3-4am.Its not job data, its INTEREST RATE, mother of all news ...

Investing in US stocks, Does anyone know how?

Investing in US stocks, Does anyone know how?

|

|

Nov 4 2009, 11:38 PM Nov 4 2009, 11:38 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

3-4am.Its not job data, its INTEREST RATE, mother of all news ...

|

|

|

|

|

|

Nov 4 2009, 11:45 PM Nov 4 2009, 11:45 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Did you see that pop?

Dollar tanks Oil moves up Gold moves up ERX moves up 4.5% TNA moves up 3% TCK moves up 5% C moves up 2.5% Everything moves up ahead of Fed decision and if they changed their mind, bam, down we go. But, I do expect we'll pull back after the announcement for quick profit taking. This post has been edited by danmooncake: Nov 4 2009, 11:47 PM |

|

|

Nov 4 2009, 11:52 PM Nov 4 2009, 11:52 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

unrealized gain of USD36.40.

I play very small, I really believe that small pull back will happen, but I wait for C to go up to USD4.50. If US market is sure win, I should move more fund inside.. just give some time to learn it.. Added on November 5, 2009, 12:07 amOk.. tomorrow morning waiting to win extra cash.. This post has been edited by epalbee3: Nov 5 2009, 12:07 AM |

|

|

Nov 5 2009, 01:15 AM Nov 5 2009, 01:15 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

I think we'll have sell the news at 3am/4am, all majors are moving off their highs now.

Oil, Transport, Tech... |

|

|

Nov 5 2009, 01:40 AM Nov 5 2009, 01:40 AM

|

Senior Member

2,352 posts Joined: Jan 2003 From: Pixelgasm |

QUOTE(epalbee3 @ Nov 4 2009, 11:52 PM) unrealized gain of USD36.40. On the long run its definitely a sure win. But the question remains, how low can u buy and how long can u keep. I play very small, I really believe that small pull back will happen, but I wait for C to go up to USD4.50. If US market is sure win, I should move more fund inside.. just give some time to learn it.. Added on November 5, 2009, 12:07 amOk.. tomorrow morning waiting to win extra cash.. |

|

|

Nov 5 2009, 04:26 AM Nov 5 2009, 04:26 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Fed says BUY stocks.

Don't fight them. So, we must BUY during the dip. But, sell the news come first! Update after closing: CSCO beats estimates! We may get another pop for tech stocks next trading day. This post has been edited by danmooncake: Nov 5 2009, 06:17 AM |

|

|

|

|

|

Nov 5 2009, 07:54 AM Nov 5 2009, 07:54 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

QUOTE(danmooncake @ Nov 5 2009, 04:26 AM) Fed says BUY stocks. Yeah.. C drops 20 cents after Fed declared interest remains.Don't fight them. So, we must BUY during the dip. But, sell the news come first! Update after closing: CSCO beats estimates! We may get another pop for tech stocks next trading day. so prepare for the next rally.. Added on November 5, 2009, 8:02 amI am quite surprise how market operates.. buy the rumours, sell the news. I guess playing one day in US market is equivalent to playing one month in KLSE.. Now my interest stocks are C, LVS, MGM. Just buy on the big dip, hold for sometimes and sell at rally. This post has been edited by epalbee3: Nov 5 2009, 08:02 AM |

|

|

Nov 5 2009, 08:34 AM Nov 5 2009, 08:34 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

FED keep the interest rate. Traders are selling off - scared of "bad" news.

As my previous post, true indeed 3-4 pm mega sales. Looking back at 10,100 before the next dive. |

|

|

Nov 5 2009, 11:51 AM Nov 5 2009, 11:51 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

so how was the day trading or short term holdings for u all?

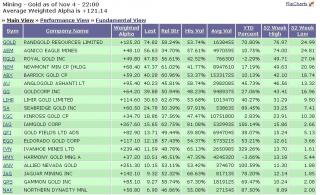

buy the dip takes ball as u going against wat u've read in books or listening to those granny/ aunt/ fren stories  it seems we hav not yet encounter a dip tat never rallies was the fed mesej clear? myself waiting nex week action for some direction in meantime, no harm putting some small fun capital to buy the dip & sell the rally wei taugehs, dun la jus take & take, mus contribute & do ur part in tis thread, as u all wanna learn rite?? no such thing as free lunch who can assist to look at chart or FA or etc & giv feedback for us how to play gold stock

weird, no takers, even when gold hit new high?? ok... i wun comment on ur pick, i remain silent & wun pass any sarcastic comments nor pictures u all can discuss it freely (if u all wan la)... or i guess u all prefer to be spectators onli wil a gold etf interest u all? but its kinda mahal (livermore buy high & sell higher concept)

here we go, the louyah analyst report Stocks ended mixed Wednesday as a late sell-off wiped out most of the day's earlier gains. The Dow and the NYSE composite added 0.3% each. The S&P 500 edged up 0.1%, and the Nasdaq eased 0.1%. All closed near session lows. While the market has mostly gained the past three sessions, volume has been lame. The lack of big volume recently is the market's way of saying that institutional investors aren't much interested in buying or selling. Such caution made sense early Wednesday because the market was expecting a statement from the Federal Reserve. The Fed kept interest rates unchanged, and its message was in line with expectations. While waiting for that piece of news, the market received a jobs report that was worse than expected and a nonmanufacturing index that also fell short of views. The market shrugged off the negatives, rising in slow trade. Indexes were volatile after the Fed's statement, then coughed back most of their gains in the final hour. This post has been edited by sulifeisgreat: Nov 5 2009, 04:25 PM |

|

|

Nov 5 2009, 08:25 PM Nov 5 2009, 08:25 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Thu Nov 5 Up Next 9:30am Unemployment Claims Forecast : 523K, anything lower - market will TANK! |

|

|

Nov 5 2009, 10:06 PM Nov 5 2009, 10:06 PM

|

Senior Member

768 posts Joined: Jan 2005 |

WASHINGTON (Reuters) - The number of U.S. workers filing new claims for jobless insurance fell more than expected last week to a 10-month low, government data showed on Thursday, pointing to a gradual improvement in the labour market.

Initial claims for state unemployment benefits dropped 20,000 to a seasonally adjusted 512,000 in the week ended October 31, the lowest since early January, the Labour Department said. New jobless claims had bounced around the 520,000-532,000 range over the previous four weeks. |

|

|

Nov 5 2009, 10:57 PM Nov 5 2009, 10:57 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Taikor TNA is moving fast.

LVS was down. now up again. Haih, C = curap.. no moving |

|

|

Nov 5 2009, 11:14 PM Nov 5 2009, 11:14 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Don't you love this crazy market and buying the dip idea?

Up we go again! Wheeee!! IMO, the US Fed won't want this market to tank and they already intentionally don't want to raise interest rates. Consumer not spending is not a concern anymore, everything is "less bad" than expected including jobs are a good thing. Added on November 5, 2009, 11:45 pm Wow! Watch that pop!! S&P broke 1060... some may starting to short., let see if we can stay above. C has strong resistance at 4.06. Sold 200 @ TNA 39.10, still got another 200 batch avg 36 in my position. Will wait to see where this takes us later. This post has been edited by danmooncake: Nov 5 2009, 11:53 PM |

|

|

|

|

|

Nov 6 2009, 12:08 AM Nov 6 2009, 12:08 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

can't wait, sold C at 4.05.

earn some peanuts.. Added on November 6, 2009, 12:11 amnothing to play now.. everything is expensive.. wait till another dip first.. This post has been edited by epalbee3: Nov 6 2009, 12:11 AM |

|

|

Nov 6 2009, 01:11 AM Nov 6 2009, 01:11 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(epalbee3 @ Nov 6 2009, 12:08 AM) can't wait, sold C at 4.05. Not just C, the banks aren't participating in this rally. earn some peanuts.. Added on November 6, 2009, 12:11 amnothing to play now.. everything is expensive.. wait till another dip first.. Look at FAS, UYG, XLF, hardly move at all. Added on November 6, 2009, 3:19 am Some banks are moving.. FAS moved above 70 slightly.. not in rally mode yet. Maybe just waiting for the other majors to move up first. Energy not moving up yet. Added on November 6, 2009, 4:06 am Update: 4:05am We broke above 10K and S&P1065, sell button just got activated. Update: 5:01am We closed above 10K..and S&P1066. This is a bullish! Shorts have to cover. Tomorrow, everyone expects the Fed unemployment numbers to be good! If so, we'll re-test Dow 10100 or S&P 1100 This post has been edited by danmooncake: Nov 6 2009, 05:09 AM |

|

|

Nov 6 2009, 08:35 AM Nov 6 2009, 08:35 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

QUOTE(danmooncake @ Nov 6 2009, 01:11 AM) Not just C, the banks aren't participating in this rally. I am quite interested in two counters: C and MGMLook at FAS, UYG, XLF, hardly move at all. Added on November 6, 2009, 3:19 am Some banks are moving.. FAS moved above 70 slightly.. not in rally mode yet. Maybe just waiting for the other majors to move up first. Energy not moving up yet. Added on November 6, 2009, 4:06 am Update: 4:05am We broke above 10K and S&P1065, sell button just got activated. Update: 5:01am We closed above 10K..and S&P1066. This is a bullish! Shorts have to cover. Tomorrow, everyone expects the Fed unemployment numbers to be good! If so, we'll re-test Dow 10100 or S&P 1100 C is moving from 3.80 - 4.10; not playing now, as the resistant level is still unknown. MGM is moving from 9.00 - 10.15; I will buy it if it falls below 9.25. Still not familiar with URE, URY and FAS, which are leverage ETFs (2x and 3x). Will need more studies to see their behaviors.. But indeed if you know them, they are volatile counters, chance to earn in multiple. |

|

|

Nov 6 2009, 08:38 AM Nov 6 2009, 08:38 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(epalbee3 @ Nov 6 2009, 08:35 AM) I am quite interested in two counters: C and MGM Yes, don't play with the leveraged ETF until you're absolutely sure of this behavior. C is moving from 3.80 - 4.10; not playing now, as the resistant level is still unknown. MGM is moving from 9.00 - 10.15; I will buy it if it falls below 9.25. Still not familiar with URE, URY and FAS, which are leverage ETFs (2x and 3x). Will need more studies to see their behaviors.. But indeed if you know them, they are volatile counters, chance to earn in multiple. Just pretend to trade them using pen and paper for about a few times and see how well you can do. |

|

|

Nov 6 2009, 08:45 AM Nov 6 2009, 08:45 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Nov 6 2009, 01:11 AM) Not just C, the banks aren't participating in this rally. Aye, C stuck in the middle of nowhere. Last 3 weeks when DOW at 10K, C was at 4.70's.Look at FAS, UYG, XLF, hardly move at all. Added on November 6, 2009, 3:19 am Some banks are moving.. FAS moved above 70 slightly.. not in rally mode yet. Maybe just waiting for the other majors to move up first. Energy not moving up yet. Added on November 6, 2009, 4:06 am Update: 4:05am We broke above 10K and S&P1065, sell button just got activated. Update: 5:01am We closed above 10K..and S&P1066. This is a bullish! Shorts have to cover. Tomorrow, everyone expects the Fed unemployment numbers to be good! If so, we'll re-test Dow 10100 or S&P 1100 I'm looking at 10,100 before tank again.."profit taking" in play. 10K comes early, was expecting on Monday as unknown friday news. Means if today 2 news are good, 10,100 is no sweat? I still dun think so that fast, as profit taking will kicks in |

|

|

Nov 6 2009, 08:48 AM Nov 6 2009, 08:48 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Yes, this cycle is getting shorter.. but perhaps this time around,

I think Dow may go slightly higher since Financials and Energy have not rally yet. |

|

|

Nov 6 2009, 10:24 AM Nov 6 2009, 10:24 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

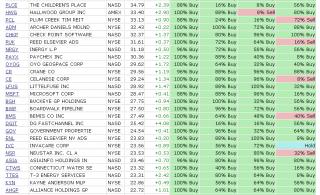

there realy r stock participating in tis good news scenario

u jus gotta really look for them, (if u wan to) & move out of ur comfort zone expand ur research, otherwise, jus stick with those etf

here we go, the louyah analyst report. myself also need to digest it & plan for nex week The Nasdaq added 2.4% and the Dow 2.1%. The S&P 500 and the NYSE composite gained 1.9% and 1.8%, respectively. Volume was moderately lower on both major exchanges. First, Cisco Systems (CSCO) beat expectations on quarterly earnings and sales in its after-hours report Wednesday. The company offered a stronger forecast than analysts expected. Cisco's report carried special significance to the Street because it was the first major technology firm to report results that included October numbers. A second piece of good news was initial jobless claims. The figure offered a brighter picture than Wall Street expected. Third-quarter productivity also added to the positive tone. It grew 9.5%, topping views and notching the best gain in six years. Finally, October retail figures were stronger than expected, according to Retail Metrics. The retail sector remains an area of concern for market watchers. Doubts linger on whether or not battered U.S. consumers will open their wallets and spend. On Friday, the market will focus on the government's data on October unemployment. The unemployment rate is expected to come in at 9.9%. The Street is watching the number as a gauge for future consumer spending. |

|

Topic ClosedOptions

|

| Change to: |  0.0191sec 0.0191sec

0.32 0.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 11:02 PM |