So seems to me the management fee recognised as expense in both PRS funds are the net of the refund of management fees for the funds they invested in. But ultimately, the total management fee charge is still 1.5% although it's not reflected as expenses in the PRS fund itself. It is however reflected in the NAV of the funds since the funds invested in is net of NAV....

I did my homework; I contacted the AHAM PRS customer service and seek further clarification on the MER and annual management fee method of calculation.

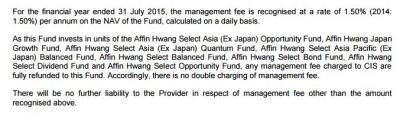

1) The annual report of Affin-Hwang Moderate PRS fund states the annual management fee as 1.5% p.a.

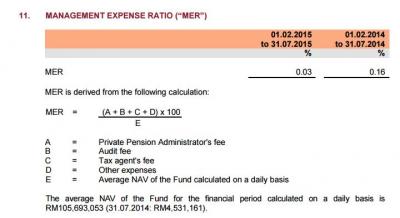

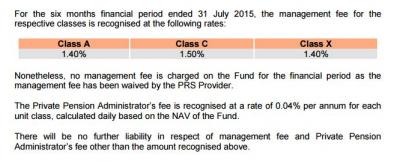

2) In that same report, the MER is 0.32% p.a. NB: MER is the total expenses that includes annual management fee. To my layman mind; this is confusing because how could MER be less than management fee? Logically it should be more!

3) The explanation given is that the PRS provider will multiply 1.5% x average daily NAV over one financial year.

4) Let's take average NAV over a financial period as equal to RM 1.00. Lets assume one holds 1,000 units, therefore, 1.5% x RM 1.00 x 1,000 units = RM 15.00 to be withheld by the PRS provider as revenue.

5) The PRS fund invests in a basket of other funds and all of these funds impose an annual management fee to the PRS fund. However, based on SC guideline, fund house cannot double-charge on annual fees therefore, the underlying fund must refund whatever is charged to the PRS fund.

III) After the refund while adding the trustee, tax agent and other miscellaneous expenses the MER comes to 0.32% p.a.

IV) This means that in the final calculation: 0.32% x RM 1.00 x 1,000 units = RM 3.20 is withheld instead as revenue by the PRS provider after the refund from the underlying funds, instead of the initial RM 15.00.

Hope this makes sense to clears up the confusion.

Xuzen

p/s Based on my above understanding, this means that PRS is a more efficient way to enter into the unit trust fund. Zero sales charge, relatively low MER, one entry point to expose to a professionally asset allocated global portfolio.... apa lagi lu mau?

Err... In summary, so my understanding was correct?

If you remember some of my previous posts, I am a firm believer of PRS with my additional employer retirement benefits going into PRS instead of EPF. So I don't dispute its advantages eventhough we pay a bit more MER (effectively target fund MER + PRS fund MER). But the biggest freebie is still the tax relief la and the flexibility to buy non-Msia funds compared to EPF MIS

p/s: On second thought, maybe the additional MER would outweigh the benefit for employer contribution or employee contribution in excess of RM3k since the amount adds up over the years until retirement age

Jun 9 2014, 10:09 AM

Jun 9 2014, 10:09 AM

Quote

Quote

0.0315sec

0.0315sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled