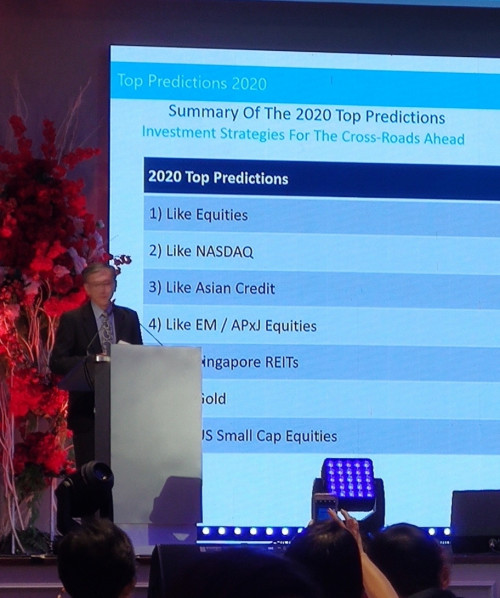

from rhb cny dinner last night...

Singapore REITS, S-REITS

|

|

Jan 15 2020, 03:52 PM Jan 15 2020, 03:52 PM

Return to original view | Post

#1

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

|

|

|

Jan 15 2020, 06:51 PM Jan 15 2020, 06:51 PM

Return to original view | Post

#2

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 8 2021, 06:02 PM Oct 8 2021, 06:02 PM

Return to original view | Post

#3

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 8 2021, 05:11 PM) QUOTE(Hansel @ Oct 8 2021, 05:17 PM) Emm,... no bro,... the nationality of the final beneficiary is the key, not the country of domicile of the custodian,...That's is why,... we need to input our nationality when we first opened accounts. bro Hansel!... just saying hi... Why is that fella not replying ? After I go off here,... I can't debate with him anymore,..... nowadays, quite busy and not much time to log-on. TOS... bro Hansel is correct... ...and Swiss - Malaysia treaty 15% I just checked |

|

|

Oct 8 2021, 06:57 PM Oct 8 2021, 06:57 PM

Return to original view | Post

#4

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 8 2021, 06:05 PM) maybe he has 1 share... so IB give him 1 finger... lol... dunno manquite sure his Swiss share is held by ibkr Europe somewhere not ibkr USA... TOS liked this post

|

|

|

Oct 8 2021, 07:09 PM Oct 8 2021, 07:09 PM

Return to original view | Post

#5

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Hansel @ Oct 8 2021, 06:34 PM) Good to see you again, bro,... been sometime,... aiyoh...I'm still holding-on to my 3 tranches of AUDJPY,... I forgot abt them until my debate with Ramjade started this evening and after seeing your post/greeting,... I remember saying it's about to peak liao in 1-2 weeks... be careful best to take some profits... now give back a few BMWs liao... nvm lah haha |

|

|

Oct 8 2021, 08:43 PM Oct 8 2021, 08:43 PM

Return to original view | Post

#6

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 8 2021, 07:03 PM) have to check T&C... ideally tax obligations are the customer's... so for an international company with multi national customers... they should have a way to manage taxes properly... |

|

|

|

|

|

Oct 8 2021, 11:16 PM Oct 8 2021, 11:16 PM

Return to original view | Post

#7

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 8 2021, 09:09 PM) lawyers can't help... need international tax agents...anyways... I'm quite sure IB is correct... in that they buy for you in their name... and Hansel is also correct... in tax treaties and tax obligations... hence to get back what is owed with ibkr... you have to file a claim and pay a fee... had you bought Swiss stocks with a Malaysia broker... the 15% wht would be correctly used ps... there is no need to fly any where like Ramjade suggested... lol This post has been edited by dwRK: Oct 8 2021, 11:19 PM |

|

|

Oct 9 2021, 07:20 PM Oct 9 2021, 07:20 PM

Return to original view | Post

#8

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 9 2021, 05:23 PM) Ok, so IB is not correct lah. In the end it is the beneficiary's country of origin (Malaysia) that matters for tax treaties consideration. I find it not very fair that I need to pay fees if the law of Switzerland etc. already establish a treaty with Malaysia. The cost of getting my fees exceed the amount that I can claim back, not economical... Ridiculous biggest known problem for nominee account. that is why broker selection is important "for your needs"... also IB didn't force you to sign up... It is like the treaties are there for no reasons and useless. fee is usually to discourage baseless claims... also low cost brokers need to cover extra work... lol anyways... UK, US, MY... all looks like 15% wht with Switzerland... so really dunno the story TOS liked this post

|

|

|

Oct 13 2021, 07:22 PM Oct 13 2021, 07:22 PM

Return to original view | Post

#9

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 29 2021, 10:24 PM Oct 29 2021, 10:24 PM

Return to original view | Post

#10

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 29 2021, 10:26 PM Oct 29 2021, 10:26 PM

Return to original view | Post

#11

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 30 2021, 10:11 AM Oct 30 2021, 10:11 AM

Return to original view | Post

#12

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 30 2021, 10:35 AM Oct 30 2021, 10:35 AM

Return to original view | Post

#13

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 30 2021, 10:03 AM) If everyone argue like that then LHDN would have collected nothing i think all countries its progressive for tax residents... and flat rate for non-residents TOS liked this post

|

|

|

|

|

|

Oct 30 2021, 10:47 AM Oct 30 2021, 10:47 AM

Return to original view | Post

#14

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(kart @ Oct 30 2021, 08:58 AM) If the dividend (derived from Stock Exchanges not in Malaysia) is credited into our banking accounts in Singapore or any other foreign country, income tax should not be imposed upon our dividend, right? QUOTE(TOS @ Oct 30 2021, 09:01 AM) What about if it goes to SG bank account, then you move that dividend into Malaysia say via CIMB SG/Maybank SG to say CIMB MY? depends how IRB writes the law... dunno yet... if taxed when given or taxed when repatriated/remitted... If LHDN/IRB wants to argue, you transfer it to Malaysia, so you receive it in Malaysia in the end. Sound plausible? most of IRB's other regulations has move from repatriated to when given since this is "new" to ppl... maybe they a bit generous in this transition period and only taxed when repatriated edit: just wanna say tax at source/when given makes life easier for ppl in reducing paperwork/records keeping etc. also when you progress and naik pangkat get higher pay... you would have paid less taxes when your bracket is 18% vs 26%... This post has been edited by dwRK: Oct 30 2021, 11:04 AM TOS liked this post

|

|

|

Oct 30 2021, 03:23 PM Oct 30 2021, 03:23 PM

Return to original view | Post

#15

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Nov 4 2021, 07:27 AM Nov 4 2021, 07:27 AM

Return to original view | Post

#16

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Nov 4 2021, 12:59 AM) Bro, you can get the free share, sell it and cash out straight away. I know of one Singaporean guy doing that with his wife. Instant I think 10% ROI. There's no penalty for doing it. Back when it only required SGD2500 of deposit. That guy did the above but still keeping the moomoo account. #truestory i agree.You can then close account if you don't want to use them and withdraw all your money. Again no penalty. That's what some people in the US do. Farming free cashback from new sign up credit cards and free stocks from brokerage. When people give you free money, take it. Don't turn down free money. It's not ethical but hey the company is the one throwing out free money. it's their advertisement budget... instead of spending millions advertising on TV, papers, etc... they give promo free share... I'm quite sure they already considered ppl hit n run just for it... so would not feel bad for them but I didn't do it... TOS liked this post

|

|

|

Nov 5 2021, 10:00 PM Nov 5 2021, 10:00 PM

Return to original view | Post

#17

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 5 2021, 08:52 PM) Interesting stuff you have there. So no need to worry about tax as long money does not go back to M'sia. aiyoh... the headline said "... received in Malaysia" mah... kept overseas not taxed lor... hahaha Thanks for clarification. but this is not really an option for a lot of us lah... we eventually need to bring $ back IRB really going after the new e-commerce economy ppl lah... those online business, freelancer and traders, etc... also what is not taxable locally should not be taxable when foreign sourced... anyways will see... |

|

|

Nov 5 2021, 11:22 PM Nov 5 2021, 11:22 PM

Return to original view | Post

#18

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 5 2021, 10:09 PM) So local UT/companies dividends will also be taxed then, if the government wants foreign-sourced and brought-in ones stuffs taxed. des why I think main target is e-commerce ppl... hopefully dividends is not collateral damage... anyways wait n see lah...ASNB and EPF will be exempted I guess, otherwise millions of people will raise a big row. |

|

|

Nov 12 2021, 11:50 AM Nov 12 2021, 11:50 AM

Return to original view | Post

#19

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(prophetjul @ Nov 12 2021, 10:28 AM) i am listening to EY budget seminar. there's also a shearn delamore webinar this afternoon...The MOF director has indicated that they are are still many hurdles and clarifications to be made on foreign sourced income. Challenges will be any money retrieved from overseas and their source. How to go about this especially if if they are gifts to loved ones? |

|

|

Nov 12 2021, 02:00 PM Nov 12 2021, 02:00 PM

Return to original view | Post

#20

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(prophetjul @ Nov 12 2021, 12:53 PM) yeah... my mrs say they covering technicalities n hidden implications of the finance bill... not sure if it's a public webinar... I tot it was when I saw their website... that's when I tag you since you joined the EY one... but mrs says its for their clients...so it may be a different one |

| Change to: |  0.4176sec 0.4176sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 09:06 AM |