QUOTE(Ramjade @ May 25 2019, 07:30 PM)

Why do you need a Islamic fast saver? Best to go with normal fast saver.

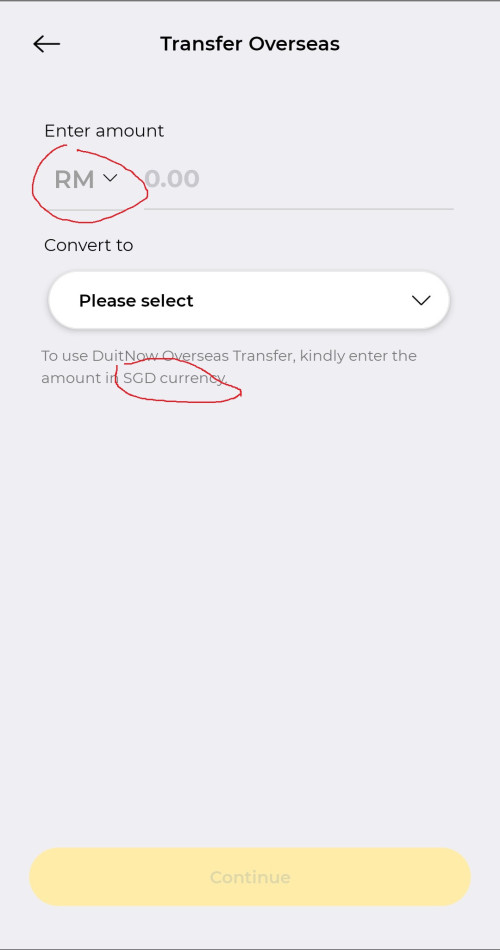

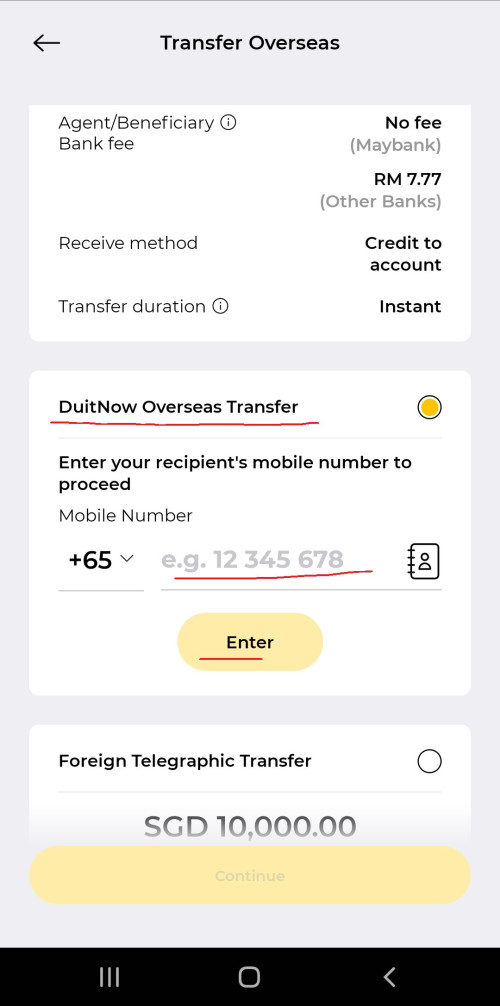

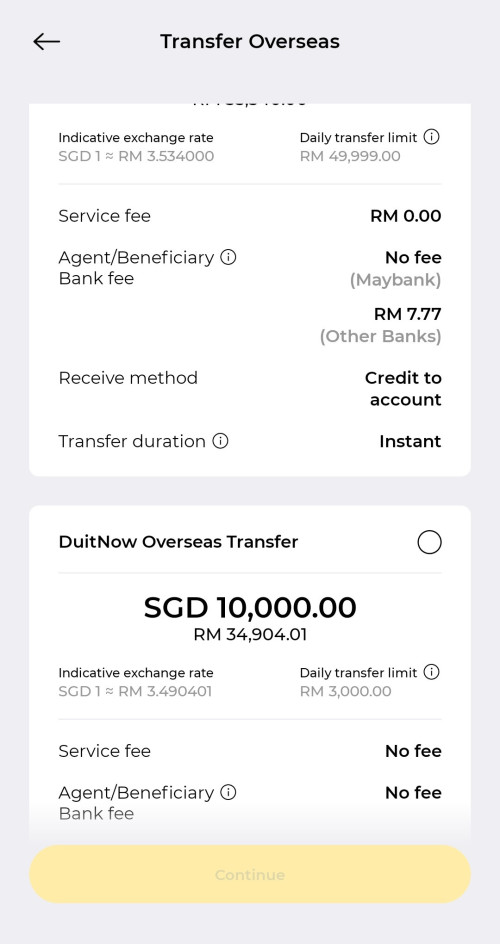

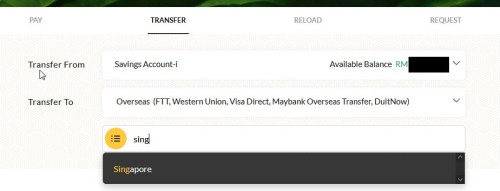

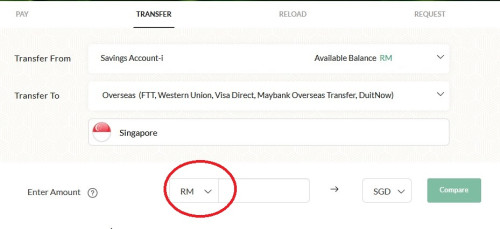

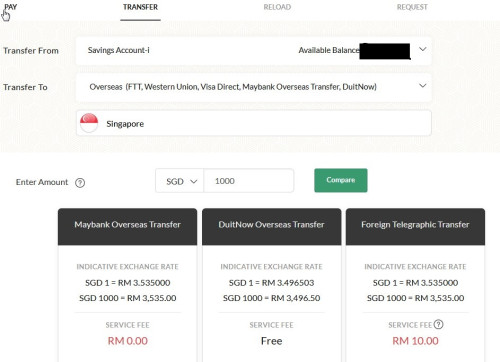

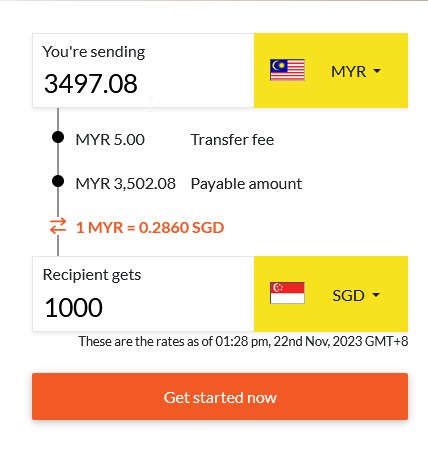

Avoid using banks to transfer money overseas whether to SG or back to Canada. You are easily paying more (hike up exchange rate + fees, fees and more fees)

Use services provided by fintech. Cheaper and faster. Recommended fintech

Instarem (I think they service Klang Valley, Penang, Johor area for KYC), Moneymatch (they have etc so you can open account anywhere you have internet) and max money (guess they only have service KL)

KYC is where you meet them to verify your identity, documents.

Cheapest rate so far

Max money (haven't use them)

Instarem (always use them, their rayes

Instarem

Moneymatch (used to use them then it got expensive vs instarem, some people said if transfer around 1130-1150

on Sunday night can be chepaer than instarem. Not sure true or not. Going to test it out)

Regarding the Islamic Fastsaver, I'll be honest I actually didn't know lol. I just bookmarked a link that was previously in this thread. I'll check out the regular fastsaver.Avoid using banks to transfer money overseas whether to SG or back to Canada. You are easily paying more (hike up exchange rate + fees, fees and more fees)

Use services provided by fintech. Cheaper and faster. Recommended fintech

Instarem (I think they service Klang Valley, Penang, Johor area for KYC), Moneymatch (they have etc so you can open account anywhere you have internet) and max money (guess they only have service KL)

KYC is where you meet them to verify your identity, documents.

Cheapest rate so far

Max money (haven't use them)

Instarem (always use them, their rayes

Instarem

Moneymatch (used to use them then it got expensive vs instarem, some people said if transfer around 1130-1150

on Sunday night can be chepaer than instarem. Not sure true or not. Going to test it out)

Will check out Instarem. Thanks for the advice

May 25 2019, 07:55 PM

May 25 2019, 07:55 PM

Quote

Quote

0.1808sec

0.1808sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled