QUOTE(crimsonhead @ Nov 6 2019, 03:04 AM)

Hi, what is the import tax for toy “figurine” collection? Total price is 900usd (400usd + shipping 500usd), coming from US.

Tariff Code 9503.00.4000 which have 10% SST.| Bump Topic Add Reply RSS Feed New Topic New Poll |

![]() Malaysia Import Duties

Malaysia Import Duties

|

|

Nov 6 2019, 08:50 AM Nov 6 2019, 08:50 AM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

|

|

|

Nov 6 2019, 09:18 AM Nov 6 2019, 09:18 AM

Show posts by this member only | IPv6 | Post

#1702

|

Senior Member

2,261 posts Joined: Jun 2005 From: -H3AV3N- |

|

|

|

Nov 6 2019, 09:28 AM Nov 6 2019, 09:28 AM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

Nov 8 2019, 10:49 AM Nov 8 2019, 10:49 AM

Show posts by this member only | IPv6 | Post

#1704

|

Probation

0 posts Joined: Nov 2019 |

Hi

I am planning to buy a mobile phone cover from HK. The price is USD 35 after discount, shipping is free. Do I have to pay any import duties and SST on this? Thanks. I've looked everywhere and can't find the answer. |

|

|

Nov 10 2019, 02:00 AM Nov 10 2019, 02:00 AM

Show posts by this member only | IPv6 | Post

#1705

|

Junior Member

119 posts Joined: Oct 2009 From: malaysial |

May i know how much tax for leather wallet? 251euro free shipping with dhl. Thanks

|

|

|

Nov 10 2019, 11:26 AM Nov 10 2019, 11:26 AM

|

All Stars

13,475 posts Joined: Jan 2012 |

|

|

|

Nov 10 2019, 11:29 AM Nov 10 2019, 11:29 AM

|

All Stars

13,475 posts Joined: Jan 2012 |

QUOTE(Hsinz @ Nov 8 2019, 10:49 AM) Hi Bought plenty of cover from taobao and never paid anything. Besides under RM500 usually will be let go.I am planning to buy a mobile phone cover from HK. The price is USD 35 after discount, shipping is free. Do I have to pay any import duties and SST on this? Thanks. I've looked everywhere and can't find the answer. |

|

|

Nov 14 2019, 05:10 PM Nov 14 2019, 05:10 PM

|

Junior Member

355 posts Joined: Dec 2010 |

Hi all, purchased a pre-used designer leather bag on ebay with free shipping, totalling around USD $450. Not sure about the weight but I'm assuming less than 1kg.

Would they still charge import duty of 10% even if I bought it as a gift? If anyone can share the calculation, that would be great. |

|

|

Nov 22 2019, 10:06 AM Nov 22 2019, 10:06 AM

|

Senior Member

1,330 posts Joined: Apr 2008 |

Any idea if I buy this and ship back $650, how much will it get taxed/import duty?

https://www.clevertraining.com/assioma-peda...ing-power-meter This post has been edited by ChipZ: Nov 22 2019, 04:51 PM |

|

|

Dec 3 2019, 06:21 PM Dec 3 2019, 06:21 PM

|

All Stars

13,202 posts Joined: Jul 2006 |

buy kpop items and being charge 383 duty +53 handling fee by sf express.

they sent me a k1 draft with wrong purchase value, so im going to settle myself |

|

|

|

|

|

Dec 6 2019, 11:13 AM Dec 6 2019, 11:13 AM

|

Junior Member

51 posts Joined: Nov 2015 |

Hey brothers,

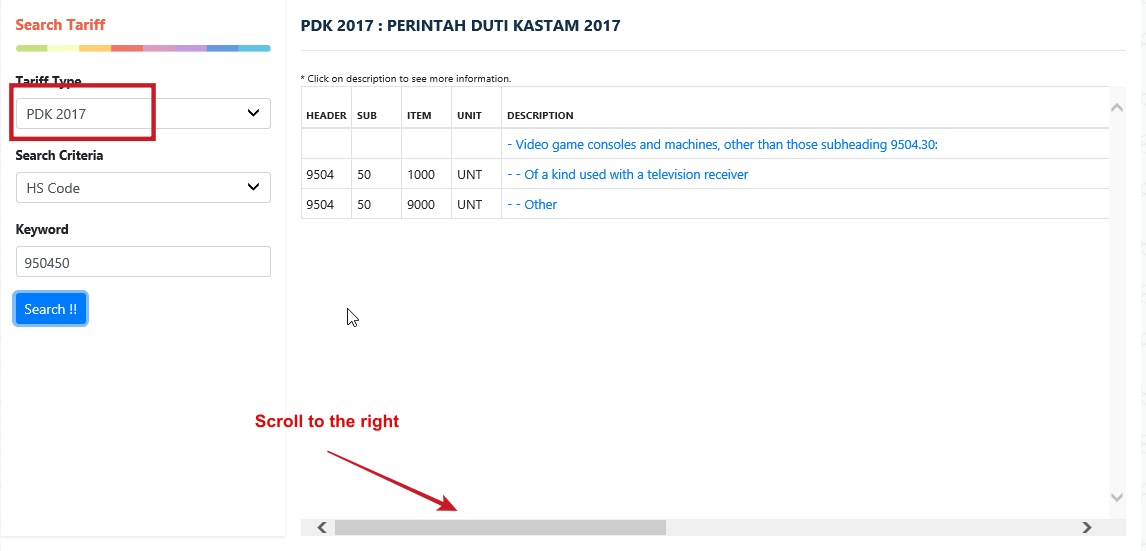

I read like thirty pages in this topic, thanks kherel for the deep explanation on calculating the taxes based on the CIF value & IATA rates. 1) Does anyone know what's the HS code for console games (e.g. PS4/PC games)? I can't seem to find it. 2) I tried to search for video game console (e.g. PS4/Xbox machine). There is some result BUT doesn't show a code and any value for the import rate. Does this mean its 0% tax? |

|

|

Dec 6 2019, 12:02 PM Dec 6 2019, 12:02 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(BobSponge @ Dec 6 2019, 11:13 AM) Hey brothers, : 9504.50 1000 I read like thirty pages in this topic, thanks kherel for the deep explanation on calculating the taxes based on the CIF value & IATA rates. 1) Does anyone know what's the HS code for console games (e.g. PS4/PC games)? I can't seem to find it. 2) I tried to search for video game console (e.g. PS4/Xbox machine). There is some result BUT doesn't show a code and any value for the import rate. Does this mean its 0% tax? - Video game consoles and machines - - Of a kind used with a television receiver 0% Import duty, 10% SST |

|

|

Dec 6 2019, 02:02 PM Dec 6 2019, 02:02 PM

|

Junior Member

51 posts Joined: Nov 2015 |

QUOTE(kherel77 @ Dec 6 2019, 12:02 PM) : 9504.50 1000 Thanks kherel. I got the same result but I would like to ask how did you get the 10% SST figure? - Video game consoles and machines - - Of a kind used with a television receiver 0% Import duty, 10% SST If you see the result below under PDK 2017, The column for "IMPORT RATE" and "SST" is blank on the customs page. I assume blank would mean 0% for both import duty and SST?  I have a second question if you don't mind. Do you know what's the HS code for console games? (e.g. PS4/PC/XBOX games). Basically console games on disc. |

|

|

Dec 6 2019, 03:27 PM Dec 6 2019, 03:27 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(BobSponge @ Dec 6 2019, 02:02 PM) Thanks kherel. I got the same result but I would like to ask how did you get the 10% SST figure? If you see the result below under PDK 2017, The column for "IMPORT RATE" and "SST" is blank on the customs page. I assume blank would mean 0% for both import duty and SST?  Scroll to the right for duty/tax percentage. QUOTE(BobSponge @ Dec 6 2019, 02:02 PM) I have a second question if you don't mind. Do you know what's the HS code for console games? (e.g. PS4/PC/XBOX games). Basically console games on disc. 8523.80.9900: Import duty 0%, SST 5% |

|

|

Dec 6 2019, 08:41 PM Dec 6 2019, 08:41 PM

|

Junior Member

51 posts Joined: Nov 2015 |

|

|

|

Dec 9 2019, 11:48 AM Dec 9 2019, 11:48 AM

|

Junior Member

166 posts Joined: Dec 2008 From: C:\Windows\System32 |

i bought 40 pieces of used CDs from Zenmarket. Is there a possibility that custom will hold my item? There are few options that the website offer such as:

1. remove the website sticker on the parcel 2. remove all price tags on the item and remove any invoice @ receipt 3. Other special request (i can request to tag the parcel as personal belonging) 4. The items can be shipped multiple times (separate the CDs to few parcels and posted separately) |

|

|

Dec 9 2019, 01:55 PM Dec 9 2019, 01:55 PM

|

Senior Member

4,150 posts Joined: Mar 2006 |

Hi, can I know what's the rate for purchase of tshirt, polo shirts, rugby jerseys. Basically clothing. Is there any difference in price of the import duty or SST say if I buy RM1200 worth of tshirts/clothing, including shipping in 1 package comparing to splitting it to 2 RM600 packages?

This post has been edited by air_mood: Dec 9 2019, 02:03 PM |

|

|

Dec 9 2019, 04:08 PM Dec 9 2019, 04:08 PM

Show posts by this member only | IPv6 | Post

#1718

|

Junior Member

794 posts Joined: Feb 2010 |

Hi,

May I know if my friend to ship a new road bike from Japan to Malaysia to me. Will it subject to Import Duty or SST? If yes, how many percent applicable for it?? |

|

|

Dec 9 2019, 05:04 PM Dec 9 2019, 05:04 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(baldiajaib @ Dec 9 2019, 11:48 AM) i bought 40 pieces of used CDs from Zenmarket. Is there a possibility that custom will hold my item? There are few options that the website offer such as: No reason for Customs to hold your items unless containing indecent or pornographic material of any description. 1. remove the website sticker on the parcel 2. remove all price tags on the item and remove any invoice @ receipt 3. Other special request (i can request to tag the parcel as personal belonging) 4. The items can be shipped multiple times (separate the CDs to few parcels and posted separately) Music CD's have 5% SST. |

|

|

Dec 9 2019, 05:08 PM Dec 9 2019, 05:08 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(air_mood @ Dec 9 2019, 01:55 PM) Hi, can I know what's the rate for purchase of tshirt, polo shirts, rugby jerseys. Basically clothing. Is there any difference in price of the import duty or SST say if I buy RM1200 worth of tshirts/clothing, including shipping in 1 package comparing to splitting it to 2 RM600 packages? Both situation will incur duty/tax. 2nd method will increase total duty/tax as freight charge is calculate twice. |

| Change to: |  0.0293sec 0.0293sec

0.28 0.28

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:18 AM |