QUOTE(jmas @ Dec 11 2025, 06:23 PM)

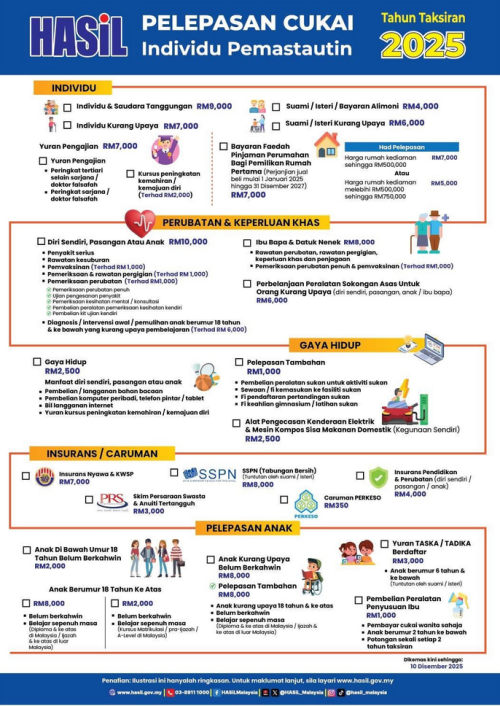

| Tax Relief Category | Year of Assessment 2024 | Year of Assessment 2025 |

| **Disabled Individual** | RM 6,000 | **RM 7,000** |

| **Disabled Husband / Wife** | RM 5,000 | **RM 6,000** |

| **Disabled Child** | RM 6,000 | **RM 8,000** |

| **Medical Expenses for Parents** | Parents only.<br>Covers medical, special needs, and carer expenses. | Parents **and Grandparents**.<br>Now explicitly includes **dental treatment**. |

| **Child Learning Disability Expenses** | Restricted to RM 4,000 | Restricted to **RM 6,000**<br>(Includes assessment, early intervention, and rehabilitation). |

| **Medical Examination & Screening** | Restricted to RM 1,000.<br>Covers full medical exam, mental health, and COVID-19 detection. | Restricted to RM 1,000.<br>Expanded to include **purchase of self-health monitoring equipment** (e.g., glucometers, BP monitors) and **disease detection test fees**. |

| **Lifestyle (Sports)** | Restricted to RM 1,000.<br>For use by self, spouse, or child. | Restricted to RM 1,000.<br>Expanded to include use by **parents**. |

| **Green Technology / EV** | Restricted to RM 2,500.<br>Expenses on EV charging facilities. | Restricted to RM 2,500.<br>Expanded to include **purchase of domestic food waste composting machines**. |

| **Housing Loan Interest (First Home)** | Not applicable. | **New Relief**.<br>Up to **RM 7,000** (property value ≤ RM 500k) or **RM 2,500** (property value RM 500k–750k).<br>Valid for Sale & Purchase Agreements signed between 1 Jan 2025 and 31 Dec 2027. |

This post has been edited by nelson969: Dec 11 2025, 09:55 PM

Dec 11 2025, 05:26 PM, updated 7d ago

Dec 11 2025, 05:26 PM, updated 7d ago

Quote

Quote 0.0144sec

0.0144sec

0.66

0.66

5 queries

5 queries

GZIP Disabled

GZIP Disabled