Guts, just curious, since some banks do take asb dividend as an income, does it applicable only for mortgage or to all loan?

ASB loan, worth to get it???

ASB loan, worth to get it???

|

|

Nov 12 2018, 02:14 PM Nov 12 2018, 02:14 PM

Return to original view | Post

#121

|

Senior Member

1,608 posts Joined: Nov 2007 |

Guts, just curious, since some banks do take asb dividend as an income, does it applicable only for mortgage or to all loan?

|

|

|

|

|

|

Nov 13 2018, 09:46 PM Nov 13 2018, 09:46 PM

Return to original view | IPv6 | Post

#122

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(haziqnet @ Nov 13 2018, 09:03 PM) Other loan accept asbf need an agreement and current account to consider as an income. I don't get it. 😂If u own a house you can do this trick. Make a tenancy agreement using your siblings name, stamp it and pay the monthly rent into your bank account by yourself. After 6 month bank will take the rent money as an income. Its like you rent the house but instead u live in it. |

|

|

Nov 14 2018, 12:23 PM Nov 14 2018, 12:23 PM

Return to original view | Post

#123

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(haziqnet @ Nov 13 2018, 09:03 PM) Other loan accept asbf need an agreement and current account to consider as an income. Actually what i want to know is, let say for example, i want to apply for a personal loan, and i have asbf.. So will the bank calculate the asb dividend as income also, just like trying to apply for mortgage?If u own a house you can do this trick. Make a tenancy agreement using your siblings name, stamp it and pay the monthly rent into your bank account by yourself. After 6 month bank will take the rent money as an income. Its like you rent the house but instead u live in it. |

|

|

Dec 4 2018, 02:04 PM Dec 4 2018, 02:04 PM

Return to original view | Post

#124

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Dec 4 2018, 04:24 PM Dec 4 2018, 04:24 PM

Return to original view | Post

#125

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Dec 5 2018, 01:41 PM Dec 5 2018, 01:41 PM

Return to original view | Post

#126

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(wild_card_my @ Dec 5 2018, 07:26 AM) Hey guys, CIMB/CIMB-Islamic raised their Base Rate by 0.1%, effectively yesterday (if I heard correctly), but I held up from posting this because it hasn't been reflected on CIMB clicks when I checked. As it is now, it has been reflected, my interest rate jumped by 0.1%. So if you have CIMB's mortgage/ASB-financing account (or other variable-interest rate accounts), you are affected Eh, did bnm raise the opr?On another subject, the current best effective rate for ASB-financing is 4.85% p.a. Yesterday  Today  |

|

|

|

|

|

Dec 5 2018, 02:57 PM Dec 5 2018, 02:57 PM

Return to original view | Post

#127

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(haziqnet @ Dec 4 2018, 06:24 PM) I want to explain what is the hybrid method by using calculation. Why its better not to stay compounding when you still not max out your 200k asbf. Here I will give you 2 different calculation. Should be applicable also to 50k and 30k asbf, right?1st method compounding 100k compounding for 5 years. Prinsipal sv - 8172 Compounding div. - 40,255 Total - 48,427 2nd method hybrid apply 100k at 1st year than another 100k 2nd year (hybrid) for 5 years 1st 100k Principal sv - 8172 Div. Balanced (7000 - 6441.84) x 4 years) - 2232 (div. Balanced = dividen - 1 year installment) 5th year div. - 7000 Total - 17,404 2nd 100k Principal sv - 6370 Compounding div. (4 years) - 31080 Total - 37,450 Nett total for both certificate after termination - 54,854 Additional 6427 if using hybrid technique than compounding only from 100k. Just think how much the different gap if you terminate at 10,15,20 or 30 years. Its just a simple comparison and hybrid will give more for you at the end. You just need to pay installment the same like you did with your 100k. This method only suitable for those who cant afford to max out 200k asbf to maximize the potential return from the normal compounding technique. You can start as low as 10k and max out till 200k however it will take many years to achieve it. Dun stay compounding when you still not max out your 200k asbf. Notes : Loan rate 5%, tenure 30 years without insurance. Dividen prorate 7% (monthly - 536.82) -haziq- |

|

|

Dec 6 2018, 11:20 AM Dec 6 2018, 11:20 AM

Return to original view | Post

#128

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(wild_card_my @ Dec 6 2018, 09:46 AM) Short answer: NEP Great info.. Btw, what's the diff between equity and mixed assets fund? Which one is better, more volatile related to the economics condition?Long answer: Malays don't save, so the government decided in the late 80s to create ASB to encourage them to save. ASB is actually just an equity-based unit trust fund with two unique features which are also the prerequisites for the fund to be well-adopted by the Malays: a. Fixed-price unit. Your capital does not change at all. You can deposit RM10,000 today AM, change your mind in the PM and withdraw RM10,000 with no fees whatsoever. On the other end of the extreme, you can deposit RM10,000 today, and after 50 years your capital would still be RM10,000. This capital is guaranteed by PNB, which means even in the event of a stock market crash, depositors would still be able to withdraw their capital in full - this is important because Malays are wary of negative returns b. Consistent yearly returns in the form of dividends. Dividends are paid every year early in January. Due to the nature of dividends, there would never be negative returns - the worst possible dividend is "NO dividend". Historically the minimum dividend was 6.75% for investment year of 2016 (paid out in Jan 2017). Now to your main question as to why ASB can give much more compared to FD: ASB was launched in 1990 as an equity-fund, but this year in May they changed its classification to a mixed-asset fund. During great economic periods, ASB would give a somewhat moderate returns of about 7-8% p.a compared to other unit trust funds that are generating 2 digit year-on-year returns. ASB would keep the proceeds in reserve. During economic downturns, when other equity-based unit trust funds are giving lesser or even negative returns, ASB would utilize its reserve to maintain giving out consistent dividends. At least this is how I believe it works as ASB is less transparent than the typical unit trust funds which are under the purview of the Securities Commissions - these funds are very transparent, with the NAV updated on the daily basis, Quarterly Fund Reviews and half-year reports breaking down the holdings based on industry and companies. By the way, when I said Malays, I actually meant Bumiputras as a whole. In any case, I am not really into racial debates, but these are some of the main reasons as to why ASB was created. If not for ASB, Malays generally would not save - which I guess is in line with what they found in their studies in the 80s. They launched ASB in 1990 |

|

|

Dec 6 2018, 03:23 PM Dec 6 2018, 03:23 PM

Return to original view | Post

#129

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(wild_card_my @ Dec 6 2018, 02:03 PM) The fund types determine the mandate given to the fund managers to create the portfolio for the said fund. Thanks for the sharing Equity-funds invest in shares, almost exclusively, they cannot deviate to invest in bonds and money market instruments (certificate deposits, cash, etc.); at least not for long periods of time. Equity-funds have different types too, such as bluechip funds (counters: sime darby, axiata, Maybank; the famous ones), growth funds (these are listed/public companies, but you would probably never heard of them due to their smaller sizes/market-cap), etc. Mixed-asset funds are akin to balanced-funds. With this mandate, the fund managers are able to manage their portfolio with a longer leash - meaning are allowed to diversify the portfolio so they are not exclusively invested in equities; which is especially important during the bull vs bear run when it is not necessarily profitable to have an equity-heavy portfolio. It is generally accepted that mixed/balanced funds tend to be less volatile, but at the same time they are also not as profitable, or have lower potential to be profitable compared to the equity-funds. These are not the hard-and-fast rules though, each year there are balanced/mixed-asset funds that out-perform the lower-performing equity funds. I have to mention though that I do not know any more than this - my experience in the banking line is limited to sales; not fund management. I cannot recommend funds or counters for people to buy. I invest based on fundamentals and I understand every bit of the reports that I read, but I do not know enough to "teach" people about investing I can help with financing though. Just saying, the best ASB financing rate is now 4.85% The dividend is declared as a %. Fine, if you insist that the dividend is declared as sen/unit, do note that ASB is a fixed-price fund. Meaning each unit is ALWAYS RM1 so if it is declared as 7sen/unit, what it actually means is that the dividend is 7sen for each RM1 you have deposited; or in short, 7% dividend pay out. (do not forget to pro-rate, depending on the month you deposited your money) |

|

|

Dec 14 2018, 10:02 AM Dec 14 2018, 10:02 AM

Return to original view | Post

#130

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(buggie @ Dec 14 2018, 09:55 AM) Hopefully Zetty out to prove herself in her first dividend declaration. Dig into their reserves to post a Conservative, yet decent % I thought she already declared dividend for a fund few weeks back? so it wont be the first. Dividends in 2 weeks! Stoked yet? Stoked? Gatal tangan already.. |

|

|

Dec 21 2018, 03:29 PM Dec 21 2018, 03:29 PM

Return to original view | Post

#131

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Dec 21 2018, 04:10 PM Dec 21 2018, 04:10 PM

Return to original view | Post

#132

|

Senior Member

1,608 posts Joined: Nov 2007 |

So since the dividend is lower than last year (the 6.5 one

|

|

|

Dec 21 2018, 04:19 PM Dec 21 2018, 04:19 PM

Return to original view | Post

#133

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(wild_card_my @ Dec 21 2018, 04:14 PM) 2 different account, loan account vs investment account but will the bank 'see' the dividend as 7% or just 6.5? In case of taking asb dividend as an income..Based on how you calculate the bonus dividend, (minimum balance of past 12 months x 0.5%), it means the actual dividend is 7% anyway. |

|

|

|

|

|

Dec 21 2018, 04:25 PM Dec 21 2018, 04:25 PM

Return to original view | Post

#134

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Dec 21 2018, 04:34 PM Dec 21 2018, 04:34 PM

Return to original view | Post

#135

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Dec 21 2018, 06:01 PM Dec 21 2018, 06:01 PM

Return to original view | IPv6 | Post

#136

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(ezrachan @ Dec 21 2018, 04:37 PM) Noted.. QUOTE(ezrachan @ Dec 21 2018, 05:58 PM) 1. Agree, we also will look at DSR if the DSR still within limit after taking asb financing, your cc application should be no problem. Statement means the annual statement?2. The grace period 6 months or 1 year also counted and it's true ya bukan tipu2. If apply less than that and got approved that's mean u are so lucky or ur credit rating very good. 3. Dividend asb will take as additional income if u provide the statement. If u didn't provide it, bank will not calculate for u lah. 4. 100% agree for the "luck". Hard to say, sometimes just need luck to get the cc approved 😅. I got many customers approved cc just by their luck |

|

|

Dec 21 2018, 06:06 PM Dec 21 2018, 06:06 PM

Return to original view | IPv6 | Post

#137

|

Senior Member

1,608 posts Joined: Nov 2007 |

|

|

|

Dec 21 2018, 06:56 PM Dec 21 2018, 06:56 PM

Return to original view | IPv6 | Post

#138

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(wild_card_my @ Dec 21 2018, 06:08 PM) Future? More like past dividend earned. Thanks.. For example, if you take ASB-f today, and you apply for a mortgage in June next year, with no dividend earned, the bank will consider the ASB-f commitment, but not the dividend, because you have not received any yet. QUOTE(ezrachan @ Dec 21 2018, 06:09 PM) Wait, what? So only asbf will count future dividend as income... |

|

|

Dec 21 2018, 10:53 PM Dec 21 2018, 10:53 PM

Return to original view | IPv6 | Post

#139

|

Senior Member

1,608 posts Joined: Nov 2007 |

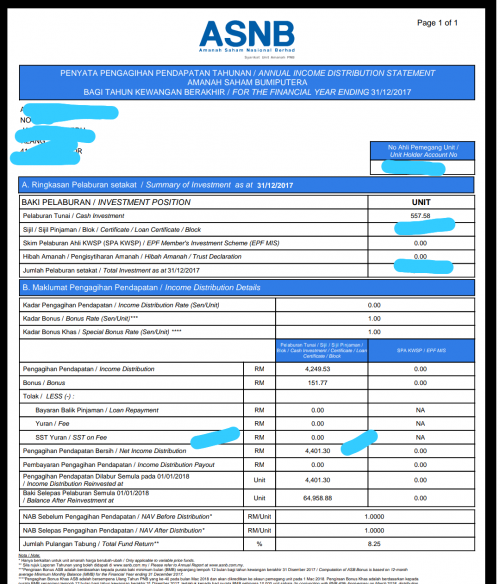

QUOTE(ezrachan @ Dec 21 2018, 07:47 PM) 1.Asb dividend statement: u already get the dividend and it's ur money. From that bank will take 80% (depends on which bank) and divide by 12. Great explanation.. Thanks  From the above example, dividend earn is rm4401.30. (Rm4401.30x 80%)/ 12 = rm293.42 Let say ur salary rm3000, from the asb dividend will add on rm293.42 so ur income now is rm3293.42. U can use this to apply house loan, car loan etc. 2.Future dividend income. Your salary is rm3000 and u are applying rm100k asb loan. So bank can calculate ur additional income from future dividend, u might get is.... (100k x 7%) x80% / 12= rm466.67 So ur total income : rm3466.67 This is only applicable for asb financing application. For others application, they will not calculate asb future dividend coz u have not earn the dividend yet. Example, just apply asb loan rm100k on February 2018 and want to apply house loan on Oct 2018. Will bank calculate future dividend as additional income? The answer is no. Hope this clarify u. Ask more if u still have questions |

|

|

Dec 22 2018, 12:17 AM Dec 22 2018, 12:17 AM

Return to original view | IPv6 | Post

#140

|

Senior Member

1,608 posts Joined: Nov 2007 |

QUOTE(HolySatan @ Dec 21 2018, 11:51 PM)  ASB 200K | 1 year only 2015 : 7.25 + 0.50** 2016 : 6.75 + 0.50** 2017 : 7.00 + 0.25*** + 1.0* 2018 : 6.50 + 0.50*** * special anniversary bonus PNB ** prorate bonus 120 month *** prorate bonus 12 month -:- prorate dividen 12 month profit : 2015 = 2017 > 2018 > 2016 2015 (200000 x 7.25%) + [(200000 x 0.50%) x 12/120] = 14600 2016 (200000 x 6.75%) + [(200000 x 0.50%) x 12/120] = 13600 2017 (200000 x 7.00%) + [(200000 x 0.25%) x 12/12] + (10000 x 1%) = 14600 2018 (200000 x 6.50%) + [(200000 x 0.50%) x 12/12] = 14000 |

| Change to: |  0.0253sec 0.0253sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 10:30 AM |