When the bull breaks it's back on S&P500/KLCI + glove shenanigans blow over, MB with a relatively low beta is gonna plummet alongside with the market

I reckon when q2 comes out p/e <10, p/b may or may not break 1

MayBank shareholder Group

MayBank shareholder Group

|

|

Jul 23 2020, 04:42 PM Jul 23 2020, 04:42 PM

Return to original view | Post

#1

|

Junior Member

43 posts Joined: Dec 2019 |

When the bull breaks it's back on S&P500/KLCI + glove shenanigans blow over, MB with a relatively low beta is gonna plummet alongside with the market

I reckon when q2 comes out p/e <10, p/b may or may not break 1 |

|

|

|

|

|

Jul 23 2020, 04:44 PM Jul 23 2020, 04:44 PM

Return to original view | Post

#2

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

Jul 24 2020, 10:00 AM Jul 24 2020, 10:00 AM

Return to original view | Post

#3

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(AthrunIJ @ Jul 23 2020, 07:30 PM) Correcto mundo, what I mean by that is that when the market (KLCI/SP500) plummets, MB will plummet alongside, because it has a relatively low beta which indicates that it correlates with the market movements very much.  At this point, it's only systematic risk that can bring down MB back to my buy targets, MB has too little idiosyncratic risks. PS: Does anyone know how to get rid of the probation status? It's incredibly annoying having to restraint myself to only 3 posts a day. Is there any admin I can contact regarding this? |

|

|

Jul 24 2020, 05:13 PM Jul 24 2020, 05:13 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(AthrunIJ @ Jul 24 2020, 12:10 PM) By relatively low I mean a beta figure of around ~0.8-1, when the market crashes again, MB will inevitably crash alongside, however, the magnitude of the crash may be slightly less. I think you're confused because you thought a low beta meant that it carried extremely low volatility. It's low, but not THAT low. |

|

|

Jul 24 2020, 05:16 PM Jul 24 2020, 05:16 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(langstrasse @ Jul 24 2020, 10:42 AM) That’s what I thought too, but not too sure now - IMHO MBB is more a long term investment and not really a “speculative” stock. So my guess is if the market tanks this will probably be among the last in a person’s portfolio to get sold off. Fair, but you're assuming the perspective of one who manages their own common stock selections in their portfolio. The layman who carries index funds/ ETFs would bail when they see the market crash, alongside all the selections in it, including MB. It would fall, yes, as vindicated by foregoing examples forged in March, but not too much. langstrasse liked this post

|

|

|

Jul 25 2020, 08:23 AM Jul 25 2020, 08:23 AM

Return to original view | Post

#6

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

|

|

|

Jul 30 2020, 01:01 PM Jul 30 2020, 01:01 PM

Return to original view | Post

#7

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

Jul 30 2020, 05:08 PM Jul 30 2020, 05:08 PM

Return to original view | Post

#8

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

Aug 8 2020, 07:49 PM Aug 8 2020, 07:49 PM

Return to original view | Post

#9

|

Junior Member

43 posts Joined: Dec 2019 |

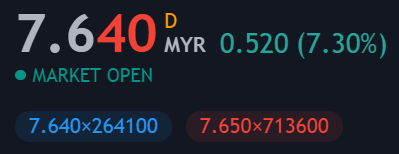

Wa, I take my eyes off for a few days MB still hovering @ 7.5 due to the entire Singaporean bank dividend shenanigan? Or is it because of upcoming q2 fear? It's now 9.96 PE and 1.08 PB tho

|

|

|

Aug 8 2020, 09:45 PM Aug 8 2020, 09:45 PM

Return to original view | Post

#10

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(HumbleBF @ Aug 8 2020, 09:24 PM) Just bad sentiment for all banking sectors I guess. Loan moratorium etc. LOL you still bull enough to goreng other counters ah? I pulled out big time already as I'm getting more and more bearish lolI think will continue drop further next week...else, if it back up 7.9 I'm thinking to get back some capital from here so can goreng other counters more 😂 |

|

|

Aug 12 2020, 03:37 PM Aug 12 2020, 03:37 PM

Return to original view | Post

#11

|

Junior Member

43 posts Joined: Dec 2019 |

Holy shit what happened today? Why suddenly straight fly to 7.700? People buying MBB because ASB buy MBB also or people selling gloves to buy MBB?

|

|

|

Aug 17 2020, 02:56 PM Aug 17 2020, 02:56 PM

Return to original view | Post

#12

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

Sep 1 2020, 05:18 PM Sep 1 2020, 05:18 PM

Return to original view | Post

#13

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

|

|

|

Sep 5 2020, 10:16 AM Sep 5 2020, 10:16 AM

Return to original view | Post

#14

|

Junior Member

43 posts Joined: Dec 2019 |

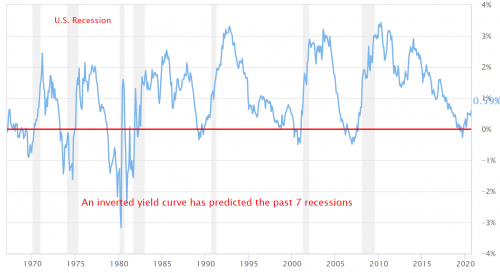

QUOTE(alworks @ Sep 3 2020, 07:45 AM) means likely will have another round of discount? the chart can tell roughly when the bubble will burst? thanks sifu got enlighten... The only factor that will discount MBB's price futher is only systematic risk, since r-rf=a+b(r-rf)+e according to single index model, alpha and standard error already priced in after the dividend cut, futher opr cut won't affect the price significantly as we've seen previously. Only a global recession will break the bull's back.I'm confident the market will crash eventually. Here are my justifications  CAPE/Shiller's PE is @ 32. Only two times in history has cape ever exceed 32, and that was the dotcom crash and the great depression.  A cap to GDP ratio of 1.6 means we are vastly overpaying 1.6 dollars for 1 dollars of product. This should be enough of a justification alone.  Back in 2018 there was a panic because Trump was just elected as president, there was a brief period of inverted yield curve but the recession didn't happen, so I'm confident a much more dire depression is due to happen. 3 alone should be enough elaboration on why I'm extremely bearish right now. Oh and, the chart is mostly fundemental indicators, telling you the CURRENT state of the company, it can't predict the future. Technical indicator such as MACD 12 26, RSI, MFI may be able to tell the very short term movement of the common price, but that's about it. |

|

|

Sep 5 2020, 10:38 AM Sep 5 2020, 10:38 AM

Return to original view | Post

#15

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(machonacho @ Sep 5 2020, 10:16 AM) The only factor that will discount MBB's price futher is only systematic risk, since r-rf=a+b(r-rf)+e according to single index model, alpha and standard error already priced in after the dividend cut, futher opr cut won't affect the price significantly as we've seen previously. Only a global recession will break the bull's back. Also, not to mention the recent upward price spread momentum of SPY warrants shows the similar bearish perspective of other investors.I'm confident the market will crash eventually. Here are my justifications  CAPE/Shiller's PE is @ 32. Only two times in history has cape ever exceed 32, and that was the dotcom crash and the great depression.  A cap to GDP ratio of 1.6 means we are vastly overpaying 1.6 dollars for 1 dollars of product. This should be enough of a justification alone.  Back in 2018 there was a panic because Trump was just elected as president, there was a brief period of inverted yield curve but the recession didn't happen, so I'm confident a much more dire depression is due to happen. 3 alone should be enough elaboration on why I'm extremely bearish right now. Oh and, the chart is mostly fundemental indicators, telling you the CURRENT state of the company, it can't predict the future. Technical indicator such as MACD 12 26, RSI, MFI may be able to tell the very short term movement of the common price, but that's about it.  |

|

|

Sep 9 2020, 02:12 PM Sep 9 2020, 02:12 PM

Return to original view | Post

#16

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(alworks @ Sep 7 2020, 08:32 AM) I'm not advising you on anything, this is just my take on the matter. A good guru teaches you how to buy, a bad guru teaches you which to buy, but I'm neither. A crash may or may not happen, but when it does, I'll be vindicated and laughing on the sideline.Shorting wouldn't be a great idea in my opinion, while I do believe a crash will eventually happen, ASB is acting as a resistance factor. While the market will go down eventually, you might not be able to remain solvent for that long. "The markets can remain irrational longer than you can remain solvent." - Keynes. |

|

|

Sep 9 2020, 02:19 PM Sep 9 2020, 02:19 PM

Return to original view | Post

#17

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

Nov 10 2020, 03:44 PM Nov 10 2020, 03:44 PM

Return to original view | Post

#18

|

Junior Member

43 posts Joined: Dec 2019 |

A single glance at the screener shows that gloves are losing steam, my guess would be institutions cashing out on gloves and going back to more durable stocks as all the trading was done after hours on monday and early hours of today. Beta shows a spike from 0.85 to 1.11 (rn) which means that it's not KLCI being bought as a whole.

With the second wave of lockdown, could mean that things are gonna get a whole lot more worst and institutions are bracing themselves. Or it might mean that Maybank is bringing back dividends for q4 and we just haven't gotten the news yet.  Things are starting to stagnant a little bit, see tomorrow if the train's still going |

|

|

Nov 10 2020, 04:02 PM Nov 10 2020, 04:02 PM

Return to original view | Post

#19

|

Junior Member

43 posts Joined: Dec 2019 |

|

|

|

Nov 10 2020, 04:26 PM Nov 10 2020, 04:26 PM

Return to original view | Post

#20

|

Junior Member

43 posts Joined: Dec 2019 |

QUOTE(alworks @ Nov 10 2020, 04:17 PM) Bro, i m not good at warrant.....mind to explain further? Is it u mean today's sudden shooting rocket of banks are just temporary? thanks in advance. No la still cant say for certain, price still ties in with random walk theory, but what I can tell you is that some people are expecting the price to reach at least 8.08 (KEYWORD EXPECTING MAY OR MAY NOT COME TRUE JUST LIKE LAST TIME TOPLGLOVE C91 sky high exercise people still join in the fun)As for explaining warrants ahhh |

| Change to: |  0.1127sec 0.1127sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 03:15 AM |