Does it mean this has passed custom?

Jul 11, 20170 2:39 pm

Item en route to

MYKULA

Jul 11, 201710:09 am

Customs Inspection (Import)

MYKULA

Jul 11, 201710:08 am

Item arrived at

MYKULA

| Bump Topic Add Reply RSS Feed New Topic New Poll |

![]() Malaysia Import Duties

Malaysia Import Duties

|

|

Jul 12 2017, 03:32 PM Jul 12 2017, 03:32 PM

|

Senior Member

2,381 posts Joined: May 2005 From: Narnia |

Hello.

Does it mean this has passed custom? Jul 11, 20170 2:39 pm Item en route to MYKULA Jul 11, 201710:09 am Customs Inspection (Import) MYKULA Jul 11, 201710:08 am Item arrived at MYKULA |

|

|

|

|

|

Jul 12 2017, 07:55 PM Jul 12 2017, 07:55 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(doinkz_gaara @ Jul 12 2017, 03:32 PM) Hello. Not yet. Still in transit. That is pre-clearance base on Master AWB submitted by shipping agent.Does it mean this has passed custom? Jul 11, 20170 2:39 pm Item en route to MYKULA Jul 11, 201710:09 am Customs Inspection (Import) MYKULA Jul 11, 201710:08 am Item arrived at MYKULA |

|

|

Jul 12 2017, 08:39 PM Jul 12 2017, 08:39 PM

|

Senior Member

2,381 posts Joined: May 2005 From: Narnia |

QUOTE(kherel77 @ Jul 12 2017, 07:55 PM) But in PostNL it says:DateTimeLocationStatus Tue Jul 11 20:39 Released by customs Tue Jul 11 16:09 Shipment at customs Tue Jul 11 16:08 Received in country of destination Thu Jul 6 02:33 NLSent to country of destination Tue Jul 4 16:05 Shipment is pre-alerted Ah so confused. Hopefully I won't get a shock tomorrow. |

|

|

Jul 13 2017, 01:03 PM Jul 13 2017, 01:03 PM

|

Junior Member

158 posts Joined: Jul 2008 |

Guys, hope I could get some help here.

Can I know the import tax/gst or what other possible fees for bag importation from China? Me and my partner have produced 100 bags in China and would like to ship in to Malaysia for sales. can I know how they count the importation tax/gst or others? Supplier is uisng FEDEX. Thanks in advance! |

|

|

Jul 14 2017, 11:45 AM Jul 14 2017, 11:45 AM

|

Junior Member

230 posts Joined: Jan 2008 |

Hi. Anyone here have experience buying a mobile phone cover accessory from South Korea? I would like to know if any import duty will be charged. I have checked Customs tariff code 8517, which indicates 0% import rate. But not sure if it is correct code, appreciate if anyone here can confirm.

|

|

|

Jul 14 2017, 01:45 PM Jul 14 2017, 01:45 PM

|

Senior Member

896 posts Joined: May 2007 |

QUOTE(evilhomura89 @ Jul 6 2017, 11:09 PM) yes 6% GST Same case here. Using cGW, No prob with the item, but the shipping change from rm210 to rm498 by the kastam! What???? The??? Far????BUT, it will depends on how Kastam decide to calculate the shipping cost as they WILL NOT follow the shipping cost written in the shipping invoice - hence you'll be paying more than the actual 6%. This is my recent experience - I bought a watch from eBay US and it was forwarded to me via comgateway Since comgateway was having some promos, I only paid about 10 USD to have it shipped via DHL (but in their invoice they declared it at about 27 USD, which is pretty much standard rate). But when the watch arrived, DHL called and told me the charges I need to pay is RM123 (RM73 GST plus RM50 DHL fees). My watch was declared at 155 USD (which is approximately RM600+), total cost is about 180 USD which comes to around RM775. See the picture below: This is my official shipping invoice which declares the item price and freight cost. [attachmentid=8948417] So technically, the GST that I should be paying is 6% of RM775 - comes to around RM46. But why do I have to pay RM73 which is more than 6% of RM1000? This is the kastam receipt and it tells an entirely different story. [attachmentid=8948418] No problem with the item price there, but look at the freight cost given by kastam - RM498.75 ?! How did the kastam give such prices considering the fact that my shipping box only has a weight of 400g and volumetric weight of 1kg maximum. To me, this is pure blatant rip off by our beloved kastam trying to siphon money from the regular person like you and me. For what reason, I don't know...probably to reduce the country's debt. So, my only solutions for this issue is, avoid DHL/FedEx at all cost as all items will have to go through full custom declaration and taxation. If it's below RM500, maybe there's still a chance of not getting taxed. When possible and not urgent or not too valuable, I don't mind using the normal airmail/EMS handled by Pos Malaysia. Items sent via normal airmail still have a good chance of being overlooked as there are too many parcels to be handled everyday. Also, always under declare if you don't mind - why should I declare truthfully knowing that the custom will still try to mark it up by having ridiculous freight charge estimation. If you under declare, make sure there's no invoice or price tag in your parcel in case it gets opened up for further checking. Under declare works best for used/second hand items. This post has been edited by N33d: Jul 14 2017, 01:46 PM |

|

|

Jul 14 2017, 05:01 PM Jul 14 2017, 05:01 PM

|

Senior Member

5,886 posts Joined: Jan 2003 From: BM |

|

|

|

Jul 16 2017, 08:05 PM Jul 16 2017, 08:05 PM

|

Junior Member

195 posts Joined: Jan 2014 From: your heart, mara digital |

hi buying 200usd worth of headphone, will it be taxed? if so how much?

This post has been edited by xxhunter: Jul 16 2017, 08:05 PM |

|

|

Jul 17 2017, 10:11 AM Jul 17 2017, 10:11 AM

|

Senior Member

896 posts Joined: May 2007 |

QUOTE(evilhomura89 @ Jul 14 2017, 05:01 PM) no... first of all, cGW does not allow that.. the sum declared must match the original invoices.secondly, i am naive.. I have thought that i will at least taxed fairly according to what i have paid. Only then i realize that custom can exercise their power to overwrite the shipping fees as they deem fit and tax you based on that(they assumed you under declare your shipping cost). So even with shipping discount by the forwarding agent, the custom might not choose to believe what they see and revise the shipping fee to charge you tax. i have calc before i shipped my thing over here. The sum is <500.. around rm430 region incl. shipping cost which is less than rm500. I am able to get heavy disc from the fwd company, my shipping cost is <rm140.. imagine for a vol weight of 6kg! after the revision by custom, my import cost has ballooned to rm600-700 region. and they derived the tax amount based on that! in the end i kena 10%+6%... rm100 taxed.. |

|

|

Jul 17 2017, 03:40 PM Jul 17 2017, 03:40 PM

|

Senior Member

5,886 posts Joined: Jan 2003 From: BM |

QUOTE(N33d @ Jul 17 2017, 10:11 AM) no... first of all, cGW does not allow that.. the sum declared must match the original invoices. well, i guess it's a lesson learntsecondly, i am naive.. I have thought that i will at least taxed fairly according to what i have paid. Only then i realize that custom can exercise their power to overwrite the shipping fees as they deem fit and tax you based on that(they assumed you under declare your shipping cost). So even with shipping discount by the forwarding agent, the custom might not choose to believe what they see and revise the shipping fee to charge you tax. i have calc before i shipped my thing over here. The sum is <500.. around rm430 region incl. shipping cost which is less than rm500. I am able to get heavy disc from the fwd company, my shipping cost is <rm140.. imagine for a vol weight of 6kg! after the revision by custom, my import cost has ballooned to rm600-700 region. and they derived the tax amount based on that! in the end i kena 10%+6%... rm100 taxed.. (1) when using CGW or any other forwarders that doesn't allow under declaration of item value - if your seller allows it, request them to remove the sales invoice or any receipt that indicates the pricing. I knew that CGW will not under declare for me, i asked the seller to exclude any invoices and i did the declaration on CGW myself. But of course don't under-declare until it doesn't make sense haha (2) use forwarders that allows you to change the declaration value (3) avoid DHL/FedEx and use airmail (4) when all else fails, be prepared to pay a premium to get your items |

|

|

|

|

|

Jul 17 2017, 07:19 PM Jul 17 2017, 07:19 PM

|

Senior Member

896 posts Joined: May 2007 |

QUOTE(evilhomura89 @ Jul 17 2017, 03:40 PM) well, i guess it's a lesson learnt Thanks evilhomura89(1) when using CGW or any other forwarders that doesn't allow under declaration of item value - if your seller allows it, request them to remove the sales invoice or any receipt that indicates the pricing. I knew that CGW will not under declare for me, i asked the seller to exclude any invoices and i did the declaration on CGW myself. But of course don't under-declare until it doesn't make sense haha (2) use forwarders that allows you to change the declaration value (3) avoid DHL/FedEx and use airmail (4) when all else fails, be prepared to pay a premium to get your items your reply is very useful to me regarding airmail, confusing as I did not see any popular forwarders mentioned this airmail service. Do i need to request from them too? Since it's a large vol, so i assume the shipping cost will be cheaper? |

|

|

Jul 17 2017, 07:43 PM Jul 17 2017, 07:43 PM

|

Senior Member

5,886 posts Joined: Jan 2003 From: BM |

QUOTE(N33d @ Jul 17 2017, 07:19 PM) Thanks evilhomura89 I think a lot of forwarders refuse to use airmail due to the high risk of stuff getting missingyour reply is very useful to me regarding airmail, confusing as I did not see any popular forwarders mentioned this airmail service. Do i need to request from them too? Since it's a large vol, so i assume the shipping cost will be cheaper? At least with reputable service like FedEx/DHL, their asses are well-covered in case of any theft or lost parcel Generally when someone ships from the US internationally via USPS, that's the normal airmail service. For normal airmail service, all parcels will be handled by Pos Malaysia when they arrive in Malaysia. The tracking numbers can usually be tracked on Pos Malaysia usual tracking webpage - http://poslaju.com.my/track-trace-v2/ Below are my experience buying from different countries: 1. Japan (Zenmarket) - i always request for SAL shipment (aka Economy Airmail, max limit of 2kg per parcel) and they allow you to change the declaration value. Handling is the same as the normal airmail service. 2. China (Yeslogistic) - China to Malaysia by air, not sure how. You can choose either Skynet, ABX or Airpak to deliver it to your house. Shipment from China have ways of coming into Malaysia. You can import batteries, electronics, phones, liquid, powder etc without worrying about stuff getting stuck in custom if you use their "sensitive shipping option". I've always declared my items below 100 USD to avoid problems. Bulky item such as furniture, bicycles can be imported too via sea route. 3. Germany (eBay seller used "DHL") - this DHL is different from the usual DHL express. DHL is their national post agency aka Deutsche Post. Handling is the same as the normal airmail service. 4. Ukraine (eBay seller used Ukrposhta) - Handling is the same as the normal airmail service but my package was opened by kastam. It was a used vintage lens but since it was from Ukraine, they probably had to check it to make sure it's not something dangerous This post has been edited by evilhomura89: Jul 17 2017, 07:44 PM |

|

|

Jul 20 2017, 12:10 PM Jul 20 2017, 12:10 PM

|

Junior Member

73 posts Joined: Jan 2010 |

Hi all, I am planning to ship in some Games for personal and maybe resell purpose but I have yet to check which transport is convenient to be used.

1) If there is tax how will it be calculated - as Ive only purchase goods with value of Rm500 and below only. 2) Will I need to declare the item value? 3) Is there a way to avoid heavy Tax Duties/Charges ? Sorry for the noob questions, Thanks for reading and for assisting! |

|

|

Jul 21 2017, 03:12 PM Jul 21 2017, 03:12 PM

|

Senior Member

896 posts Joined: May 2007 |

QUOTE(evilhomura89 @ Jul 17 2017, 07:43 PM) I think a lot of forwarders refuse to use airmail due to the high risk of stuff getting missing Thanks sifu At least with reputable service like FedEx/DHL, their asses are well-covered in case of any theft or lost parcel Generally when someone ships from the US internationally via USPS, that's the normal airmail service. For normal airmail service, all parcels will be handled by Pos Malaysia when they arrive in Malaysia. The tracking numbers can usually be tracked on Pos Malaysia usual tracking webpage - http://poslaju.com.my/track-trace-v2/ Below are my experience buying from different countries: 1. Japan (Zenmarket) - i always request for SAL shipment (aka Economy Airmail, max limit of 2kg per parcel) and they allow you to change the declaration value. Handling is the same as the normal airmail service. 2. China (Yeslogistic) - China to Malaysia by air, not sure how. You can choose either Skynet, ABX or Airpak to deliver it to your house. Shipment from China have ways of coming into Malaysia. You can import batteries, electronics, phones, liquid, powder etc without worrying about stuff getting stuck in custom if you use their "sensitive shipping option". I've always declared my items below 100 USD to avoid problems. Bulky item such as furniture, bicycles can be imported too via sea route. 3. Germany (eBay seller used "DHL") - this DHL is different from the usual DHL express. DHL is their national post agency aka Deutsche Post. Handling is the same as the normal airmail service. 4. Ukraine (eBay seller used Ukrposhta) - Handling is the same as the normal airmail service but my package was opened by kastam. It was a used vintage lens but since it was from Ukraine, they probably had to check it to make sure it's not something dangerous save it to my note for future reference appreciate it |

|

|

Jul 24 2017, 09:52 AM Jul 24 2017, 09:52 AM

Show posts by this member only | IPv6 | Post

#1255

|

Junior Member

148 posts Joined: May 2005 |

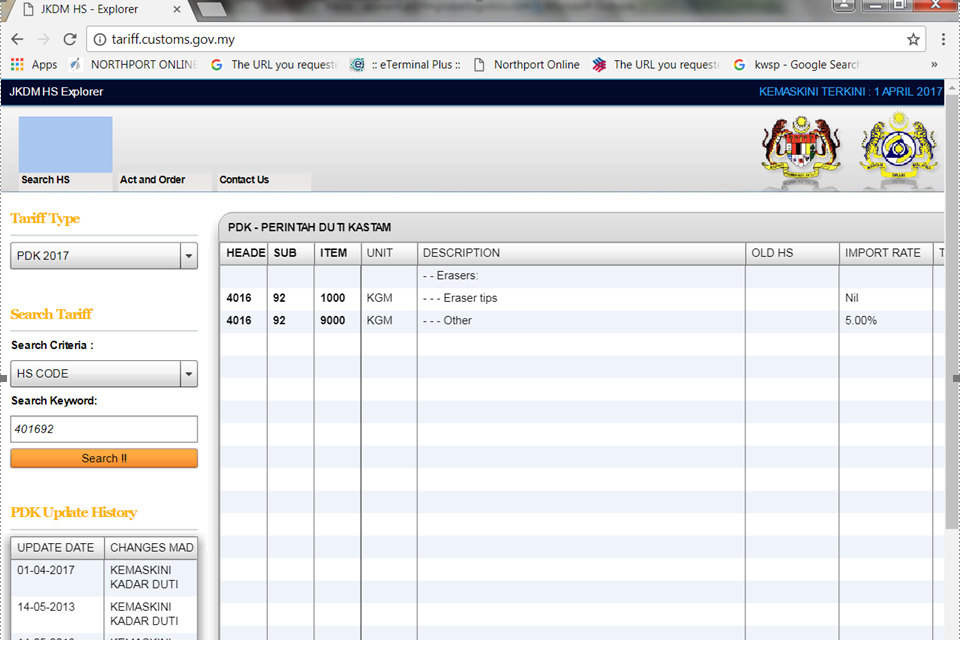

Hi to all sifus here, possible to shed some light on this matter?

We are shipping eraser by sea from Taiwan. Usually the items declared under tariff code 4016921000, which is 0% import duty, it has been in this way for many years. However now the port handler company informed us that item now has to declared under tariff code 4016929000 which has duty 5%. They said is new policy implemented by custom on April-May this year.  tariff code 4016921000 description is eraser whereas 4016929000 is under other, i doesn't sound convincing at all. Any advise on how to work this around? This post has been edited by totox7: Jul 24 2017, 09:53 AM |

|

|

Jul 25 2017, 12:46 PM Jul 25 2017, 12:46 PM

|

Senior Member

1,031 posts Joined: Jan 2010 |

Bringing electronic toys from sg to malaysia by flight

Anyone know how much the taxes? Quantity 20 F |

|

|

Jul 27 2017, 01:11 PM Jul 27 2017, 01:11 PM

|

Junior Member

106 posts Joined: Dec 2008 |

Hello, I was thinking to purchase a woman leather bag from Farfetch, anyone know roughly how much is the tax? Thanks.

This post has been edited by neverland: Mar 14 2019, 07:43 PM |

|

|

Aug 5 2017, 07:08 AM Aug 5 2017, 07:08 AM

|

Newbie

0 posts Joined: Sep 2016 |

Hi, need your kind help. I'm planning in buying an obutto gaming chair and table from Singapore. There are 2 scenario:

1. Buy new, have them shipped via TNT. Item cost 780 SGD + 130 SGD shipping. 2. Buy second hand, cost 700 SGD. Not in box and look used. I pick up my self using my car. Please advise the cost for each scenario. Your kind help will be much appreciated. |

|

|

Aug 14 2017, 11:32 AM Aug 14 2017, 11:32 AM

|

Senior Member

3,688 posts Joined: Jun 2008 From: P6Punk |

hi need guidance from all sifu here,

i bought a notebook from SG cost 2.1k and now the item is withheld at kastam.i received a call from POS laju that i need to go to collect myself,my question is how much tax would i be liable to pay after i open the package infront of them? Thanks in Advance |

|

|

Aug 28 2017, 02:51 PM Aug 28 2017, 02:51 PM

|

Junior Member

124 posts Joined: Mar 2015 |

Question, if I put the correct HS codes on something I bought from the US, can the customs officer still be cheeky and try to charge me for import duty? Can I argue with them if according to that HS code, import duty is NIL and only subjected to GST? What are the odds of me winning the said argument?

|

| Change to: |  0.0370sec 0.0370sec

0.63 0.63

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 11:42 AM |