Outline ·

[ Standard ] ·

Linear+

Credit Cards Credit Card v17, Ask general questions here, Please read the 1st post before posting!

|

saksoba

|

Jun 18 2012, 07:56 PM Jun 18 2012, 07:56 PM

|

|

Hello, few days I ago I applied for citibank clear card.. the idea to apply citibank clear card is due to low annual fee and I want to do Balance Transfer. Later, CS called and forward all the document.. I filled in and submit. Later I notice the BT rate is 9.9%. I'm careless since I did not read it carefully. CS said she will submit my application by tomorrow morning. Is it wise for me to cancel or just keep it? Please advice  |

|

|

|

|

|

saksoba

|

Jun 18 2012, 08:35 PM Jun 18 2012, 08:35 PM

|

|

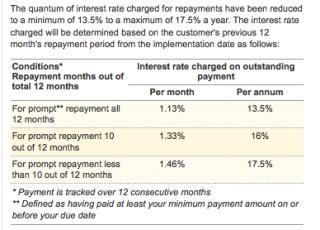

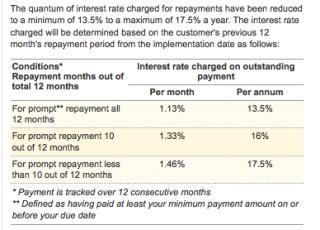

QUOTE(hye @ Jun 18 2012, 08:06 PM) It is still better than 18% p.a. It is really up to you to decide ... if you found something better then you may pursue it. Please note that once you take Citibank BT ... you might as well keep the card in the safe until you clear your BT. Learn from your mistakes - asking for quick rescue will not help you much in life.. That's the best advise we can give you. Yes. that's what I'm planning to do. It purely for BT and I might keep the card in my lock. heh. So, assume my debt float between 5k - 6k (keep using) in debt and my minimum payment is 250. If I pay promptly every month 500 (my debt still floating cause I'm using it), do I still fall i 13.5 or 17.5? I never miss my payment (Rm500) before due date.

I dont think I quite understand table above  This post has been edited by saksoba: Jun 18 2012, 08:35 PM This post has been edited by saksoba: Jun 18 2012, 08:35 PM |

|

|

|

|

|

saksoba

|

Jun 19 2012, 06:17 AM Jun 19 2012, 06:17 AM

|

|

QUOTE(charymsylyn @ Jun 18 2012, 11:43 PM) Lower retail interest for prompt repayment is simply defined as minimum payment received on or before due date. If you are new, you have no record and are placed in the highest tier. Upon reaching the first anniversary, your tier is adjusted based on your payment pattern in the preceding 12 months. May I know if it possible for me to call them and check my tier interest rate? |

|

|

|

|

Jun 18 2012, 07:56 PM

Jun 18 2012, 07:56 PM

Quote

Quote

0.0182sec

0.0182sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled