QUOTE(mojo86 @ Jul 21 2020, 01:29 AM)

In the monthly statement under Purchases, towards the end there's a column called "AMOUNT IN TRADED CURR". Is this amount the total amount paid including brokerage fees, stamp duty and clearing fees?

I seem to be have trouble coming up with the correct amount based on my own calculations.

QUOTE(beebo101 @ Jul 28 2020, 04:17 PM)

I have similar issue. I made record for each transaction, but somehow the total earning amount is different from my calculation. The difference is quite big, I worried the system got problem. Any sifu here facing similar problem? On top of that, there was once system got error (few moths ago) , sold off my stock and realised lost rm10k showed in the record. They told me system did not deduct money from my acct, but in the realised gain/loss record the error still not yet corrected.

QUOTE(zeqqy @ Jul 30 2020, 02:51 AM)

Hi.. How to report system error.. Like calculated sell/buy price wrongly..just lost almost 2k becouse of this.

Tq in advance..

i have used itrade for many years.

there was once an error did happen, a human one.

need to report to remisier to rectify or call the help desk for directions.

other than that, there are 2 possibilities why yr own calc do not match theirs.

1. if fx, be sure u use the right settings to keep in same fx becos by default, it converts to RM for every buy and sell.

each time it converts, u lose the spread - this usually amounts to a huge diff... instead of gain, u may get a loss.

2. for local bursa transactions, if in doubt, check yr calc against the e-contract.

do not forget besides brokerage, there is contract stamp of 0.1%, clearing fees and service tax.

if u use a wrong formula and miss out any of those, the numbers will be incorrect... big diff with big traded amounts.

QUOTE(andalpha @ Jul 29 2020, 03:38 PM)

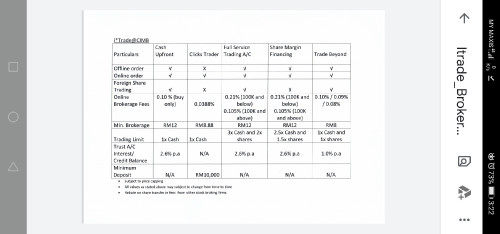

Hi, have not used itrade for a long time. My account's brokerage fee is still at 0.42%/min RM12. Thinking to change to TradeBeyond with 0.1%/min RM8.

Besides lower brokerage fees, any sifus can tell me the difference between the old Securitized Trading Account and the new TradeBeyond? Many thanks.

it will be silly not to change over... brokerage % diff is huge.

beyond will only allow 1:1 collateralization for trading unlike the leveraged trade limits of the old way.

i.e., if u have 100k cash, u buy 100k... when it is paid up, u can trade another counter up to 100k too.

but if u incur losses in that trade, either u pay up or they will forced sell yr paid up stocks.

Feb 19 2016, 11:32 AM

Feb 19 2016, 11:32 AM

Quote

Quote

0.0587sec

0.0587sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled