QUOTE(prophetjul @ May 18 2012, 08:21 AM)

Do you think the economy of Msia will ever surpass Singapore?

If not then SGD should be well safer than RGT in the long haul.

Thought ALL wills will take into account of that?

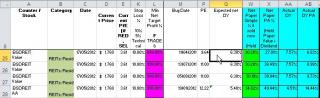

i am in AIMS, Sabana and Cambridge.

Waiting for First to retreat further hopefully to 85.

Still only 20% of my intended allocation!

Its very difficult to catch these fishes...

Plantation REITS? What do they do?

er.. side track a bit ar Mods.If not then SGD should be well safer than RGT in the long haul.

Thought ALL wills will take into account of that?

i am in AIMS, Sabana and Cambridge.

Waiting for First to retreat further hopefully to 85.

Still only 20% of my intended allocation!

Its very difficult to catch these fishes...

Plantation REITS? What do they do?

Wills - Wills written in country A MAY not be executable fully in country B, thus in country B, it may be as good as dying intestate.

Usually, only non-moveable assets like physical properties are affected BUT to be on the safe side, best to have a Will drawn up in EACH country U have assets in.

---

Plantation REITs? Something like BSDREIT http://www.al-hadharahboustead.com.my/overview.html

---snippet---

Income Streams

Under the Al-Hadharah Boustead REIT, plantation assets will be leased back to the vendors for a three-year renewable tenancy with a cumulative period of up to thirty years. At the end of every three years, the fixed rental will be reviewed and a new rental will be agreed between the parties. The new rental will be determined based on historical crude palm oil (CPO) prices, prevailing and expected future CPO prices, cost of production, extraction rates and yield per hectare. Hence, income sources for Al-Hadharah Boustead REIT include:

Fixed Rental

With the renewal of the Ijarah agreement effective from 1 January 2010, the fixed rental income for the second tenancy term is increased from Tenants will pay a cumulative fixed rental of approximately RM53.2 million to RM57.8 million per annum for the first tenancy term of three years. This will be payable on a bi-monthly basis.

Performance-Based Profit Sharing

In addition to a fixed rental, the Al-Hadharah Boustead REIT may enjoy an annual profit sharing of net incremental income based on a formula pegged to CPO and fresh fruit bunch (FFB) prices. This net incremental income is determined based on the actual CPO price realised for the year, above the reference price of RM2,000 per MT for the first next three years. It will be shared on a 50:50 basis between the Tenants and the Fund. This profit sharing payment is the first of its kind in the REIT market and may translate into more handsome distribution yields for unitholders.

Capital Gains

Given the development potential of some of the plantation assets, especially those located in prime locations; there is a potential upside for capital gains. The gains realised may be distributed as bonus distributions.

May 18 2012, 08:30 AM

May 18 2012, 08:30 AM

Quote

Quote

0.0923sec

0.0923sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled