But that all change with Maybankard 2 AMEX where we earn unlimited 5X Treats Points which is equivalent to 2.5% returns based on cash vouchers or on the spot conversion to cash at selected merchants PLUS 5% cash back every weekends. I am sure most of you guys have the Maybankard 2 Cards by now and enjoying the cash back and seeing your points grow pretty fast.

But why stop there? Many seniors here have earn more pocket money with their credit cards. But first you must have the cash in hand to pay for your transactions in order to make money. Want to know how? Here are the steps in general.

1. Get a card that offers free annual fee waiver for life. If you have to pay annual fee, before you even start earning money with your credit card you are already in the negative.

2. Get a cash back card or cards since most of these cards have a cap.

3. Swipe your card after the Statement Date and enjoy up to 45 days free credit (once again if you have Outstanding Balance, this won't apply as you'll be working for the banks by paying interest on the new transactions).

4. Then do 0% Balance Transfer or go for 0% installment and deposit the money you are suppose to pay towards the credit card outstanding balance into FD. Once again, you need the money in hand prior to your purchase, else you earn nothing but you do save on interest charges with some little bit work.

To read my full article on how to optimize earning pocket money with your credit cards, click below link to read it. In the article I gave examples of using different combinations of credit cards for different transactions to optimize earnings.

Click here to read my article Earn Pocket Money with Credit Cards.

Of course, we can also earn money indirectly by getting a free annual fee credit card that offers you discount at a particular merchant that you patronize often, just make sure you earn more than RM50 to cover the GST.

For those who have children in private primary & secondary schools, International Schools, Colleges or Universities which accept credit cards, you too can earn back some cash from the tuition fees. Click here to read my article Education Bills - Which Is The Best Card To Use? In this article I have also touched on two items that may earn you more pocket money:

1) If you like charge RM68K and above, do look into HLB Fortune Card where you may earn more than 1% cash back.

2) For overseas expenses, I have listed cards that rewards you more.

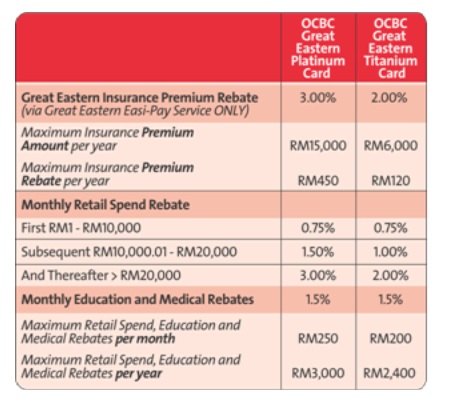

The OCBC Great Eastern Credit Card earns you 1.5% cash back for education bills; and the monthly cap is RM200 and RM250 for the Great Eastern Titanium and Platinum respectively. If you have GE insurance policy, you should seriously consider the OCBC Great Eastern Credit Card where it also earns you up to 3% cash back for your GE insurance policy. Click here to OCBC site to learn more. And if you do spend above RM20K per month, you should also look into this card where you can earn up to 3% cash back.

And for those who wants to be educated on how credit cards can make you poorer day by day, click here to read my article Credit Cards are Cash Cow for Banks. Are You Working for the Banks.

This post has been edited by Gen-X: Nov 18 2011, 09:13 PM

Sep 19 2011, 09:46 AM, updated 15y ago

Sep 19 2011, 09:46 AM, updated 15y ago Quote

Quote

0.0197sec

0.0197sec

0.64

0.64

5 queries

5 queries

GZIP Disabled

GZIP Disabled