF savings in Akaun Sejahtera or Akaun Fleksibel? Your savings will continue to grow. “If members choose not to withdraw from Akaun Sejahtera or Akaun Fleksibel, their balances will continue to earn dividends, allowing savings to accumulate further for retirement. “By carefully managing these accounts, members can ensure they are financially prepared for both short-term challenges and long-term security in retirement,” EPF said. If you had to take money out, put money back in when you can The EPF said “the primary purpose of EPF savings is to ensure a secure retirement”, and said EPF members can get advice from its trained Relationship & Advisory (RA) officers before making big decisions on taking money out from EPF savings. “While the EPF offers withdrawal schemes for essential life cycle needs such as housing, education and health, these withdrawals should be made with careful consideration and are subject to certain conditions,” it said, referring to the withdrawals allowed from Akaun Sejahtera even before age 55. “It is crucial for members to prioritise long-term financial stability, and we strongly encourage consulting EPF RA Officers before making any major withdrawal decisions. They can provide valuable guidance to help members weigh their options and make informed choices that balance immediate needs with retirement planning. “After a withdrawal, members should focus on replenishing their retirement savings to maintain financial security in their later years,” EPF told Malay Mail. EPF said one of the effective ways to do this is through Voluntary Contributions, where EPF members can top up their EPF savings periodically. For Voluntary Contributions, you can add in extra money to your EPF savings, with the minimum amount being RM1 and the maximum annual limit being RM100,000. The maximum RM100,000 limit would cover all types of Voluntary Contributions made in a year, including i-Saraan which EPF said offers a convenient option for those in the informal sector to build their retirement fund. “By making additional contributions, members can benefit from annual dividend returns, allowing their savings to grow steadily over time, ultimately securing a more comfortable and financially stable retirement,” EPF told Malay Mail. The dividends for EPF members last year was 5.5 per cent (conventional savings) and 5.4 per cent (Shariah savings). While the minimum annual dividend for EPF savings under the law is 2.5 per cent, EPF has consistently delivered dividend rates higher than that guaranteed figure for the past 64 years. The short and sweet summary:  Source: Malaysians at 50: Withdraw some, all, or let your EPF savings in Akaun Sejahtera grow? Here’s EPF’s take |

|

|

Nov 15 2024, 12:59 PM Nov 15 2024, 12:59 PM

Return to original view | Post

#5

|

Senior Member

8,363 posts Joined: Feb 2014 |

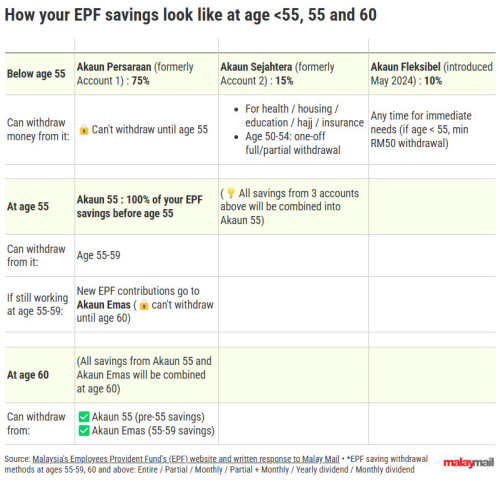

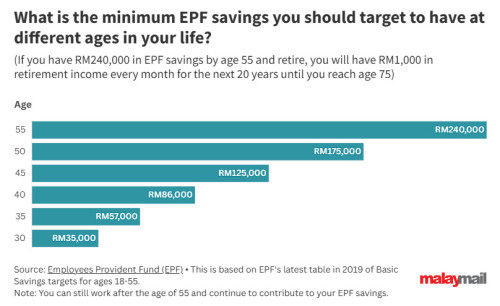

Are you planning what to do with your Employees Provident Fund (EPF) savings once you gain full access at retirement or upon turning 55?  At age 55, you can choose to withdraw your entire EPF balance, but that’s just one of many options. You could also opt for smaller, periodic withdrawals to stretch your savings further. Here’s the advice EPF shared with Malay Mail on making your retirement savings go the distance: The message is simple: Keep your savings in EPF and only withdraw regular sums every month, so the rest of your EPF savings can continue to grow. “EPF members aged 55, 60 and above have the flexibility to withdraw their savings either monthly, partially or a combination of both throughout their retirement. “These periodic withdrawals allow the remaining EPF savings to continue earning returns through annual dividends while enabling members to manage their finances during retirement,” EPF told Malay Mail when contacted. The EPF said this is an “effective strategy” to extend EPF members’ retirement savings as long as possible and to enhance their income security after retirement. “To support this approach, RA Officers are available to assist members with retirement advice and we strongly encourage retirees to opt for the monthly drawdown option. This can help members extend their savings throughout their retirement,” it said, referring to EPF’s free Relationship & Advisory (RA) service that is available at all 69 EPF branches nationwide. EPF’s trained RA officers provide advice and guidance such as on financial planning, planning for retirement and how to manage your finances post retirement. A balanced strategy to stretch the ringgit as Malaysians embrace longer lives In its response to Malay Mail, the EPF highlighted that Malaysians are now expected to live longer, with the average life expectancy in Malaysia rising from 54 years in 1957 to 75 years in 2024. “This longer lifespan emphasises the importance of planning for a secure financial future as their retirement savings need to last much longer than before,” it said. Saying it is “committed to promoting overall financial wellbeing in retirement”, the EPF pointed out that both short- and long-term needs are important. “The EPF recognises the short-term needs during times of crisis are as important as saving for retirement. Individuals can focus on longer term planning when their short-term needs are met,” it said, before offering the advice of monthly withdrawals of EPF savings if any EPF member wants to make withdrawals after the age of 55. Why are we talking about the ages 55 and 60? Here’s why, based on information available from EPF’s website: When you are below the age of 55, you will not be able to withdraw 75 per cent of your EPF savings, as it is reserved for your retirement. Withdrawals from the rest of your EPF savings could be allowed, if certain conditions are met. At age 55, you have the option to withdraw your entire EPF savings. Alternatively, you can opt for a partial withdrawal, set up monthly withdrawals, or even choose a combination of both partial and monthly withdrawals, among other choices. If you do not retire at age 55 and you continue to work, your new EPF contributions will go into a separate account called Akaun Emas, which you can only access at age 60. At age 60, you again have the option to fully withdraw all your retirement savings, including from Akaun Emas. Alternatively, you can opt for a partial withdrawal, monthly withdrawals, or a combination of both, along with other available choices. Your savings in both Akaun 55 and Akaun Emas will continue to earn dividends, if you keep your money there.  Be cautious with the option of a lump sum or full withdrawal of your EPF savings, as EPF data has shown that many members exhaust their retirement funds within just five years. How much should you target to have in EPF savings by age 55? The Basic Savings or minimum amount of EPF savings that you should target to have by age 55 is RM240,000, according to the latest target set by EPF from 2019. If you retire at age 55, RM240,000 would be equivalent to a monthly retirement income of RM1,000 for the next 20 years until you turn 75. The EPF previously said in a 2022 news report that RM600,000 would be the “adequate savings” amount for an individual to retire in Kuala Lumpur comfortably, based on data then on the basic monthly expenses for a retiree in the capital city and the life expectancy of Malaysians. RM600,000 would be equivalent to a monthly retirement income of RM2,500 for 20 years from age 55 to 75.  Source: Make your EPF savings go the distance: Smart tips for retirement at 55 and beyond BenChiew liked this post

|

| Change to: |  0.0463sec 0.0463sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 05:48 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote