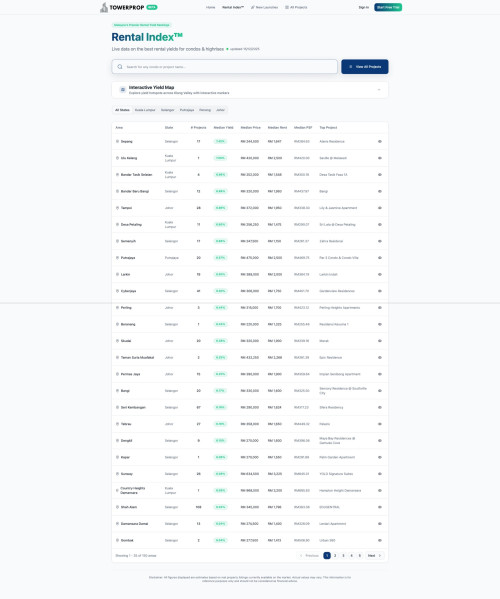

I’ve been working on a side project called TowerProp (https://towerprop.my/rental-index)

The idea came from my own frustration that in Malaysia:

- rental prices are mostly guesswork

- agents quote numbers with no proof

- it’s hard to know real rental demand

- yields are calculated blindly

- Brickz / NAPIC are useful but laggy

- PropertyGuru shows listings, not performance

What TowerProp tries to do

(early stage, still rough)

- Track 3,000+ condo projects across KL, Selangor, Johor, Penang, Putrajaya

- Estimate actual rental ranges per project

- Calculate gross yield, monthly cashflow, break-even years

- Show rental demand indicators (how fast units get rented, relisting behaviour, etc.) - coming soon

- Rank projects using a simple score (TowerScore 0–100)

- Highlight areas with stronger rental performance

- New launches: estimate rental yield before completion using nearby comparables

Right now it’s free and very data-focused (not listings, not ads).

What I really want to ask you all

I’d appreciate brutally honest answers, even if the answer is “this is useless” -- as a buyer / investor / landlord, would you actually use something like this? Why or why not?

Thanks for reading!

Dec 15 2025, 11:15 PM, updated 2w ago

Dec 15 2025, 11:15 PM, updated 2w ago

Quote

Quote

0.0146sec

0.0146sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled