Lol, luckily I did not take out money from EPF to invest in ASB2. Drop until 6% dividend compare to EPF 6.15%.

This post has been edited by junclj: Mar 28 2019, 02:49 PM

ASB loan, worth to get it???

ASB loan, worth to get it???

|

|

Mar 28 2019, 02:42 PM Mar 28 2019, 02:42 PM

Return to original view | Post

#21

|

Senior Member

2,347 posts Joined: Apr 2008 |

Lol, luckily I did not take out money from EPF to invest in ASB2. Drop until 6% dividend compare to EPF 6.15%.

This post has been edited by junclj: Mar 28 2019, 02:49 PM |

|

|

|

|

|

Apr 1 2019, 11:03 AM Apr 1 2019, 11:03 AM

Return to original view | Post

#22

|

Senior Member

2,347 posts Joined: Apr 2008 |

QUOTE(Global_Financing @ Mar 30 2019, 04:21 AM) Hi, 2. I have calculated with my excel, your RM1,061/mth at 4.9% for 30yrs a.k.a 360mths is RM199,900. Since you have to deposit cash at least RM100 to open a new ASB account. You should able to calculate your monthly payment RM1,061*12mths*3yrs is RM38,196. The total amount that you paid to bank after 3 years. The current problem is we don't know what is the future dividend rate, nobody know about the future. We cannot estimate what is the next year ASB dividend rate. Probably is 6% only? Probably is 7% or 8%? So, we can't even know what is the following 3 years ASB dividend rate. This is quite really hard to give an accurate answer to you. If you loan 30 years then should be 3 years is your optimal ROI, mine is loan 20 years. So 5 years is my optimal ROI.I've recently opened ASB account and obtained ASBF 200k from RHB (4.9%) without insurance and paying 1061/mo for 30 years tenure. I will be doing compounding method. there are some questions that I'd like to ask: 1. How do i achieve highest ROI? and what is OPM? 2. I have read in this thread that I should terminate and re apply 200k ASBF every 3 years. but, is 3 years is really the "most optimal" period? im not sure how that is calculated.. how do i even compare to terminating it in 2nd year, or terminating it in 5th year.. to see which is more profitable... 3. I have additional bullets from my salary to pay for monthly commitment on additional 200k ASBF, 30 years tenure. (another RM1k/mo commitment). what's the best option to utilize this bullet? ASBF proxy? wait for ASB2F? everymonth saving into ASB2 acc? <problem with myASNB website> 4. I have tried to Register in myASNB website using my IC, and when the website says it has sent TAC code. Problem is, I dont receive the TAC code on my phone. I've tried everyday for the past 2 weeks. I've went to RHB counter (ASB Agent) to ensure my phone number is correct. anything else i can do here? » Click to show Spoiler - click again to hide... « However, you can use my excel to modify for yourself. This excel is only for my own ASB account forecast and calculation for my own ASB account only. You should edit it to suit for your own ASB account. My own planning is keep loan for 10~15 years. After that then use my ASB2 money to settle the rest ASB loan amount. Since I do not loan in my ASB2, I am now doing saving basis on my ASB2 account. Base on my excel forecast, If I got RM1.3M during my retirement, for this RM1.3m, do you think this amount should enough for the rest of your life? I still have EPF with me and my parent's properties, shops, houses and lands. I think this should enough for me to use until the end of my life, hopefully. https://drive.google.com/file/d/1gm7pSPuVhF...iew?usp=sharing This post has been edited by junclj: Apr 1 2019, 11:34 AM |

|

|

May 11 2019, 01:06 PM May 11 2019, 01:06 PM

Return to original view | Post

#23

|

Senior Member

2,347 posts Joined: Apr 2008 |

QUOTE(Schampoo @ May 10 2019, 10:04 PM) Hi, currently my asb loan has gone up to 5.50%.. can you afford to to pay the 5.50%? How many years left for your loan payment? Do you have extra cash available in your bank account? How old are you? When do you plan to retire?So, want to ask... 1. Is it better to terminate and go for lower interest rate? 2. Is it better to taking loan without/with insurance? 3. Since now have bank offering 35 years, so better go for longest loan period? I guess your 5.50% should be loan for 20 years. If I already paid for 15 years loans, I may choose to do early settlement for my ASB loan. So I will save up more rebate from the loan interest. Anyway its depends on your economy power. Rich people doesn't really care for it, due to the shorter term you loan, then the least sum loan interest have to pay to bank. |

|

|

May 14 2019, 08:56 AM May 14 2019, 08:56 AM

Return to original view | Post

#24

|

Senior Member

2,347 posts Joined: Apr 2008 |

New update from my RHB online banking portal, my ASB loan interest now just newly dropped to 5.00% p.a. Before that is increased from 5.10% to 5.20%. Finally they reduce my loan interest.

|

|

|

May 16 2019, 12:33 PM May 16 2019, 12:33 PM

Return to original view | Post

#25

|

Senior Member

2,347 posts Joined: Apr 2008 |

QUOTE(junclj @ May 14 2019, 08:56 AM) New update from my RHB online banking portal, my ASB loan interest now just newly dropped to 5.00% p.a. Before that is increased from 5.10% to 5.20%. Finally they reduce my loan interest. Just notice that RHB loan drop again from 5.00% to 4.95%, the latest interest rate for ASB loan for 240months.

This post has been edited by junclj: May 16 2019, 12:38 PM |

|

|

May 16 2019, 01:09 PM May 16 2019, 01:09 PM

Return to original view | Post

#26

|

Senior Member

2,347 posts Joined: Apr 2008 |

Perhaps for me still stay with my current 20 years loans without cancel it to reapply a 35 years loans.

I am now aged 34, this year was my 5th years of paying my installment. Meaning that I still have 15 years to go. After 15 years I will be aged 49. However, I am planning to do early settlement at the 15th year. My ASB2 is doing in saving basis and planning to save up to RM100k in 10 years. Meaning that, when I reach my age 44, I will able to withdraw money from my ASB2 to settle up the rest amount of my ASB loan then I can get my certificate earlier. So start from 44 until my retirement, I do not need to worry about money. Probably will able to reach more than RM1m. Its enough for me to enjoy the rest of my life. I'm single, unmarried, don't have wife and don't have children. It's because I can't find a gf, I already 34 years old now. No gf, no wife and never planning to marry. Better just keep everything simple, my family is just my sisters and parents. Many of you just look at the lowest interest rate. In fact, if you keep cancel and reapply your loan, the length will keep extend and extend. Originally, you may plan to retire at age 55 but now your retirement will extend to age 65 because you keep extend your asb loan period over and over again. 35 years for me is too long, RM200k for 4.75% in 35 years is RM410,760. RM200k for 4.95% in 20 years is RM315,600. You have to spend 15 more years to pay the extra RM100k interest to bank. |

|

|

Jun 12 2021, 11:30 PM Jun 12 2021, 11:30 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,347 posts Joined: Apr 2008 |

Just curious about asb loan. I search the whole internet but everybody are just talking about surrender and terminate their asb loan but I did not find anyone there talking about doing early settlement of asb loan.

Let's say lah, if I loan for 20 years of asb loan. If I was paid for loans until the 15th years then I decide to do early settlement. Besides, early settlement can help reduce my loan interest loss. So why don't I just straight do settlement earlier if I have cash in hand? So be frankly speaking, actually I have asb1 loan with RM199K since 2015 (now already growth until RM280k+ in total) and asb2 has RM190k+ of cash now (my asb2 is doing saving basis without loan). I am now planning to further fill up my asb2 balance by just using cash until to reach up it's maximum RM200k limit then let it growth for the next 10 years. After 10 years later then I decide to take out some of the money from asb2 (or asb3 and even asm later after I filled up my asb2 to maximum limit) to settle asb1 loan. So what can I do? Can I do early settlement for asb loan? This post has been edited by junclj: Jun 13 2021, 12:30 AM |

|

|

Oct 1 2021, 10:41 AM Oct 1 2021, 10:41 AM

Return to original view | Post

#28

|

Senior Member

2,347 posts Joined: Apr 2008 |

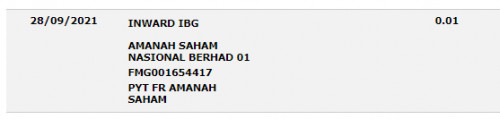

QUOTE(iamloco @ Sep 30 2021, 08:49 PM) Same here, I have no idea what is that. Probably is used for verifying our bank account status for T+6, start counting from 28/9/2021. Wait for next week and check back my myASNB portal whether the bank account status is still under pending. iamloco liked this post

|

| Change to: |  0.0237sec 0.0237sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 10:06 AM |