Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

cklimm

|

Feb 20 2021, 02:19 PM Feb 20 2021, 02:19 PM

|

|

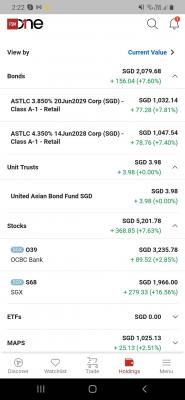

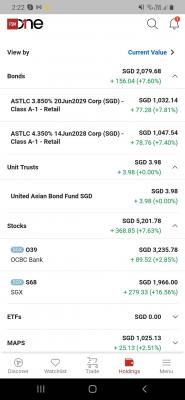

QUOTE(!@#$%^ @ Feb 15 2021, 09:34 PM) mine was idle. but recently trying out stashaway, endowus and syfe. The Stashaway MY and SG, both invest the in same market right?  QUOTE(corad @ Feb 15 2021, 08:19 PM) just wondering what everyone is doing with their "parked" $$ in SG bank account ? FD rates are nothing compared to M'sia ... so considering if I should remit the funds back (and get a slight gain on current exchange rates) or if there are better things that can be done. SG bank is a bridgehead, leading to an array of opportunities. Attached thumbnail(s)

|

|

|

|

|

|

cklimm

|

Feb 20 2021, 02:27 PM Feb 20 2021, 02:27 PM

|

|

QUOTE(!@#$%^ @ Feb 20 2021, 02:25 PM) yup, but i was just going for SA simple. Hey, it looks better than FSM's measly 0.6%. https://www.stashaway.sg/simpleCan you share on the signup process? |

|

|

|

|

|

cklimm

|

Feb 20 2021, 04:52 PM Feb 20 2021, 04:52 PM

|

|

QUOTE(!@#$%^ @ Feb 20 2021, 02:41 PM) just download the app and fill in details. just need passport. Aside from passport, it asks for utility bill, hope they accept Syabas bill  |

|

|

|

|

|

cklimm

|

Jul 31 2021, 07:35 PM Jul 31 2021, 07:35 PM

|

|

QUOTE(lightonokira @ Jul 30 2021, 11:25 PM) Can someone entertain me, why would I want to open an SG maybank account? No, dont open, the capital outflow to SG has weakened Ringgit too much. Just stay. |

|

|

|

|

|

cklimm

|

Sep 8 2021, 02:48 PM Sep 8 2021, 02:48 PM

|

|

QUOTE(Ramjade @ Sep 7 2021, 11:00 PM) Go open Maybank account. Then transfer sgd1k from Maybank into sg. That's the official and old fashion way which won't be stop. That's what I did. that stack of forms, still remember, even the kakak handling it felt stress.  |

|

|

|

|

|

cklimm

|

Sep 10 2021, 08:58 AM Sep 10 2021, 08:58 AM

|

|

QUOTE(Ramjade @ Sep 8 2021, 08:37 PM) What are you doing now wiith your SGD? Hope you don't mind asking. Hopefully you don't answer me with SG FD.  Opened tiger broker, got a free Apple share; will do the same with MooMoo broker soon |

|

|

|

|

|

cklimm

|

Sep 10 2021, 01:36 PM Sep 10 2021, 01:36 PM

|

|

QUOTE(bee993 @ Sep 10 2021, 01:02 PM) is it OK to have 1 apple share each from 2 diff platform..sorry with this mood question. Dont worry, its not a mood question, thats the plan in my head too |

|

|

|

|

|

cklimm

|

Sep 11 2021, 09:41 AM Sep 11 2021, 09:41 AM

|

|

QUOTE(Ramjade @ Sep 10 2021, 11:33 PM) You mean your SGD is still sitting in the bank, not working? bought a handful of SIA and some other SG stocks, with mixed result |

|

|

|

|

|

cklimm

|

Sep 11 2021, 09:42 AM Sep 11 2021, 09:42 AM

|

|

QUOTE(!@#$%^ @ Sep 10 2021, 11:41 PM) deposit 2k then can withdraw? you can, but to withdraw the free apple share, you need 10 trading transactions. |

|

|

|

|

|

cklimm

|

Sep 11 2021, 11:52 AM Sep 11 2021, 11:52 AM

|

|

QUOTE(coolguy99 @ Sep 11 2021, 11:16 AM) I have sg broker account but didn’t invest yet. My sgd is still mainly in StashAway. Do you think it’s better to invest in the stock market? Thing is I don’t have much time to monitor the sg market hence I opted for StashAway instead sg stashaway return is like 1.2% p.a, comparable to some 1 month FD here. For monitoring, I dont monitor much, just buy and forget. |

|

|

|

|

|

cklimm

|

Sep 11 2021, 09:47 PM Sep 11 2021, 09:47 PM

|

|

QUOTE(Ramjade @ Sep 11 2021, 08:29 PM) SIA okay marr, positive return, though not as good as yours lah. |

|

|

|

|

|

cklimm

|

Sep 12 2021, 09:40 AM Sep 12 2021, 09:40 AM

|

|

QUOTE(TOS @ Sep 11 2021, 09:52 PM) Did you buy anything else on SGX? REITs/banks? sgx itself, ocbc, sats, keppel dc reits, sembcorp... |

|

|

|

|

|

cklimm

|

Sep 12 2021, 09:41 AM Sep 12 2021, 09:41 AM

|

|

QUOTE(Ramjade @ Sep 12 2021, 02:29 AM) Forget about investing in sg market. You want slow growth, low risk, go buy apple, microsoft, Costco, Lockheed Martin and home depot in us market. If you die die must buy sg stocks, mapletree commercial trust, mapletree logistics trust, frasers logistics trust, elite commercial trust. I have heard about 30% withholding tax in US, mind to share how you navigate that? |

|

|

|

|

Feb 20 2021, 02:19 PM

Feb 20 2021, 02:19 PM

Quote

Quote 0.1894sec

0.1894sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled