Outline ·

[ Standard ] ·

Linear+

Credit Cards Earn Pocket Money with your Credit Cards, Let's share

|

TSGen-X

|

Sep 19 2011, 02:58 PM Sep 19 2011, 02:58 PM

|

Lifetime LYN Member

|

QUOTE(ck23 @ Sep 19 2011, 02:50 PM) just to add with RM8000 insurance premium, with you sticking with MBB 2 Visa/MC, you can earn RM40 and not need to pay additional GST which comes out more than if you had signed up for HLB Essential just for the same insurance premium where you earn RM30 after GST which is less! |

|

|

|

|

|

ck23

|

Sep 19 2011, 03:03 PM Sep 19 2011, 03:03 PM

|

|

QUOTE(Gen-X @ Sep 19 2011, 02:58 PM) just to add with RM8000 insurance premium, with you sticking with MBB 2 Visa/MC, you can earn RM40 and not need to pay additional GST which comes out more than if you had signed up for HLB Essential just for the same insurance premium where you earn RM30 after GST which is less! ok. thank you. I will stick with MBB2. I applied for OCBC and UOB too, just to use it for petrol over the weekdays. No response from them yet so far. =.= Im another Fresh graduate who eagerly looks for CC. haha.. |

|

|

|

|

|

snigapoe

|

Sep 20 2011, 09:42 AM Sep 20 2011, 09:42 AM

|

|

this is my 2nd month on mbb CC

never be able to reach up to the cash back quota==

|

|

|

|

|

|

TSGen-X

|

Sep 20 2011, 11:01 AM Sep 20 2011, 11:01 AM

|

Lifetime LYN Member

|

QUOTE(snigapoe @ Sep 20 2011, 09:42 AM) this is my 2nd month on mbb CC never be able to reach up to the cash back quota== good lah, means you not spending unnecessary and saving much more that you can earn from the cash back. If you had read my article RM103 billion Credit and Balance Transfer written back in 2009, I posted a quote where a study reveal that a person having a credit card spend 17% more than a person using cash! For example. tifosi mentioned in Citibank thread that his expenses increase RM200-RM300 because of AMEX Free coffee offer. |

|

|

|

|

|

gerrardling

|

Sep 20 2011, 11:06 AM Sep 20 2011, 11:06 AM

|

|

QUOTE(Gen-X @ Sep 20 2011, 11:01 AM) good lah, means you not spending unnecessary and saving much more that you can earn from the cash back. If you had read my article RM103 billion Credit and Balance Transfer written back in 2009, I posted a quote where a study reveal that a person having a credit card spend 17% more than a person using cash! For example. tifosi mentioned in Citibank thread that his expenses increase RM200-RM300 because of AMEX Free coffee offer. you are so free to trace back what ppl said  . To snigapoe, you can help ur parents, sister, bro, relative to pay their bills and expenses, later ask them to pay back to you This post has been edited by gerrardling: Sep 20 2011, 11:06 AM |

|

|

|

|

|

TSGen-X

|

Sep 20 2011, 11:12 AM Sep 20 2011, 11:12 AM

|

Lifetime LYN Member

|

QUOTE(gerrardling @ Sep 20 2011, 11:06 AM) you are so free to trace back what ppl said  . To snigapoe, you can help ur parents, sister, bro, relative to pay their bills and expenses, later ask them to pay back to you haha, no lah happened to just read tifosi's comment yesterday. As for paying for others, if the cash back was like uncap maybe worthwhile but to earn less than RM50 and do other people's work I think not worth it. What if they conveniently forgets to pay you back  |

|

|

|

|

|

gerrardling

|

Sep 20 2011, 11:18 AM Sep 20 2011, 11:18 AM

|

|

QUOTE(Gen-X @ Sep 20 2011, 11:12 AM) haha, no lah happened to just read tifosi's comment yesterday. As for paying for others, if the cash back was like uncap maybe worthwhile but to earn less than RM50 and do other people's work I think not worth it. What if they conveniently forgets to pay you back  ask them to give money to you first before u help them to pay lor. |

|

|

|

|

|

snigapoe

|

Sep 20 2011, 02:10 PM Sep 20 2011, 02:10 PM

|

|

QUOTE(Gen-X @ Sep 20 2011, 11:01 AM) good lah, means you not spending unnecessary and saving much more that you can earn from the cash back. If you had read my article RM103 billion Credit and Balance Transfer written back in 2009, I posted a quote where a study reveal that a person having a credit card spend 17% more than a person using cash! For example. tifosi mentioned in Citibank thread that his expenses increase RM200-RM300 because of AMEX Free coffee offer. that's what i practicing only pay for those that i needed and will never use CC for any unnecessary stuff almost 2 month finally come up to 5k TP  |

|

|

|

|

|

ronnie

|

Sep 21 2011, 12:23 AM Sep 21 2011, 12:23 AM

|

|

Thanks to Gen-X, I have been making pocket money (aka FD interest) from CIMB BT program....

This post has been edited by ronnie: Sep 21 2011, 07:30 AM

|

|

|

|

|

|

MGM

|

Sep 21 2011, 04:45 PM Sep 21 2011, 04:45 PM

|

|

GenX, thanks for the very informative contents in your "Earn Pocket Money with credit cards" at http://creditcardsmalaysia.blogspot.comWould like to reconfirm with you, is there a 1% charge on MBB 0% 12 months BT as stated in one of your article? http://creditcardsmalaysia.blogspot.com/20...e-transfer.htmlThis post has been edited by MGM: Sep 21 2011, 04:46 PM |

|

|

|

|

|

TSGen-X

|

Sep 21 2011, 04:57 PM Sep 21 2011, 04:57 PM

|

Lifetime LYN Member

|

QUOTE(MGM @ Sep 21 2011, 04:45 PM) GenX, thanks for the very informative contents in your "Earn Pocket Money with credit cards" at http://creditcardsmalaysia.blogspot.comWould like to reconfirm with you, is there a 1% charge on MBB 0% 12 months BT as stated in one of your article? http://creditcardsmalaysia.blogspot.com/20...e-transfer.htmlFor Maybankard 2 Cards and non-Islamic cards confirm it is 0% 12 months. For Islamic cards like Petronas, I really no idea. Call CS to confirm. This post has been edited by Gen-X: Sep 21 2011, 06:12 PM |

|

|

|

|

|

MGM

|

Sep 21 2011, 05:39 PM Sep 21 2011, 05:39 PM

|

|

QUOTE(Gen-X @ Sep 21 2011, 04:57 PM) For Maybankard 2 Cards and non-Islamic cards confirm it is 0% 12 months. For Islamic cards like eEtronas, I really no idea. Call CS to confirm. Thanks, just checked the T&C on MBB 0% 12 months BT , confirm as 0% finance charge: 6. Minimum transfer amount for the 6 months to 12 months plans is RM1,000 and for the 24 months to 36 months plans is RM2,000.The special Finance Charge will be valid from the date of posting (“Date of Posting”) for period of 6 months at 0.5%, 9 months at 0.75%, 12 months at 0%, 24 months at 0.375% and 36 months at 0.413%. At the expiry of the Special Finance Charge period for the 6 months and 9 months plans, a normal finance charge of 1.4583 % per month (or 17.5 % p.a) calculated on a daily basis will be imposed until the date of repayment in full. This post has been edited by MGM: Sep 21 2011, 05:48 PM |

|

|

|

|

|

MSS

|

Oct 1 2011, 07:47 PM Oct 1 2011, 07:47 PM

|

|

I'm using Public Bank card.

Only about RM1-RM3 got per month.

Spend about RM500-RM2000.

|

|

|

|

|

|

tifosi

|

Oct 1 2011, 08:01 PM Oct 1 2011, 08:01 PM

|

|

PBB cards only gives out 0.3% cash back on it's retail transactions (excluding petrol). Not to mention, it does not have points system as well also.

Once in a while they give out few hundred Ks first come first serve basis promo cash back which not to say that bad as I had gotten a few times before but generally it is a crap card and simply choosing another card from other banks will be a better choice.

|

|

|

|

|

|

Waachaaa

|

Oct 2 2011, 09:21 AM Oct 2 2011, 09:21 AM

|

|

Hi Gen-X, i read your blogs on the cash rebate it seems there are 3 cards offering the best deal. However i found there is a similarities on each of them. Im considering for 2 CC as my transaction per month usually more than 1K.

1. OCBC Titanium

Pros: 5% cash back

Cons: Limited to RM50 per month

2. UOB 1 Card

Pros: 5% cash back

Cons: Limited to RM50 per month

3. Maybankard2

Pros: 5% cash back

Cons: Limited to RM50 per month, No 5% cash back on weekday

|

|

|

|

|

|

TSGen-X

|

Oct 2 2011, 10:28 AM Oct 2 2011, 10:28 AM

|

Lifetime LYN Member

|

QUOTE(Waachaaa @ Oct 2 2011, 09:21 AM) Hi Gen-X, i read your blogs on the cash rebate it seems there are 3 cards offering the best deal. However i found there is a similarities on each of them. Im considering for 2 CC as my transaction per month usually more than 1K. 1. OCBC Titanium Pros: 5% cash back Cons: Limited to RM50 per month 2. UOB 1 Card Pros: 5% cash back Cons: Limited to RM50 per month 3. Maybankard2 Pros: 5% cash back Cons: Limited to RM50 per month, No 5% cash back on weekday UOB Cash back - only petrol and groceries capped at RM30 each and other type of transactions uncapped. Please go to UOB Thread for more info. . Only Petrol you get 5% cash back capped at RM30 or pumping RM600 Petrol. This post has been edited by Gen-X: Oct 2 2011, 10:48 AM |

|

|

|

|

|

ubuntu

|

Oct 2 2011, 10:29 AM Oct 2 2011, 10:29 AM

|

|

QUOTE(ronnie @ Sep 21 2011, 12:23 AM) Thanks to Gen-X, I have been making pocket money (aka FD interest) from CIMB BT program.... The CIMB 0% BT program has ended on 30-June right? Is there any credit card currently offer 0% BT programme? |

|

|

|

|

|

TSGen-X

|

Oct 2 2011, 10:34 AM Oct 2 2011, 10:34 AM

|

Lifetime LYN Member

|

QUOTE(ubuntu @ Oct 2 2011, 10:29 AM) The CIMB 0% BT program has ended on 30-June right? Is there any credit card currently offer 0% BT programme? This should be posted at BT Thread. In my blog I have published two articles where I have informed that CIMB and MBB 0% BT extended to 3st December 2011. For my readers easy reference, I even have a Balance Transfer Page - click here.The other Bank offering 0% BT is Public Bank. |

|

|

|

|

|

TSGen-X

|

Nov 18 2011, 09:05 PM Nov 18 2011, 09:05 PM

|

Lifetime LYN Member

|

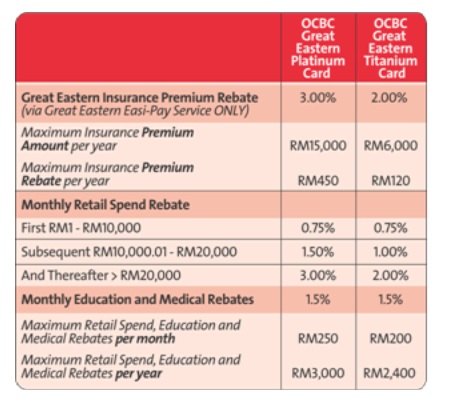

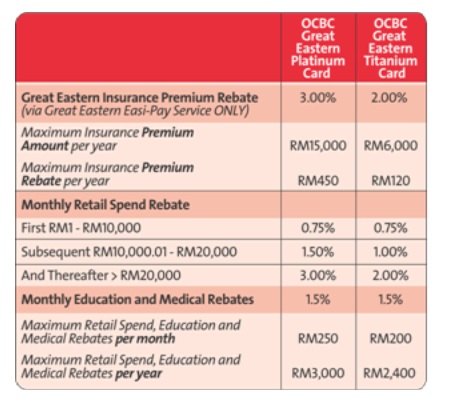

Recently I published an article titled Education Bills - Primary Secondary College and University - Which Is The Best Card To Use? This article would be informative for those who have kids where the school accept credit card. Click here to read the article and hopefully you can earn some money back from your kids' tuition fees.In the above article I have also touched on two items that may earn you more pocket money: 1) If you like charge RM68K and above, do look into HLB Fortune Card where you may earn more than 1% cash back. 2) For overseas expenses, I have listed cards that rewards you more. The OCBC Great Eastern Credit Card earns you 1.5% cash back for education bills; and the monthly cap is RM200 and RM250 for the Great Eastern Titanium and Platinum respectively. If you have GE insurance policy, you should seriously consider the OCBC Great Eastern Credit Card where it also earns you up to 3% cash back for your GE insurance policy. Click here to OCBC site to learn more. And if you do spend above RM10K per month, you should also look into this card where you can earn up to 3% cash back.  |

|

|

|

|

|

maywyue

|

Jul 8 2018, 08:32 AM Jul 8 2018, 08:32 AM

|

New Member

|

Ur blog is not open to public, how do I read it?

|

|

|

|

|

Sep 19 2011, 02:58 PM

Sep 19 2011, 02:58 PM

Quote

Quote

0.0220sec

0.0220sec

0.63

0.63

5 queries

5 queries

GZIP Disabled

GZIP Disabled