Come share what ETFs you all have invested

Anyone here invested in ETF ?

Anyone here invested in ETF ?

|

|

Yesterday, 12:31 PM Yesterday, 12:31 PM

|

Senior Member

1,019 posts Joined: Sep 2018 |

Come share what ETFs you all have invested

|

|

|

|

|

|

Yesterday, 12:32 PM Yesterday, 12:32 PM

|

Junior Member

150 posts Joined: Oct 2009 From: Klang, Selangor D.E Status: Work Everyday |

QUOTE(Knnbuccb @ Dec 12 2025, 12:29 PM) Actually why ah not bad login few time, i login masuk kerja until logout kerja, if you see me in /k meaning i am workingWhy we addicted to /k Some ppl see /k terus ask me wtf u doing wasting ur time To them is like they wouldn't bother at all but to me is like every day must login few times ... |

|

|

Yesterday, 12:33 PM Yesterday, 12:33 PM

|

Junior Member

118 posts Joined: Dec 2021 |

|

|

|

Yesterday, 12:36 PM Yesterday, 12:36 PM

Show posts by this member only | IPv6 | Post

#24

|

Junior Member

821 posts Joined: Jun 2005 |

vtsax + vxus or vt and chill vwra if you have the access RT8081 liked this post

|

|

|

Yesterday, 12:36 PM Yesterday, 12:36 PM

Show posts by this member only | IPv6 | Post

#25

|

Junior Member

355 posts Joined: May 2022 |

|

|

|

Yesterday, 12:44 PM Yesterday, 12:44 PM

|

Senior Member

3,495 posts Joined: Jan 2003 |

QUOTE(Medufsaid @ Dec 11 2025, 05:49 PM) Imbi Plaza Lot 1.28 liked this post

|

|

|

|

|

|

Yesterday, 12:44 PM Yesterday, 12:44 PM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

3,969 posts Joined: Nov 2007 |

Currently

Weekly topup - voo Bi-weekly topup - gold ETF , GLDM Bought but didn't top up anymore: CAM HS tech |

|

|

Yesterday, 12:47 PM Yesterday, 12:47 PM

|

Junior Member

150 posts Joined: Oct 2009 From: Klang, Selangor D.E Status: Work Everyday |

|

|

|

Yesterday, 12:49 PM Yesterday, 12:49 PM

|

Junior Member

328 posts Joined: Jan 2015 |

Fsm

|

|

|

Yesterday, 12:52 PM Yesterday, 12:52 PM

|

Senior Member

2,115 posts Joined: Apr 2013 |

wahed kira or not :X

|

|

|

Yesterday, 01:48 PM Yesterday, 01:48 PM

|

Junior Member

187 posts Joined: Dec 2017 |

|

|

|

Yesterday, 02:24 PM Yesterday, 02:24 PM

|

Junior Member

355 posts Joined: May 2022 |

QUOTE(Imbi Plaza Lot 1.28 @ Dec 12 2025, 01:48 PM) What's garbage bin? Don't just simply say. Don’t get me wrong. I am also holding crypto but not via ETF.Please read more about crypto so that you can learn, gain knowledge, and understand what it is. It’s very volatile and I can’t think of any sustainable profit over long term. It all depend on each goal. My goal is for long term interest with good capital appreciation. I can put value on stocks based on company performance. Again, didn’t meant to be negative My goal for ETF is long term over 20 years or so, don’t want to worry over high risk and volatility. Besides I also need to see the volume of the fund and the fund performance This post has been edited by RT8081: Yesterday, 02:53 PM |

|

|

Yesterday, 02:27 PM Yesterday, 02:27 PM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

355 posts Joined: May 2022 |

|

|

|

|

|

|

Yesterday, 02:33 PM Yesterday, 02:33 PM

Show posts by this member only | IPv6 | Post

#34

|

Senior Member

1,537 posts Joined: Jul 2008 |

SPYL on FSM

|

|

|

Yesterday, 02:34 PM Yesterday, 02:34 PM

Show posts by this member only | IPv6 | Post

#35

|

Senior Member

1,537 posts Joined: Jul 2008 |

QUOTE(Imbi Plaza Lot 1.28 @ Dec 12 2025, 01:48 PM) What's garbage bin? Don't just simply say. crypto etf is for those with constraints and unable to invest directly onto cryoto, such as insti..but you..why you?Please read more about crypto so that you can learn, gain knowledge, and understand what it is. |

|

|

Yesterday, 02:35 PM Yesterday, 02:35 PM

Show posts by this member only | IPv6 | Post

#36

|

Junior Member

126 posts Joined: Apr 2016 From: Melaka |

VOO

|

|

|

Yesterday, 02:50 PM Yesterday, 02:50 PM

|

Junior Member

355 posts Joined: May 2022 |

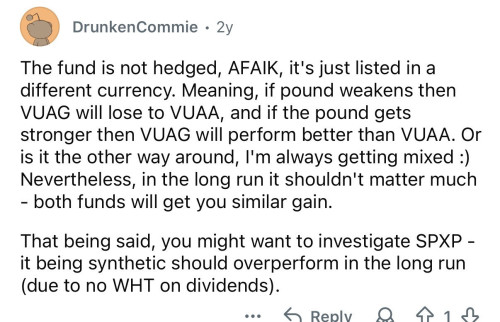

QUOTE(Knnbuccb @ Dec 12 2025, 12:29 PM) Earlier I was outside, was not able to explainVUSA is a distributing type ETF, the accumulating (auto reinvest dividend) is VUAG. QUOTE VUSA is the ticker symbol for the Vanguard S&P 500 UCITS ETF, which is a popular investment fund that tracks the performance of the S&P 500 index. Domicile: The fund is legally domiciled in Ireland. This Irish domicile makes it a UCITS (Undertakings for Collective Investment in Transferable Securities) compliant fund, which is a European regulatory framework designed for investor protection, making it accessible to many non-U.S. investors. Listing: It is listed and traded on several stock exchanges, prominently on the London Stock Exchange (LSE). Fund Type: VUSA is a distributing ETF, meaning it pays out dividends to investors as cash payments. Its accumulating counterpart, which automatically reinvests dividends, has the ticker symbol VUAG Price around USD 130.98 https://www.vanguard.co.uk/professional/pro...sd-distributing I think should be available in FSMOne or IBKR. Why buying this ETF ? I checked in Reddit and one of the commenter said this  https://www.reddit.com/r/ETFs_Europe/s/ElIRKV2d45 This post has been edited by RT8081: Yesterday, 02:56 PM |

|

|

Yesterday, 02:54 PM Yesterday, 02:54 PM

Show posts by this member only | IPv6 | Post

#38

|

Senior Member

1,238 posts Joined: Sep 2006 From: K.L |

VWRA, FWRA and CSPX bah

|

|

|

Yesterday, 02:59 PM Yesterday, 02:59 PM

|

Junior Member

355 posts Joined: May 2022 |

|

|

|

Yesterday, 03:06 PM Yesterday, 03:06 PM

|

Junior Member

355 posts Joined: May 2022 |

|

| Change to: |  0.0524sec 0.0524sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 03:05 AM |