QUOTE(xgen123 @ Dec 2 2020, 10:38 PM)

Hi Guys! New to PRS here. Thinking to open a PRS account for the tax incentive by year end.

1) Is it better to invest via PPA website or FSM? Any difference?

2) What are the recommended funds for high growth long term?

3) Can non-bumis invest in Islamic funds?

Thanks!

1) Is it better to invest via PPA website or FSM? Any difference?1) Is it better to invest via PPA website or FSM? Any difference?

2) What are the recommended funds for high growth long term?

3) Can non-bumis invest in Islamic funds?

Thanks!

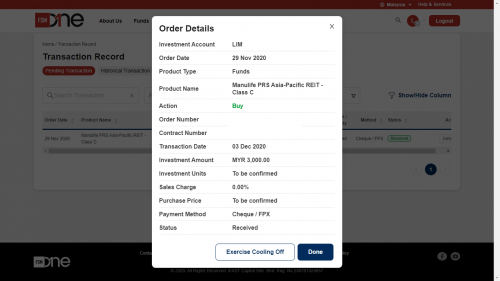

i'm using FSM, 0% sale charges, for certain fund house, you don't need to mail the paper form to open account. Can manage/invest multiple fund house at the same time

PPA website , never tried.. not sure.

2) What are the recommended funds for high growth long term?

i'm taking Principal PRS Plus Asia Pacific Ex Japan Equity which invest in asia pacific region... For others, most of the PRS fund are malaysia equity based, it depends on personal preferences on region and fund house...

3) Can non-bumis invest in Islamic funds?

can of cos.

Dec 3 2020, 09:49 AM

Dec 3 2020, 09:49 AM

Quote

Quote

1.7519sec

1.7519sec

1.13

1.13

7 queries

7 queries

GZIP Disabled

GZIP Disabled