Sime Darby’s 9-month net profit increases 30% at RM3.1b

Thursday, 31 May 2012 10:24 Anuja Ravendran 0 Comments

Sime Darby Bhd is confident that it will surpass last year’s financial performance, having announced a 29.7% increase in net profit at RM3.1 billion for nine months ended March 31, 2012 (9M12), compared to RM2.4 billion in the same quarter last year.

Its president and group chief executive Datuk Mohd Bakke Salleh said up until April this year, the company had already chalked up a net profit of RM3.4 billion whereas net profit for its financial year ended June 30, 2011, was RM3.7 billion.

“The stronger performance was on the back of commendable results from the plantation, industrial and property divisions,” he said at a press conference in Kuala Lumpur yesterday.

For its cumulative nine months, Sime Darby posted a 16% rise in revenue to RM33.5 billion compared to RM28.8 billion in the same period last year.

Mohd Bakke said the plantation business, which recorded a 20% increase in pretax profit of RM2.4 billion for the cumulative nine months, had benefitted from higher crude palm oil (CPO) prices realised at an average of RM2,881 per metric tonne (MT).

The company expects oil palm prices to hover between RM3,100 and RM3,200 per MT for the next few months depending on factors such as spike in demand during festive periods and more traders buying palm-based products, he said.

Additionally, Mohd Bakke said Sime Darby will venture into the palm oil refining business in Indonesia by setting up a RM350 million facility in South Kalimantan with a capacity of 850,000MT a year to mitigate the 20% export tax that Indonesia imposes on CPO exports.

Its plantations segment contributes about 55% to 60% of the conglomerate’s total earnings, industrial machines contributes 20%, motor and property segments contribute 10% each and the rest are from energy and utilities and healthcare segments, he said.

The industrial division recorded a growth of 41% at RM986 million for its cumulative nine month period on the back of strong mining, logging and construction activities in Australasia and Malaysia, he said. The division’s current orderbook is at RM4.6 billion, spanning over a period of five months to 20 months.

Meanwhile, the property division showed a 50% increase in pretax profit to RM315 million in its 9M12, buoyed by higher sales contribution from its various sales project, Mohd Bakke said.

“The take-up rate for high-end products is slower but normal linkhouses are selling like hotcakes,” he told reporters.

He added that the company will launch a new township called Elmina comprising commercial, residential and retail properties adjacent to the Denai Alam township in Selangor in the next financial year. The details of the project is being finalised.

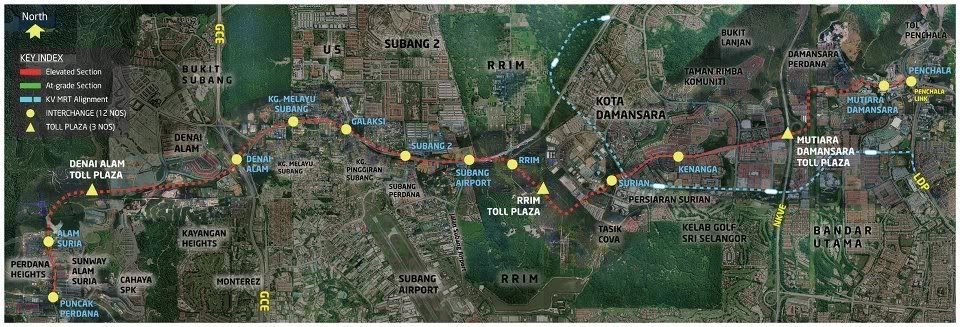

Added on June 19, 2012, 11:41 pmFrom the report above, looks like we will be getting a new township elmina east adjacent to denai alam starting next year. Apparently, it is suppose to be a green township. They are promoting more green pockets in elmina east. Looks like this area is getting very exciting with so many new developments. DASH will fit in nicely here as the population starts to increase.

Added on June 19, 2012, 11:45 pmQUOTE(Mr.Muffin @ Jun 19 2012, 10:52 PM)

Take note that the DASH passes by denai alam right at the southern tip. Possibility quite close to those house with red roof nearer the big lake. Luckily, it is not that close to maple and aster grove. It is buffer by the MBSA hall and sports complex.

This post has been edited by goldwish: Jun 19 2012, 11:45 PM

Jun 18 2012, 12:10 AM

Jun 18 2012, 12:10 AM

Quote

Quote

0.0258sec

0.0258sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled