QUOTE(mita @ May 19 2009, 10:03 PM)

If the world recover, we will surely recover though not as spectacular as others. Malaysia is part of the globalized economic/Keynesian financial system. We are not North Korea or Cuba. If USA is the heart, Japan is the Kidney, Malaysia is like the testicle of the body, without testicle the heart can still live ......

http://en.wikipedia.org/wiki/Economy_of_MalaysiaExports $195.7 billion f.o.b. (2008 est.)

Main partners : United States 15.6%, Singapore 14.6%, Japan 9.1%, People's Republic of China 8.8%, Thailand 5%, Hong Kong 4.6% (2007)

Imports $156.2 billion f.o.b. (2008 est.)

Main Partners Japan 13%, People's Republic of China 12.9%, Singapore 11.5%, United States 10.8%, Taiwan 5.7%, Thailand 5.3%, South Korea 4.9%, Germany 4.6%, Indonesia 4.2%

Warren Buffetts says that diversification is a protection against ignorance.

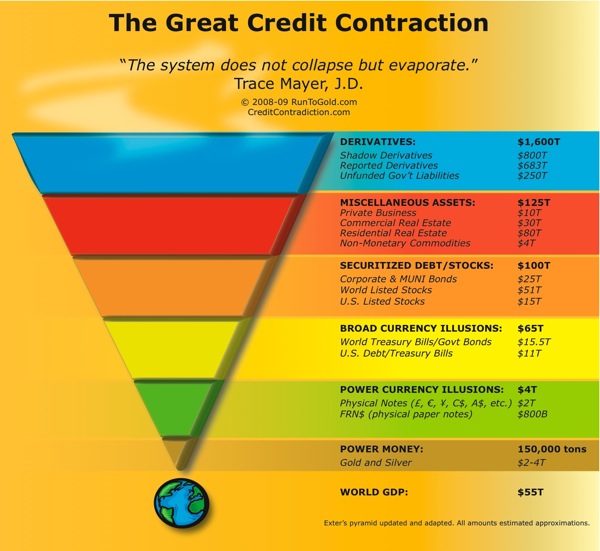

If you know that financial assets and housing assets are going to crash to the abyss because of massive debt deflation, it just doesn't make sense to diversify into these area right?

mita,

<<If the world recover, we will surely recover though not as spectacular as others. >>

This has been proven WRONG. Malaysia had not recover from the 97/98 recession while others has. So, what makes you think that Malaysia can recover this recession??

<<Warren Buffetts says that diversification is a protection against ignorance. >>

Bingo. Unless you are Warren Buffet, you are IGNORANT.

In personal finance, there are ONLY 2 kinds of people,

1) Those who know that they know nothing.

2) Those who do not know that they know nothing.

<< If you know that financial assets and housing assets are going to crash to the abyss because of massive debt deflation, it just doesn't make sense to diversify into these area right?>>

So, tell me when the crash going to happen and when it is going to stop?? You DO NOT KNOW. And, nobody knows. So, a strategy that is based on TIMING does not work either.

An asset allocation based investment strategy does not based on TIMING. And, by rebalancing, you always SELL HIGH and BUY LOW.

http://www.marketwatch.com/LazyPortfolioCheck out lazy portfolio above.

Dreamer

This post has been edited by dreamer101: May 20 2009, 09:36 PM

May 15 2009, 12:59 AM

May 15 2009, 12:59 AM

Quote

Quote

0.0135sec

0.0135sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled