Any PRS is doing well since you signed up for it? Please share the fund name. Thanks

Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Nov 24 2020, 11:02 PM Nov 24 2020, 11:02 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

5,741 posts Joined: Apr 2019 |

Any PRS is doing well since you signed up for it? Please share the fund name. Thanks

|

|

|

|

|

|

Nov 24 2020, 11:10 PM Nov 24 2020, 11:10 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

5,741 posts Joined: Apr 2019 |

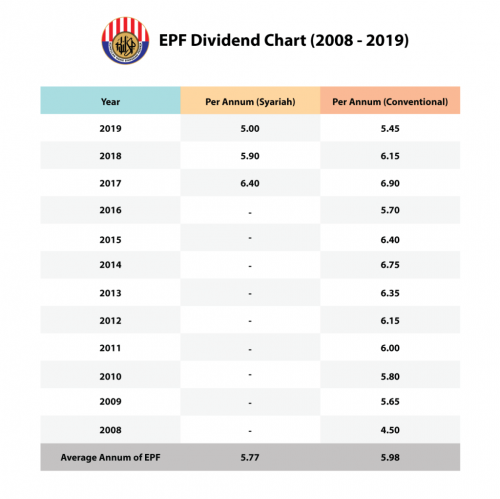

QUOTE(ironman16 @ Nov 24 2020, 11:08 PM) Affin-Hwang-PRS-Moderate-Fund The REIT is a bit sad. IRR= 5.94% ROI=21.54% hold= 3 years 8 months 18 days CIMB-Principal-PRS-Plus-Asia-Pacific-Ex-Japan-Equity-Class-C IRR=7.81% ROI=21.10% hold= 2 years 10 months 12 days AmPRS-Asia-Pacific-REITs-Class-D IRR= 3.40% ROI=0.70% hold= 0 years 4 months 31 days u sendiri tengok , up to date.....my PRS fund Overall on average seems like performing similarly to EPF? Correct me if I'm wrong. |

|

|

Nov 24 2020, 11:25 PM Nov 24 2020, 11:25 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(ironman16 @ Nov 24 2020, 11:13 PM) EPF how many % i dont know .... EPF past years the Reits PRS is special one bcoz i purposely wanna buy at low (current situation), wanna see can fly in future or not.... havent reach 3k yet.....still waiting dip , will reach 3k this week or next week ......then stop .  [/url [/urlYou know what you're doing 👍 QUOTE(MUM @ Nov 24 2020, 11:14 PM) have some idea of their performance.... Thanks[url=https://www.ppa.my/wp-content/uploads/2020/11/PRS-Fund-performance_OCT2020_Fund-Performance-All-Funds.pdf]https://www.ppa.my/wp-content/uploads/2020/...e-All-Funds.pdf depends on when you starts to calculates too... ] This post has been edited by gashout: Nov 24 2020, 11:27 PM |

|

|

Sep 10 2021, 11:32 AM Sep 10 2021, 11:32 AM

Return to original view | IPv6 | Post

#4

|

Senior Member

5,741 posts Joined: Apr 2019 |

there is a highly recommended fund that's in this thread.

i can't seem to find it anymore. can anyone please tell me what it is? thanks. |

|

|

Sep 10 2021, 11:35 AM Sep 10 2021, 11:35 AM

Return to original view | IPv6 | Post

#5

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(cempedaklife @ Sep 10 2021, 11:34 AM) yes, thanks a lot, cempedak! |

|

|

Sep 10 2021, 12:40 PM Sep 10 2021, 12:40 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(ironman16 @ Sep 10 2021, 12:09 PM) https://assets.theedgemarkets.com/pictures/...edgemarkets.jpg this is nice.https://www.ppa.my/wp-content/uploads/2021/...ul2021_Full.pdf oso can use this as comparision.......... Thanks a lot, ironman! ironman16 liked this post

|

|

|

|

|

|

Jun 21 2023, 04:24 AM Jun 21 2023, 04:24 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

5,741 posts Joined: Apr 2019 |

I've played klse us stock crypto cfds but I dunno anything about bonds.

I'm so nood with bonds. Where do you buy them? They can get burnt too right if the institute cannot repay you? |

|

|

Jun 21 2023, 10:16 AM Jun 21 2023, 10:16 AM

Return to original view | IPv6 | Post

#8

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(xander2k8 @ Jun 21 2023, 05:21 AM) Go Google good example Credit Suisse AT1 bonds as not all bonds can be mature and paid regularly with coupons and you can get burn as well so don’t think 100% bonds are safe unlike some do think that 🤦♀️ QUOTE(MUM @ Jun 21 2023, 06:28 AM) QUOTE(Ramjade @ Jun 21 2023, 07:49 AM) If you are rich and you are priority customers of banks, they offer you. One bond is RM250k or in Singapore SGD250k. thats great. now i know why i never touch bond.Reasons I don't like bonds 1. Only the rich can afford them. 2. You need huge chunk of your money just to buy bond (not diversified) unless your RM250k is small change. 3. Bank earn some money from you so indirectly your relationship manager also get paid (I try my level best not to pay my banks/let banks earn money from me). 4. Your bond payout is not increasing over time unlike my dividend stocks. That's why bonds are more affordable in US at only USD25/bond as far as I know la. Not sure if there are expensive bond (I am sure there are). too poor and too risky for me |

|

|

Dec 2 2023, 09:48 AM Dec 2 2023, 09:48 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Ramjade @ Dec 2 2023, 09:29 AM) There are 100s of prs and maybe only 5 that can beat epf returnPut fund into prs to reduce income tax but risk lower return. Is what people need to consider. Did my UT many years ago. Will never touch it anymore. |

| Change to: |  0.1442sec 0.1442sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 05:50 AM |