The very basic things we should consider when investing in REITs are non other than DPU and yield.

DPU

DPU, the Distribution per Unit, is how much dividend we get for every unit/share of the REIT. This information can be easily found in the SGX portal @ www.sgx.com, under "Listed Companies" -> "Corporation Action". Example select CapitaMall Trust for Company Name, select Dividend for the Category. Following is what you should see for the DPU since January 2009 for CapitaMall Trust (CMT):

For SREITs, the DPU is given either quarterly (4 times per year) or semi-annually (2 times per year). From the above table, base on the Dates of Expiry or Date Payable, we can see that CapitaMall Trust distributes the DPU every quarter. Following are the details of the SREITs distribution frequency:

REIT Frequency of Distribution

AscendasReit -Quarterly

AIMSAMPIReit - Quarterly

AscottReit - Semi-Annually around Jul and Jan period.

Cache - Quarterly

Cambridge - Quarterly

CapitaComm - Semi-Annually around Jul and Jan period.

CapitaMall - Quarterly

CapitaRChina - Semi-Annually around Jul and Jan period.

CDL H-Trust - Semi-Annually around Jul and Jan period.

FirstREIT - Quarterly

Fortune (HK cents)- Semi-Annually around Jul and Jan period.

FrasersComm - Semi-Annually around Oct and Apr period.

FrasersCT - Quarterly

K-Reit - Semi-Annually around Jul and Jan period.

LippoMapleTrust - Quarterly

MapleTreeLog - Quarterly

PLife - Quarterly

Saizen - Semi-Annually around Jul and Jan period.

Saban - Quaterly

Starhill Gbl - Quarterly

Suntec - Quarterly

Yield

Yield is the annualised DPU divided by the share price. Annualised DPU means how much DPU we can get for the whole year. The usual practice in calculation of annualised DPU is to take the latest DPU and mulitply by number of distributions per year, i.e. X 4 for quarterly distribution, X 2 for semi-annual distribution.

Of course there are variations to the way in calculating yield. For a REIT giving a stable and consistent amount of DPU, the above method should be accurate. For a REIT with widely varying DPU every distribution, you may add up all the distributions per year, or half a year than multipy by 2, to get a more accurate estimate of the annualized DPU. From observation, the DPU of SREIT is fairly stable, with very little % variable QoQ, other than when there is a rights issue in which the DPU is diluted, or when a troubled REIT temporarily cuts the DPU.

Distributable Income

The DPU is derived from the distributable income of a REIT. The distributable income is how much cash the REIT is able to distribute. Now there is a subtle difference between the REIT and a normal company in terms of dividend payment. For a normal company, it may pay out a certain percentage of its net profit as dividend. But net profit may not consist of purely cash earnings, as some earnings that are posted as profit may not be cash income, example increase in valuation of a property. Similarly, decrease in valuation of a property may be posted as a loss in the calculation of net profit, but it does not mean a loss of cash. For REITs, the distributable income is derived from its cash earnings, so technically it is possible for a REIT to post a net loss when the decrease in valuation of its properties is much more than the rental income, and yet it is still able to have a postive distributable income.

The distributable income statement can be determined from the quartly earnings report of the REIT. You can get the quarterly report from the SGX portal, under "Listed Companies" -> "Company Announcements". Select "Last 3 Months" for the Announcement Period, and say for example "CapitaMall Trust" for the Company Name. Look out for something along the line of "MISCELLANEOUS :: 2009 THIRD QUARTER UNAUDITED FINANCIAL STATEMENT & DISTRIBUTION ANNOUNCEMENT".

Once you get hold of the report, look for the "Statement of Total Return & Distribution Statement". The Distribution Statement will tell you how much cash is available for distribution (Amount available for distribution to Unitholders), and how much cash is actually paid out for that quarter (Distributable income to Unitholders). The Distributable income to Unitholders divided by the total number of units/shares of the REIT will give you the DPU. The total number of units in issue by the REIT can be found out in the same report. Look for Total issued and issuable Units as at end of period under Details of any change in the issued and issuable Units.

By MAS regulation, a REIT is supposed to give out at least 90% of its amount available for distribution to Unitholders. Currently most of the REITs are giving out 100%, and as far as I know CDL HTrust has cut its distribution to 90% since early this year.

Of course there are other indicators such as NAV, Gearing, etc. Please pop into the following useful site.

http://sreitinvestor.blogspot.com/2009/11/...dpu-and_13.html

Witholding Taxes- As far as i know, if the REIT distributes at least 90% of its Distributable Income, there is NO withholding taxes

for individuals with regards to S-REITS, making it more attractive than M-REITS.

For news

http://sreit.reitdata.com/

For updated investment Data Summary

http://reitdata.com/

DISCUSS AND ENJOY!

Added on September 11, 2012, 9:34 amREITs – Phillip

5 September 2012

Comments Off

Results Season Takeaways

Sector Overview

The Real Estate Investment Trust (REIT) Sector in our Singapore coverage consists of 23 REITs listed on Singapore exchange with a market capitalization of USD35 billion.

Majority of S-REITs turned in positive DPU

S-REIT’s dividend yield of 5.5% is less appealing than a quarter ago and there is limited upside given rich valuation based on +1 STD of P/B ratio

Earnings Surprise?

Across the S-REITs universe, majority of them turned in positive DPU. Negative rental reversion was not the main reason for the dip in DPU. The drag in DPU was caused by some other factors such as divestment of property assets, issuance of new units, on-going major asset enhancement works and amongst others.

Under our coverage, the DPU estimates for CDL HT, PLife REIT and Sabana REIT were largely in-line, forming 49%, 51% and 50% of our FY12 projections.

Capital management outlook

The variable-rate loans that are pegged to swap offer rates maintained flat

Liquidity is expected to remain healthy at current loan-to-deposit ratio (LDR) level of 91.9%

Financial position of REITs looks healthy, with comfortable gearing and longer weighted average debt to maturity

Recommendation

P/B ratio has progressively moved towards +1 SD and it had served as a strong resistance level for the past four years. From our viewpoint, it is going to be an uphill struggle to break above +1 STD. Given there is no major negative shocks from the western countries, P/B ratio should hover around this level as the current situation is not much better compared to two years before, undermined by lingering Euro debt problems and anaemic US growth.

For investors with mid- to long- term horizon, they may want to place their bet on Suntec REIT which is undergoing major makeover (phase 1-4) at Suntec City, stretching from Jun-12 to 2014. In this regard, return on investment from the refurbishments is likely to stream in in staggered phases. The tax savings from MBFC Phase I and potential ORQ could make up the loss for the drop in vacancy. Valuation is also undemanding and trading at a steep discount of 26.5% relative to Mapletree Commercial Trust (MCT) and Starhill Global REIT.

Added on September 11, 2012, 9:38 amSingapore REITs Yield World’s Best Returns: Southeast Asia

By Pooja Thakur - Sep 5, 2012 9:29 AM GMT+0800

http://www.bloomberg.com/news/2012-09-04/s...heast-asia.html

Singapore’s real estate investment trusts, the best performing in the world this year, are luring investors after a shopping spree for properties across Asia gives them a broader stream of rental income.

Singapore’s $38 billion REIT market has returned an average 37 percent in 2012, twice the gains in the U.S., U.K. and Japan, according to data compiled by Bloomberg. Australia, the largest REIT market in the Asia-Pacific region with $86 billion, advanced 24 percent.

Growth among Singapore REITs was led by asset acquisitions and rental appreciation, with total rental revenue increasing 5.8 percent annually between 2008 and 2011, according to property broker CBRE Group Inc. In the first half, Singapore REITs were the second-most active purchasers after Japan in Asia, buying assets in Australia, China, Japan, Malaysia and South Korea, and accounting for 33 percent of acquisitions by the region’s REITs since 2009, CBRE said.

“Singapore remains amongst the last few AAA rated economies,” Priyaranjan Kumar, Singapore-based regional director of the capital markets group at broker Cushman & Wakefield, said in an interview. “Its real estate market has received unprecedented attention from most investors as it’s seen to offer a good proxy for the increasingly recognized strength of the Asian consumer.”

The gap between their yield and interest rates is double that in Australia, according to data compiled by Bloomberg. Property trusts in the island-state offer an average 413 basis- point income return premium relative to 10-year government bonds, while in Australia they average 192 basis points, data compiled by Bloomberg showed. A basis point is 0.01 percentage point.

Game Change

Singapore’s REITs have a dividend yield of 6.47 percent, according to data compiled by Bloomberg. That compares with to 4.97 percent in Hong Kong and 5.01 percent in Australia.

Economic growth in the Southeast Asian island-nation across the Johor Strait from Malaysia will probably accelerate to 3.9 percent next year from 2.7 percent in 2012, the International Monetary Fund forecast in its World Economic Outlook report in April. The advanced economies, including the U.S. and U.K., are estimated to expand 2 percent in 2013.

“The game has changed from capital appreciation to capital preservation,” Tim Gibson, a Singapore-based fund manager for Asia-Pacific property equities at Henderson Global Investors, said.

Budget Surplus

Singapore boasts the world’s biggest budget surplus relative to economic output, adding to demand for its currency as Europe’s fiscal woes roil global markets, the IMF said. The Singapore dollar is the best performer this year after the Philippine peso among the 11 most-traded Asian currencies tracked by Bloomberg. Singapore is one of seven nations with AAA ratings and stable outlooks from Moody’s Investors Service, Standard & Poor’s and Fitch Ratings.

Tax incentives, which include exemptions on foreign income received by Singapore-listed REITs and distributing at least 90 percent of their income as dividends to unit holders, also helped boost demand.

Singapore offers a pipeline of assets from developers, a fair regulatory environment and a base of international investors and quality sponsors, Jason Kern, Hong Kong-based managing director and head of real estate and lodging advisory for Asia-Pacific at HSBC Holdings Plc, said in an interview. A sponsor is a developer with a stake in the REIT and whose properties form the trust’s pipeline of assets to be purchased.

Outperforming Stocks

“Coming out of the global financial crisis, investors have focused on transparent, predictable markets with sustainable income profiles,” Cushman’s Kumar said.

Singapore REITs also have a liquid secondary market, low transaction costs, and low leverage compared with Japan and other large REIT markets, Kumar added.

Four of the top 10 best-performing REITs with assets of more than $250 million in the region are from Singapore, according to data compiled by Bloomberg. Including dividend yields, Frasers Commercial Trust (FCOT) has returned 58 percent this year, AIMS AMP Capital Industrial REIT 48 percent, and Keppel Land Ltd.’s K-REIT Asia (KREIT) 46 percent.

Singapore REITs have outperformed the city-state’s benchmark Straits Times Index, which has climbed 13 percent this year. The 10-year government bond yield in Singapore was 1.38 percent as of Aug. 29. Adjusted for inflation, Singaporean savers currently receive a negative real return on their savings of 4.79 percent.

Market Recovery

The REIT market in the Asia-Pacific region is worth $205 billion, more than before the global financial crisis, according to the Asia Pacific Real Estate Association. European REITs are below the levels before the crisis, while North America, the world’s largest REIT market, has seen assets climb 82 percent from December 2007, the data showed.

Singapore is the region’s third-largest REIT market after Australia and Japan’s $45 billion, according to data compiled by Bloomberg.

The real estate market in Singapore recovered sharply after the first quarter of 2009, with prime rents and capital values increasing in excess of 60 percent over lows during the global financial crisis, according to New York-based Cushman.

Total investment turnover for Asian REITs reached US$7 billion during the first six months of the year, a 14 percent decline from the second half of 2011, on concerns over the eurozone debt crisis and the weaker outlook for the regional economy, Los Angeles-based CBRE said.

More Selective

“Although Asian REITs are expected to remain in buying mode, they will likely turn more selective towards future acquisitions, with yield enhancement and insulation from the global economic slowdown emerging as important criteria,” CBRE analysts Ada Choi and Leo Chung wrote in a report on Asia’s REIT market last month.

Earnings growth, or distribution per unit of Singapore REITs, will slow to 4 percent in the two years ending 2014, with the previous highs of a 13 percent growth rate between 2006 and 2008 appearing unachievable, Singapore-based analysts, led by Derek Tan, at DBS Group Holdings Ltd. said in an Aug. 21 note. Maturing portfolios will add to slowing growth, Tan said.

The outlook for Singapore’s commercial-leasing segment is becoming more challenging and the funding environment is likely to become more volatile over the next two years, Standard & Poor’s credit analyst Wee Khim Loy said in a note on Aug. 2. A dislocation in the credit markets may cause significant financial stress because the trusts rely on bank funding, the rating company said. Leverage levels of most office REITs could become weak if property values decline by as much as 10 percent, it said, maintaining a negative outlook for the office segment.

Uncertain Outlook

Still, Singapore REITs are well placed to weather tight operating conditions as the trusts have increased their financial flexibility and diversified their funding sources, the rating company said.

There remains ample room for future growth in REITs as prime rents remain 25 percent to 30 percent off their peak in the second quarter of 2008, Kumar said. At current yields, Singapore REITs are attractive for investors looking for total returns, he said.

“There are a lot of uncertainties in terms of economic outlook, so investors are actually looking for stability, defensive earnings,” Eddy Loh, a Singapore-based equity strategist for Asia at Barclays Plc, said in a phone interview. “Coupled with the fact that we still have a very low interest rate environment and the dividend yields for some of these REITs can go up 6 percent to 7 percent that seems to be very attractive to investors actually.” Loh is advising clients to bet on industrial and retail REITs.

REIT IPOs

The three-month Singapore Interbank Offered Rate is at an all-time low of just under 0.4 percent, compared with a peak of 3.56 percent in 2006, according to data compiled by Bloomberg.

The performance of real estate trusts is prompting a flurry of initial share sales by REITs that may top $2 billion, with as many as six companies planning to list their assets, according to HSBC’s Kern. That’s the most since 2010 when Singapore REITs raised $4.13 billion, according to data compiled by Bloomberg.

Ascendas Hospitality Trust (ASHT) raised about S$459 million ($369 million) in July, while Far East Organization, Singapore’s biggest closely held developer, drew S$717.6 million in an initial share sale of a hotel trust last month.

“If we think we are five years through a lost decade from a global economic standpoint, then we will see money flowing into REITs as people will continue to chase yields,” Gibson said. “Unless we see interest rates increasing at any point in time, then that will stop the party, but I don’t think you need to be dancing too close to the door just yet.”

To contact the reporter on this story: Pooja Thakur in Singapore at pthakur@bloomberg.net

To contact the editor responsible for this story: Andreea Papuc at apapuc1@bloomberg.net

Added on September 11, 2012, 9:47 amSREITs – Kim Eng

10 September 2012

The allure of S-REITs

Gravity Defying: Highest Yield-Spreads and Returns Globally.

S-REITs has risen 28.7% YTD, outperforming even major REITs markets such as US, Australia and Japan etc

We pointed out that S-REITs has one of the highest yield spreads globally in our previous report dated 3 Sep 2012. We took a deeper look at global/regional peers and below are our assumptions and proposed theses why this may be the case:

Why Asian REITs have much higher yield spreads.

The Asian REITs (S-REITs, J-REITs, and HK-REITs, excluding M-REITs), outperformed the non-Asian REITs (US-REITs, UK-REITs, A-REITs) in terms of yield spreads partly due to higher borrowing costs in the West (consequence of US/European deleveraging) and Australia.

With the exception of M-REITs, the Asian REITs incur average cost of borrowing (sector average) of ~1.5%-3.1%, much lower than the 5.5%-6.9% expensed by non-Asian REITs.

We noted that despite risk-free rates being low in the US (1.7%) and UK (1.8%), the actual borrowing costs to companies on the ground are relatively higher, compared to Asia. Western banks have become parsimonious in their lending vis-à-vis the robust loan growth situation amongst Asian banks.

From our observations, A-REITs and UK-REITs have average cost of borrowings much higher than normalized1cap rates, rendering DPU yields to be trading near cap-rates levels. As a result, yield spreads are much lower in comparison. For US-REITs, the high borrowing costs are partly offset by their higher cap rates, but this is still insufficient to cover the 178-211 bps yield spread lag behind Asian REITs (excluding M-REITs).

In M-REITs case, both the cost of borrowing and risk free rates are much higher than S-REITs, J-REITs and HK-REITs, resulting in much lower yield spreads.

What gives S-REITs the edge over other Asian REITs.

Higher Capitalization Rates:

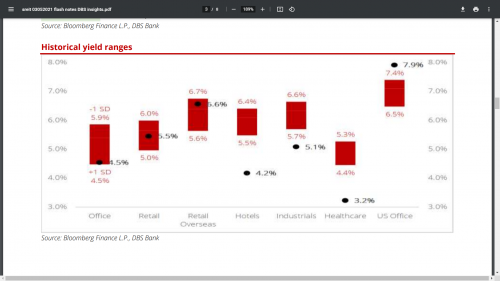

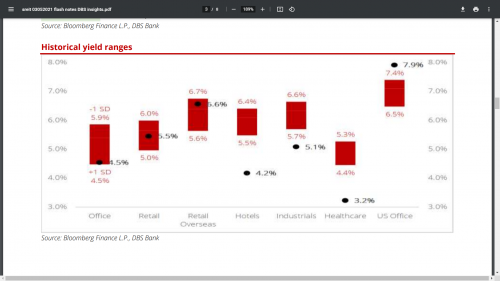

On a sector basis, Singapore has relatively higher normalised2 cap rates (net property income that can be extracted per annum for each S$ dollar invested in investment properties), compared to Hong Kong and Japan.

For example in HK, cap rates (net basis) for prime office and prime retail buildings on a stabilized basis are around 3%-3.5% and 3.5%-4% respectively. However, in Singapore, cap rates for prime office and prime retail properties are at least 4.0% and 5.0% respectively.

This enables S-REITs to offer DPU yields of ~6% without trading at price-to-book discount (1.07x PBR). On the other hand, in order to offer DPU yields of ~5%, HK-REITs and J-REITs have to trade at ~0.8x PBR.

Unlikely interest rates hike until end 2014:

The MAS manages the Sing dollar’s strength by buying or selling currencies to keep its exchange rate against major currencies within a policy band, and by adjusting the band occasionally to steer the exchange rate. This FX-centred monetary policy regime means that Singapore’s short-term interest rates are essentially a function of US short-term interest rates.

Most economists do not expect any significant interest rates hike until end of 2014, following the US Fed’s intent to keep short-term interest rates near zero till then. If correct, this would imply that the cost of borrowings for S-REITs (some pegged to SIBOR) will stay at current low levels through 2012-2014.

Others reasons:

The strong SGD, chasing yields climate and lack of investable alternatives in the market are other factors providing price support for S-REITs. Investors are also drawn to the transparency and predictability of S-REIT dividends, particularly in the midst of the external market uncertainty

Yields can compress another 70-90 bps (Peak Valuations).

S-REITs are presently trading at 5.9% FY12 yield and a yield spread of 463 bps. We think there is downside room for another 70-90 bps compression in view of the following two reasons:

The S-REITs’ average and stabilized long-term yield spread (excluding the GFC period) is around ~370 bps.

The effective cap rate for S-REITs is around 5.3%. If we take cap rates as the floor for FY12 DPU yield (since overall S-REITs sector trading at P/B of ~1x), there is another 70 bps for yields to be compressed further.

A yield-spread compression of another 70-90 bps equates to an average price appreciation of 13%-19% for the sector.

Maintain OVERWEIGHT on S-REITs.

We conducted a 2QCY12 results round-up and target price update for S-REITs under our coverage. Most S-REITs reported 2QCY12 distributable incomes that were in-line with our forecasts. Moving forward, we expect DPU growth of 1.4%-9.6% per annum over FY11-FY13F (except Suntec REIT which will likely suffer DPU decline due to ongoing refurbishments at Suntec City).

Our top BUYS remain with the more defensible industrial and retail REITs with total returns of 10%-17%. We think their risk-reward proposition still appear favorable to yield-driven investors. Maintain OVERWEIGHT on the overall S-REITs sector.

____________________________________________________________________________________________________________

http://fifthperson.com/5-important-factors...st-in-any-reit/

If you’re looking for passive income, then investing in stocks that pay you a stable and growing dividend is something that you need to keep your eye open for. In that vein, REITs are great investments if you plan to invest for stable, passive income. Why so?

Firstly, REITs (or real estate investment trusts), as their name suggests, invest in real estate. And in land-scarce Singapore, property in general makes for a great long-term investment. Our country is also safe, politically stable, and well run (although some of us would disagree!) which means the value of our real estate is likely to hold and appreciate over time. And although many of our REITs also invest in assets overseas, most of them own properties that are mainly located in Singapore.

Secondly, REITs pay a high dividend yield. There are currently 35 REITs listed in Singapore with an average dividend yield of 7.5% (as at Feb 2016). With the current market downturn, some REITs have yields as high as 10% right now! One of the main reasons why REITs offer such high yields is because they enjoy tax-exempt status as long they pay out at least 90% of taxable income to shareholders. The tax breaks and high payouts mean higher yields for investors. The recent 2015 Singapore budget extended tax breaks for REITs for another five years.

Thirdly, REITs also pay their dividends (or distributions) four times a year. In comparison, a typical company usually only pays dividends once or twice a year. So if you’re an investor who wants to receive a steady, regular stream of passive income throughout the entire year, REITs will do very well for you.

So now that we’ve established that REITs offer a high, steady stream of passive income for investors, what are the important factors you need to look at before you invest in any particular REIT?

Here are five important factors you need to consider:

#1 Type of Industry

Not all REITs are made the same. Singapore REITs fall into six broad categories: office, retail, residential, healthcare, hospitality, and industrial. Each sector has its own specific characteristics that will affect a REIT’s growth, risk profile, and performance.

For example, office REITs like CapitaCommercial Trust, own office buildings. During a bull economy, businesses do well and demand for office space is high. This translates to higher rents and property income for the REIT. During a recession, the chips fall the other way – some businesses go bust, demand tumbles and office rents fall in tandem. The economic cycle largely affects the performance of an office REIT.

On the other hand, retail REITs like Starhill Global own shopping malls. Even in times of recession, many malls are usually still packed with shoppers and shop spaces are fully tenanted. Demand for retail space remains high which means rents and property income for the REIT barely drop.

All things equal, investing in a retail REIT is less volatile than investing in an office REIT. Of course, investors are aware of this and hence generally willing to pay higher prices for a retail REIT which lowers your dividend yield.

#2 Dividend Yield

This is probably the first ratio that every investor looks for when investing for dividends. While everyone enjoys a high dividend yield, what’s more important is to examine a REIT’s dividend track record.

Does a REIT pay a stable or rising dividend per share (or distributions per unit) year after year? Or does it tend to fluctuate every year?

A REIT that’s able to steadily grow its income and dividend per share year after year is understandably a more attractive investment than a REIT whose dividend payouts fluctuate all the time.

A REIT with a higher dividend yield doesn’t necessarily mean that it’s a “better” investment. For example, an office REIT usually has higher yields compared to a retail REIT, but office REITs are also more volatile and less resilient than retail REITs.

#3 Property Yield

Property yield is the amount of income a REIT can generate from a property. For example, if a property is worth 10 million dollars and earns $400K in rent in one year, then its property yield is 4%. Understandably, the higher the yield, the better. But what’s more important is to examine whether a REIT’s property yield is stable or rising over the years. A well-managed REIT will look for ways to continually improve its property yield.

One common way for a REIT to improve its property yield is to acquire yield-accretive properties. For example, if a REIT’s property yield is 4% and it acquires a new property that generates a 5% yield, the new acquisition will help to increase the REIT’s overall property yield.

#4 Gearing Ratio

Gearing ratio represents a REIT’s amount of debt over its total assets. The higher the ratio, the more debt a REIT has.

In Singapore, REITs are tightly regulated and only allowed to borrow up to 45% of their total assets. So if a REIT owns a billion dollars in assets, it can only borrow up to $450 million in loans. A REIT can borrow the money to fund new acquisitions for growth, upgrade its buildings, etc.

The lower the gearing ratio, the more conservative a REIT is. At the same time, a high gearing ratio does not necessarily mean that a REIT is a poor investment – it just means that a REIT is willing to take on more debt (and risk) for growth.

#5 P/B Ratio

P/B ratio measures a REIT’s share price against its net asset value (NAV) per share. Theoretically, a P/B ratio of 1 indicates a fair valuation. A ratio above 1 means a REIT is overvalued and a ratio below 1 means it is undervalued.

For example, if a REIT’s share price is $1 and its NAV per share is $2, then its P/B is 0.5 – essentially you’re only paying 50 cents for every dollar of net assets.

In practice though, you shouldn’t simply rely on P/B alone to value a REIT. Other important factors, like the ones we’ve discussed above and more, must also be taken into consideration when choosing to invest in a REIT.

While REITs in general are great investments for dividends, not all REITs are equal – it’s important to pick only the best-managed REITs that are able to pay you a long-term growing dividend and appreciate in value over time.

QUOTE(TOS @ Jun 11 2021, 10:40 PM)

Hello.

- Price is a function of supply and demand. You are right that since supply is limited the equilibrium price should be high, but demand plays its role too. Also, how price behaves depends on market structure. Is it perfect competition, monopolistic competition, oligopoly or monopoly?

Generally as land is limited, while SG's population growing, investors attracted by its various offerings, high demand and low supply, price will go up. But in the long run supply and demand side are rather elastic, so it's hard to tell. No one has a magic crystal ball after all. Things may change for the better or the worse.

- REITs are income-oriented vehicles, so dividend yields are prime consideration for many. Capital growth comes with increasing AUM, and factors like inclusion in indices, liquidity etc. Overall, both capital growth and dividend income play important roles and how they are distributed depends on the asset classes, AUM and liquidity. REITs with new economy asset classes, fast-growing AUM and higher margins tend to have higher capital gain components in total return and hence low yield. But as they mature, the capital gain component vanishes but the yield rises.

Minimum target really depends on industry/asset classes/AUM/sponsor. Blue chip REITs generally large/mid-caps tend to have lower yields and after adding capital gain, total return on par with typical blue chips stocks. Small-caps have higher yields but that also mean higher risk. Risk here refers to refinancing risk. REITs are highly leveraged, and in the event of downturn, there is a higher chance that banks don't want to refinance their loans, with small-caps the most vulnerable to this. So higher yields mean higher risk. Other factors to consider are sponsors (Temasek/GLC-linked?, or IHH). Sponsors with poor reputation/quality may require higher risk premium to compensate. Hence higher yields. Certain asset classes have higher yields than others, say PBSA, while new economy assets can have lower yields, say data centers.

6% would be a typical yield for a mid-cap or the large ones in the small-cap space. Blue chips ones can range for the low 3-4% like Keppel DC/Parkway LIFE to 5% like Ascendas REIT. Small-caps can go up to 7-8% as seen in major US office REITs.

- Yes, different REITs have different strategies. Some concentrate on certain areas like Ascendas mainly focuses in SG while a small portion is invested in developed markets. Some entirely invest outside of SG, say Elite Commercial (entirely UK government properties), or Cromwell EU REIT (all EU properties). US Office REITs, as the name suggest focus on US office assets. They include KORE, MUST, and Prime US REIT. There can also be mixed REITs that do not have any particular restriction on geographical exposure. In general, it's the trust deed that stipulates the geographical limitations, it's up to the REIT's management and investors to decide the geographical locations of the assets.

- Criteria for blue chips: (Not all are needed in order to qualify for a blue-chip)

1. Scale/AUM: Large cap or mid-cap, large number of properties, diversified tenant base

2. Liquidity: Included in major indices, high turnover/volume, easily buy and sell with little influence to market

3. Track record: Increasing dividends over, long run, generally positive long-run trend

4. Sponsors: Who are the major shareholders? Are they GLCs in SG? ROFR pipelines available?

5. Yields: Generally low to medium, low not because they are worthless, but because they are growing or command higher premium due to their stability.

6. P/BV: Higher price to book value, somewhat growth-oriented or stable, only 2 REITs fit into this criteria, Parkway LIFE and Keppel DC.

Please don't forget your investment. REITs, especially blue-chip ones, almost always have EFR, equity fund raising annually to purchase new properties and investors should subscribe to them. Otherwise your investment will be diluted over time. As they can purchase properties anytime in a year, constant monitoring is needed.

-Not qualified to answer anything Moomoo-related. You can ask here though: https://forum.lowyat.net/topic/5135077/+140

Malaysians access SREITs via foreign brokers in general, like TSG/Moomoo that you have. Some buy via Syfe (https://forum.lowyat.net/topic/4969696/+80). Other avenues include indirect investment via various ETFs like STI ETFs, SREIT ETFs. Or actually if you are "rich" enough, and has less risk appetite, you can buy SREIT bonds too. https://forum.lowyat.net/index.php?showtopic=5020731

Lastly have a look at some of the links and resources I posted here: https://forum.lowyat.net/index.php?showtopi...&#entry99272404

This post has been edited by prophetjul: Jun 12 2021, 08:34 AM- Price is a function of supply and demand. You are right that since supply is limited the equilibrium price should be high, but demand plays its role too. Also, how price behaves depends on market structure. Is it perfect competition, monopolistic competition, oligopoly or monopoly?

Generally as land is limited, while SG's population growing, investors attracted by its various offerings, high demand and low supply, price will go up. But in the long run supply and demand side are rather elastic, so it's hard to tell. No one has a magic crystal ball after all. Things may change for the better or the worse.

- REITs are income-oriented vehicles, so dividend yields are prime consideration for many. Capital growth comes with increasing AUM, and factors like inclusion in indices, liquidity etc. Overall, both capital growth and dividend income play important roles and how they are distributed depends on the asset classes, AUM and liquidity. REITs with new economy asset classes, fast-growing AUM and higher margins tend to have higher capital gain components in total return and hence low yield. But as they mature, the capital gain component vanishes but the yield rises.

Minimum target really depends on industry/asset classes/AUM/sponsor. Blue chip REITs generally large/mid-caps tend to have lower yields and after adding capital gain, total return on par with typical blue chips stocks. Small-caps have higher yields but that also mean higher risk. Risk here refers to refinancing risk. REITs are highly leveraged, and in the event of downturn, there is a higher chance that banks don't want to refinance their loans, with small-caps the most vulnerable to this. So higher yields mean higher risk. Other factors to consider are sponsors (Temasek/GLC-linked?, or IHH). Sponsors with poor reputation/quality may require higher risk premium to compensate. Hence higher yields. Certain asset classes have higher yields than others, say PBSA, while new economy assets can have lower yields, say data centers.

6% would be a typical yield for a mid-cap or the large ones in the small-cap space. Blue chips ones can range for the low 3-4% like Keppel DC/Parkway LIFE to 5% like Ascendas REIT. Small-caps can go up to 7-8% as seen in major US office REITs.

- Yes, different REITs have different strategies. Some concentrate on certain areas like Ascendas mainly focuses in SG while a small portion is invested in developed markets. Some entirely invest outside of SG, say Elite Commercial (entirely UK government properties), or Cromwell EU REIT (all EU properties). US Office REITs, as the name suggest focus on US office assets. They include KORE, MUST, and Prime US REIT. There can also be mixed REITs that do not have any particular restriction on geographical exposure. In general, it's the trust deed that stipulates the geographical limitations, it's up to the REIT's management and investors to decide the geographical locations of the assets.

- Criteria for blue chips: (Not all are needed in order to qualify for a blue-chip)

1. Scale/AUM: Large cap or mid-cap, large number of properties, diversified tenant base

2. Liquidity: Included in major indices, high turnover/volume, easily buy and sell with little influence to market

3. Track record: Increasing dividends over, long run, generally positive long-run trend

4. Sponsors: Who are the major shareholders? Are they GLCs in SG? ROFR pipelines available?

5. Yields: Generally low to medium, low not because they are worthless, but because they are growing or command higher premium due to their stability.

6. P/BV: Higher price to book value, somewhat growth-oriented or stable, only 2 REITs fit into this criteria, Parkway LIFE and Keppel DC.

Please don't forget your investment. REITs, especially blue-chip ones, almost always have EFR, equity fund raising annually to purchase new properties and investors should subscribe to them. Otherwise your investment will be diluted over time. As they can purchase properties anytime in a year, constant monitoring is needed.

-Not qualified to answer anything Moomoo-related. You can ask here though: https://forum.lowyat.net/topic/5135077/+140

Malaysians access SREITs via foreign brokers in general, like TSG/Moomoo that you have. Some buy via Syfe (https://forum.lowyat.net/topic/4969696/+80). Other avenues include indirect investment via various ETFs like STI ETFs, SREIT ETFs. Or actually if you are "rich" enough, and has less risk appetite, you can buy SREIT bonds too. https://forum.lowyat.net/index.php?showtopic=5020731

Lastly have a look at some of the links and resources I posted here: https://forum.lowyat.net/index.php?showtopi...&#entry99272404

Sep 11 2012, 09:33 AM, updated 7 months ago

Sep 11 2012, 09:33 AM, updated 7 months ago

Quote

Quote

0.0429sec

0.0429sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled