QUOTE(voncrane @ Aug 23 2018, 03:59 PM)

Dude.. One simple question..

Scenario A..

Mike currently has a loan of 209k for 200k ASB units. This is with full Takaful and loan rate of say 5%. When Mike comes to "refinance" with you. He obviously still wants 200k ASB units. What does your "refinancing" do?

Scenario B

Mike currently has a loan of 190K for 200k ASB units. This is without Takaful and loan rate of say 5%. When Mike comes to "refinance" with you. He obviously still wants 200k ASB units. What does your "refinancing" do?

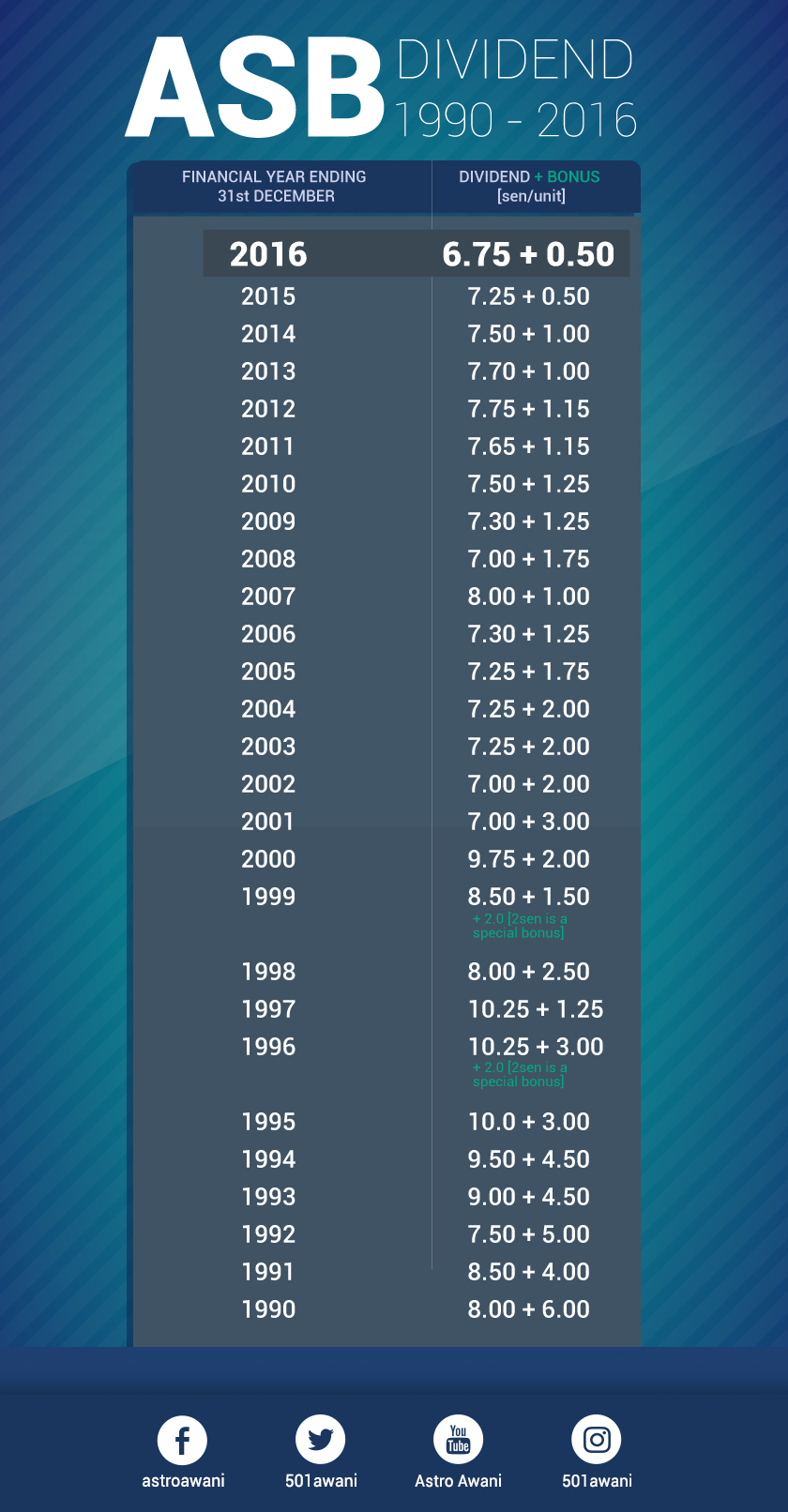

Also, don't think I didn't notice how you only pushed a certain agenda for house purchases, in favor of your completely risk free loans/refinancing.. Also noticed you glossed over the declining returns and banks reducing interest rates in accordance.. I guess my pals and family who bought a particular landed property for around 400k all in.. Brand new from devs.. Free MOT, SPA, furnishings..bla bla.. That was 4 years ago. Today, same property is worth 700k as is.. Oh yeah, paid cash and no loans.. I'd call that a good deal for 4 years.. Especially if one also lived in the property.. So if sold today.. Means the past years has been basically rent free. But as I said.. I don't blindly accept stuffs from so called pros.. I'm unregistered and uncertified.. Yet, I do understand far more legalese and financial industry terms than most.. This without having to call in my educational qualifications and background.. Just using common sense here. mind you, from my previous posts, I'm all for not purchasing a crib unless absolutely needed and all factors taking into consideration. You'd get this, if you weren't sitting so high up on that horse, looking down..

Edit: Modified above for better clarity. Awaiting response on how refinancing doesn't mean taking up another loan.. Only this time, either from the same or a different institution.

1. ASB-f Scenario A..

Mike currently has a loan of 209k for 200k ASB units. This is with full Takaful and loan rate of say 5%. When Mike comes to "refinance" with you. He obviously still wants 200k ASB units. What does your "refinancing" do?

Scenario B

Mike currently has a loan of 190K for 200k ASB units. This is without Takaful and loan rate of say 5%. When Mike comes to "refinance" with you. He obviously still wants 200k ASB units. What does your "refinancing" do?

Also, don't think I didn't notice how you only pushed a certain agenda for house purchases, in favor of your completely risk free loans/refinancing.. Also noticed you glossed over the declining returns and banks reducing interest rates in accordance.. I guess my pals and family who bought a particular landed property for around 400k all in.. Brand new from devs.. Free MOT, SPA, furnishings..bla bla.. That was 4 years ago. Today, same property is worth 700k as is.. Oh yeah, paid cash and no loans.. I'd call that a good deal for 4 years.. Especially if one also lived in the property.. So if sold today.. Means the past years has been basically rent free. But as I said.. I don't blindly accept stuffs from so called pros.. I'm unregistered and uncertified.. Yet, I do understand far more legalese and financial industry terms than most.. This without having to call in my educational qualifications and background.. Just using common sense here. mind you, from my previous posts, I'm all for not purchasing a crib unless absolutely needed and all factors taking into consideration. You'd get this, if you weren't sitting so high up on that horse, looking down..

Edit: Modified above for better clarity. Awaiting response on how refinancing doesn't mean taking up another loan.. Only this time, either from the same or a different institution.

A. Incomplete question. What is the current outstanding of the loan, and what is the cash-value of the ARTA? This is why I always recommend clients not to take ARTA, people who do are getting bad advises, because when they need to refinance or settle the account, they would have to incur some losses (through the premium of the insurance agent which happens to be the bank itself). Currently the best rate is 4.9%, and some clients who took up ASB financing is currently being charged 5.45%, it would be a mismanagement of one's own finances if you do not look into the market rate and refinance the loan into something that is of better rates

Incomplete question, which suggests inexperience of the person asking the question. Please try again

B. As above, incomplete question (what is the original loan amount), but this is more doable. I assume John has paid for the financing for a few years, thus making the current outstanding reduced by a bit. He would have to ask the current bank to close the ASB-financing account, all the units (non-dividend, non-cash) would be sold off. Refinancing that loan would allow him to get 190k or 200k from the new bank, at the rate of 4.9%, he can take a reduced tenure or l. I dont understand what you are trying to do here.

By the way, may I suggest that you use the correct terms when posting your questions/assertions. Using the right terms, there are differences between the loan limit (original loan amount) and current principal outstanding. However you chose to write these instead: "currently has a loan of 209k" . Which is confusing and allows room for miscommunication. Usually I would visit INVESTOPEDIA when i am not sure about some terms because I avoid using the wrong terms, since as you can see in here and in the mortgage threads, I see myself as an educator of sorts.

2. On to the property side, I noticed that you love using anecdotal examples to back your points, of which I am not going to address mainly due to 3 reasons:

1. they are anecdotal and personal which do not represent the whole real-estate industry as a whole.

2. It could be coming out of your behind for all i know, a.k.a bullshit

3. There is no way that I can argue against personal experiences, we can hear about it, talk about it, but please don't use anecdotal experiences to prove you points.

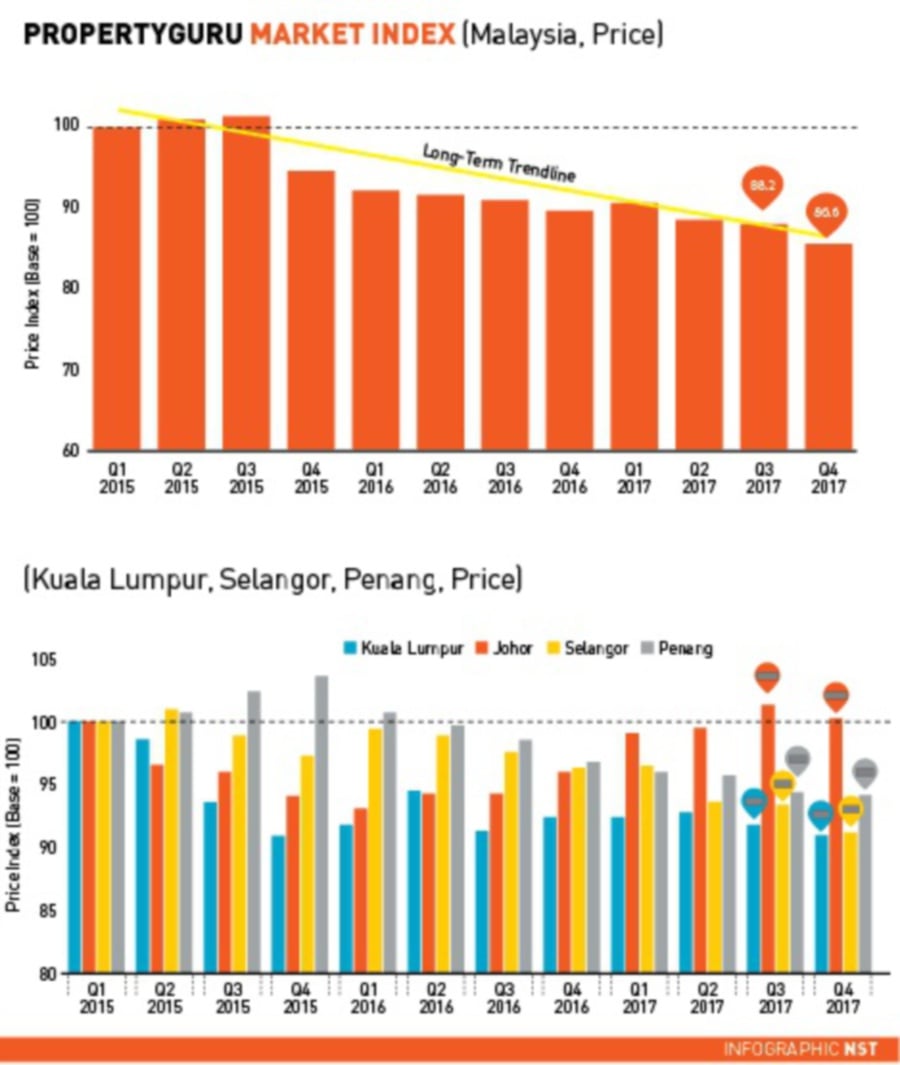

What I claim is true though, a lot of publications are saying the same thing, here is one of them:Downtrend in property prices

On top of this, paper gains are not gains unless you sell it off. You need to understand the differences between liquid assets like cash/ut/asb vs real estate that takes between 3 to 6 months for the transaction to complete, if that.

QUOTE(salimbest83 @ Aug 23 2018, 04:12 PM)

So I take it from ur advises

Max out all 400+400k asb loan

And don't buy house yet..

I reluctant to buy house yet coz didn't know where I will settle down.. Especially waifu. Coz her department usually will rotate staff to other place after 5 years

BTW got one land lot just less than 200 meter from school.. Maybe will stay there after all. Easier for my child later.. 4y old now

You are right, with ASB-financing you can close the account in as soon as 10 days, as per my experience. So it is a good liquid investment. In the event when you need to buy a house, you can just call up the bank, fill up some forms, and the loan will be closed in a very short time. Max out all 400+400k asb loan

And don't buy house yet..

I reluctant to buy house yet coz didn't know where I will settle down.. Especially waifu. Coz her department usually will rotate staff to other place after 5 years

BTW got one land lot just less than 200 meter from school.. Maybe will stay there after all. Easier for my child later.. 4y old now

Dividend income from the ASB can also be used as part of your total income, useful when the banks are calculating your debt-service-ratio. It will not be able to cancel out your commitments as a whole, but it is better than having the commitment but without the income (i.e hire purchase)

This post has been edited by wild_card_my: Aug 23 2018, 05:13 PM

Aug 23 2018, 04:57 PM

Aug 23 2018, 04:57 PM

Quote

Quote

0.0402sec

0.0402sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled