QUOTE(MNet @ Oct 8 2009, 11:12 PM)

This look like an indicator called Super Signal.Forex V6

Forex V6

|

|

Oct 8 2009, 10:20 PM Oct 8 2009, 10:20 PM

Return to original view | Post

#101

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

|

|

|

Oct 10 2009, 11:24 AM Oct 10 2009, 11:24 AM

Return to original view | Post

#102

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

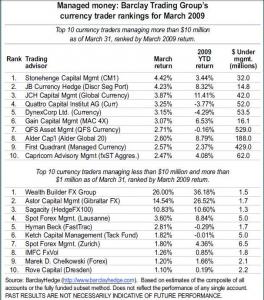

QUOTE(gslearning @ Oct 9 2009, 06:10 PM) bro.. as far as i know, in order to join legal fx fund management. you need to have at least US$1million gslearning, is it something like that in the attachment?they have been around more than 10 years, regulated by government, participated by banks and capital guaranteed somemore. Added on October 10, 2009, 11:27 am QUOTE(dannyooi_84 @ Oct 10 2009, 10:12 AM) Initially I don't want to set any SL and TP because I want to go long term. But I chicken out on that idea. I was thinking what if it goes down till i get a margin call then I'm doom. Set my conservative SL/TP but reset a higher TP before I left my workplace. You can have trading method without TP & SL but you need to use smaller lot size like $0.01/pip or lower than 100units, just always remind yourself Margin Used don't exceed 3%, normally i trade 3% below.What is the benefit of using trailing stop compare to SL/TP? Any opinion? This post has been edited by rstusa: Oct 10 2009, 11:27 AM Attached thumbnail(s)

|

|

|

Oct 11 2009, 11:13 PM Oct 11 2009, 11:13 PM

Return to original view | Post

#103

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

Oct 15 2009, 10:09 AM Oct 15 2009, 10:09 AM

Return to original view | Post

#104

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(rayloo @ Oct 15 2009, 10:04 AM) Guys, anyone using 3G broadband to trade ? I find it is too dangerous, cause many times it lags and hang. Streamyx is more stable. BTW, I need your adivice to fine tune my strategy. I trade UJ, I notice the daily fluctuation is about 100 pips, let say I trade hourly chart. Is the setting target profit at 15 pips and stop loss at 50 pips reasonable ? I'm using Maxis 3G to trade on mobile MT4, so far so good.I ask this because I intend not to monitor in every minute, I see is better to leave it few hours and the market will come to my target price. Previously my TP and SL ratio was 1:1, like my TP 15 pips and SL 15 pips, many times I almost ended up forced selling before the profit kicked in the next minute. Luckily I was around to cancel the SL and wait a bit before my profit comes. My current target is daily profit about 30 pips. So I need to do few trades of 10 pips to 15 pips gain. Apart from that can you sifus slightly define the character of different pair of currency ? Thank you. |

|

|

Oct 19 2009, 11:04 PM Oct 19 2009, 11:04 PM

Return to original view | Post

#105

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(MNet @ Oct 19 2009, 04:03 PM) esa another buble to be burst soon or sooner Yeah, agree the comments above. I don't know why now a day still got a lot of ppl want to discuss of irregularity forex broker, why don't they just look for the regulated broker which give more confidence on them?I have friends in Hong Kong, and I’ve get my friends to check out their so called “incorperated” in Hong Kong office (the one stated on the website), and it turns out that the office is non-exist. It is a virtual office. For those who don’t know what is virtual office, go search it. it means they “rent” a “company address” just for the put the company name there, but in actual, they do not have office. it’s something like Imaginary Office. After i hear that, i check all the other so called address of other office in china, singapre, and thailand, ALL ALSO VIRTUAL OFFICE!! which means, this “company” have NO office AT ALL! they are all just empty shell! go search their address, you will see a lot of comapany, also using the exactly same address, because why, they also rent the same address! So it means that if you got a problem, suddenly they disappear, and you thought u still can find them in the office, and you will end up no place to go to, BECAUSE IT NEVER EXIST. AND that is not the worst yet, the so called “FINANCIAL Broker” the NZ Finance, ALSO VIRTUAL OFFICE, How in the hell a real financial broker can function even without a proper office??? So think again if you think you want to invest in this company This is so James Phang style. disappear with no sign left for you to search! Can anyone explain to me, if their system is so good, why would they want to employ so many SE and emmax ppl to help them run this business?? if you really interested in Forex, better find a regulated broker to trade with, No regulated broker have a lot of problem, simply let ppl use their system, and have no control on them, these type broker very dangerous. they can cut you off without give u good reason, and they not afraid to do that coz they are not binded by regulation! |

|

|

Oct 19 2009, 11:13 PM Oct 19 2009, 11:13 PM

Return to original view | Post

#106

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(jye'n @ Oct 19 2009, 09:27 PM) Yes, i strongly agree. I will practice with demo account for a few months until i'm comfortable to deal with real money. Currently i'm trying IBFX, any comment? Try either Oanda, IBFX or Alpari UK. Those brokers overall with good services. If you want to start with capital lees than USD500, then Oanda suitable. IBFX as my recommend you need at least USD500 and Alpari UK at least USD5000 to avoid risking your account, because you're still new, so i suggest the capital to risk ratio about the capital amount i told you which you're not easy to loss all your money but before you start live, go for demo first.Added on October 19, 2009, 11:18 pm QUOTE(epalbee3 @ Oct 20 2009, 12:09 AM) You can check here http://www.cftc.gov/marketreports/financia...rfcms/index.htmThis post has been edited by rstusa: Oct 19 2009, 11:18 PM |

|

|

|

|

|

Oct 19 2009, 11:25 PM Oct 19 2009, 11:25 PM

Return to original view | Post

#107

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

Oct 22 2009, 05:17 PM Oct 22 2009, 05:17 PM

Return to original view | Post

#108

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

Oct 23 2009, 09:32 AM Oct 23 2009, 09:32 AM

Return to original view | Post

#109

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(hansapkuay @ Oct 22 2009, 10:11 PM) hmm... just lost 5 dollar.in future,how can i prevent this? how do i check if something like this happen? go to http://www.forexfactory.com/calendar.php and check out the daily news there with the red labels.Added on October 23, 2009, 9:33 am QUOTE(qcs @ Oct 22 2009, 11:23 PM) heard it.. just launch in aug. run MLM style... but duno is scam or not This one also look like using MLM system http://www.superconsultancy.asia/hope below link can help http://e-sabah.com/thread-43252-1-1.html This post has been edited by rstusa: Oct 23 2009, 09:33 AM |

|

|

Oct 23 2009, 06:12 PM Oct 23 2009, 06:12 PM

Return to original view | Post

#110

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

Luckily I TP both GBPUSD & EURGBP, both got 100pips respectively.

|

|

|

Oct 27 2009, 08:53 AM Oct 27 2009, 08:53 AM

Return to original view | Post

#111

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

Oct 27 2009, 10:42 AM Oct 27 2009, 10:42 AM

Return to original view | Post

#112

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(sleepwalker @ Oct 27 2009, 10:51 AM) No. That's a typical reaction to DOW falling 200 points. It went right through the floor and it's a basic forex101 that when equities, oil and commodities fall, USD goes up. It's not just the EU. Oil fell, USD/CAD went up. Typical reaction is oil price down, USD up and vice versa. Commodities fell, AU and NU went through the floor too together with it. All happened last night with the DOW leading the way down. Yes, you can see USD is up, so EURUSD down, USDCAD & USDCHF up.Added on October 27, 2009, 9:52 am Not so much old school trendline break. It's more old school people buying USD when riskier equities fall. It all happened last night. |

|

|

Nov 2 2009, 04:02 PM Nov 2 2009, 04:02 PM

Return to original view | Post

#113

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

|

|

|

Nov 3 2009, 08:26 PM Nov 3 2009, 08:26 PM

Return to original view | Post

#114

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(dannyooi_84 @ Nov 3 2009, 08:50 PM) I'm no sifu, but seems like EU is uptrend long term according to my lousy chart. But today during my office meeting, I heard from an analyst that the dollar will strengthen la. In my analysis on D1 chart, EURUSD looking for a strong LONG.I'm my opinion, I guess long term USD will strengthen... any sifus to explain more? |

|

|

Nov 4 2009, 08:46 AM Nov 4 2009, 08:46 AM

Return to original view | Post

#115

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

Stay calm on your plan!

|

|

|

Nov 10 2009, 08:39 AM Nov 10 2009, 08:39 AM

Return to original view | Post

#116

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

Nov 10 2009, 09:30 AM Nov 10 2009, 09:30 AM

Return to original view | Post

#117

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

5 Reasons Why the Dollar Could Continue to Fall

1. Dollar Carry Trade Overused but not Overplayed The primary reason why the dollar is weakening is because of the overused term "dollar carry trade." However although it is overused it is not overplayed because we have long said that how the dollar performs will depend upon where the Federal Reserve stands compared to the rest of their peers. Last week, the Fed reaffirmed their steady as she goes mentality by leaving the FOMC statement virtually unchanged. The Fed is very happy with the way things are right now and are not in a rush to unwind Quantitative Easing. In contrast, the central banks of Australia, the Eurozone and even Japan are much more likely to continue "deloosening" monetary policy. We still believe that the U.S. central bank will be amongst the last to raise interest rates and for that reason, the dollar carry trade should remain intact. Back in October, we published this chart of how close the market believes each of the major central banks are to raising interest rates and for the most part, it still applies. 2. G20 Pledges Continued Stimulus The latest reason why the dollar is falling is because of the G20's pledge to provide ongoing stimulus. More stimulus is positive for the equity markets which in turn has helped to lift the EUR/USD and other risk trades. Over the past 2 years, there has been an 80 percent correlation between the S&P 500 and the EUR/USD. As long as members of the G20 are not paring back stimulus, high yielding currencies should outperform the U.S. dollar. 3. Geithner Avoids Talking about the Dollar Treasury Secretary Geithner also avoided talking about the U.S. dollar at the G20 meeting. Typically, good old Tim likes to take this opportunity to reiterate the U.S.' strong dollar policy and his failure to do so may be more than just a careless mistake particularly in an audience of countries who hold massive dollar reserves and are fidgeting about the continued weakness of the U.S. dollar. It is no secret that the U.S. only pays lip service to its strong dollar policy. In a low inflation environment such as today, a weak dollar helps more than it hurts the U.S. economy. 4. Economic Fundamentals Friday's non-farm payrolls number indicates the tough economic environment in the U.S. The unemployment rate has climbed above the psychologically hobbling 10 percent mark to 10.2 percent as job losses continued for the 22nd month. Millions of Americans are out of work and could have a tough time finding work over the next year which means that we could be facing a particularly weak holiday shopping season. Unless the U.S. labor market turns around, the impressive GDP growth that we saw in the third quarter may not be sustained. 5. Little Technicals Support Finally, there is little technical support underneath the dollar. Taking a look at the dollar index, 74.93 is the 14 month low and the index is trading just above that. If this level is broken, the next major point of support is not until 71.50. For the EUR/USD a break above 1.5060 opens the door for a move towards 1.55 and for USD/JPY support is at 87. Futures trades have also trimmed their bets on dollar weakness which means that a break of support levels could encourage a wave of new short dollar positions. Source: Bloomberg This post has been edited by rstusa: Nov 10 2009, 09:30 AM |

|

|

Nov 11 2009, 06:00 PM Nov 11 2009, 06:00 PM

Return to original view | Post

#118

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

|

|

|

Nov 11 2009, 07:12 PM Nov 11 2009, 07:12 PM

Return to original view | Post

#119

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(AllHell @ Nov 11 2009, 07:46 PM) how in the hell does schoolin in babypips answers my question? mind answering that? or to make things easier just give me a direct answer to my first noob question..if u can't then just stfu rather giving lame remarks after my post..it's like asking someone to go google for answers, dumbass! If you're rude in this topic, i won't give you a damn answer from your up coming noob question. I only help those who are willing to learn and not for those disturb & insult other people here. God bless you that other ppl will help you here. |

|

|

Nov 16 2009, 09:18 PM Nov 16 2009, 09:18 PM

Return to original view | Post

#120

|

Senior Member

1,798 posts Joined: Sep 2004 From: Yuen Long, HK || Seremban || Kuala Lumpur |

QUOTE(alenac @ Nov 16 2009, 09:27 PM) Its mamak stall web site. R u sure this guy want to go up market selling EA? Anyway don't see story of his background. Maybe the STG biz can't gain any income then realised forex EA can help him make money.R u sure he is a DR. Seems in malaysia many conman around with DR insignia behind them. |

|

Topic ClosedOptions

|

| Change to: |  0.0227sec 0.0227sec

0.32 0.32

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 04:34 AM |