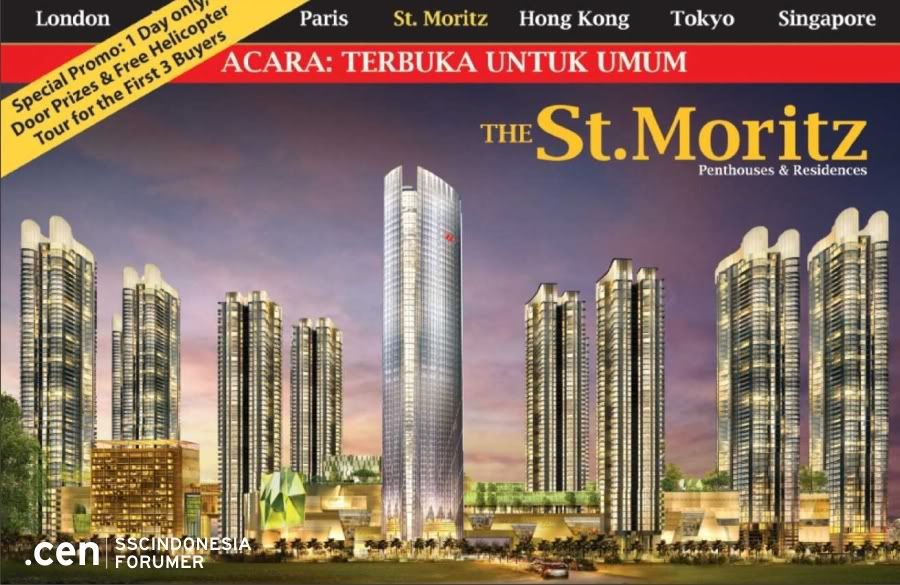

A simple preview of the luxury malls in Jakarta today will tell you their upper middle class purchasing power.

The same for property. Their new launches will make KL's most expensive to shame.

» Click to show Spoiler - click again to hide... «

Jakarta Official Flagship Standalone Boutiques Only 2012

Here are the list (Free-standing Boutiques only):

- (PI) = Plaza Indonesia

- (GI) = Grand Indonesia

- (PP) = Pacific Place

- (PS) = Plaza Senayan

- (SC) = Senayan City

- (PIM2) = Pondok Indah Mall 2

- (CP) = Central Park

- (GC) = Gandaria City

- (KK) = Kota Kasablanka

- (KC) = Kuningan City

- (KV) = Kemang Village (Lippo Mall Kemang)

- (MKG3) = Mal Kelapa Gading 3

- (MTA) = Mal Taman Anggrek

- (EP) = Emporium Pluit

- (MOI) = Mall of Indonesia

- (Plangi) = Plaza Semanggi

- (eX) = Entertainment X'nter

- (fX) = Lifestyle X'nter

- Kemang st.

LUXURY BRANDS

- a.testoni (PI)

- ALBERTA FERRETTI (PI)

- Aigner (PI, GI, PS, MTA, PIM 2, GC, CP)

- Anteprima (PI)

- alldressedup (KC)

- BALENCIAGA (PI)

- Bottega Veneta (GI, SC)

- Burberry (GI, SC)

- Brioni (PI)

- Bally (PS, PI)

- BROOKS BROTHERS (PS)

- BCBG MAXAZRIA (SC, PI)

- BVLGARI (PI, PP)

- BVLGARI Accessories (PI, PP)

- Bell & Ross (PP)

- Bang & Olufsen (PI, PP)

- Bose (PS, GI, MTA, CP)

- CHANEL (GI)

- CÉLINE (PS)

- CHRISTIAN LOUBOUTIN (PI)

- Cartier (PI)

- Canali (PP)

- COACH (PS)

- CHARRIOL (PI)

- Christofle (PI)

- Calvin Klein (PI, SC, PP)

- Dior (PS)

- DOLCE & GABBANA (GI)

- Diane von Furstenberg (PI, PS)

- Dunhill (PS)

- DKNY (PI)

- ETRO (PP, PI)

- Ermenegildo Zegna (PI, PS, PP)

- Emporio Armani (PI)

- Edidi (PI)

- FENDI (PI, PS)

- Franck Muller (PI)

- FRANCESCO BIASIA (SC, PI)

- FURLA (GC, CP, KC)

- Farah Khan (PI)

- GIVENCHY (PI)

- GIORGIO ARMANI (PI)

- Giorgio Fedon 1919 (PS)

- GUCCI (PI, GI, PS, SC)

- Giuseppe Zanotti Design (PI)

- HERMÈS (PI, PP)

- HERMÈS • PUIFORCAT • SAINT-LOUIS (PI)

- HERMÈS Watch Boutique (PS)

- Hugo Boss (PI, PP, PS, PIM 2, GC, CP)

- JUDITH LEIBER (PI)

- Jean Paul Gaultier (PI)

- Jimmy Choo (PI)

- JOHN HARDY (PI)

- Just Cavalli (PS)

- KENZO (PI)

- Kate Spade (PI, PS)

- LANVIN (PI)

- Loewe (GI, PI)

- Louis Vuitton (PI, PP, PS)

- Longchamp (PI, PS, PIM 2)

- LA PERLA (PS)

- Longines (PS, PI)

- MICHAEL KORS (PS)

- MaxMara (PI, PS)

- Moreschi (PS, PI)

- MARC BY MARC JACOBS (PI)

- Montblanc (PI, PP, PS, MTA, PIM 2)

- Mondial (PI, PS)

- Mandarina Duck (KK)

- Notte (PI)

- Omega (PI, PP, PS)

- On Pedder (PI)

- PRADA (PI)

- Roberto Cavalli (PS, PP)

- RED Valentino (PI)

- RODO (PI)

- ROLEX (PI)

- RICHARD MILLE (PI)

- RADO (SC)

- RIMOWA (PI)

- Sergio Rossi (PS)

- Salvatore Ferragamo (GI, PI, SC)

- STUART WEITZMAN (PI)

- Stefano Ricci (PI)

- S.T. Dupont (PP, PS, PI)

- Swarovski (PI, KC, KV)

- TOD'S (PI, PP, SC)

- TIFFANY & Co. (PI, PP)

- TAG Heuer (PI, GI, PP, PS, SC)

- TUMI (GI, SC, KK)

- U-BOAT Italo Fontana (PI, PP)

- Valentino (PI, PP)

- VERSACE (PI, SC)

- VERSACE COLLECTION (GC, CP)

- VERSACE HOME (PI)

- Vertu (PS)

- VABENE (PI)

- Yves Saint Laurent (SC)

- Yafriro Celebrer Le Temps (PI)

- ZILLI (PI)

FASHION APPAREL & ACCESSORIES

- AJ | ARMANI JEANS (GC, CP, KC)

- A|X ARMANI EXCHANGE (PI, SC)

- Agatha Paris (PI)

- Accessorize (KK, KC, KV, PI)

- ALDO (PI, PS, PIM 2, KC, KK, KV)

- adidas originals (PI, KV)

- Adidas (GI, PP, SC, PS, CP, MTA, MKG 3, PIM, Plangi, KK, KV)

- Ashworth® (KK)

- AND1 (SC, PIM 2)

- Andrew Shoes (SC, GI, MKG 3, PIM 2, MTA)

- Aprica (PI)

- BOSS ORANGE (GC, CP, KC)

- bebe (GI, PP, SC, PI, KV, KK)

- BANANA REPUBLIC (GI, SC)

- Bershka (PI, CP, SC, KK)

- BRAUN BUFFEL (PI, SC, MKG 3, GI, PIM 2)

- BONIA (GI, KK, KV)

- Bocorocco Italia (GC)

- Byford London (GC, MOI)

- Beetle Bug (GC, CP, PIM 2)

- Billabong (PIM 2, CP, KK)

- Baleno (GI, MTA, MKG, PIM 2, EP)

- Bossini (SC, PIM 2, MTA, MKG, EP)

- Barbie (PIM 2, GC, CP)

- Bata (MTA, MKG, PIM, Plangi)

- Bratpack (KC)

- Coast London (PS, PIM 2)

- Camper (PI, SC)

- Cache Cache (PIM 2, EP, MKG 3, KK)

- Columbia Sportswear Company™ (PI, GC)

- Cotton On (KK, KC)

- Claire's (KK, KV, SC)

- Cuffz (KK)

- Carlo Rino (KV)

- Cop-Copine (GI)

- Crumpler (eX)

- Converse (PI, SC, CP, Plangi, KK)

- Clarks (GI, SC, PIM 2, KK)

- Charles & Keith Signature Label (PP)

- Charles & Keith (PI, GI, SC, MTA, MKG 3, PIM 2, PS, GC, CP, EP, fX, KK)

- Crocs (PI, GI, SC, MTA, MKG 3, GC, CP, EP, kemang, KV, KK)

- Cymbeline Paris (MTA)

- Crocodile (GI)

- Condotti (MTA, GC, EP, KK, KV)

- Camel Active (MKG 3)

- Château de Sable (PI, PIM 2)

- Colettee (PI, SC)

- Catimini Paris (PI)

- DKNY JEANS (PP, PI)

- Desigual (PS)

- Dorothy Perkins (GI, CP, PIM 2, GC, KK)

- Donini (PP, PIM 2, KK)

- DC Comics Super Heroes (PI, PIM 2, GI, GC)

- DC Shoes (PI, KV)

- diva (CP, GC, KK, KC)

- Delsey (GC)

- Esprit (PP, MTA, MKG 3, PIM 2)

- edc by esprit (PP, MTA, MKG 3)

- ecco (KK, GC, KV)

- Evita Peroni (PP, SC)

- Elle (GI, PIM)

- Elle Homme (MTA, MKG 3, PIM 2)

- Elle Kids (GI)

- Everlast (KK)

- Ellesse (KC)

- Everbest (PP, SC, PS, GC, Plangi, KV)

- evb* (MKG, GC)

- Emile et Rose (PI)

- ebase (PIM 2)

- FRED PERRY (PI)

- Folli Follie (PP, PS, PI, GC)

- FOREVER 21 (GI, PIM 1)

- Forever New (KC, KV, KK)

- FLORSHEIM (PI, PIM 2)

- Fiorucci (PI, MTA, GC)

- FOSSIL (PIM 2, CP)

- Flight 001 (PI, GC)

- FitFlop Footwear (KC)

- Fjord (PI)

- FIFA (GC)

- Factor (SC, MTA, MKG)

- Fila (PIM 2)

- Guess by Marciano (PI)

- GUESS (GI, PP, PS, SC, PIM 2, MKG 3, MTA, CP, GC)

- Guess Accessories (PI, GI, PS, SC, MTA, MKG, CP, GC, KC, KV, KK)

- Guess Footwear (PP, PIM 2)

- guess kids (GI, SC, CP)

- GAP (GI, SC, PIM 2)

- GAP Kids & Baby GAP (PP, SC, GI, PIM 2)

- GEOX (PI, PP, SC, PIM 2)

- Gianni Paolo (PP)

- Giorgio Agnelli (EP, KK)

- Giordano Concepts (GI)

- Giordano/Ladies (GI, PIM 2)

- Giordano (PI, MTA, MKG 3, PIM 2, EP, GC, Plangi, KV, KK)

- G2000 (SC, MTA, MKG, PIM 2)

- Gallop (CP)

- Gosh (PI, GI, PS, SC, MKG 3, MTA, PIM 2, EP, KK)

- Gingersnaps (PI, PIM 2, GC, SC, KC, KK)

- HUNTING WORLD (PI)

- Hoss Intropia (PS)

- H.E. by MANGO (CP, PI, KK)

- Havaianas (PS)

- Hush Puppies Apparel (GI)

- Hush Puppies Accessories (SC, MKG 3, MTA, PIM, GC, EP, Plangi, KV, KK)

- Harley Davidson MotorClothes (PIM 2)

- Hellolulu® (PI)

- I AM jewelry & accessories (KV)

- I.P. Zone (PIM 2)

- Juicy Couture (PI)

- JanSport (eX)

- Jockey (KK)

- Jack Nicklaus (PI, MKG, PIM 1, KK, KV)

- KAREN MILLEN (PS, PIM 2, PI)

- Kipling (SC, MTA, PIM 2, CP, GC, KC, KK)

- Kickers (MKG, KK)

- Kappa (MTA, MKG, PIM 1, KK)

- Kamiseta (MTA, MKG)

- Kent (PP, KK)

- Karen & Chloe (GI, CP, KK)

- LeSportsac (PI, PS, PIM 2, MKG)

- LACOSTE (PI, GI, PS, PIM 2, CP, GC, SC, KC, KK)

- Lacoste L!VE (KC)

- Lustro (PI)

- Levi's (PI, GI, PP, PS, SC, PIM 2, MKG 3, MTA, CP, GC, KK)

- La Senza (GI, PP, SC, CP, MTA, PIM 2, GC)

- Lee (PIM 2, MKG, CP, PI)

- Lee Cooper (MKG, PIM)

- Lucieno (PI)

- Lovelinks (CP, GC)

- MAX & Co. (SC)

- Massimo Dutti (GI, SC, PIM 2, KC)

- MANGO (PI, GI, PP, PS, PIM 2, MTA, SC, CP, GC, KC)

- MANGO TOUCH (CP, PIM 2)

- Miss Selfridge (SC, KK)

- MORGAN de TOI (KV)

- MUJI (PI, GI, MOI, MTA, PIM 1)

- m)phosis (PI, SC, PP, PS, PIM 2, KK)

- Mario Minardi (KK)

- Marie Claire (SC, PIM 2, MTA, GC)

- Mothercare (PI, GI, PP, SC, MTA, MKG 3, PIM 2, GC, EP, CP, KC, KK)

- Monet & Co. (GI, SC, PIM, EP)

- Mooks (MKG)

- NINE WEST (PI, GI, PS, SC, MTA, CP, PIM 2, GC, KK)

- New Look (CP, SC, PIM 1, KK)

- Next (GI, PIM 2, MKG 3, MTA, GC, CP, SC)

- Next Kids (KK)

- NAUTICA (PI, SC, MTA, CP, MKG 3, PIM 2, GC, KK, KC, KV)

- Nike (PI, PP, PS, SC, MTA, MKG 3, PIM 2, GC, GI, EP, KK)

- Nike Sports Wear / NSW (PI)

- Nike Golf (PP, PS, PIM 2)

- Noche (SC, Plangi)

- Nannini Eyewear (PS)

- Oasis (KK, KV)

- OAKLEY (GI)

- Obermain Germany (PIM 1)

- Okaïdi & Obaïbi (PI, SC, KV)

- OshKosh B'Gosh (PP, MTA, MKG, PIM 2, CP, GC)

- Oregano spain (CP)

- Pepe Jeans (KK)

- Paris Hilton (GI)

- Pull & Bear (GI, MKG 3, PIM 2, CP, KK, KC)

- PEDDER RED (PI, GC, KV)

- PANDORA (PIM 2, SC, PI, KK)

- Promod (SC, MKG 3, KV, KK)

- Paris Bijoux (PI)

- Pedro (PI, PP, SC, PIM 2, MKG 3, fX, MTA, KK)

- Payless ShoeSource (CP, GC, Plangi, KK, KV)

- Polo Ralph Lauren (MTA, MKG 3, GC, EP, kemang, KV, KK)

- PUMA (PI, GI, SC, CP, MTA, MKG 3, PIM 2, KC, KK)

- Pazzion (PI)

- prettyFIT (GC, CP, PIM 2, KK)

- PLA Shoes (PI, PS)

- Puremilk (GI, MKG 3, fX)

- Puku (PI, GC)

- Quiksilver (PIM, KK, KV)

- RAOUL (GI, PP, SC)

- Rotelli (PI, PS, SC, MTA, MKG, PIM 2, KV)

- Rockport (PS, PIM, SC, PS, KK)

- Reebok (PI, GI, KK)

- Reeride by Reebok (KK)

- Rip Curl (SC, PIM 2)

- Reef (KK)

- Rudy Project (PIM 2, fX, Plangi)

- Rhumell (SC)

- SUITE BLANCO (SC, KC)

- Superdry (PI, SC, CP, KK)

- STEVE MADDEN (PIM 2, SC, MTA, KK)

- Stradivarius (PI, CP, SC, KK, KV)

- Staccato (PIM 2, SC, KK, KV)

- Sperry (KK)

- Samsonite (PI, PS, SC, MKG 3, CP, GC, KK)

- Skechers (CP, GC, KK)

- Scholl (GC)

- Samuel & Kevin (GI, MTA, PIM 2, EP, KK)

- Sun Paradise (PIM 2)

- Sophie Martin (Plangi)

- Snoopy House (MTA, MOI)

- Snoopy Baby (MTA, EP)

- TRUE RELIGION (KK)

- TOMMY HILFIGER (GC, CP, KC)

- Tonino Lamborghini (PP, PI)

- TED BAKER (GI, PS)

- Thomas Sabo (PI, GC, PP)

- Timberland (SC)

- TOPMAN (GI, SC, CP, PIM 2, KK)

- TOPSHOP (GI, SC, CP, PIM 2, KK)

- TOCCO TOSCANO (GC)

- TOUGH Jeansmith (PI)

- Triumph (PI, KC)

- The North Face (KC)

- The Cufflinks Store (PI, PP)

- Umbro (MKG, MTA)

- Victoria's Secret (PS)

- VERSACE JEANS (KC)

- Van Laack (PP)

- VANS (KK)

- Verdè (PI, GI)

- Valentine Secret (PP)

- Vincci (SC, MTA, PIM 2)

- WAREHOUSE (SC, KK, GI)

- Wallis (KC, SC)

- Wakai (CP, PI, KK)

- Wrangler (PIM, KK)

- Wacoal (MTA, GC, MOI)

- WOOD (MTA, KK)

- Y-3 by Yohji Yamamoto (PI)

- ZARA (PI, GI, PS, SC, PIM 2, MKG 3, MTA, CP, KK)

JEWELRY & WATCHES

- Alexandre Christie (MTA)

- BONIA Timepiece (CP)

- CERRUTI 1881 Timepieces & Ornaments (PI)

- Cortina Watch (PI)

- Club Solitaire (PI)

- Charles Jourdan Watches (PI)

- Casio G-Factory (PI, fX, CP, SC, GC)

- DeGem (PI)

- Doris Vinci (MTA)

- Disney Couture (PI)

- Esprit Timewear & Jewel (PP, CP)

- Folli Follie Watches (PI, PP, PS, GC)

- Frank & Co. (PI, PS, MTA, MKG, PIM)

- Frank Duet (MTA, PIM 2, Plangi)

- Felice Collezioni (PS, SC, MTA, PIM 2, MKG)

- Gc – Guess Collection (PI, GI, PS, CP)

- Guy Laroche Timepieces (PI)

- gordonMax (PP)

- In Time (SC, PIM 2, PS)

- Luminox (CP, KK)

- Kenneth Cole watches (PI)

- Marc Eckō (SC)

- Monet (GC)

- Nixon Watches (eX)

- Nautica Watches (PS, SC)

- odm (eX)

- POLICE (eX, GC)

- Perlini's Silver (GI, MTA, MKG, PIM, Plangi)

- Primagold (PI)

- RED ARMY WATCHES (GI, SC)

- Swatch (PI, GI, SC, MTA, CP, MKG, PIM 1, GC, EP, PS, KK, KC)

- Seiko (PS)

- Startime (PI, GC)

- ToyWatch (PI, MKG 3)

- TISSOT (PI, PS, PIM 2)

- The Time Place (PI, PS, PP)

- The Palace by Mondial (MKG 3)

- Timex (MTA, fX, GI, GC)

- The Carat Gallery (PI)

- Urban Icon (PI, GI, PP, SC, CP, MKG 3)

- Victorinox Swiss Army (SC)

- Veni Vidi Vici (SC, PP, CP)

- Watch The Wrist (PI)

- Windsor Diamonds (PS)

- Watch Zone (GI, SC, CP, EP, KK)

- Watch World (eX, GI, CP, MKG, PP, EP)

- Watch Studio (GI, GC)

DEPARTMENT STORE

- CENTRO (MOI, Plangi)

- DEBENHAMS (SC, KV)

- GALERIES LAFAYETTE (PP)

- METRO (PP, PS, PIM, MTA, GC)

- MARKS & SPENCER (PI, GI, PS, SC, PIM 2, MTA, MKG 3, CP, KK)

- SEIBU (GI)

- SOGO (PS, PIM 2, MKG 3, EP, CP, KK)

- THE GOODS DEPT• (PP)

BEAUTY & HEALTH

- BOBBI BROWN (PI, PP, PS)

- BEAUTÉ de KOSÉ (MTA)

- Browhaus & Strip (PI, SC, PIM 2)

- Bianco (PI)

- Bella Skin Care (PI, EP)

- CLARINS (PP)

- Clé de Peau Beauté (PI)

- Crabtree & Evelyn (PI, KK, KV, KC)

- Domicile (PI)

- Etude House (MTA, MKG 3, GC, EP, KC)

- Erha Apothecary (PI, PP, GC, SC)

- Erhalogy (PP, SC, PIM 2)

- Glow living beauty (PI)

- GNC (PI, GI, PP, PS, SC, PIM 2, MTA)

- HARNN (PI)

- Harnn & Thann (PS)

- ~H2O+ (PI)

- J.F. Lazartique Paris (PI)

- Jean Yip (MKG 3, PIM 2)

- Kiehl's New York (PS, PIM, MKG 3, SC)

- Kenko Reflexology (PI, GI, PP, CP, GC)

- Kenko Fish Spa (GI, PP, SC)

- La Mer (PI, PP, PS)

- L'Occitane (PI, PP, PS, SC, MKG 3, CP, PIM 2, GC, KK)

- LA Splash (PI)

- Lu'Vaze (PI, PS)

- M.A.C (GI, PP, PIM 2)

- MAKE UP STORE (PI, PP)

- Make Up For Ever (PI, PS)

- Make Up For Ever Make Up School (PI)

- MakeOver (CP, KC)

- Menard (PIM 1)

- Marie France Bodyline (PI, PIM 2, MKG 3, EP)

- NYX (eX, CP)

- Natural Farm (GI, PI, SC, PS, MKG)

- Nano Philosophy (GI)

- O.P.I (PI, PS, GC)

- Obagi (MTA, MKG 3, PIM 2)

- Phiten (GI, SC)

- SEPHORA (KC, KV, KK)

- Shu Uemura (SC, MKG 3, PS)

- Skin Food (eX, SC, MTA, MKG 3, CP, PI)

- Senses (GI)

- Svenson (EP)

- TONI & GUY (eX, MKG 3, PIM 2, CP)

- The Body Shop (PI, GI, PP, PS, SC, PIM 2, MTA, CP, GC, EP, KK)

- The Face Shop (eX, PS, SC, CP, MTA, MKG, GC, EP, KK)

- Watsons (PIM 2, MKG 3, KK)

- Yves Rocher France (MTA, MKG)

MULTI-BRANDS

- Alta Moda Uomo (PS, PP, MTA)

- CLUB 21 (kemang)

- DENIM DESTINATION (SC)

- FJL (kemang)

- Ivy (PS)

- Jade (PI, SC)

- John (PI)

- Kidz Station (PI, MKG, MTA, MKG, GC, EP, KC)

- LINEA (PI, PS, PIM 2, SC, CP, kemang)

- Lafayette (PI)

- Le Privee (PI)

- Lucy House (PI)

- Life. Store (SC)

- MASARI (PI, SC, PIM 2)

- MUSE (PS, PI)

- MEZZO (KC)

- meeToo (PIM)

- Madison (GI)

- Ojero (PI)

- Papilion Duo (PP)

- Planet Sports (GI, SC, MTA, MKG 3, KC, KK)

- Planet Surf (SC, MTA, Plangi)

- Point Break World (PS, MTA, PIM 2, MKG 3)

- RUMOURS (PI, PS)

- ROCOCO (PI, PP, PIM2, PS, GI)

- ROCOCO Accessories (PI)

- STANDARD DENIM SUPPLY CO. (PS)

- Sole Effect (PIM 2, CP)

- Samba (GI, KK, eX)

- Sports Station (PI, SC, PS, PP, CP, MKG, PIM 2, GC, EP, KK)

- Soccer Station (PI, CP, PIM 2)

- Surfer Girl (SC)

- The Upper East (GI)

- The Papilion (kemang)

- Travelogue (CP, GC, SC, KK, PI)

- Toys City (PIM 2, CP)

- Toys Kingdom (GI, GC)

- The Athlete’s Foot (SC, PS, PIM, MKG, MTA)

INDONESIAN BRANDS

- (X) S.M.L (PI, GI, PS, SC, PIM 2, MKG 3, KC)

- (X) S.M.L NOIR (PI)

- (X) S.M.L Accessories (PI)

- 16DS (GI)

- 126 (One Two Six) (MKG, MTA, PIM 2, EP)

- Alleira (PI, GI, SC, GC, CP)

- Alleira Kids (PI)

- AMANTE (MTA, eX, PS, PP, PIM 2)

- Alun Alun Indonesia (GI)

- Aveda (GI, MTA)

- (ak.'sa.ra) (PI, PP)

- Accent (MKG 3, GC, Plangi)

- Arithalia (MTA, MKG, PIM 2, Plangi)

- Arnon Brook (MTA)

- Andre Valentino (MKG, PIM 2)

- Akachan House (PI)

- Abacus (GI)

- Biyan (PS, PP)

- Biyan Bride (kemang)

- Biasa (kemang)

- Bin House (PI, kemang)

- Batik Keris (PI, GI, PP, MTA, PIM 2, KC, KK)

- Brutus (GI, MTA)

- Body & Soul (PIM 2, MKG 3, MTA, GC, EP, kemang)

- Bellagio (PP, MKG, PIM 2, EP, KK)

- Ballin (PP)

- b!ing (SC, PI)

- Coconut Island (GI, GC)

- Contempo (PI, GC, EP)

- Contempo Kids (PI)

- Ciel (PS)

- Cherokee (SC)

- Cool Kids (MTA, GI, PP, SC, PIM 2, GC, CP, EP)

- Cool Teen (GI, CP, MKG 3, EP)

- Chic Simple (MTA, MKG, PIM 2)

- Colorbox (MKG, GC, EP, KK)

- Calliope (MKG 3)

- Coogee Kids Shoes (PI)

- Cotonnier (PI)

- Cerise Jewelry (PI)

- Christin Diamond (PI)

- Crown Jewelery (PI, PP)

- Denny Wirawan (GI)

- Danjyo-Hiyoji (GI)

- Damn! I Love Indonesia (GI, fX)

- Deer (GI)

- Danar Hadi (KK)

- Edward Hutabarat (PP)

- Et Cetera (MKG 3, PIM 2, GC, KK)

- Eiger (GC, Plangi)

- École (MTA)

- Eustacia & Co. (PIM 2, MTA)

- FREDDIE.FREDDIE (SC)

- Gaya The Designer's (PI)

- Gaudi (GI, MTA, MKG 3, PIM 2, GC, EP)

- Geulis (GI)

- Harry's Palmer (MTA, EP)

- Hammer (MTA, PIM, GC, EP)

- Harrington Home (GI)

- House Of Jealouxy (GI)

- Hunting Fields (GI)

- Heatwave (eX, MTA)

- Iwan Tirta Private Collection (PI, PP, PIM 2, GI)

- Ichwan Toha (GI)

- IDEKO (PI)

- Icons (MTA, MKG, PIM 2)

- Invio (PP, MTA)

- I C Y (PI, fX)

- izzue (GC)

- Jacquelink (PI)

- Jeanny Ang Couture (MTA)

- Jeans Republic (MTA, MKG 3)

- KLÉ (GI)

- Keeve (PI)

- KORZ (MKG, GC)

- Kisoon and Flora Harto Design (PP, PIM, GC)

- Kesawan (PI)

- Level One (GI)

- Lea Jeans (GC)

- Lezilla Fashion Shoes (GI)

- League (SC, PIM 2)

- Lavinda (MTA, GI)

- Leone'Uomo (MKG, PIM)

- Little Heirloom (PI)

- Lomography (GI)

- Leaf (MTA)

- Lil Moo (eX, PS, KK)

- Mama & Leon (GI)

- Martha Tilaar (GI, MTA, MKG)

- My Cup Of Tee (GI)

- Magnolia (GC, PIM 2, SC, KK)

- Mineola (KK)

- Moselle (PI)

- Magic Happens x MYE (GI)

- Mimsy (GI)

- Monday To Sunday (GI)

- Monaco (MTA, PIM 2)

- N.Y.L.A (GI, SC, MTA, PIM 2, GC)

- Nail (GI, MTA, GC)

- Number 61 (MKG 3)

- Naima (GI)

- No'om and Soe.Hoe (GI)

- One Earth (MKG 3)

- Ocean Line (CP, GC)

- Orange (MTA, SC, MKG 3, PIM 2, GC)

- Osella Kids (EP)

- Phoebe & Chloe (PI, GI, CP)

- Plus Minus (SC)

- Parang Kencana (PS, PP, GI)

- P.S. (GI, MKG, PIM)

- Periplus (PI, PS, MKG, PIM)

- Plastic Culture (GI)

- Red Liquid (PI)

- Roemah Pengantin by Anne Avantie (GI, MTA)

- Rockets (PIM 2)

- R n beth (PI)

- Rebel For A Cause Charity Store (GI)

- Sebastian's (PI, PS, MTA)

- Studio 133 Biyan (SC, MKG 3)

- STELLA RISSA (GI)

- Sally Koeswanto (GI)

- Simplicity (MTA, MKG)

- Stellamas (PI)

- Satcas & Sash (GI)

- Saint and Sinner (GI)

- Silla Home (GI)

- Salt n Paper (PIM 2, eX)

- Tina Andrean (GC)

- Tracce (PP, MKG 3, PIM 2, GC)

- The Little Things She Needs (eX, GI, CP, MKG 3, SC, GC, EP, PI, KK)

- T-Lab (PI, PS)

- The Executive (GI, MTA, MKG, GC, EP, Plangi, CP, KK)

- The Cat Walk Gallery (MKG 3)

- Tic-Tac-Toe (PI)

- Tiny & Co. (PI)

- Tik Shirt (GI)

- Tick Tock (GI)

- Tosavica (GI)

- Urban Twist (MTA, MKG)

- Uptown Girl (MTA, MKG)

- Yellowline (MKG 3, MTA, PIM)

HOME & LIFESTYLE

- Armani/Casa (Da Vinci Tower)

- Arbor & Troy (GI)

- Alessandra Home (PI)

- American Giant (KK)

- Apple iBox (PI, GI, CP, SC, MKG 3)

- Ariston (GI, MTA, MKG, CP, EP)

- Biyan Living (kemang)

- Blackberry® Store (MKG 3, GC)

- Blanchetti (PI)

- Best Denki (GI, PP, SC, CP)

- Baylis & Harding Co. (PP)

- Book & Story (PI, PP)

- Colombostile (Da Vinci Tower)

- CERRUTI (Da Vinci Tower)

- Czarre (PI)

- Ciacci (GI)

- Contempo (GI)

- Cellini (MTA, MKG 3, EP, KK)

- Charis Home (SC)

- CG Art Space (PI)

- Driade (PI)

- Duomo (SC)

- Drexel Heritage (Da Vinci Tower)

- Daiso (KK)

- Elephant & Coral (PI)

- Elite (SC)

- Euro Mattress (CP)

- Early Learning Center (PI, GI, PP, SC, MTA, MKG 3, PIM 2, GC, EP)

- FENDI CASA (Da Vinci Tower)

- FRANZ Collection (PI)

- Friven & Co. (SC)

- Floral Home (PI, PS, PIM)

- Floe Boutique Flower Shop (PS, PI)

- GODIVA (PI)

- Golf House (PS, PP, SC, MTA, MKG 3, KK)

- Henredon (Da Vinci Tower)

- Hollywood Homes (Da Vinci Tower)

- Hickory Chair (Da Vinci Tower)

- Home-Fix The D.I.Y Store (PI)

- HALO Living (GI)

- Hot Wheels (PP)

- Hallmark (MTA, PI)

- Havana Gallery (PI)

- Hankook Ceramic (MKG)

- IPE Cavalli (Da Vinci Tower)

- Jehann Kläuss (MTA)

- Jonathan Charles (Da Vinci Tower)

- KENZO Maison (Da Vinci Tower)

- KARE Design. Germany (SC)

- Kinokuniya (GI, PS, PIM2)

- King Koil (GI, MTA, MKG 3, CP)

- Kettler (GI, PS, MTA, MKG, SC, PIM 2)

- Livvi Casa (PI)

- La Flo (PI)

- La Germania italia (CP)

- [lo:renza] (CP, EP)

- Lady Americana (CP, EP)

- LG Shop (GI, PP, SC)

- Lovely Lace (PI, MTA, PIM)

- Lifehouse Bookstore (PI)

- Lock & Lock (CP)

- MISSONI Home (kemang)

- Minotti (kemang)

- MOIE (PP, kemang)

- Melandas (GI, PP, SC, MTA, CP, EP)

- Maitland Smith (Da Vinci Tower)

- Natuzzi (Da Vinci Tower)

- Narumi (PP)

- Nolff (CP)

- Nokia (GI, PP, SC, CP, MKG 3, PIM 2)

- Osim (SC, PP, GI, MTA, MKG 3, PIM 2)

- Ogawa (SC, MTA, PP, GI)

- Papilion Duo & Biyan Living (PP)

- Patchi (PI, PP, PIM 2)

- Parennials (PI)

- Pazia (PI, fX, GI, KC)

- Royal Selangor (GI, PS)

- Rosewood (MTA, PIM)

- Saint-Louis Lounge (PI)

- Schott Zwiesel (PP)

- Simmons (PP, CP, MTA, EP)

- Serta (GI, MTA, MKG 3)

- Slumberland (GI, MTA)

- Saint James (GI, PIM 2)

- Shaga (SC, GI)

- Shoppe De Pazia (GI)

- Sony Center (GI, PP, MTA, MKG 3)

- Sharp (GI)

- Samsung Plaza (PP)

- Sanrio (PS, SC)

- Thomasville (Da Vinci Tower)

- Theodore Alexander (Da Vinci Tower)

- Tempur (PI)

- Troika (GI, PS)

- Toto (GI, PP)

- Times Bookstores (PP)

- Terry Palmer (SC, PIM)

- Tokyo 1 Store (PI, GC, KK)

- USA Prank (PI)

- Vivere (PP, SC, PIM 2, MKG 3, CP)

- Vinoti Living (PI, MKG 3, MTA, EP)

- WEDGEWOOD (PP)

- WMF (PP)

- Woof! (PI)

more collections in Jakarta's leading dept. store:

DEBENHAMS

- 7 For All Mankind

- American Apparel

- Acne Jeans

- BCBGeneration

- Ben Sherman

- Betty Jackson

- Band of Outsiders

- Bleulab

- Cheap Monday

- Dr.Denim Jeansmakers

- DL 1961

- Ella Moss

- French Connection

- Guy Laroche

- Henry Holland

- Jasper Conran

- John Rocha

- Jonathan Saunders

- Julien Macdonald

- Junk Food

- Mandarina Duck

- Matthew Williamson

- Nicole Farhi

- Oasis

- Original Penguin

- PREEN

- Principles

- Redherring

- Rock & Republic

- Rich & Skinny

- Spanx

- Splendid

- True Religion

- T-Tech by Tumi

- Thomas Nash

- William Rast

and many-many more...

This post has been edited by accetera: Oct 28 2012, 11:01 PM

Aug 31 2012, 06:28 PM, updated 14y ago

Aug 31 2012, 06:28 PM, updated 14y ago

Quote

Quote

0.1084sec

0.1084sec

1.35

1.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled