QUOTE(contestchris @ Apr 25 2024, 05:40 PM)

An update:

KWSP - RM179.9k

Equities - RM347.9k

Cash - RM12.9k

ILP - RM12.6k

Bond - RM40.5k

Credit card - RM26.9k

Total - RM566.9k

Home MV ~RM470-500k / Remaining HL RM447k

Car MV ~RM60-65k / Remaining HP RM64k

* Will exclude these from net asset computation, the MV (slightly conservative) just about covers the remaining loan amount.

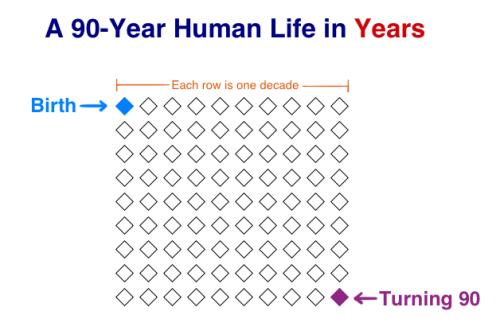

Age - 30 y/o

Target RM1mil net worth by 35, and RM1mil in EPF by 40 (purely from employment, except self-contribution <RM3k p.a. to meet the tax benefit as long as it's available). At the moment, despite life throwing some curveballs (RM40k in unexpected expenses in the last 6 months), still on track.

You'll get there. I hit the EPF mark and the compounding will take it even further faster.KWSP - RM179.9k

Equities - RM347.9k

Cash - RM12.9k

ILP - RM12.6k

Bond - RM40.5k

Credit card - RM26.9k

Total - RM566.9k

Home MV ~RM470-500k / Remaining HL RM447k

Car MV ~RM60-65k / Remaining HP RM64k

* Will exclude these from net asset computation, the MV (slightly conservative) just about covers the remaining loan amount.

Age - 30 y/o

Target RM1mil net worth by 35, and RM1mil in EPF by 40 (purely from employment, except self-contribution <RM3k p.a. to meet the tax benefit as long as it's available). At the moment, despite life throwing some curveballs (RM40k in unexpected expenses in the last 6 months), still on track.

Apr 26 2024, 03:45 PM

Apr 26 2024, 03:45 PM

Quote

Quote

0.0867sec

0.0867sec

1.03

1.03

7 queries

7 queries

GZIP Disabled

GZIP Disabled