Outline ·

[ Standard ] ·

Linear+

Investment THE ELEMENTS @ AMPANG [OWNERS' THREAD], fancy RM430k you get to live near KLCC?

|

cwt2878

|

May 11 2021, 09:29 AM May 11 2021, 09:29 AM

|

Getting Started

|

Don't have chance to go look see at this area due to mco.. anyone can feedback what kind of tenant profile can get for rental of studio / 1 bedroom condo here?

|

|

|

|

|

|

cwt2878

|

May 20 2021, 08:29 PM May 20 2021, 08:29 PM

|

Getting Started

|

Property portal shows asking rental ranges from 1500 to 2500 for furnished units of the same size.

If can rent out at the top of this range, then should be fine.

This is assuming the asking rental is reflecting real market rate.

|

|

|

|

|

|

cwt2878

|

May 21 2021, 09:56 PM May 21 2021, 09:56 PM

|

Getting Started

|

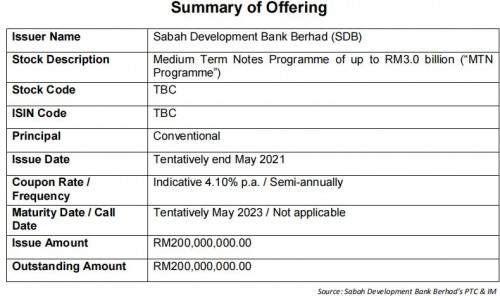

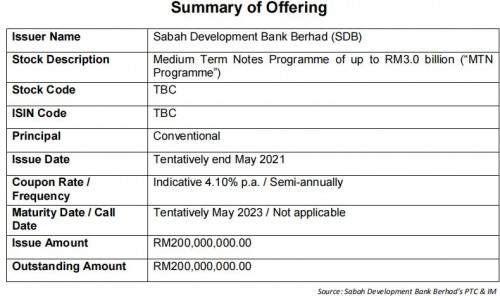

QUOTE(HereToLearn @ May 21 2021, 10:58 AM) Which tenant would want to pay at the top range when they can choose the cheapest available option? Also note that most likely the bidded unit was unfurnished. It should only be rented at unfurnished rate. Buy a AA1 bond also gives a better yield, I just simply dont understand why would people buy properties in the current market if it is for investment purposes, unless he/she is highly confident that the rental rate is going to improve SIGNIFICANTLY, that it is worth taking the risk to buy now  . Edited: Btw, the bond is sold out. Dont PM me for more info, I dont sell these products (not a banker). Yes, is a big IF... Anyhow, to compare property yield with bond yield should also consider with property u r likely leveraging banks money. I.e. you cant borrow money from bank at 3% interest to buy bond with 4.1% yield. |

|

|

|

|

|

cwt2878

|

May 22 2021, 06:25 AM May 22 2021, 06:25 AM

|

Getting Started

|

Sure... thats why i would be satisfied if my property yield is around 3.27% now.

Even better if this was bought with 0 or 10% down payment

|

|

|

|

|

May 11 2021, 09:29 AM

May 11 2021, 09:29 AM

Quote

Quote

0.0326sec

0.0326sec

1.07

1.07

7 queries

7 queries

GZIP Disabled

GZIP Disabled