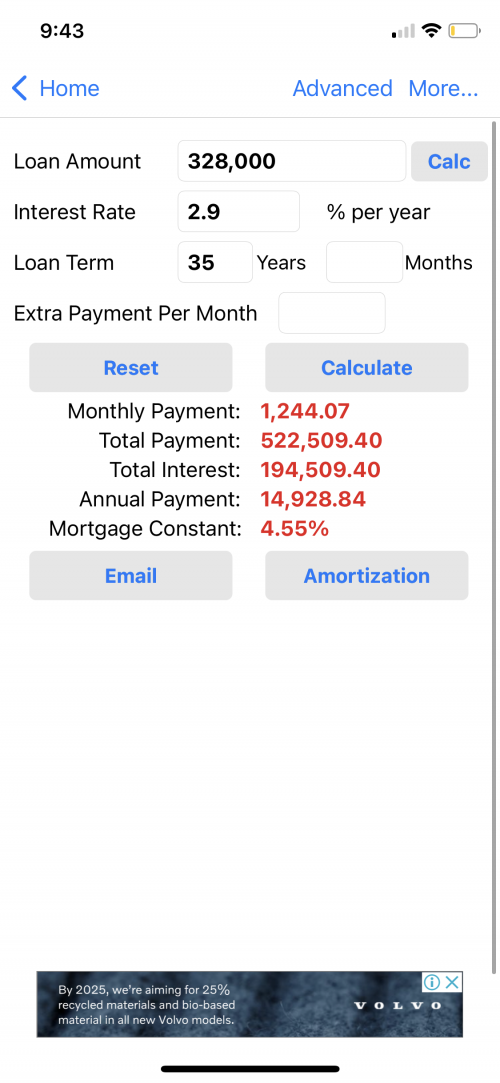

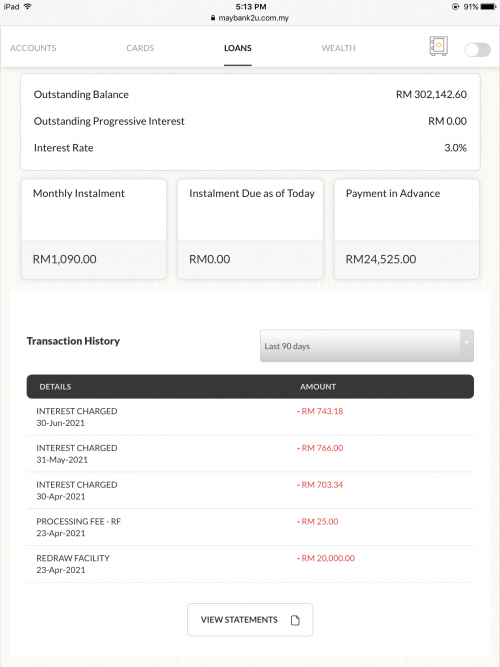

I'm thinking of reducing my Maybank mortgage payment (personal use property). Right now I'm paying via ESI (standing instruction) that will deduct a pre-determined amount from my account every 1st day of the month.

I can also pay more by using the 'Online Bill Payment > Maybank Loan / Hire Purchase'.

Now, I'm assuming that if I transferred money through this method, it will end up at the 'Payment In Advance' balance in my loan account. How do I pay so that it will reduce the principal amount of the loan instead of waiting to be deducted at the end of the month? I'm planning to pay more these days to reduce the interest amount.

If Maybank doesnt allow me to reduce principal balance automatically (e.g I have to write formal letter etc.. zzzzZZzz), am planning to refinance the property with another bank after my locked-in period in 2 year's time. What should I look for when shopping for my next home loan? Maybe I should consider a flexi-loan? Whats the average % of interest difference between flexi-loan an a non-flexi one?

Thanks

Jun 14 2008, 08:10 PM, updated 5y ago

Jun 14 2008, 08:10 PM, updated 5y ago Quote

Quote

0.0533sec

0.0533sec

0.94

0.94

6 queries

6 queries

GZIP Disabled

GZIP Disabled