New major trend has emerge. Take position with Frontken. Major revenue > 70% derives from Taiwan operation, proxy to AI chip growth.

Should be the mega trend for 24/25.

frontkn

frontkn

|

|

Apr 23 2024, 04:39 PM Apr 23 2024, 04:39 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,601 posts Joined: Sep 2021 |

New major trend has emerge. Take position with Frontken. Major revenue > 70% derives from Taiwan operation, proxy to AI chip growth.

Should be the mega trend for 24/25. |

|

|

|

|

|

May 6 2024, 01:13 PM May 6 2024, 01:13 PM

Return to original view | Post

#2

|

Senior Member

1,601 posts Joined: Sep 2021 |

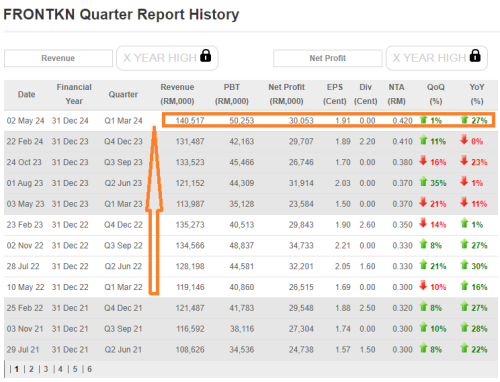

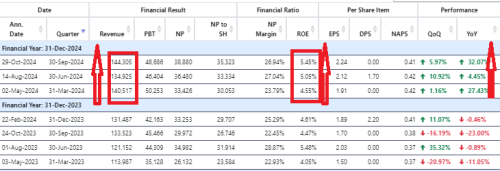

The market already started to acknowledge the Frontken upcoming explosive Qr, stay put & do nothing into year 2025.

Previous high way back at year 2022, once this is breached with the exit of the previous novice investor, it will scale the new height.  Improving Qr Revenue with the improving PBT is the finest quality growth investors looking for. The newbie or retailers will not touch because of the perceive rich valuation but the growth investors are taking position now & expect the valuation on current entry to come down in the near future. This is how you hog a good candidate of husband or wife, you don't wait till they become rich & successful or model look, you know they are workings hard to reach that, you already start making move to tackle them. Those who remained single or got screened out in the race, some example of life for you to ponder. The expansion way back at year 2021 started to kick in. https://theedgemalaysia.com/article/frontke...e-robust-demand KUALA LUMPUR (April 6): Frontken Corp Bhd's Taiwanese unit is purchasing an industrial property in Taiwan for NT$367.5 million (about RM53.29 million), cash, to expand its production capacity there to support increasing demand from its semiconductor customers. In a bourse filing, the group said its 91.25%-owned Ares Green Technology Corp (AGTC) has inked a sale and purchase agreement with MH GOPOWER Co Ltd for the purchase. The property — comprising an office building with a production area and basement car park with a total built-up area of 10,927 sq m — is located on a piece of leasehold land in the Southern Taiwan Science Park. The purchase will be financed with internal funds. Frontken said AGTC's capacity from its existing facility can no longer support "the ever-increasing demand" from its customers. "In anticipation of projected significant increase in workload from its customers, it needs to have additional capacity to cater for the anticipated multi-year of growth in the semiconductor space," Frontken said. "The proposed acquisition will more than double the physical operating and production space, as well as capacity to support the growth and demand from its customers," Frontken added. The acquisition is expected to be completed by July. Shares in Frontken finished 3.08% or 16 sen lower at RM5.04 today, valuing it at RM5.31 billion, after 2.6 million shares were done. The stock has jumped over 130% in the past one year. |

|

|

Jul 10 2024, 04:36 PM Jul 10 2024, 04:36 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,601 posts Joined: Sep 2021 |

Frontken-WA : RM 0.515

Exercise Price : RM 4.00 Underlying Price : RM RM 4.71 Conversion Ratio: 1:1 Maturity: 3/5/2026 The WA is in deep discount at (RM 4.71 - RM 4.00) - RM 0.515 = RM 0.195. Buy the WA & send to conversion to get your volume + entry price at RM 4.00 + RM 0.51. After that sell the converted share to the market to profit the discount RM 0.195 /per share. Dead chicken deal, no one notice? This post has been edited by nihility: Jul 10 2024, 04:36 PM |

|

|

Nov 7 2024, 10:32 AM Nov 7 2024, 10:32 AM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,601 posts Joined: Sep 2021 |

3 subsequent Quarters showing growth with revenue + growth net profit. This counter is already in the radar for the Growth Investors. When all the paths are eliminated, only left 1 single path remain. The power of being patient & doing nothing, waiting for the "water flow" to reach as the time flow gracefully. |

| Change to: |  0.0191sec 0.0191sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 11:36 PM |