-deleted-

found the answer in the previous posts. thanks,

This post has been edited by mroys@lyn: Dec 20 2018, 07:10 AM

Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Dec 19 2018, 01:25 PM Dec 19 2018, 01:25 PM

Return to original view | Post

#1

|

Senior Member

1,037 posts Joined: Jul 2009 |

-deleted-

found the answer in the previous posts. thanks, This post has been edited by mroys@lyn: Dec 20 2018, 07:10 AM |

|

|

|

|

|

Oct 18 2019, 03:26 PM Oct 18 2019, 03:26 PM

Return to original view | Post

#2

|

Senior Member

1,037 posts Joined: Jul 2009 |

QUOTE(MUM @ Oct 14 2019, 06:59 PM) if only buy 1 yr @ 3k.....you save RM600 tax very much depends on timing. i started last oct with affin-hwang, saved on tax relief and got 8%+ returnsthe if PRS funds is annualised at 4.5% ROI pa and if other investment is 6% ROI pa 1.5% of 3k is RM45 x 13 yr = 585 abt 13.3 yrs to breakeven at RM600 if you get to invest a 6% ROI like ASB.. so if RM45 x 20 yrs = RM900 that is > the RM600 tax saving... so it depends how long in PRS and is there a 1.5% ROI pa or more investing vehicle out there over the PRS fund per year... This post has been edited by mroys@lyn: Oct 18 2019, 03:27 PM |

|

|

Oct 20 2019, 04:16 PM Oct 20 2019, 04:16 PM

Return to original view | Post

#3

|

Senior Member

1,037 posts Joined: Jul 2009 |

|

|

|

Oct 20 2019, 05:26 PM Oct 20 2019, 05:26 PM

Return to original view | Post

#4

|

Senior Member

1,037 posts Joined: Jul 2009 |

QUOTE(yklooi @ Oct 20 2019, 04:53 PM) for if for the same duration, if one were to take up Affinhwang Shariah Moderate instead of non shariah...then the returns would not be > 5% or if for the same duration, if having Cimb Moderate one...the return would have been > 10% too or if for the same duration, if having Cimb PRS Plus Equity....then |

|

|

Nov 11 2019, 04:27 PM Nov 11 2019, 04:27 PM

Return to original view | Post

#5

|

Senior Member

1,037 posts Joined: Jul 2009 |

sifus, any recommendation for affin-hwang prs fund? plan to dump 3k for tax relief purposes.

|

|

|

Nov 11 2019, 04:28 PM Nov 11 2019, 04:28 PM

Return to original view | Post

#6

|

Senior Member

1,037 posts Joined: Jul 2009 |

|

|

|

|

|

|

Aug 19 2020, 01:12 PM Aug 19 2020, 01:12 PM

Return to original view | Post

#7

|

Senior Member

1,037 posts Joined: Jul 2009 |

lol... Sudha sudah menang!!!

» Click to show Spoiler - click again to hide... « |

|

|

Oct 7 2020, 09:08 AM Oct 7 2020, 09:08 AM

Return to original view | Post

#8

|

Senior Member

1,037 posts Joined: Jul 2009 |

QUOTE(GrumpyNooby @ Oct 7 2020, 08:11 AM) I'm also holding Affin PRS Moderate Fund. Me too, have been keeping with this fund for 3 years consecutively for tax relieve purposes. 3 years with average total returns of 15%, not bad.I'm only investing into existing funds; not employing your strategy of 1 new PRS fund per calendar year. |

|

|

Nov 17 2021, 08:52 AM Nov 17 2021, 08:52 AM

Return to original view | Post

#9

|

Senior Member

1,037 posts Joined: Jul 2009 |

|

|

|

Nov 17 2021, 12:47 PM Nov 17 2021, 12:47 PM

Return to original view | Post

#10

|

Senior Member

1,037 posts Joined: Jul 2009 |

Thank you bro, just created FSMOne account but was informed that my current PRS with Affin i-Access cannot link with FSMOne new purchase/top-up.

QUOTE(CSW1990 @ Nov 17 2021, 12:03 PM) |

|

|

Nov 17 2021, 02:24 PM Nov 17 2021, 02:24 PM

Return to original view | Post

#11

|

Senior Member

1,037 posts Joined: Jul 2009 |

|

|

|

Dec 22 2022, 03:19 PM Dec 22 2022, 03:19 PM

Return to original view | Post

#12

|

Senior Member

1,037 posts Joined: Jul 2009 |

My affin-hwang prs moderate 5-year top-ups are similar to 5 years annualised return, still making 1% out of 15k investment. if i put in fd, i can get rm900+ (based on 2% rate) instead of 150 but again i get tax relieves.

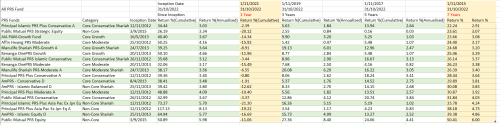

QUOTE(viknes36 @ Dec 21 2022, 04:28 PM) please refer to respected fund performance here: https://www.ppa.my/wp-content/uploads/2022/...ll-PRS-Fund.pdf i filter based on past 7 years performance.  |

|

|

Dec 22 2022, 04:13 PM Dec 22 2022, 04:13 PM

Return to original view | Post

#13

|

Senior Member

1,037 posts Joined: Jul 2009 |

|

|

|

Jan 4 2024, 11:42 AM Jan 4 2024, 11:42 AM

Return to original view | Post

#14

|

Senior Member

1,037 posts Joined: Jul 2009 |

Is the tax relief up to RM3,000 on contribution to a Private Retirement Scheme still applicable for Year 2024? When can we sell/liquidate the fund? Thanks,

|

|

|

Jan 4 2024, 12:11 PM Jan 4 2024, 12:11 PM

Return to original view | Post

#15

|

Senior Member

1,037 posts Joined: Jul 2009 |

|

| Change to: |  0.0298sec 0.0298sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 03:58 PM |