QUOTE(kochin @ Aug 19 2015, 03:08 PM)

boss, not trolling but genuine legitimate question.

for purchase of a commercial prop nowadays, is it beneficial to buy a GST imposed prop or without?

summer suites price is more or less min 500k. it is at the exact threshold of present GST requirement.

while it may not affect the individuals who owns SS 1st hand, but it will definitely affect those who are looking into purchasing now.

if they buy a unit without GST, so if no output, they can't claim input tax, right? and similiarly when they dispose in future, they may be subjected to same condition.

so in all fairness, i would think corporate or business minded people would actually prefer a commercial which charges GST to enable them to also bill or factor their rents accordingly as well.

correct kah?

which brings to the next question, does that mean that 1st hand seller can opt to sell with and/or without GST?

kakakaka. damn confusing.

I don't get the logic of your first question. Why would there be any benefit for the buyer in paying GST on the purchase?

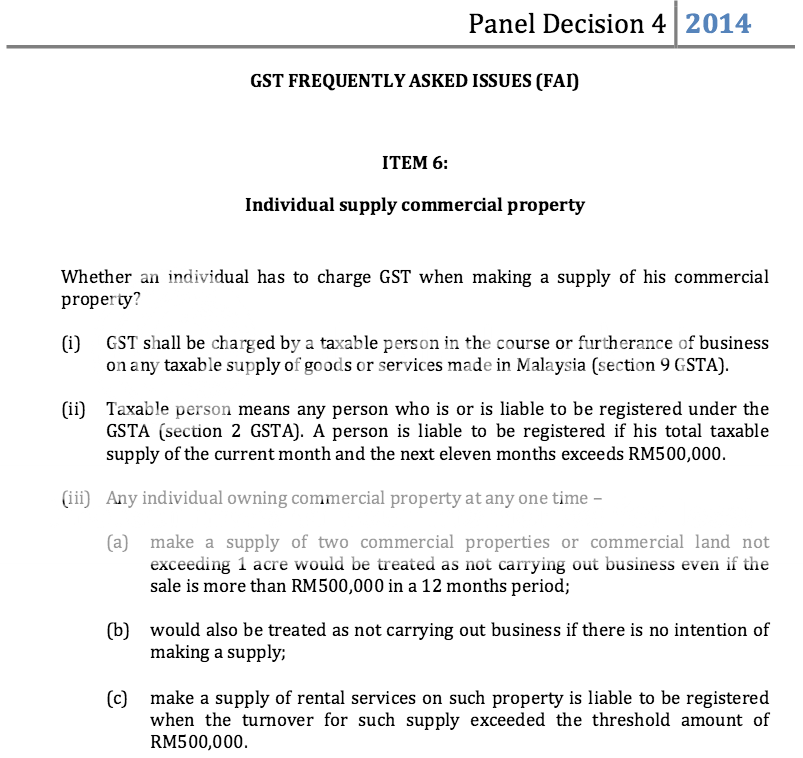

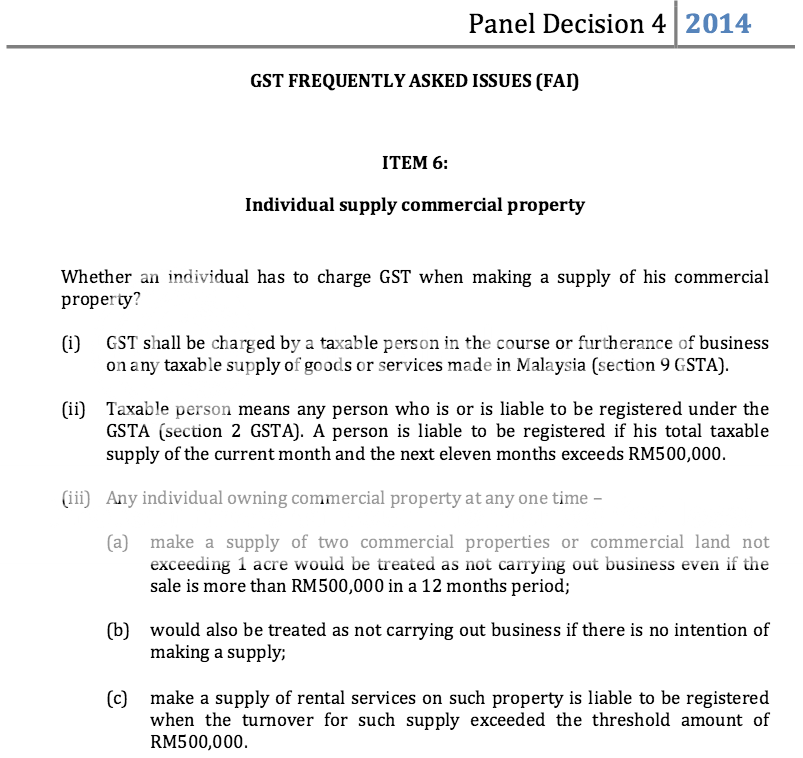

For the 2nd question its a no. There is no choice, the seller either has to collect or doesn't have to collect. Refer below:

While there are still aspects on GST that are not yet 100% clear, there are also items that have been cleared up. Many rulings, guides, clarifications have already been published on the Customs website. Those who need information should always refer to professional tax consultants or industry experts who have kept abreast with these updates. If one were to rely on unqualified opinions from laypersons, then one would easily be confused.

Asking on online forums is usually one of the worst sources of information. Many people like posting unsubstantiated information and hearsay pretending to be experts.

I myself do not claim to be an expert. However I have taken the time to learn about the subject and whenever possible will share the source of the information so others can explore further and verify if needed.

From the

http://gst.customs.gov.my website:

Based on the above, as long as you don't sell more than 2 commercial properties, or more than 1 acre of commercial land within a 12 month period, you don't have to collect GST from your buyer.

AND even if you do sell more than 2 commercial properties, but you can justify to Customs that "there is no intention of making a supply", then you do not have to collect GST from your buyer.

Apr 14 2015, 03:39 PM

Apr 14 2015, 03:39 PM

Quote

Quote

0.0247sec

0.0247sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled