1st time user. What does park mean? And how do I follow this post?

Investment THE ELEMENTS @ AMPANG [OWNERS' THREAD], fancy RM430k you get to live near KLCC?

Investment THE ELEMENTS @ AMPANG [OWNERS' THREAD], fancy RM430k you get to live near KLCC?

|

|

Sep 8 2019, 12:33 PM Sep 8 2019, 12:33 PM

Return to original view | Post

#1

|

Senior Member

2,282 posts Joined: Sep 2019 |

1st time user. What does park mean? And how do I follow this post?

|

|

|

|

|

|

Sep 8 2019, 09:32 PM Sep 8 2019, 09:32 PM

Return to original view | Post

#2

|

Senior Member

2,282 posts Joined: Sep 2019 |

Hi all, does anyone know has the rooftop garden for the elements completed? Also, if the free shuttle bus service to KLCC, Jalan Ampang, Pavilion and Jalan Bukit Bintang is there as per advertised on PropertyGuru.

Thanks guys. |

|

|

Sep 9 2019, 06:15 AM Sep 9 2019, 06:15 AM

Return to original view | Post

#3

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AskarPerang @ Sep 8 2019, 10:52 PM) Yes to your both questions. Hi Askar Perang, do you know if I can go to auction with bank cheque under my parents' name. Upon successful bidding, get a bank loan under my parents' name, but put the S&P under my name. I know buying directly from developer allows it. Unsure about auction.But the shuttle service is no longer free. Need to purchase RM30 a booklet to get 10 return tickets to & from KLCC/Paviliion. And is not bus. Is a 10 seater van. Is a well managed place I would say. Just that surrounded by many similar blocks of high rise (oversupply). That's why compare to initial launch price, you dont think got any increment in price today. And majority of the lelong units in the market actually own by foreigners. I am at overseas, so wont be able to get a loan under my own name as I dont have income in Malaysia. |

|

|

Sep 25 2019, 04:32 PM Sep 25 2019, 04:32 PM

Return to original view | Post

#4

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(aznar84 @ Sep 25 2019, 11:35 AM) If taken into acc the maintenance fee plus bank loan top-up, might reach RM 700 more or less.... Have the management fixed the leaking issue? Elements also got problem with window leakage & pipings... Yaa... mine chosen low floor because we expect to stay there in the beginning... but got better offer for landed sub-sale house during completion, so end up renting this unit... Does the common area still look like the image attached? Attached thumbnail(s)

|

|

|

Sep 30 2019, 03:42 PM Sep 30 2019, 03:42 PM

Return to original view | Post

#5

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Oct 8 2019, 11:26 PM Oct 8 2019, 11:26 PM

Return to original view | Post

#6

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AskarPerang @ Oct 7 2019, 09:10 AM) Is it worth buying though? Cause the unit is badly damaged (removing the external balcony area, it is still selling at 592k/1432sf = 414 sf for a badly damaged unit)Assuming 50k for repair and renovation, it is selling at 448 psf for a low unit that is susceptible to noise from the pool. |

|

|

|

|

|

Oct 12 2019, 05:37 PM Oct 12 2019, 05:37 PM

Return to original view | Post

#7

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Apr 27 2021, 03:50 PM Apr 27 2021, 03:50 PM

Return to original view | Post

#8

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AskarPerang @ Jun 25 2019, 05:03 PM) Both units got 2 registered bidders. B-11-1 sold at 636k A-29-15 sold at 652k Very good catch. Refer to this post here: https://forum.lowyat.net/index.php?showtopi...post&p=92805900 Last month got a same size unit sold at 780k. Seriously crazy. QUOTE(AskarPerang @ Oct 25 2019, 06:53 PM) Now fully furnished asking only 600k, might even go lower after negotiation. RIP FOMO bidders |

|

|

Apr 27 2021, 05:27 PM Apr 27 2021, 05:27 PM

Return to original view | Post

#9

|

Senior Member

2,282 posts Joined: Sep 2019 |

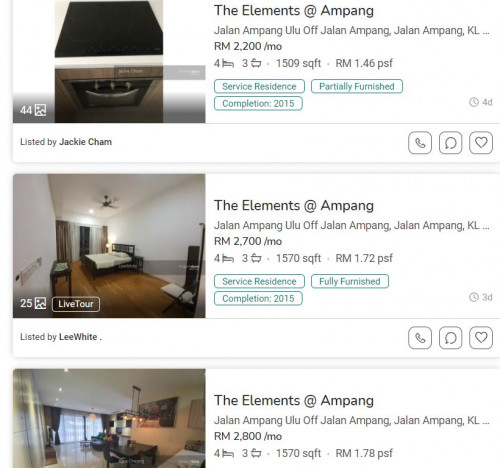

QUOTE(flight @ Apr 27 2021, 04:26 PM) Oh you are right, my bad. I didnt check properly. The ones I checked were 1400ish. But psf wise still similar to the unit bid at 636k (the one at 607k had defects).https://www.propertyguru.com.my/property-li...nn-tan-32648440 https://www.propertyguru.com.my/property-li...cheong-32533680 But dont compare fully furnished (incur additional cost, mess up rental yield calcs as different people will have different furnishing fee), compare partially furnished unit, current net rental yield is about 3.27% for the 1400ish units and the unit bidded at 636k (psf wise)  This post has been edited by HereToLearn: Apr 27 2021, 05:37 PM |

|

|

Apr 27 2021, 05:36 PM Apr 27 2021, 05:36 PM

Return to original view | Post

#10

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(flight @ Apr 27 2021, 05:30 PM) Its probably fairer to take a range instead of picking the absolute lowest few rents. Yes your argument is fair.The higher rents are rm4k, most of it is around rm3k to rm3.5k. Renting out unfurnished in this market seems like a bad idea. But in the market, USUALLY the lowest ones get the deal 1st (to minimize untenanted period). So I always use the lowest rent and lowest selling price for rental yield calcs. Also, I was comparing unfurnished sale to unfurnished rent And yes, renting out unfurnished in this market seems like a bad idea. This one i partially agree - depending on how one furnishes the unit. If one chooses to beef up the unit a damn lot but only to increase the rent by a little, then it might further reduce the rental yield |

|

|

May 20 2021, 06:25 PM May 20 2021, 06:25 PM

Return to original view | Post

#11

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AskarPerang @ May 20 2021, 03:21 PM) Attracted 3 bidders fight just now. With the rental yield he is getting, I doubt it is a good investment.Unit sold at 560k. Last month able to win unchallenged at 492k but nobody interested. As usual waiting for rock bottom price and end up need to fight. 2 months ago reserve price at 547k. The 3 bidders must be very optimistic that the rental rate will go up. But who knows, they might be own stay buyers |

|

|

May 21 2021, 10:58 AM May 21 2021, 10:58 AM

Return to original view | Post

#12

|

Senior Member

2,282 posts Joined: Sep 2019 |

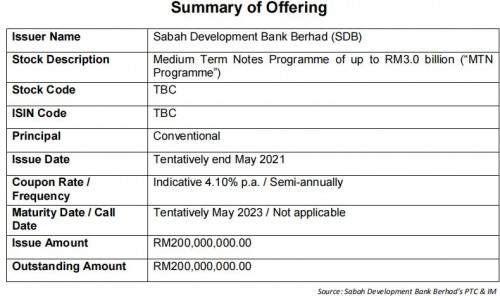

QUOTE(cwt2878 @ May 20 2021, 08:29 PM) Property portal shows asking rental ranges from 1500 to 2500 for furnished units of the same size. Which tenant would want to pay at the top range when they can choose the cheapest available option? Also note that most likely the bidded unit was unfurnished. It should only be rented at unfurnished rate.If can rent out at the top of this range, then should be fine. This is assuming the asking rental is reflecting real market rate. Buy a AA1 bond also gives a better yield, I just simply dont understand why would people buy properties in the current market if it is for investment purposes, unless he/she is highly confident that the rental rate is going to improve SIGNIFICANTLY, that it is worth taking the risk to buy now  . Edited: Btw, the bond is sold out. Dont PM me for more info, I dont sell these products (not a banker). This post has been edited by HereToLearn: May 21 2021, 11:03 AM |

|

|

May 21 2021, 11:00 PM May 21 2021, 11:00 PM

Return to original view | Post

#13

|

Senior Member

2,282 posts Joined: Sep 2019 |

https://forum.lowyat.net/index.php?showtopi...post&p=99063702

I did the calcs with leveraged money (with 5% stock return and 4% rental yield). If you are interested to compare with this particular bond, you can repeat the calcs with 4.1% bond yield and 3.27% rental yield. |

| Change to: |  0.0350sec 0.0350sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 02:18 AM |