Outline ·

[ Standard ] ·

Linear+

ASB loan, worth to get it???

|

Porie

|

Nov 21 2017, 06:20 PM Nov 21 2017, 06:20 PM

|

|

I want to ask all sifus when is the best time to terminate/apply asb loan?

Should I just wait next year when government announce year dividend? Or just straight away go with it?

I have 30k loan right now with maybank @ 5%, planning to go higher and choose other banks with better rates.

|

|

|

|

|

|

Porie

|

Dec 16 2017, 10:31 AM Dec 16 2017, 10:31 AM

|

|

QUOTE(CSS @ Dec 14 2017, 10:38 PM) This is a no brainer and the lamest form of investment. All Bumiputras should sign up for max loan and continue to enjoy free money from the government. Yes bro but some people still dont want to do it due to religious reasons. |

|

|

|

|

|

Porie

|

Dec 21 2017, 02:09 PM Dec 21 2017, 02:09 PM

|

|

Hi guys,

Just want to ask you guys a quesiton.

If lets say I already have around 50k in my ASB account, am I still eligible for the 200k ASB loan? Thanks

|

|

|

|

|

|

Porie

|

Dec 22 2017, 12:32 PM Dec 22 2017, 12:32 PM

|

|

QUOTE(POYOZER @ Dec 22 2017, 09:58 AM) Better take takaful for protection. Is there any benefit in taking takaful if you’re planning to cancel and refinance the loan? Sorry newbie question |

|

|

|

|

|

Porie

|

Dec 23 2017, 09:12 AM Dec 23 2017, 09:12 AM

|

|

QUOTE(haziqnet @ Dec 23 2017, 08:52 AM) No benefit. Instead your profit will be less. If u want to commit the loan only in short period of time dun apply with takaful. Long term ok but still not recommend to do so. Apply takaful with 3rd party is the best choice more benefits. Thanks for the reply. |

|

|

|

|

|

Porie

|

Mar 28 2019, 12:02 PM Mar 28 2019, 12:02 PM

|

|

6% still considered okay i guess.

|

|

|

|

|

|

Porie

|

Apr 1 2019, 12:18 PM Apr 1 2019, 12:18 PM

|

|

ASB2 bila boleh keluarkan? Nak buat rolling ni.

|

|

|

|

|

|

Porie

|

Apr 22 2019, 10:42 AM Apr 22 2019, 10:42 AM

|

|

QUOTE(wild_card_my @ Apr 21 2019, 04:40 PM) That is the softcap i was talking about. It is calculated as the total accumulated distributions (mistakenly referred to as dividend) that you have received since the inception of your account Yes you can invest that figure into your ASB as cash I really didn't know about this "unit boleh beli" until I download the app. Guess I can invest few more thousands on my ASB1. Thanks! |

|

|

|

|

|

Porie

|

Jul 11 2019, 02:31 PM Jul 11 2019, 02:31 PM

|

|

QUOTE(eviee729 @ Jul 9 2019, 08:19 PM) after getting the ASB financing, will it difficult to apply any other loans? Some bank consider ASB dividends as part of your variable income |

|

|

|

|

|

Porie

|

Oct 15 2019, 11:40 PM Oct 15 2019, 11:40 PM

|

|

QUOTE(sunshines71 @ Oct 15 2019, 10:56 PM) Anyone knows when ASB2 financing will be opened again?  Not in near future, asb1 quota also almost out |

|

|

|

|

|

Porie

|

Oct 16 2019, 09:23 AM Oct 16 2019, 09:23 AM

|

|

QUOTE(Davez89 @ Oct 16 2019, 02:53 AM) where to check the asb1 quota ya? I asked cimb officer 2 months back when I wanted to refinance. He said asb1 quota also almost out. |

|

|

|

|

|

Porie

|

Oct 19 2019, 10:27 AM Oct 19 2019, 10:27 AM

|

|

QUOTE(buggie @ Oct 18 2019, 07:14 PM) By the way... 2.5 months to dividend! Anyone stoked yet? I suspect the dividend to be really low this year.. as other funds are doing really poorly too. |

|

|

|

|

|

Porie

|

Oct 24 2019, 10:37 PM Oct 24 2019, 10:37 PM

|

|

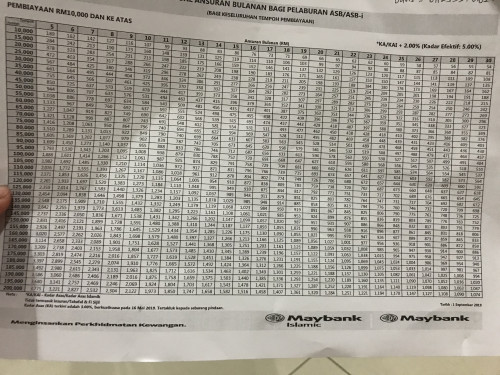

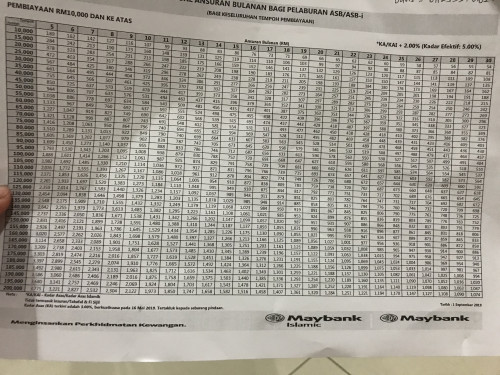

QUOTE(SGLT2 @ Oct 24 2019, 08:35 PM) May i know if plan to apply asbf with tiger bank, the rate is 5.0 or how ya? Don’t understand this part ka/kai+2% (kadar efektif 5:0%)  Bank may change the KA (kadar asas) or KAi (kadar asas islamic) anytime, even during tenure. The 2% or "spread" is fixed. Right now the KA is 3%, so 3%+2% = 5% If somehow, the bank changes the KA to 7% for example, then your total interest will be 7%+2% = 9% |

|

|

|

|

|

Porie

|

Oct 30 2019, 05:07 PM Oct 30 2019, 05:07 PM

|

|

QUOTE(bobsj @ Oct 30 2019, 03:36 PM) Anyone on here who can do ASB2 financing? What are the rates like? For context, I've got quite a substantial sum already in my ASB2 account. However, I would like to release the funds for a separate investment. Any help would be much appreciated. asb2 financing already out of quota |

|

|

|

|

|

Porie

|

Oct 30 2019, 05:50 PM Oct 30 2019, 05:50 PM

|

|

QUOTE(bobsj @ Oct 30 2019, 05:19 PM) Thanks. When does it open again? Not in the near future... |

|

|

|

|

|

Porie

|

Dec 18 2019, 03:05 PM Dec 18 2019, 03:05 PM

|

|

Is this the lowest so far?

|

|

|

|

|

|

Porie

|

Dec 18 2019, 04:08 PM Dec 18 2019, 04:08 PM

|

|

QUOTE(valve @ Dec 18 2019, 03:17 PM) For newly subscribed (start Feb 2019), how is it impacted ? Dividend starts from March 2019 onwards |

|

|

|

|

|

Porie

|

Dec 23 2019, 10:15 AM Dec 23 2019, 10:15 AM

|

|

QUOTE(cucikaki @ Dec 22 2019, 11:02 PM) Hi. In order to get the dividend for that month, must put the money in asb by 31 or 1 of the month. Let’s say i deposited RM2k on 1 November 2019, will i get dividend on that RM2k in November? Dividend depends on the lowest amount of the month. So it's better if you put few days before the month starts. |

|

|

|

|

|

Porie

|

Dec 30 2019, 10:27 AM Dec 30 2019, 10:27 AM

|

|

QUOTE(silkysilk @ Dec 30 2019, 08:56 AM) when can withdraw asb next year 2 january |

|

|

|

|

|

Porie

|

Jan 1 2020, 10:09 AM Jan 1 2020, 10:09 AM

|

|

Special reinvestment is bonus right?

|

|

|

|

|

Nov 21 2017, 06:20 PM

Nov 21 2017, 06:20 PM

Quote

Quote

0.0364sec

0.0364sec

0.78

0.78

7 queries

7 queries

GZIP Disabled

GZIP Disabled