Outline ·

[ Standard ] ·

Linear+

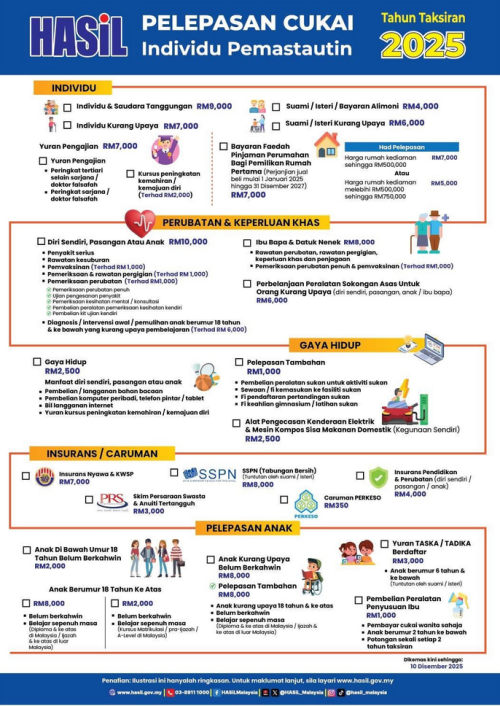

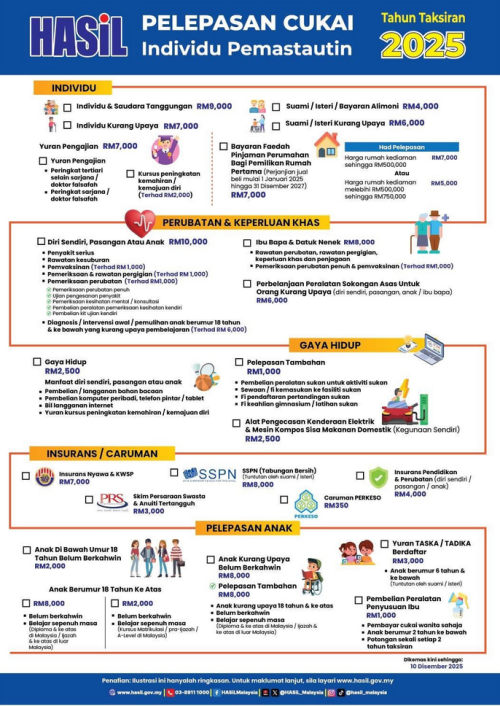

Lhdn : ya2025 tax relief sudah out, Cepat call tax agent / self plan !

|

TSnelson969

|

Dec 11 2025, 05:26 PM, updated 7d ago Dec 11 2025, 05:26 PM, updated 7d ago

|

|

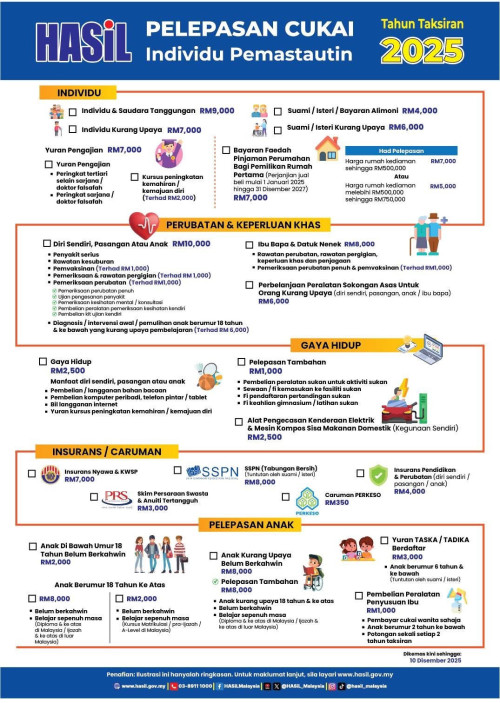

https://www.hasil.gov.my/en/individual/indi...on/tax-reliefs/QUOTE(jmas @ Dec 11 2025, 06:23 PM) | Tax Relief Category | Year of Assessment 2024 | Year of Assessment 2025 | | **Disabled Individual** | RM 6,000 | **RM 7,000** | | **Disabled Husband / Wife** | RM 5,000 | **RM 6,000** | | **Disabled Child** | RM 6,000 | **RM 8,000** | | **Medical Expenses for Parents** | Parents only.<br>Covers medical, special needs, and carer expenses. | Parents **and Grandparents**.<br>Now explicitly includes **dental treatment**. | | **Child Learning Disability Expenses** | Restricted to RM 4,000 | Restricted to **RM 6,000**<br>(Includes assessment, early intervention, and rehabilitation). | | **Medical Examination & Screening** | Restricted to RM 1,000.<br>Covers full medical exam, mental health, and COVID-19 detection. | Restricted to RM 1,000.<br>Expanded to include **purchase of self-health monitoring equipment** (e.g., glucometers, BP monitors) and **disease detection test fees**. | | **Lifestyle (Sports)** | Restricted to RM 1,000.<br>For use by self, spouse, or child. | Restricted to RM 1,000.<br>Expanded to include use by **parents**. | | **Green Technology / EV** | Restricted to RM 2,500.<br>Expenses on EV charging facilities. | Restricted to RM 2,500.<br>Expanded to include **purchase of domestic food waste composting machines**. | | **Housing Loan Interest (First Home)** | Not applicable. | **New Relief**.<br>Up to **RM 7,000** (property value ≤ RM 500k) or **RM 2,500** (property value RM 500k–750k).<br>Valid for Sale & Purchase Agreements signed between 1 Jan 2025 and 31 Dec 2027. |

This post has been edited by nelson969: Dec 11 2025, 09:55 PM This post has been edited by nelson969: Dec 11 2025, 09:55 PM

|

|

|

|

|

|

KingArthurVI

|

Dec 11 2025, 05:27 PM Dec 11 2025, 05:27 PM

|

|

Like no difference...? Anyone knows what's new this year?

|

|

|

|

|

|

teehk_tee

|

Dec 11 2025, 05:30 PM Dec 11 2025, 05:30 PM

|

|

Wake me up when individual relief move from 9k since decades ago

|

|

|

|

|

|

TSnelson969

|

Dec 11 2025, 05:31 PM Dec 11 2025, 05:31 PM

|

|

QUOTE(KingArthurVI @ Dec 11 2025, 05:27 PM) Like no difference...? Anyone knows what's new this year? Note 22 Note 4 Note 8 Note 15 Note 16c Note 2 Note 7 Note 10 Note 21 |

|

|

|

|

|

zerorating

|

Dec 11 2025, 05:32 PM Dec 11 2025, 05:32 PM

|

|

as long as i could get zakat rebate, i am happy.

|

|

|

|

|

|

Zhik

|

Dec 11 2025, 05:32 PM Dec 11 2025, 05:32 PM

|

|

EPF deduction raise to 7k ?

I am surprised. Lol.

haiz, overlooked.

This post has been edited by Zhik: Dec 11 2025, 07:21 PM

|

|

|

|

|

|

ClericKilla

|

Dec 11 2025, 05:33 PM Dec 11 2025, 05:33 PM

|

|

Parking

|

|

|

|

|

|

Tamiya

|

Dec 11 2025, 05:36 PM Dec 11 2025, 05:36 PM

|

|

QUOTE(Zhik @ Dec 11 2025, 05:32 PM) EPF deduction raise to 7k ? I am surprised. Lol. Same only |

|

|

|

|

|

pillage2001

|

Dec 11 2025, 05:39 PM Dec 11 2025, 05:39 PM

|

|

QUOTE(Zhik @ Dec 11 2025, 05:32 PM) EPF deduction raise to 7k ? I am surprised. Lol. Seems the same as the year before I think. |

|

|

|

|

|

pronester

|

Dec 11 2025, 05:41 PM Dec 11 2025, 05:41 PM

|

Getting Started

|

QUOTE(zerorating @ Dec 11 2025, 05:32 PM) as long as i could get zakat rebate, i am happy. 4K + 3K |

|

|

|

|

|

darkterror15

|

Dec 11 2025, 05:43 PM Dec 11 2025, 05:43 PM

|

|

same old and i lost 8k to claim for sspn now because only 1 side can claim.

house loan relief also cannot apply to me

|

|

|

|

|

|

lonely66

|

Dec 11 2025, 05:45 PM Dec 11 2025, 05:45 PM

|

|

tak bayar income tax = pengkhainat negara

|

|

|

|

|

|

killdavid

|

Dec 11 2025, 06:16 PM Dec 11 2025, 06:16 PM

|

|

QUOTE(darkterror15 @ Dec 11 2025, 05:43 PM) same old and i lost 8k to claim for sspn now because only 1 side can claim. house loan relief also cannot apply to me Why only one side claim sspn ? |

|

|

|

|

|

darkterror15

|

Dec 11 2025, 06:19 PM Dec 11 2025, 06:19 PM

|

|

QUOTE(killdavid @ Dec 11 2025, 06:16 PM) Why only one side claim sspn ? ask madani |

|

|

|

|

|

jmas

|

Dec 11 2025, 06:23 PM Dec 11 2025, 06:23 PM

|

|

| Tax Relief Category | Year of Assessment 2024 | Year of Assessment 2025 | | **Disabled Individual** | RM 6,000 | **RM 7,000** | | **Disabled Husband / Wife** | RM 5,000 | **RM 6,000** | | **Disabled Child** | RM 6,000 | **RM 8,000** | | **Medical Expenses for Parents** | Parents only.<br>Covers medical, special needs, and carer expenses. | Parents **and Grandparents**.<br>Now explicitly includes **dental treatment**. | | **Child Learning Disability Expenses** | Restricted to RM 4,000 | Restricted to **RM 6,000**<br>(Includes assessment, early intervention, and rehabilitation). | | **Medical Examination & Screening** | Restricted to RM 1,000.<br>Covers full medical exam, mental health, and COVID-19 detection. | Restricted to RM 1,000.<br>Expanded to include **purchase of self-health monitoring equipment** (e.g., glucometers, BP monitors) and **disease detection test fees**. | | **Lifestyle (Sports)** | Restricted to RM 1,000.<br>For use by self, spouse, or child. | Restricted to RM 1,000.<br>Expanded to include use by **parents**. | | **Green Technology / EV** | Restricted to RM 2,500.<br>Expenses on EV charging facilities. | Restricted to RM 2,500.<br>Expanded to include **purchase of domestic food waste composting machines**. | | **Housing Loan Interest (First Home)** | Not applicable. | **New Relief**.<br>Up to **RM 7,000** (property value ≤ RM 500k) or **RM 2,500** (property value RM 500k–750k).<br>Valid for Sale & Purchase Agreements signed between 1 Jan 2025 and 31 Dec 2027. |

|

|

|

|

|

|

Zhik

|

Dec 11 2025, 07:21 PM Dec 11 2025, 07:21 PM

|

|

QUOTE(Tamiya @ Dec 11 2025, 05:36 PM) QUOTE(Tamiya @ Dec 11 2025, 05:36 PM) overlooked . sorry inb4 individual relief never raised in view of inflation all the while. This post has been edited by Zhik: Dec 11 2025, 07:23 PM |

|

|

|

|

|

hanzyms

|

Dec 11 2025, 07:23 PM Dec 11 2025, 07:23 PM

|

Getting Started

|

Why for house loan interest only for agreement sign after 1jan25?

|

|

|

|

|

|

netflix2019

|

Dec 11 2025, 07:24 PM Dec 11 2025, 07:24 PM

|

|

Hiring accountant to do tax filing for me.

Prefer sexy lenglui. So can do tax "relief" for me. Hueheuehue

|

|

|

|

|

|

ramdieslow

|

Dec 11 2025, 07:28 PM Dec 11 2025, 07:28 PM

|

Getting Started

|

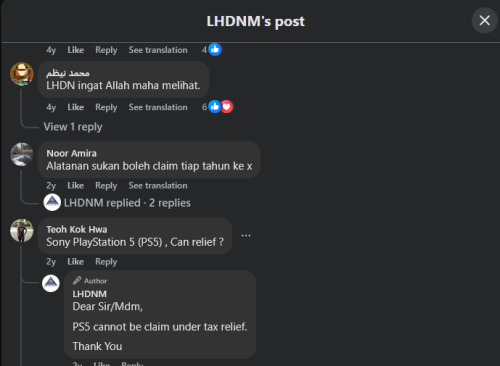

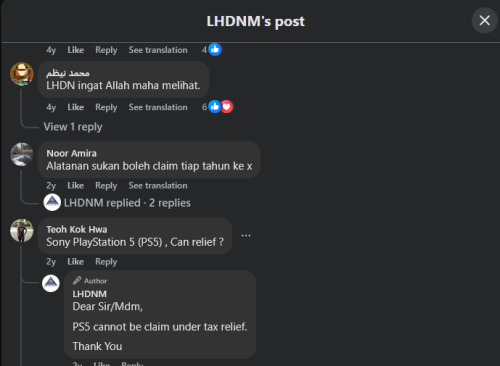

Aku nak tahu

Beli ps5 claim boleh?

Equipment for esport

|

|

|

|

|

|

TruboXL

|

Dec 11 2025, 07:35 PM Dec 11 2025, 07:35 PM

|

|

Really topkek those whose grandparents already dead

|

|

|

|

|

|

killeralta

|

Dec 11 2025, 08:01 PM Dec 11 2025, 08:01 PM

|

Getting Started

|

QUOTE(TruboXL @ Dec 11 2025, 07:35 PM) Really topkek those whose grandparents already dead Medical claim very narrow type of disease only |

|

|

|

|

|

kcchong2000

|

Dec 11 2025, 08:06 PM Dec 11 2025, 08:06 PM

|

Getting Started

|

QUOTE(ramdieslow @ Dec 11 2025, 07:28 PM) Aku nak tahu Beli ps5 claim boleh? Equipment for esport If u can make the shop owner write n invoice PS5:to PerSocom Go This post has been edited by kcchong2000: Dec 11 2025, 08:06 PM |

|

|

|

|

|

fantasy1989

|

Dec 11 2025, 08:37 PM Dec 11 2025, 08:37 PM

|

|

QUOTE(killdavid @ Dec 11 2025, 06:16 PM) Why only one side claim sspn ? QUOTE(darkterror15 @ Dec 11 2025, 06:19 PM) now is either father or mother ..total 8k right? no matter how many child |

|

|

|

|

|

TSnelson969

|

Dec 11 2025, 08:42 PM Dec 11 2025, 08:42 PM

|

|

QUOTE(ramdieslow @ Dec 11 2025, 07:28 PM) Aku nak tahu Beli ps5 claim boleh? Equipment for esport esport / ps5 is not count base on LHDN eye |

|

|

|

|

|

TSnelson969

|

Dec 11 2025, 08:42 PM Dec 11 2025, 08:42 PM

|

|

QUOTE(hanzyms @ Dec 11 2025, 07:23 PM) Why for house loan interest only for agreement sign after 1jan25? their rule ( lhdn ) , their logic , take or leave - LHDN |

|

|

|

|

|

loserguy

|

Dec 11 2025, 08:45 PM Dec 11 2025, 08:45 PM

|

|

QUOTE(killeralta @ Dec 11 2025, 08:01 PM) Medical claim very narrow type of disease only The interesting one is dental treatment  |

|

|

|

|

|

darkterror15

|

Dec 11 2025, 08:46 PM Dec 11 2025, 08:46 PM

|

|

QUOTE(fantasy1989 @ Dec 11 2025, 08:37 PM) now is either father or mother ..total 8k right? no matter how many child yup..more details on sspn lowyat page |

|

|

|

|

|

wawasan2200

|

Dec 11 2025, 09:18 PM Dec 11 2025, 09:18 PM

|

Getting Started

|

don't want pay tax to madani

1k sports relief buy what?

|

|

|

|

|

|

TSnelson969

|

Dec 11 2025, 09:21 PM Dec 11 2025, 09:21 PM

|

|

QUOTE(wawasan2200 @ Dec 11 2025, 09:18 PM) don't want pay tax to madani 1k sports relief buy what? 1.Aikido 2. Aquatics 3. American Football 4. Weightlifting 5. Badminton 6. Dart 7. Basque pelota 8. Sailing 9. Cycling 10. Canoeing 11. Skiing 12. Baseball 13. Biathlon 14. Billiard 15. Bodybuilding 16. Boccia 17. Handball 18. Netball 19. Basketball 20. Football 21. Volleyball 22. Bowling 23. Lawn bowls 24. Boules 25. Flying disc 26. Capoeira 27. Chess 28. Draughts 29. Bridge 30. Dodgeball 31. Fistball 32. Spinning top 33. Gymnastic 34. Goalball 35. Golf 36. Wrestling 37. Arm wrestling 38. Hapkido 39. Hockey 40. Ice stock sport 41. Judo 42. Ju-jitsu 43. Kabaddi 44. Karate 45. Fitness 46. Kempo 47. Kendo 48. Korfball 49. Cricket 50. Curling 51. Lacrosse 52. Tower running 53. Fencing 54. Jump rope 55. Surf 56. Skating 57. Archery 58. Climbing 59. Rowing 60. Shooting 61. Athletics 62. Orienteering 63. Paintball 64. Cheerleading 65. Modern pentathlon 66. Dragon boat 67. Pickleball 68. Table tennis 69. Polo 70. Rugby 71. Recreational 72. Roundnet 73. Sambo 74. Sepak takraw 75. Silambam 76. Silat olahraga 77. Squash 78. Softball 79. Stacking sports 80. Automobile sports 81. Powerboating sports 82. Underwater sports 83. Equestrian sports 84. Electronic sports 85. Sliding sports 86. Fishing sports 87. Dancesport 88. Traditional games 89. Air sports 90. Yoga sports 91. Taekwondo 92. Dragon and lion dance 93. Tug of war 94. Tchoukball 95. Tennis 96. Teqball 97. Throwball 98. Boxing 99. Torball 100. Triathlon 101. Vovinam 102. Woodball 103. Wushu go figure lol This post has been edited by nelson969: Dec 11 2025, 09:21 PM |

|

|

|

|

|

PeinEVO

|

Dec 11 2025, 09:26 PM Dec 11 2025, 09:26 PM

|

|

QUOTE(nelson969 @ Dec 11 2025, 09:21 PM) if i got buy electronic chess board that cost 1.5k considered can claim ah? |

|

|

|

|

|

TSnelson969

|

Dec 11 2025, 09:36 PM Dec 11 2025, 09:36 PM

|

|

QUOTE(PeinEVO @ Dec 11 2025, 09:26 PM) if i got buy electronic chess board that cost 1.5k considered can claim ah? hmmm dont know, cant advice... |

|

|

|

|

|

ramdieslow

|

Dec 11 2025, 09:44 PM Dec 11 2025, 09:44 PM

|

Getting Started

|

QUOTE(nelson969 @ Dec 11 2025, 10:21 PM) 1.Aikido 2. Aquatics 3. American Football 4. Weightlifting 5. Badminton 6. Dart 7. Basque pelota 8. Sailing 9. Cycling 10. Canoeing 11. Skiing 12. Baseball 13. Biathlon 14. Billiard 15. Bodybuilding 16. Boccia 17. Handball 18. Netball 19. Basketball 20. Football 21. Volleyball 22. Bowling 23. Lawn bowls 24. Boules 25. Flying disc 26. Capoeira 27. Chess 28. Draughts 29. Bridge 30. Dodgeball 31. Fistball 32. Spinning top 33. Gymnastic 34. Goalball 35. Golf 36. Wrestling 37. Arm wrestling 38. Hapkido 39. Hockey 40. Ice stock sport 41. Judo 42. Ju-jitsu 43. Kabaddi 44. Karate 45. Fitness 46. Kempo 47. Kendo 48. Korfball 49. Cricket 50. Curling 51. Lacrosse 52. Tower running 53. Fencing 54. Jump rope 55. Surf 56. Skating 57. Archery 58. Climbing 59. Rowing 60. Shooting 61. Athletics 62. Orienteering 63. Paintball 64. Cheerleading 65. Modern pentathlon 66. Dragon boat 67. Pickleball 68. Table tennis 69. Polo 70. Rugby 71. Recreational 72. Roundnet 73. Sambo 74. Sepak takraw 75. Silambam 76. Silat olahraga 77. Squash 78. Softball 79. Stacking sports 80. Automobile sports 81. Powerboating sports 82. Underwater sports 83. Equestrian sports 84. Electronic sports 85. Sliding sports 86. Fishing sports 87. Dancesport 88. Traditional games 89. Air sports 90. Yoga sports 91. Taekwondo 92. Dragon and lion dance 93. Tug of war 94. Tchoukball 95. Tennis 96. Teqball 97. Throwball 98. Boxing 99. Torball 100. Triathlon 101. Vovinam 102. Woodball 103. Wushu go figure lol Item 84 esport doesnt count ps5 as sport equipment? |

|

|

|

|

|

TSnelson969

|

Dec 11 2025, 09:49 PM Dec 11 2025, 09:49 PM

|

|

QUOTE(ramdieslow @ Dec 11 2025, 09:44 PM) Item 84 esport doesnt count ps5 as sport equipment?  |

|

|

|

|

|

hjh87

|

Dec 11 2025, 09:57 PM Dec 11 2025, 09:57 PM

|

|

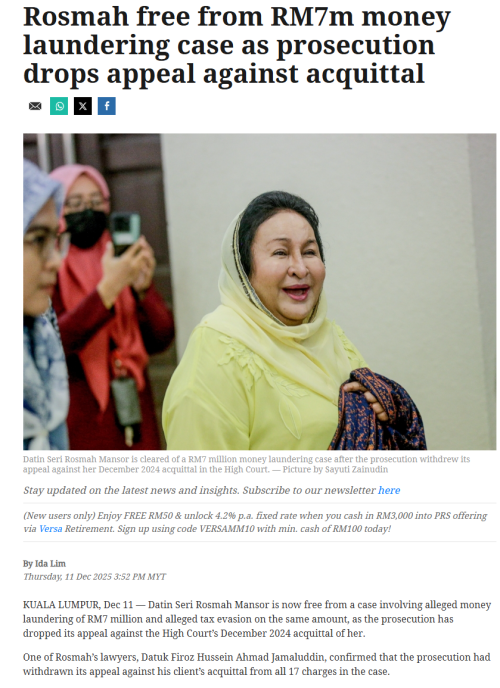

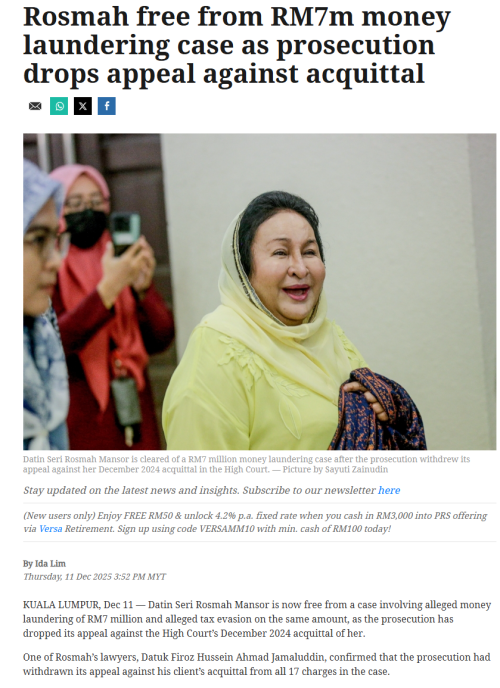

Cipek, we commoners are here stressing over what tax relief we can still claim, while this lady gets to be completely free from any tax-evasion issues. Bestnya jadi helang — tax free selama-lamanya sementara masih hidup.  |

|

|

|

|

|

Halibut

|

Dec 11 2025, 10:50 PM Dec 11 2025, 10:50 PM

|

|

I thought below 13 years old can claim tax relief for transit this year. Haha.

|

|

|

|

|

|

YahooGmail

|

Dec 11 2025, 10:54 PM Dec 11 2025, 10:54 PM

|

New Member

|

Why no pelepasan tanggungan ibubapa? Should give incentive for people taking care of parents.

|

|

|

|

|

|

Avangelice

|

Dec 11 2025, 11:13 PM Dec 11 2025, 11:13 PM

|

|

QUOTE(nelson969 @ Dec 11 2025, 05:26 PM) Don't know why you find this news when the tax relief calculators have been updated months ago |

|

|

|

|

Dec 11 2025, 05:26 PM, updated 7d ago

Dec 11 2025, 05:26 PM, updated 7d ago

Quote

Quote

0.0186sec

0.0186sec

0.75

0.75

5 queries

5 queries

GZIP Disabled

GZIP Disabled