Attached thumbnail(s)

Opening a Bank Account in Singapore

|

|

Dec 17 2023, 05:37 PM Dec 17 2023, 05:37 PM

Return to original view | Post

#21

|

Junior Member

737 posts Joined: Mar 2016 |

just putting this so that everyone can see what/ how the KYC from CIMB SG is like Attached thumbnail(s)

TOS liked this post

|

|

|

|

|

|

Dec 18 2023, 12:33 PM Dec 18 2023, 12:33 PM

Return to original view | Post

#22

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(shawnme @ Dec 12 2023, 03:02 PM) Yes, this is the one. Roughly 3 weeks since application date. May i ask when you're filling in the web form for CIMB SG savings account, To the previous post also asking, with regards to your email stating "your account number..top right". Still long way to go. That's the first email informing you your account number for your initial funding. what did you put for "Purpose of Account Opening" a) Savings b) Investment and were you asked to provide a bank statement as proof of salary crediting? I wonder how much it differs to customer by customer basis for their KYC |

|

|

Dec 18 2023, 01:01 PM Dec 18 2023, 01:01 PM

Return to original view | Post

#23

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(Medufsaid @ Dec 18 2023, 12:48 PM) I put "investment". When they asked for proof I give my bank statement and roboadvisor monthly statement does putting money in Syfe Cash+ (Flexi) and Endowus Cash Smart Secure count as investments? in my opinion, it kind of doesn't This post has been edited by moonsatelite: Dec 18 2023, 01:01 PM |

|

|

Dec 26 2023, 01:27 PM Dec 26 2023, 01:27 PM

Return to original view | Post

#24

|

Junior Member

737 posts Joined: Mar 2016 |

welp, its quite a hassle and lot of screening, should i just inform them to cancel the account opening? my biggest fear is that they will refund me via cheque

This post has been edited by moonsatelite: Dec 26 2023, 10:36 PM |

|

|

Jan 4 2024, 04:33 PM Jan 4 2024, 04:33 PM

Return to original view | Post

#25

|

Junior Member

737 posts Joined: Mar 2016 |

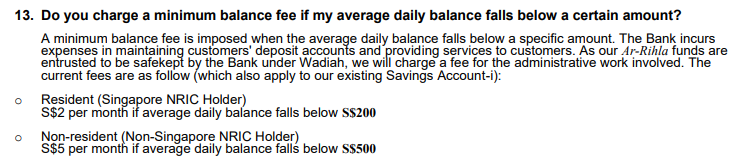

QUOTE(Ramjade @ Jan 3 2024, 07:57 PM) That is because of fall below fees. You need to "lock up" SGD500 inside there to prevent the SGD2/month fee. i wonder why don't people notice the Ar-Rihla Savings account instead which only needs SGD $200 minimum balance, the lowest requirement from Maybank SGMaybank rates sucks. See TOS reply below. They write zero fees but markup the exchange rate. i noticed that most people sign up with iSavvy (minimum SGD $500) |

|

|

Jan 5 2024, 09:20 AM Jan 5 2024, 09:20 AM

Return to original view | Post

#26

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(sidefulnes @ Jan 5 2024, 09:01 AM) Thanks for sharing this info. i am not sure if they have changed the policy now but i opened the Ar-Rihla Savings account by just logging in to Maybank Malaysia that has a webpage that will bring you to Ar-Rihla's application form and i just fill it in and done.iSavvy cause do not require valid pass to register and don't have to travel down to SG to open the account. for Ar-Rihla, requires a valid pass. Very trouble free, the only screening was that i had to provide how much am i earning per month (was not required to submit my salary slip, just email the numbers) converted to SGD and the account was opened within 3 working days. Better and faster than CIMB SG i was not required to have a valid pass. This post has been edited by moonsatelite: Jan 5 2024, 09:21 AM |

|

|

|

|

|

Jan 5 2024, 09:35 AM Jan 5 2024, 09:35 AM

Return to original view | Post

#27

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(TOS @ Jan 5 2024, 09:13 AM) Unless you need an SG bank debit card, one can just use CIMB SG and OCBC SG. Maybank SG has securities issues with their debit card, let alone having to lock up 200-500 SGD of funds aside... Not a really attractive offering. a Singaporean debit card is quite useful when you're in Singapore, although you can also use OCBC Cashless withdrawal if one has already opened an account. TOS liked this post

|

|

|

Jan 5 2024, 01:10 PM Jan 5 2024, 01:10 PM

Return to original view | Post

#28

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(Ramjade @ Jan 5 2024, 09:49 AM) when i visited Singapore on 1st week of Oct 2023, the Maybank Debit Card (tokenized with Samsung Pay) was VERY VERY useful. I could ride the MRT like a local and don't have to pay the extra 60cents foreign card admin fee nor i had to purchase EZ-Link prepaid card, paid for some stuff at FairPrice, paid for Hostel accomodation at premise.And, my itchy hands was like, "hmm.... whats the conversion rate like and how would it feel like to pay via Wise tokenized with Google Pay", was charged 60cents, even though the 60cents is only a one time charge per day, i still reverted back to Maybank SG Debit card Although when i tried withdrawing money from Citibank's ATM (atm5 member) at Changi Airport T2, it was declined, proceeded to use the OCBC terminal and did cardless withdrawal for cash. This post has been edited by moonsatelite: Jan 5 2024, 01:12 PM Ramjade liked this post

|

|

|

Jan 5 2024, 06:16 PM Jan 5 2024, 06:16 PM

Return to original view | Post

#29

|

Junior Member

737 posts Joined: Mar 2016 |

Finally the ordeal is over, took CIMB SG 24 days to open a savings account.

|

|

|

Jan 7 2024, 09:06 PM Jan 7 2024, 09:06 PM

Return to original view | Post

#30

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(Medufsaid @ Jan 7 2024, 03:11 PM) if you are non-singaporean, have you tested out if $200 is applicable to us outsiders? (navigate here and check out the FAQ) yes, been using Ar-Rihla last year until now, wasn't charged any fees at all and have maintained SGD $200 in that account |

|

|

Jan 9 2024, 09:24 PM Jan 9 2024, 09:24 PM

Return to original view | Post

#31

|

Junior Member

737 posts Joined: Mar 2016 |

|

|

|

Feb 18 2024, 09:53 AM Feb 18 2024, 09:53 AM

Return to original view | Post

#32

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(Medufsaid @ Feb 18 2024, 09:38 AM) woolala CIMB sg debit card will cost you S$10. If you want to withdraw SGD in singapore ATM, i recommend i have a CIMB SG debit card that is issued to me for free, not worth it. Its just for withdrawing cash, you can't pay/ link to ewallets with it.

If anyone still wants a CIMB SG debit card, sign up for CIMB StarSavers (Savings) instead of FastSavers |

|

|

Feb 18 2024, 10:02 AM Feb 18 2024, 10:02 AM

Return to original view | Post

#33

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(TOS @ Feb 18 2024, 09:57 AM) lol I guess that's only an ATM card? Not a debit card? here's what the card looks likeSame situation last time with my Hang Seng Bank account in HK, only got ATM card, not debit card... they purposedly wanna nudge people to owe money on credit card... haiz... Attached thumbnail(s)

|

|

|

|

|

|

Feb 18 2024, 10:03 AM Feb 18 2024, 10:03 AM

Return to original view | Post

#34

|

Junior Member

737 posts Joined: Mar 2016 |

|

|

|

Feb 19 2024, 09:32 AM Feb 19 2024, 09:32 AM

Return to original view | IPv6 | Post

#35

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(kart @ Feb 19 2024, 08:20 AM) When you applied to open CIMB FastSavers Savings Account via CIMB Singapore internet banking website, what additional steps did you perform in order to get CIMB Singapore ATM card? there are no special/ extra steps to get the ATM card, when you're signing up for CIMB StarSavers (Savings) account, there will be a question in the digital form, "would you like to have an ATM Card", click on yes and after your account is approved, the ATM card will be snail mailed to youI did not receive a CIMB Singapore ATM card, so I may have missed out the required steps. I am interested in only CIMB Singapore ATM card, since the card seems to be issued free of charge, as compared to CIMB Singapore debit card with SGD 10 issuance fee. Thank you for your information. kart liked this post

|

|

|

Mar 1 2024, 03:19 PM Mar 1 2024, 03:19 PM

Return to original view | Post

#36

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(jas029 @ Mar 1 2024, 02:44 PM) i see.. yes, i can confirm that you can use a Malaysian phone number for OCBC Singapore and to receive money via DuitNowhow about mobile number used? can register in our m'sian mobile number to say, our OCBC SG account, and received SGD through duitnow transfer? |

|

|

May 13 2024, 11:53 AM May 13 2024, 11:53 AM

Return to original view | Post

#37

|

Junior Member

737 posts Joined: Mar 2016 |

just a small update/ info furnishing, to those who opened an OCBC SG account via OCBC Digital account opening (MyKad and Malaysian passport), you ARE considered as a non-resident.

you will need to maintain SGD $20,000 after the first year of account opening or else you will be charged a fall below fee every month. i opened a Monthly Savings Account alongside that account and i visited a branch to close the Statement Savings account and the Global USD account will be closed too. i furnished my work document and passport, i am considered a resident in Singapore and no point for me to keep the Statement Savings account + Global USD account hence why i closed the account. i was informed that you have to close the account in person |

|

|

Nov 23 2024, 09:26 PM Nov 23 2024, 09:26 PM

Return to original view | Post

#38

|

Junior Member

737 posts Joined: Mar 2016 |

QUOTE(gedebe @ Nov 23 2024, 08:58 PM) while opening a cimb SG account, it asks for Singpass which in turn ask for SG NRIC and address, how does m'sian overcome this? how to overcome this is by getting a job in Singapore and be assigned a F.i.n number (Foreign identification number), then you'll automatically be able to use SingPass, that's one of the ways for a foreigner to get SingPass |

| Change to: |  0.1731sec 0.1731sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 12:28 AM |