QUOTE(Boon3 @ Nov 4 2021, 06:41 PM)

Considered old news ya since that was Sep article.

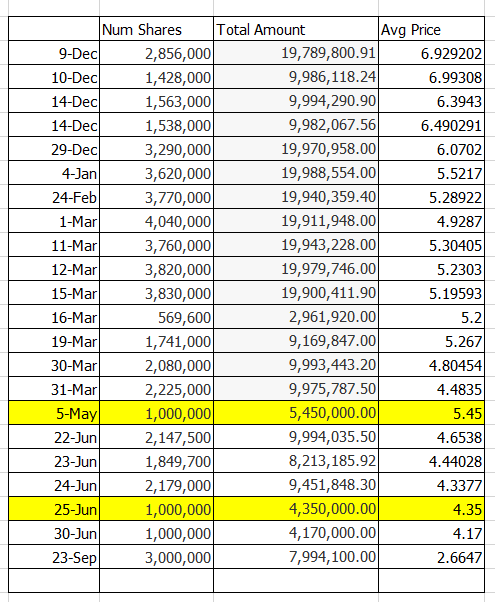

He's not a good indicator as his own purchases of Top Glove shares is sitting on paper losses of close to 150 million.

Ya. That bad.

And he's another perfect example on why one should think twice about following a ceo own share purchases. Many a times, these ceo thinks they are smarter than the market... sadly many times they also lose big time.

And in regards to share buybacks.. I am not an accountant but I dont recall any company ever marking their share buybacks to market prices. Hence, they cannot claim such losses. ( pls feel free to correct me on this point)

Don’t forget the taxes write off which is the key He's not a good indicator as his own purchases of Top Glove shares is sitting on paper losses of close to 150 million.

Ya. That bad.

And he's another perfect example on why one should think twice about following a ceo own share purchases. Many a times, these ceo thinks they are smarter than the market... sadly many times they also lose big time.

And in regards to share buybacks.. I am not an accountant but I dont recall any company ever marking their share buybacks to market prices. Hence, they cannot claim such losses. ( pls feel free to correct me on this point)

QUOTE(koja6049 @ Nov 4 2021, 08:15 PM)

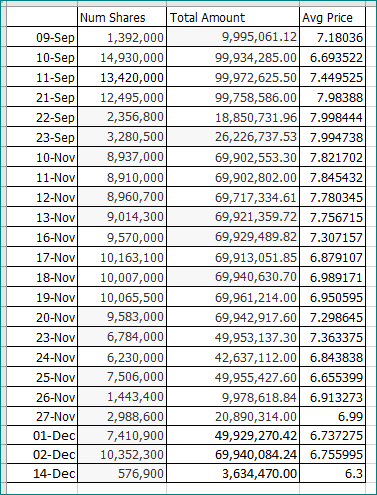

this is just my speculation, but the stock buybacks have nothing to do with good financials, rather it is a political compromise.

Remember the time when EPF needed to raise alot of funds to implement the i-sinar ilestari etc programmes. The stock buybacks coincides with EPF heavily disposing those shares

https://www.klsescreener.com/v2/news/view/7...ntinues-selling

that's why i have said that the motivations from the company standpoint and the trader standpoint is very different. But as a value investor, you need to look closely at the fundamentals in the long term, and not the short term political maneuvering. So the question is, is RM2.49 reflective of topglove's fundamentals?

Remember the time when EPF needed to raise alot of funds to implement the i-sinar ilestari etc programmes. The stock buybacks coincides with EPF heavily disposing those shares

https://www.klsescreener.com/v2/news/view/7...ntinues-selling

that's why i have said that the motivations from the company standpoint and the trader standpoint is very different. But as a value investor, you need to look closely at the fundamentals in the long term, and not the short term political maneuvering. So the question is, is RM2.49 reflective of topglove's fundamentals?

QUOTE(Boon3 @ Nov 4 2021, 08:20 PM)

QUOTE(koja6049 @ Nov 4 2021, 08:21 PM)

Most of the buybacks are political play when EPF will lend their shares to IB to short hence TG got trapped into buy back which LWC is silly instead The only way is to consolidate the shares instead of buy back which makes it worse because most have already disposed big time while retail got trapped big time

Nov 4 2021, 08:43 PM

Nov 4 2021, 08:43 PM

Quote

Quote

0.0171sec

0.0171sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled