It will be announced tomorrow. Then you can log in and check your sum right after that

EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Feb 19 2016, 10:11 PM Feb 19 2016, 10:11 PM

Return to original view | Post

#1

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

It will be announced tomorrow. Then you can log in and check your sum right after that

|

|

|

|

|

|

Jan 30 2017, 06:26 PM Jan 30 2017, 06:26 PM

Return to original view | Post

#2

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

A little bird told me it will be in the mid 5% range and will be announced as soon as next weekend

This post has been edited by Havoc Knightmare: Jan 30 2017, 06:28 PM |

|

|

Jan 30 2017, 09:36 PM Jan 30 2017, 09:36 PM

Return to original view | Post

#3

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

Jan 31 2017, 12:57 PM Jan 31 2017, 12:57 PM

Return to original view | Post

#4

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

Feb 6 2017, 10:42 AM Feb 6 2017, 10:42 AM

Return to original view | Post

#5

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(nexona88 @ Feb 6 2017, 10:26 AM) #PengumumanKWSPPelanggan yang dihormati, Dimaklumkan Kaunter Perkhidmatan KWSP akan ditutup lebih awal iaitu pada jam 4.00 petang pada 17 Februari 2017 bagi melaksanakan aktiviti penambahbaikan sistem KWSP. Segala kesulitan yang timbul amatlah dikesali. Terima kasih. Quoted from EPF's FB page. Ahem ahem |

|

|

Feb 18 2017, 07:55 PM Feb 18 2017, 07:55 PM

Return to original view | Post

#6

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

5.7%. In line with what I heard..

|

|

|

|

|

|

Feb 18 2017, 08:37 PM Feb 18 2017, 08:37 PM

Return to original view | Post

#7

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

Feb 18 2017, 08:59 PM Feb 18 2017, 08:59 PM

Return to original view | Post

#8

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(kwwong99 @ Feb 18 2017, 08:52 PM) You can't just look at absolute numbers because the dividend payout is relative. EPF holders account balance has increased by a larger percentage than income did. The 46.6B has to be divided over a larger base for 2016 as compared to 44.2B in 2015. |

|

|

Feb 18 2017, 09:25 PM Feb 18 2017, 09:25 PM

Return to original view | Post

#9

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(kwwong99 @ Feb 18 2017, 09:18 PM) The only way to know if they are paying out all their income is to look at their reserves in their balance sheet. Sometimes they hold back from declaring all the income as dividends to keep some as reserves. Which will be used to maintain the dividend rate in bad years. On the other hand you have some other government institutions who over declare dividends relative to income to the point where they become insolvent. |

|

|

Feb 18 2017, 09:48 PM Feb 18 2017, 09:48 PM

Return to original view | Post

#10

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(kwwong99 @ Feb 18 2017, 09:37 PM) 6B reserve in 2015 over 9.5B reserve in 2016. Don't you think this is too much? And the reserves use for what? It's our money - not theirs. Cannot be OPEX, right? It's not much. Consider if suddenly the stock market crashes this year and Income drops sharply, to say 10-20 B from 40+ at present. 9.5B will be hardly enough to cushion this drop. As for OPEX, its usually deducted against Income generated, just like unit trust. So the 46.6B is already net of their OPEX |

|

|

Feb 18 2017, 10:09 PM Feb 18 2017, 10:09 PM

Return to original view | Post

#11

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(kwwong99 @ Feb 18 2017, 10:02 PM) Reserves to curtain shock is understandable. 9.5B is just for 2016 and about 20% of this year income. Then 6B for 2015 or 13.6%. Surely, when you add up these 2 years we have 15.5B. Adding the last 20 years should be even more. Possibly exceed 100B. Does EPF need to set aside so much? It's kept so that we will still have dividends during years like 2008-9 when the stock market drops like 50%. Do you think EPF actually generates positive income in those years? Whatever dividends that they give you then will come from this reserve. If they don't you guys will be screaming bloody murder. On another note, it's annoying to see everyone complaining bout the lower dividend rate here. The KLCI ended the year lower last year and economy is growing at the slowest rate in recent years, the lower dividend rate should not be a surprise to anyone. |

|

|

Feb 18 2017, 10:17 PM Feb 18 2017, 10:17 PM

Return to original view | Post

#12

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

|

|

Dec 20 2018, 11:53 AM Dec 20 2018, 11:53 AM

Return to original view | Post

#13

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

They have been paying out all of their distributable income, although there is no legal requirement for them to do so, except the minimum of 2.5% as someone mentioned. So far what has been retained is generally non-distributable gains.

|

|

|

|

|

|

Dec 20 2018, 07:25 PM Dec 20 2018, 07:25 PM

Return to original view | Post

#14

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

The next dividend should be fine guys, it's the one that is coming in 2020 that we should be worried about.

|

|

|

Jan 2 2019, 08:52 PM Jan 2 2019, 08:52 PM

Return to original view | Post

#15

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

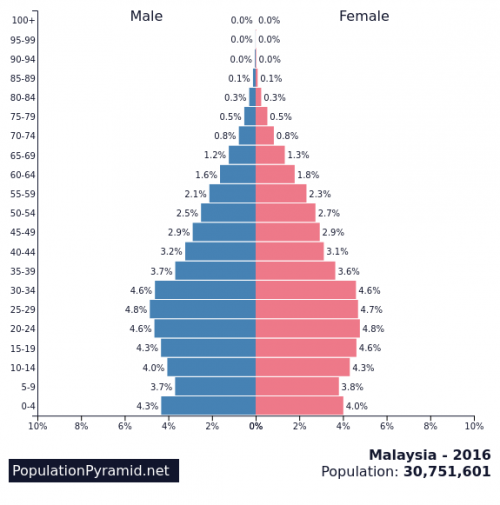

QUOTE(nexona88 @ Dec 28 2018, 10:43 AM) EPF’s number of approved withdrawals up 6.9% in 3Q18 http://www.theedgemarkets.com/article/epfs...drawals-69-3q18 QUOTE(prophetjul @ Dec 28 2018, 10:45 AM) QUOTE(kochin @ Jan 2 2019, 05:28 PM) https://www.malaysiakini.com/news/441637 Our population is starting to age already, it's just a matter of time before withdrawals exceed contributions.increased in contribution outnumbering the increase of withdrawal so net net still inflow more than outflow. performance need to be better than last year by approx 4% just to match last year declaration.  |

|

|

Jan 14 2019, 07:49 PM Jan 14 2019, 07:49 PM

Return to original view | Post

#16

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

The public keeps obsessing over the impact of the stock market on EPF returns when they are missing out on something that is just as big that is undergoing changes, that is EPFs debt investments.

While the new government likes to talk about the RM1 trillion of national debt as a purely bad thing, in reality EPF is the largest holder of the government's debt. It is EPF's debt investments, of which the bulk of It is in government bonds, that allows EPF to generate a steady base of investment income year after year even when markets are down like in 2018. As the new government has stated that they want to reduce debt levels and interest payment on the debt load, if they do achieve their target this will result in lower investment income for EPF and in turn, lower dividend payments for us in the long run. This post has been edited by Havoc Knightmare: Jan 14 2019, 08:11 PM |

|

|

Feb 11 2019, 10:47 PM Feb 11 2019, 10:47 PM

Return to original view | Post

#17

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

A little birdie says that it will be announced this weekend.

|

|

|

Feb 16 2019, 02:07 PM Feb 16 2019, 02:07 PM

Return to original view | Post

#18

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(nexona88 @ Feb 16 2019, 02:01 PM) Early days there's some worries shariah one would outperformed the existing normal one... Giving higher rate... But looking at the recent rate.. Now no more such worries 😑👍 It's not possible because the shariah universe of products is smaller than conventional. If there's a good shariah compliant stock, the conventional and shariah funds can buy in. But if there's a good stock that is not shariah compliant, only the conventional funds can buy in. Since the folks managing both funds are largely the same people, this is the inevitable outcome. At best both types perform equally.This post has been edited by Havoc Knightmare: Feb 16 2019, 02:09 PM |

|

|

Feb 16 2019, 03:14 PM Feb 16 2019, 03:14 PM

Return to original view | Post

#19

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

QUOTE(kochin @ Feb 16 2019, 02:39 PM) That could be due to different fund managers. In companies like CIMB Principal, the conventional and shariah funds are managed by two distinct teams that have little interactions with each other. With EPF, it is the same team. |

|

|

Feb 16 2019, 03:20 PM Feb 16 2019, 03:20 PM

Return to original view | Post

#20

|

Senior Member

1,205 posts Joined: Feb 2006 From: Kuala Lumpur |

|

| Change to: |  0.0435sec 0.0435sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 11:19 AM |