QUOTE(wild_card_my @ Jan 23 2020, 11:02 PM)

My cimb profit rate still at 5.1% checking just now at cimb click, will i expect lower amount soon?ASB loan, worth to get it???

ASB loan, worth to get it???

|

|

Jan 24 2020, 12:46 PM Jan 24 2020, 12:46 PM

Return to original view | IPv6 | Post

#41

|

Senior Member

1,566 posts Joined: Jun 2013 |

|

|

|

|

|

|

Jan 24 2020, 06:26 PM Jan 24 2020, 06:26 PM

Return to original view | IPv6 | Post

#42

|

Senior Member

1,566 posts Joined: Jun 2013 |

Just to update, just got back from cimb meeting up with the banker.

After several minutes conversation, she said my current 200k that currently at 5.1% can be reduced to 4.6%, fill up the form and need to wait for a month or so for it to be revised. So, i guess its a good result. |

|

|

Mar 25 2020, 06:33 PM Mar 25 2020, 06:33 PM

Return to original view | IPv6 | Post

#43

|

Senior Member

1,566 posts Joined: Jun 2013 |

My standing instruction will autopay my asbf this 28th march. So with this event, should i cancel the payment or just proceed for this month?

|

|

|

Mar 26 2020, 05:43 PM Mar 26 2020, 05:43 PM

Return to original view | Post

#44

|

Senior Member

1,566 posts Joined: Jun 2013 |

|

|

|

Apr 2 2020, 05:25 PM Apr 2 2020, 05:25 PM

Return to original view | IPv6 | Post

#45

|

Senior Member

1,566 posts Joined: Jun 2013 |

These days can withdraw money from agents banks? Or ASB offline in banks? I saw post office was offline today.

|

|

|

Apr 13 2020, 10:58 PM Apr 13 2020, 10:58 PM

Return to original view | IPv6 | Post

#46

|

Senior Member

1,566 posts Joined: Jun 2013 |

QUOTE(debonairs91 @ Apr 13 2020, 09:24 PM) no one is saying asb is bad. all im saying and it's true is that asbf is bad. take the full 5% dividend for yourself. dont share with bank. of course you would make profit with loan, but you will make much more profit if you dont take loan Penat la bro seeing your post here all over again. Congrats your post count increase tremendously afterall. |

|

|

|

|

|

Aug 18 2020, 06:50 PM Aug 18 2020, 06:50 PM

Return to original view | Post

#47

|

Senior Member

1,566 posts Joined: Jun 2013 |

QUOTE(haziqnet @ Aug 18 2020, 11:25 AM) hi everyone it have been a long time. Are we given options to pay accrued interest in one-off payment by our banks? i will opt that i think.regarding the moratorium, if u guys have difficulty to pay the financing than extend it. If not continue making payment. The longer your moratorium the more interest u will pay and this will effect your principal accumulation. However when u r not paying your loan (moratorium) that money actually is your principal. So if u understand that than no problem. Im afraid when u start continuing to pay your loan (after moratorium end), u guys will shock when seeing your principal become less already. (unless you can pay all the accrued interest in one-off payment) |

|

|

Aug 30 2020, 06:10 PM Aug 30 2020, 06:10 PM

Return to original view | Post

#48

|

Senior Member

1,566 posts Joined: Jun 2013 |

QUOTE(iamtheone2020 @ Aug 30 2020, 12:08 AM) 3.85 before the last opr reduction.. then i plan to cancel it and the next day they call and offer 3.55.. i say bsn offering 3.45 and they counter offer at that rate.. after a week i called my branch asking whats the current rate and they say revised to 3.45 my current cimb is at 3.85% so can i go the branch and ask for reduction and wait for counter offer from them?With them for the past 1 year |

|

|

Oct 1 2020, 03:50 PM Oct 1 2020, 03:50 PM

Return to original view | Post

#49

|

Senior Member

1,566 posts Joined: Jun 2013 |

so if mine deducted on every 28th, so i just have to standby only by 28th this month october right?

|

|

|

Dec 28 2020, 09:55 PM Dec 28 2020, 09:55 PM

Return to original view | IPv6 | Post

#50

|

Senior Member

1,566 posts Joined: Jun 2013 |

|

|

|

Jan 8 2021, 01:46 PM Jan 8 2021, 01:46 PM

Return to original view | IPv6 | Post

#51

|

Senior Member

1,566 posts Joined: Jun 2013 |

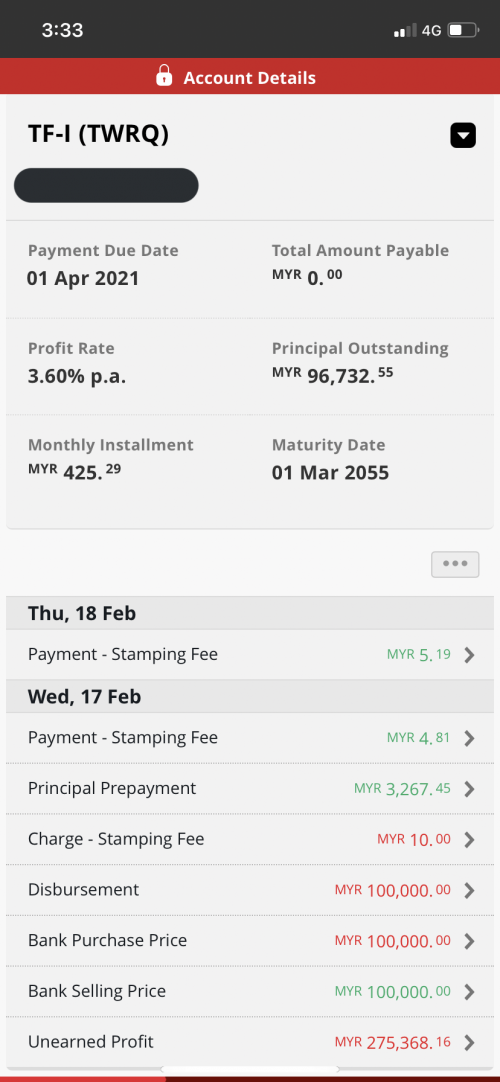

Just wanna update on my asbf refinance at cimb. Having 3 separate certs at 3.85% each, was offered only 3.60% the lowest as i’m not preferred client or payroll with cimb. Already at 5th year so lazy to change bank, but manage to lower at 3.60% with new tenure 33 years at max for my age. Was told for each certificate processing fee for RM10 only, so just proceed aje lah with sotong bank. With new rate, manage to save up to RM1020 annually compare to current rate. iamloco liked this post

|

|

|

Jan 10 2021, 11:11 PM Jan 10 2021, 11:11 PM

Return to original view | IPv6 | Post

#52

|

Senior Member

1,566 posts Joined: Jun 2013 |

QUOTE(royz @ Jan 10 2021, 08:35 AM) I was thinking of negotiating my asb2f with cimb since the rate is 3.85%. So I went to CIMB kota damansara branch and was told they can't lower it any further. Seeing your post makes me wonder whether they are just plain lazy or it differs between branches ie quota etc. Mind telling me which branch did you go to? As long your min loan is 50k no issue to refinance they must be just lazy to entertain. i went to CIMB The Curve branch, its not busy at all over there. |

|

|

Feb 21 2021, 07:06 PM Feb 21 2021, 07:06 PM

Return to original view | IPv6 | Post

#53

|

Senior Member

1,566 posts Joined: Jun 2013 |

Finally my asbf been revised to 3.6% and i check the statement came as above. Principle repayment and all are correct right? Been 4 years with cimb, i had 3 certs for 100k 50k and 50k. So for this month payment should i follow the new rate or still follow the older one? otaida00taj and eeeglow24 liked this post

|

|

|

Oct 6 2021, 08:54 PM Oct 6 2021, 08:54 PM

Return to original view | IPv6 | Post

#54

|

Senior Member

1,566 posts Joined: Jun 2013 |

|

| Change to: |  0.2102sec 0.2102sec

0.25 0.25

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 05:24 PM |