Outline ·

[ Standard ] ·

Linear+

Forex Trading Corver V3, How's Your Pips Lately? ^_^

|

billytong

|

Aug 8 2008, 01:21 PM Aug 8 2008, 01:21 PM

|

|

Fundamental are important, Fundamentals + Political event is VERY important. These 2 combine can be very powerful but technical is also one of the factor to decide whether u buy or sell. As the Yen pairs all moving down except UJ, if u guys check the Stock market chart for Nikkie, Hang Seng etc. seems all the Asian market move down very sharp this morning. The recent Strength of USD vs the world is very unreal, given there more banks and companies going bankrupt in USA more job losses. If any of u buying USD becareful lah.  This post has been edited by billytong: Aug 8 2008, 01:23 PM This post has been edited by billytong: Aug 8 2008, 01:23 PM |

|

|

|

|

|

billytong

|

Aug 12 2008, 03:11 PM Aug 12 2008, 03:11 PM

|

|

Guys stop now if u are longing euro .

I have been shorting the EU in and out scalping with big lot. There is no way I will long euro. Every time I short I got my money in. Seems it is encouraging me to short more.

|

|

|

|

|

|

billytong

|

Aug 12 2008, 04:08 PM Aug 12 2008, 04:08 PM

|

|

QUOTE(AdamG1981 @ Aug 12 2008, 03:34 PM) Might be a bigger retracement for the euro if the retail sales in the US is not convincing. I would be calling the retail sales to be -ve USD. but the tradeblance tonight would be helping USD. so on the nut case all the time there has been near to zero buying power for euro. The bear seems to be much larger than the bulls now. CPI of euro must be print equal or better to stop euro from sliding. Any colder print will make euro slides. As for the ECB rates. I would say ECB would hold again for the next meeting. Moving back to 4.0% will mean they are admitting their mistake for the previous rate hike. A rate cut will happen but not at this close to the last rate hike. Politician dont like to admit their mistake. 4.25% will probably for their "saving face". |

|

|

|

|

|

billytong

|

Aug 12 2008, 05:23 PM Aug 12 2008, 05:23 PM

|

|

I have something I wanna tell, for the pass 2-3days Europe open has been bullish to euro and later on US and Asian kill all the bull gains. Check the chart and see urself.  This post has been edited by billytong: Aug 12 2008, 05:27 PM This post has been edited by billytong: Aug 12 2008, 05:27 PM |

|

|

|

|

|

billytong

|

Aug 12 2008, 06:11 PM Aug 12 2008, 06:11 PM

|

|

the Frankfurt and London open push the euro up... then the NY and Asian session push the euro down. this has been true since beginning of this week check shorter time frame like 15-30min candle.

This post has been edited by billytong: Aug 12 2008, 06:11 PM

|

|

|

|

|

|

billytong

|

Aug 12 2008, 06:41 PM Aug 12 2008, 06:41 PM

|

|

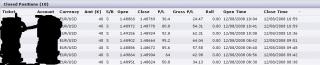

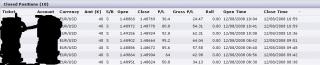

it doesnt need to be that high to confirm the mini or micro bull, a little bit of sign can pull a plug and short the rises and scalp the heck of it. Check again the time after 2pm our time. for Monday and today. There is some pull up of euro I has been saying. here is how I grab all these mini bull and short on top of those. again I hate posting edited picture, there are other better things to do than playing with paint bush.  EDIT; forgot to mention the time in my trade station is GMT+0 London time. So it is about 3-6pm time. This post has been edited by billytong: Aug 12 2008, 06:53 PM Attached thumbnail(s)

|

|

|

|

|

|

billytong

|

Aug 13 2008, 06:06 PM Aug 13 2008, 06:06 PM

|

|

I think the Retail sales which is use to be USD supportive will print lower than expected and that will send some market shock. However due to low amount of euro buyers. It will not be surprise if we see another "A" shape spike again.

|

|

|

|

|

|

billytong

|

Aug 13 2008, 06:31 PM Aug 13 2008, 06:31 PM

|

|

As far as I like hugging the dollar now, but at this rapid Appreciation is very unwelcome. IMO USA is not out of wood yet, with more banks bailing out I cant see any reason to Call a total dollar bull yet. Everytime I short scalping EU this low this thing come into my mind, it gets more nervous to hold shorts at this low.

This post has been edited by billytong: Aug 13 2008, 06:32 PM

|

|

|

|

|

|

billytong

|

Aug 13 2008, 07:15 PM Aug 13 2008, 07:15 PM

|

|

QUOTE(AdamG1981 @ Aug 13 2008, 06:35 PM) If i am to do a trade today, i probably will short the euro. Not b4 I want to see the Retail sales first. Infact I am relying retail sales to pull me a couple of good shorts.  |

|

|

|

|

|

billytong

|

Aug 13 2008, 08:42 PM Aug 13 2008, 08:42 PM

|

|

As widely expected the retail sales is red and yet the market has not given up the dollar, hence I am shorting EU @ 4925.

I think the Crude inventories will send the Crude down further and hence that is USD+

|

|

|

|

|

|

billytong

|

Aug 13 2008, 09:15 PM Aug 13 2008, 09:15 PM

|

|

TP on shorts 4925 @ 4900  Easy RM500+ |

|

|

|

|

|

billytong

|

Aug 14 2008, 09:17 AM Aug 14 2008, 09:17 AM

|

|

Yes I am basically getting more nervous shorting the euro now. We have a 1200pips drop without retracement. Anything can happen here.

|

|

|

|

|

|

billytong

|

Aug 14 2008, 01:54 PM Aug 14 2008, 01:54 PM

|

|

It is the same as having 1k playing 10USD margin. % is what matters u.

|

|

|

|

|

|

billytong

|

Aug 14 2008, 07:00 PM Aug 14 2008, 07:00 PM

|

|

Probably got burned and quit forex I think.  |

|

|

|

|

|

billytong

|

Aug 17 2008, 10:09 AM Aug 17 2008, 10:09 AM

|

|

In my oppinion all the MAs are very LAG and slow. It often only show the signal after the trend is happened. not on real time.

I having hard time trying to relate MA with the trend of a currency. It seems they dont work that well. So to speak I dont use MA or other indicators. I still think the simplest thing to identify a trend is to read the fundamental change, See the candlestick opening. Candle stick may be old but they are very realtime and quite accurate. Look the opening and closing of each bars, higher or lower. Take ur chart, zoom in/out in diff time frame and judge urself. How much the currency has dropped and what is the price pattern etc. A simple system give u the easiest and clearest identification of a trend or a signal. A complex system only make u confuse and go the wrong direction.

As for Fundamentals, just keep buying USD with cautions, we are down a few hundred to thousand pips without a strong retracement. As of cause the world economy may be in slow down but there are also limited reason to see USD going major bullish. With more and more USA banks reporting bigger and bigger loss. I actually got a little bit hand shake when I long USD. But seeing how the market keep buying USD and selling other currencies I guess I have to just follow the trend with cautions.

I will be keep selling EU with caution. I keep geting money with shorts than long. If u keep getting money from one side, stay that direction until ur SL keep getting hit a few times then u stop and see what happen then go the opposite direction for a try out.

This post has been edited by billytong: Aug 17 2008, 10:10 AM

|

|

|

|

|

|

billytong

|

Aug 18 2008, 09:23 AM Aug 18 2008, 09:23 AM

|

|

QUOTE(AdamG1981 @ Aug 17 2008, 11:29 PM) Fundamental wise, EU is also bearish. We have euro trade zone trade balance, which i think its going to be less thn 1.2 Billion. Both German and France exports have slowed tremendously due to a stronger euro. More and more likely Trichet is going to admit he will reduce IR soon. The ZEW from German will probably gonna further hurt the euro. This data will be one of the key important data that will send euro down. As for the Trichet, I am gonna say he will try to talk good about euro. He want to depreciation of euro to be slow down. Remember he said price stability & inflation is his main concern? I strongly believe even with the oil going downwards at the pace of euro depreciate it is very unwelcome to Trichet. Strong euro is one of the key that Trichet want to keep the Europe inflation low. At this rate of depreciation it is working against Price stability + inflation. In my opinion, the only thing that could save euro from Sliding more will be the housing data from USA. I would say it will print out further weakness. As for commodities, as long as all commodities keep selling off the USD will keep strengthen. |

|

|

|

|

|

billytong

|

Aug 18 2008, 09:29 AM Aug 18 2008, 09:29 AM

|

|

QUOTE(AdamG1981 @ Aug 18 2008, 09:26 AM) Billy, Yes, he's probably going to come out with a strong comment hinting that he won't let the euro slide this drastic. We will see how credible this ECB is.  Yeah, all those hot, speculative money going back to USD.  Well it is up to the market want to believe his word or not. The market may or may not listen to what he say.  |

|

|

|

|

|

billytong

|

Aug 19 2008, 10:52 AM Aug 19 2008, 10:52 AM

|

|

I am sticking with my plan... Short EU on the rise. the ZEW gonna kill EU.

|

|

|

|

|

|

billytong

|

Aug 19 2008, 01:43 PM Aug 19 2008, 01:43 PM

|

|

About RM9K, i was profit about 15K(this profit is not consider profit I guess is pure luck) then I went mad go over leverage long EU madly @ 1.35 thinking to get another 15K then bang EU go down 1.32 and I close for a loss there RM9K.....then it go up without me.  I think that is the biggest loss I have. B4 that i am playing very small keep on taking loss consistently like RM10-RM200. Right now I gonna TP b4 the housing data. Lets see the housing gonna kill some USD gain and let me reshort again.

Added on August 19, 2008, 1:45 pmI guess the only risk of shorting EU now is having a big big bad housing data and one of the major USA bank collapse. Like end of the world in USA to send euro back up above 1.5  This post has been edited by billytong: Aug 19 2008, 01:45 PM This post has been edited by billytong: Aug 19 2008, 01:45 PM |

|

|

|

|

|

billytong

|

Aug 19 2008, 02:01 PM Aug 19 2008, 02:01 PM

|

|

QUOTE(AdamG1981 @ Aug 19 2008, 01:54 PM) Billy, there are signs the housing market is starting to pick up in the US; and there are critical signs that housing is starting to collapse in France, UK, Australia. I still do think that the EURO will fall below 1.46 tonight after the German ZEW survey and US PPI for july. Well I am not rulling that chance out. But I still think housing in USA will print lower but whether or not it will print lower than expected or less than expected is another story. When the news come out Green u probably got some spike up of EU and there is where u pick ur short in.  |

|

|

|

|

Aug 8 2008, 01:21 PM

Aug 8 2008, 01:21 PM

Quote

Quote

0.0459sec

0.0459sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled