Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

Medufsaid

|

Nov 23 2024, 09:06 PM Nov 23 2024, 09:06 PM

|

|

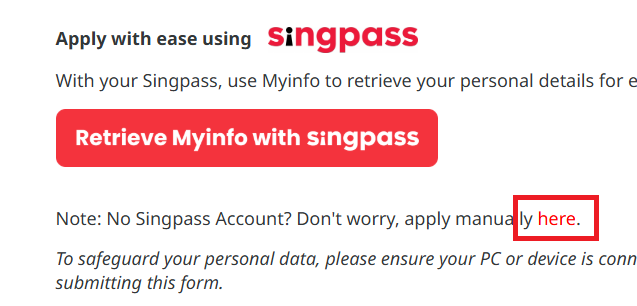

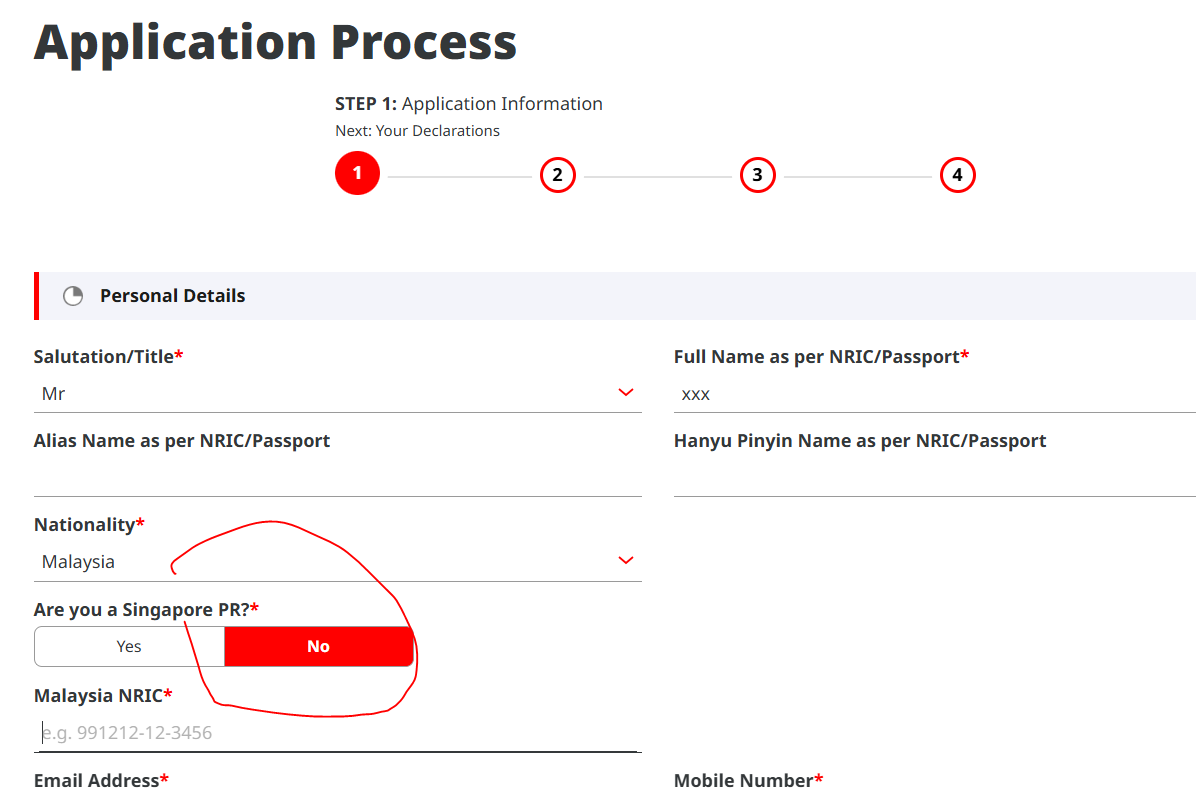

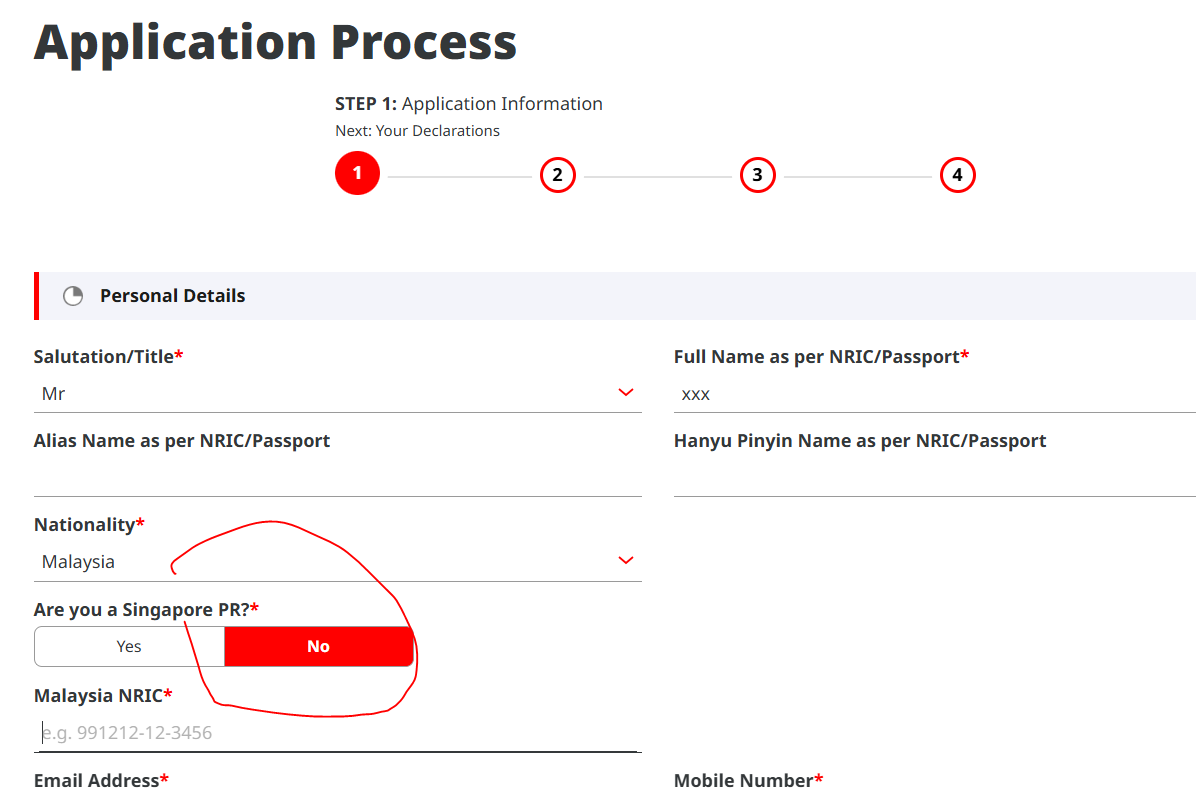

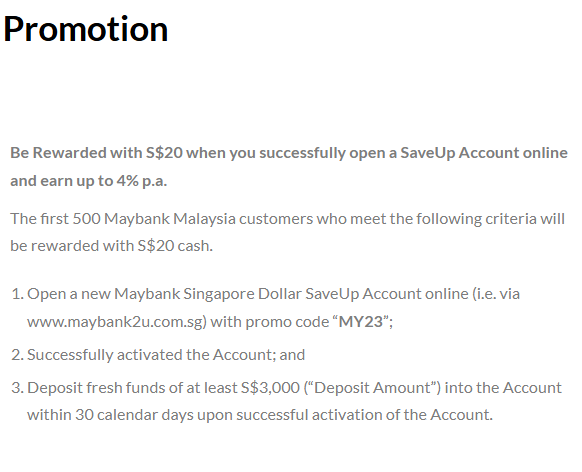

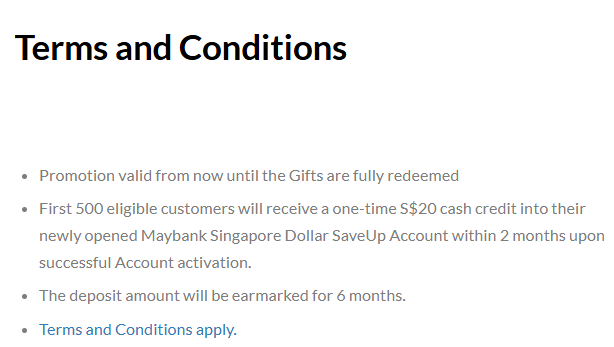

gedebe https://www.cimb.com.sg/en/personal/forms-a.../fastsaver.html btw, please open MBB sg https://www.maybank2u.com.sg/en/personal/cr...casa/index.page or OCBC sg first (via mobile app), before opening CIMB sg if not, CIMB sg will want you to send S$1k from CIMB my to validate, which is very expensive. with MBB/OCBC sg, you can send using DuitNow Overseas Transfer. after opening MBB/OCBC sg, u can then do local S$1k transfer from MBB/OCBC to CIMB sg for validation This post has been edited by Medufsaid: Jul 18 2025, 04:32 PM

|

|

|

|

|

|

Medufsaid

|

Nov 23 2024, 09:25 PM Nov 23 2024, 09:25 PM

|

|

gedebe please read and follow what i wrote  This post has been edited by Medufsaid: Nov 23 2024, 09:30 PM This post has been edited by Medufsaid: Nov 23 2024, 09:30 PM

|

|

|

|

|

|

Medufsaid

|

Nov 24 2024, 07:10 AM Nov 24 2024, 07:10 AM

|

|

gedebe yea CIMB has the best SGD->MYR forex rate, not MYR->SGD rate though. details below - SGD->MYR

CIMB has the cheapest rate. my theory is, CIMB wants to accumulate SGD, & they have loads of RM, which no institution in sg wants except us malaysian retailers. so rather than be a greedy bank for once, they'll sell RM at a competitive price (don't know why MBB sg is not following suit) - MYR->SGD

CIMB will charge you 1% to convert from ringgit to SGD

as recently as last year, CIMB is ok if we just remit SGD1 from CIMB MY to SG for e-KYC purpose. we can send the remainder S$999 via Wise. but i guess they want to earn some profit, so they changed this. as in this scenario, you need CIMB more than they need you QUOTE Cannot use that way anymore Cimb not earning money. Only way is cimb Malaysia or as intended local sg bank account under your name. if you can send S$1k from a singaporean bank into CIMB sg, it proves to CIMB sg that they are your 2nd/3rd/etc option

|

|

|

|

|

|

Medufsaid

|

Nov 24 2024, 07:53 AM Nov 24 2024, 07:53 AM

|

|

gedebe- sunwaymoney (no referral promo for now)

- moneymatch (you can enter referral code to get some discount on first transfer, but nowadays moneymatch not worth it to send SGD anymore even with discount)

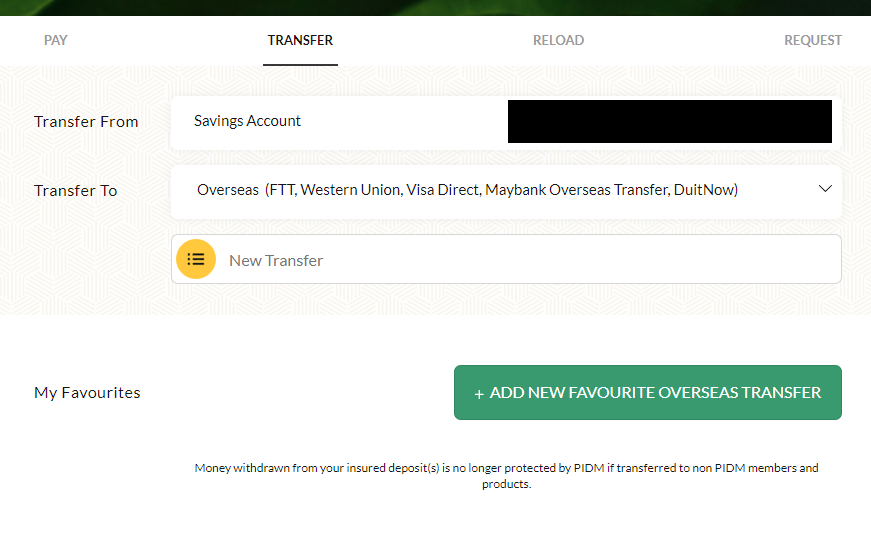

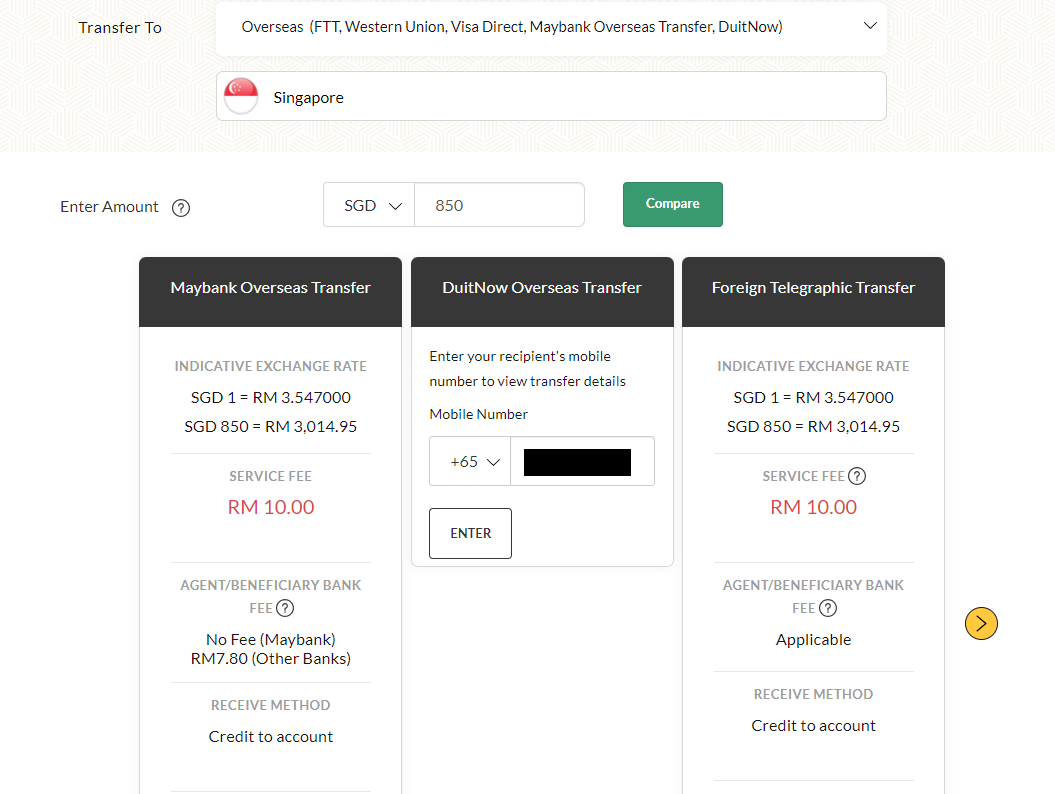

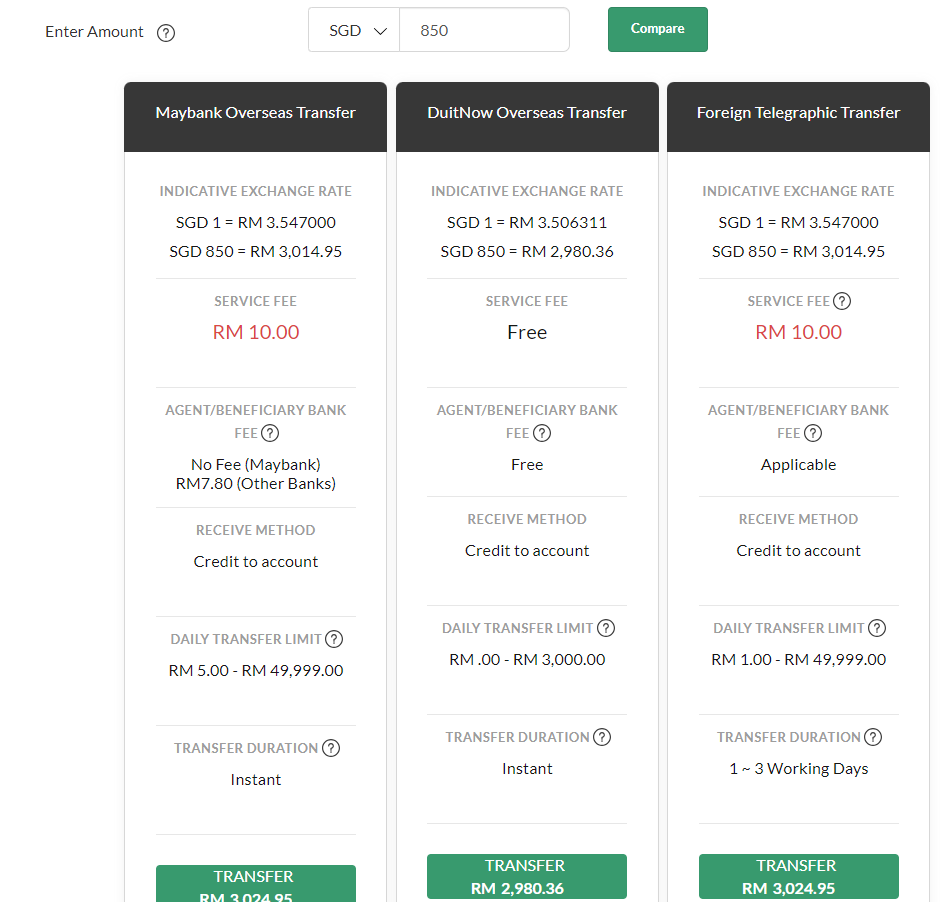

you can send up to RM3k (will be converted to roughly S$900) daily using DuitNow Overseas Transfer, from MBB/CIMB malaysia to MBB sg. CIMB sg doesn't support it for now This post has been edited by Medufsaid: Jul 6 2025, 07:56 AM

|

|

|

|

|

|

Medufsaid

|

Nov 25 2024, 08:23 AM Nov 25 2024, 08:23 AM

|

|

--edited--

OCBC SG no longer applicable to malaysians. removing this post

This post has been edited by Medufsaid: Apr 24 2025, 11:13 AM

|

|

|

|

|

|

Medufsaid

|

Nov 25 2024, 08:44 AM Nov 25 2024, 08:44 AM

|

|

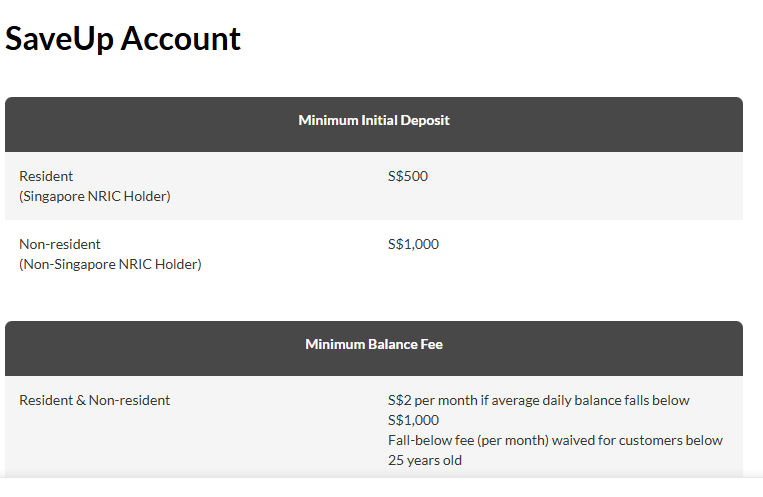

QUOTE(gedebe @ Nov 25 2024, 08:26 AM) opening a saving account also can earn refer fees? only OCBC sg QUOTE(gedebe @ Nov 25 2024, 08:28 AM) what about Sg Cimb and Sg Maybank, do they have fall below fees? cimb no. MBB depends on acct. From S$200 to S$500 |

|

|

|

|

|

Medufsaid

|

Nov 25 2024, 12:30 PM Nov 25 2024, 12:30 PM

|

|

QUOTE Yea, I applied this as well, pending the S$200 transfer. Wondering if I need more than 1 SG bank account? What say you guys? QUOTE Then the MBB SG debit card arrived after that, which I thought of not proceeding with the account, but since it arrived at door step, why not. easiest to open is MBB sg. Since those who open it half-heartedly can get the debit card straightaway. OCBC sg you need NFC phone and many many scanning of your passport to proceed |

|

|

|

|

|

Medufsaid

|

Nov 26 2024, 03:42 PM Nov 26 2024, 03:42 PM

|

|

QUOTE(gedebe @ Nov 26 2024, 03:35 PM) the debit card for Sg Mbb can only be obtained in Sg branches right and without debit card I could not create my online profile just apply, MBB sg will send to you. QUOTE Then the MBB SG debit card arrived after that, which I thought of not proceeding with the account, but since it arrived at door step, why not. |

|

|

|

|

|

Medufsaid

|

Nov 27 2024, 02:37 AM Nov 27 2024, 02:37 AM

|

|

QUOTE(Medufsaid @ Nov 23 2024, 09:06 PM) btw, please open MBB sg https://apply.maybank.com.sg/regionalcasa/A...Opening/arrihla or OCBC sg first (via mobile app), before opening CIMB sg I given you the link to open MBB sg online without needing debit card |

|

|

|

|

|

Medufsaid

|

Dec 4 2024, 09:10 PM Dec 4 2024, 09:10 PM

|

|

Last resort just call CIMB sg during office hours. Don't bother calling off hours, you'll reach their credit card dept who'll ask you to call back again during working hours

|

|

|

|

|

|

Medufsaid

|

Dec 10 2024, 11:10 AM Dec 10 2024, 11:10 AM

|

|

sunwaymoney This post has been edited by Medufsaid: Dec 10 2024, 11:10 AM |

|

|

|

|

|

Medufsaid

|

Dec 10 2024, 04:28 PM Dec 10 2024, 04:28 PM

|

|

QUOTE Dear Valued Customer

When you opened your accounts with us, you indicated that they would be used for work, study or residential purposes in Singapore.

So that we can keep your accounts open, please confirm with us that you are living in Singapore by [...]. Here is how can do so:

a) Visiting any OCBC branch in Singapore and giving us your current Singapore residential address; or

b) Designating any of your OCBC accounts as your Singapore GIRO salary crediting account.

If you we do not hear from you by [...], we regret that we will have to impose certain restrictions (i.e. you can only make withdrawals but not deposits) on the accounts and subsequently close them oh GG... looks like we have to strike OCBC off the list |

|

|

|

|

|

Medufsaid

|

Dec 10 2024, 04:44 PM Dec 10 2024, 04:44 PM

|

|

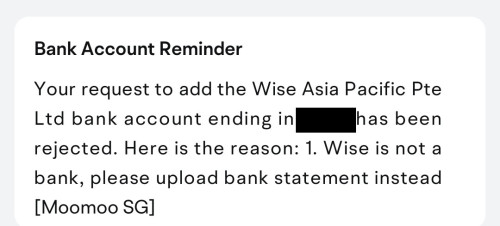

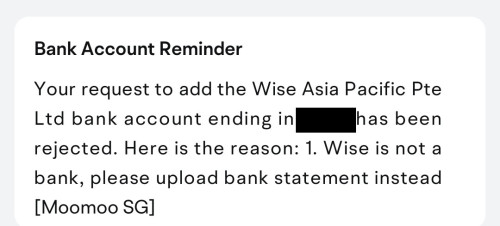

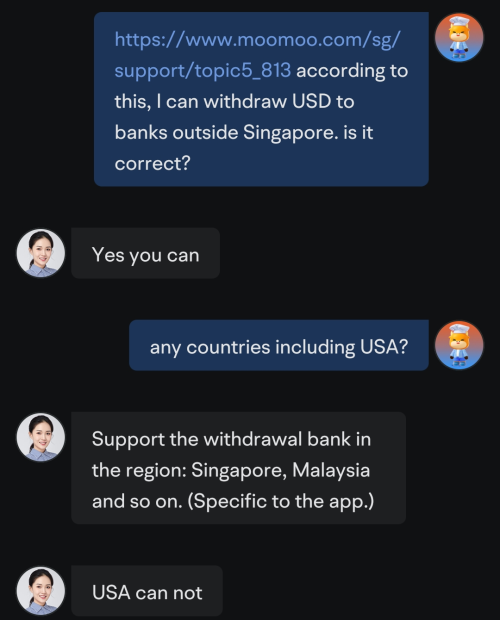

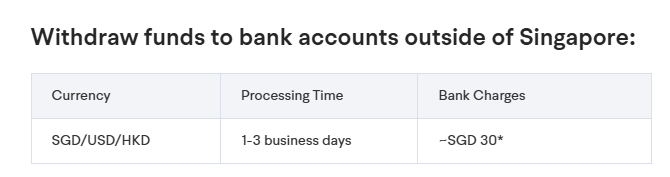

Xakiox Moomoo SG requires proof of bank statements. MBB sg doesn't have it. your only option is CIMB sg. cannot withdraw out to Wise for Moomoo SG QUOTE(Medufsaid @ Apr 28 2024, 05:55 PM) rejected  QUOTE(Medufsaid @ Dec 3 2024, 01:32 PM) if you die die want to send USD, it's is possible to send USD back to malaysian bank multi currency account for S$30 it is possible to send back to Malaysia but very expensive This post has been edited by Medufsaid: Dec 10 2024, 04:50 PM

|

|

|

|

|

|

Medufsaid

|

Dec 11 2024, 10:08 AM Dec 11 2024, 10:08 AM

|

|

QUOTE (google translate) On December 10, it was revealed online that OCBC Bank of Singapore had begun cleaning up users living outside Singapore.

Some users reported receiving emails from the bank, which required them to go to the bank offline before December 15 to provide their Singapore address, or to use an OCBC Bank account to designate the account as the one for depositing their Singapore GIRO salary. QUOTE (google translate) Now everyone is talking about OCBC Singapore's withdrawal of Chinese users. They asked everyone to open an account before, but now they are withdrawing everyone 😅, which is very unethical.

This time OCBC Singapore's OCBC withdraws Chinese users. The first batch will end on December 15, and then on December 31. Very few users can delay until the end of January; what about the funds in the account?

He looked at the second picture and provided a temporary solution.

(Shared by Xiaohongshu users) https://youtu.be/X3KcEJonQ7gcan search by this keyword 新加坡华侨银行 This post has been edited by Medufsaid: Dec 11 2024, 10:23 AM |

|

|

|

|

|

Medufsaid

|

Dec 11 2024, 01:28 PM Dec 11 2024, 01:28 PM

|

|

QUOTE(Eugenet @ Dec 11 2024, 12:34 PM) Are you mainland Chinese? malaysians also kena QUOTE(Eugenet @ Dec 11 2024, 12:34 PM) I still hold SG stocks and mutual funds invested via OCBC SG. nonetheless, can u ask OCBC sg if your account is also affected? perhaps investing something via OCBC sg will allow one to be exempted |

|

|

|

|

|

Medufsaid

|

Dec 11 2024, 06:08 PM Dec 11 2024, 06:08 PM

|

|

QUOTE(Medufsaid @ May 26 2024, 01:41 PM) does MBB sg allow you to empty out to another bank acct? S$0 balance in MBB does MBB sg allow you to empty out everything to another bank acct? |

|

|

|

|

|

Medufsaid

|

Dec 12 2024, 08:11 AM Dec 12 2024, 08:11 AM

|

|

poooky this is what i remember (might be wrong) - MBB Malaysia, you can ask them to change the account type of your savings account. not sure of any fees

- CIMB Malaysia, you cannot change any existing savings account to no-fees type. have to create a new BSA w/o fee

there's a reason why i never want to deal with CIMB unless i have to --update-- looks like 1 month ago, OCBC sg already revamped their opening account. you need proof of eventually staying in SG to open (passport alone is not enough anymore). not going to translate sorry https://youtu.be/kbuk9EAOugk so they were indeed planning this crackdown for some time This post has been edited by Medufsaid: Dec 12 2024, 09:47 AM

|

|

|

|

|

|

Medufsaid

|

Dec 12 2024, 01:47 PM Dec 12 2024, 01:47 PM

|

|

looks like it didn't come from MAS QUOTE » Click to show Spoiler - click again to hide... « (Bloomberg) – Oversea-Chinese Banking Corp, Singapore’s second-largest lender, told some international clients to show proof of residence in the city state to avoid having their accounts shut, a signal of heightened scrutiny in the wake of a spate of money-laundering cases.

OCBC gave clients a deadline to confirm they are Singapore residents with verified addresses, or face service restrictions that could lead to account closures, according to notices sent by consumer financial services. A spokesperson for the bank verified the authenticity of the documents.

“For customers outside Singapore who are coming here to live, work or study, they can open their Singapore accounts remotely,” the spokesperson said. “Documentary proof of this residential status is therefore required.”

OCBC is among several banks caught in Singapore’s largest money-laundering case where some S$3 billion ($2.2 billion) in assets were seized from more than two dozens of Chinese people who resided in the city-state for years. Local authorities are bolstering measures to combat illicit flows that also include non-bank players from property agents to traders of precious stones and metals.

Two copies of the letter seen by Bloomberg News are in simplified Chinese characters – typically used in mainland China. One of the letters indicated a deadline of Dec. 15, while the other showed Dec. 31. Another copy is in English. The documents addressed customers who had previously told the bank the accounts would be used for their work, study or residential purposes in Singapore.

“Once the account is closed, any financial arrangement related to the this account will also be cancelled,” OCBC told clients in the Chinese version.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P. CIMB MBB still ok (and hopefully in the future) since they're limited to Malaysians only worse case scenario, i'll transfer stocks from IBKR back to Moomoo Malaysia (they currently have transfer-in promo) This post has been edited by Medufsaid: Dec 12 2024, 01:56 PM |

|

|

|

|

|

Medufsaid

|

Dec 12 2024, 01:47 PM Dec 12 2024, 01:47 PM

|

|

This post has been edited by Medufsaid: Dec 12 2024, 05:50 PM

|

|

|

|

|

|

Medufsaid

|

Dec 17 2024, 04:23 PM Dec 17 2024, 04:23 PM

|

|

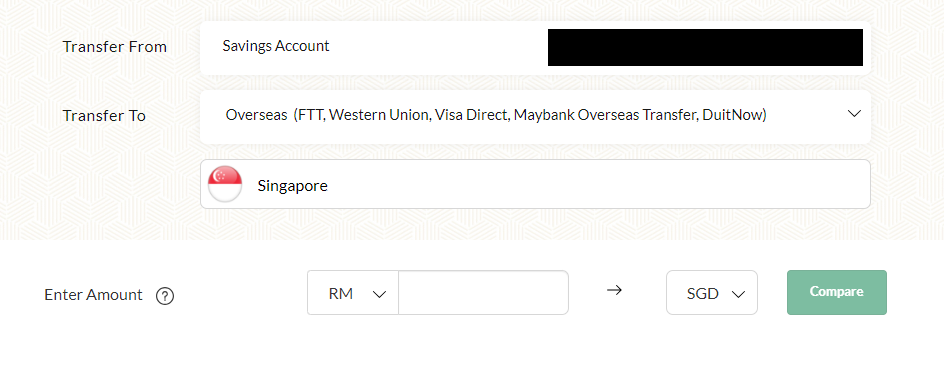

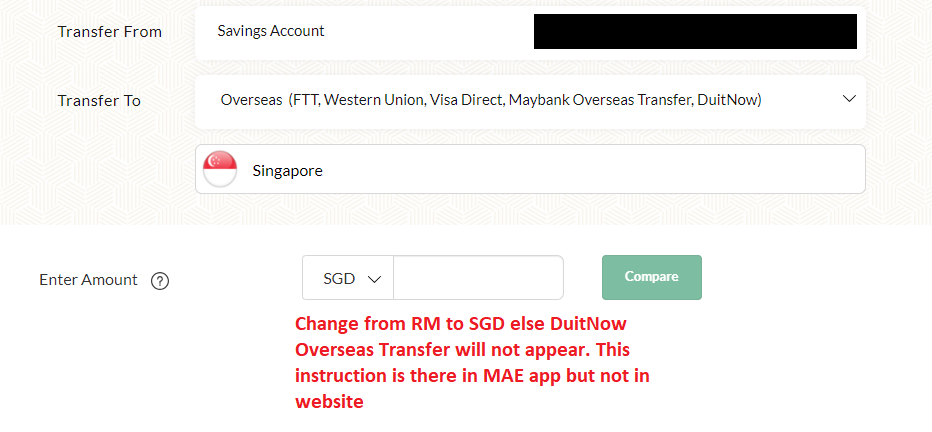

QUOTE(Medufsaid @ Jan 9 2024, 08:50 PM) QUOTE TQ SO MUCH.. i just tested.. went through..!!!! the item no. 3 . need to tonggle to SGD instead myr. receive $ instant. link your MBB sg Paynow ID to your malaysian phone number, then follow these steps to DuitNow overseas transfer S$200 from MBB malaysia This post has been edited by Medufsaid: Dec 17 2024, 04:25 PM |

|

|

|

|

Nov 23 2024, 09:06 PM

Nov 23 2024, 09:06 PM

Quote

Quote

0.0263sec

0.0263sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled