Outline ·

[ Standard ] ·

Linear+

IPO: BMS Holdings Berhad, IPO: BMS Holdings Berhad

|

TSkb2005

|

Nov 13 2025, 03:57 PM, updated 7d ago Nov 13 2025, 03:57 PM, updated 7d ago

|

|

IPO BMS Holdings Berhad

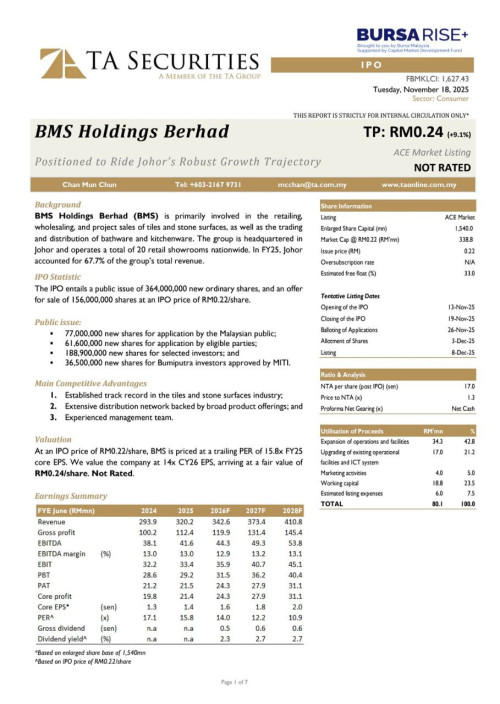

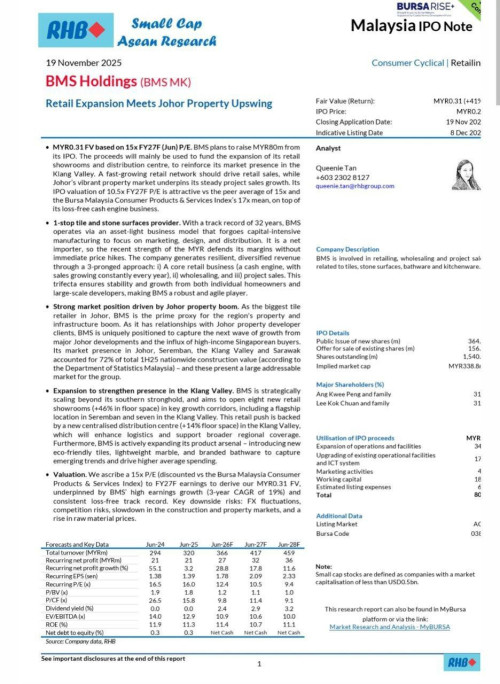

BMS Holdings Berhad, through its subsidiaries, is involved in the retailing, wholesaling, and project sales of tiles and stone surfaces across Malaysia. The company offers a wide range of products, including porcelain and ceramic tiles, natural stones like marble and granite, engineered stones, and mosaic tiles. To complement its primary offerings, the Group also provides a selection of bathware and kitchenware. The business operates through a multi-channel model, serving end-users, professionals, and resellers via its network of 20 retail showrooms under the JUBIN BMS brand, as well as engaging in project sales to contractors and property developers. The company was incorporated in Malaysia and has established a significant presence in Johor, Selangor, Kuala Lumpur, Negeri Sembilan, and Sarawak.

Market: ACE

Principal Adviser: Alliance Islamic Bank Berhad

Issuing House: Malaysian Issuing House (MIH)

Shariah Status: SC (Yes)

Listing Price: 0.22

PE Ratio: 15.83

MITI allocation: Yes

Closing Date: 19-Nov-2025

Balloting Date: 26-Nov-2025

Listing Date: 08-Dec-2025

This post has been edited by kb2005: Nov 13 2025, 03:57 PM

|

|

|

|

|

|

Fortezan

|

Nov 17 2025, 01:46 PM Nov 17 2025, 01:46 PM

|

|

The balloting date is a bit too long from the closing date. Your money will be stuck for almost a week.

|

|

|

|

|

|

nikazwa

|

Nov 17 2025, 07:37 PM Nov 17 2025, 07:37 PM

|

|

No fv so far?

|

|

|

|

|

|

Halibut

|

Nov 18 2025, 03:55 PM Nov 18 2025, 03:55 PM

|

|

|

|

|

|

|

|

IPO ADDICT

|

Nov 19 2025, 07:07 AM Nov 19 2025, 07:07 AM

|

|

BMS Holdings Berhad: Premium Margins and Multiyear Growth Story Ahead  rayden66 Publish date: Tue, 18 Nov 2025, 06:53 PM Executive Summary: BMS Holdings Berhad enters the ACE Market as one of Malaysia’s most established surface coverings retailers and distributors, backed by a 30-year operating history, twenty nationwide showrooms, and a logistics footprint exceeding 620,000 sq. ft. Its scale, brand equity and distribution reach distinguish it from traditional tile manufacturers, positioning it more as a consumer-focused retail platform rather than a cyclical building-materials counter. This distinction alone justifies a stronger valuation stance, especially given its ability to maintain high margins and consistent earnings growth. Key Investment Highlights– Financially, the Group has delivered a four-year revenue CAGR of 15.48% and PAT CAGR of 27.62%, expanding from RM207.89 million in FY2022 to RM320.18 million in FY2025. More importantly, profitability has improved steadily, with gross margins rising from 31.76% to 35.11% over the same period, driven by higher contributions from its own-brand tiles, engineered stone products and stronger pricing power in the retail and project segments. Retail gross margin now exceeds 42%, which is exceptional when compared against local manufacturers whose margins typically sit between 13% and 32%. BMS’ net margin of 6.7% also surpasses most peers in the industry comparison table, signalling a structurally higher-quality earnings profile. Potential 30 sen +     This post has been edited by IPO ADDICT: Nov 19 2025, 07:15 AM This post has been edited by IPO ADDICT: Nov 19 2025, 07:15 AM

|

|

|

|

|

|

TSkb2005

|

Nov 19 2025, 09:49 AM Nov 19 2025, 09:49 AM

|

|

Today last day to apply. Please update latest application number.

|

|

|

|

|

|

TSkb2005

|

Nov 19 2025, 01:36 PM Nov 19 2025, 01:36 PM

|

|

Nobody apply?

|

|

|

|

|

|

nexona88

|

Nov 19 2025, 02:17 PM Nov 19 2025, 02:17 PM

|

|

Macam all going for Foodie IPO lorh 🤔🧐

|

|

|

|

|

|

TSkb2005

|

Nov 19 2025, 02:20 PM Nov 19 2025, 02:20 PM

|

|

QUOTE(nexona88 @ Nov 19 2025, 02:17 PM) Macam all going for Foodie IPO lorh 🤔🧐 Super duper quiet like no applicant at all. Undersub ? |

|

|

|

|

|

TSkb2005

|

Nov 19 2025, 02:21 PM Nov 19 2025, 02:21 PM

|

|

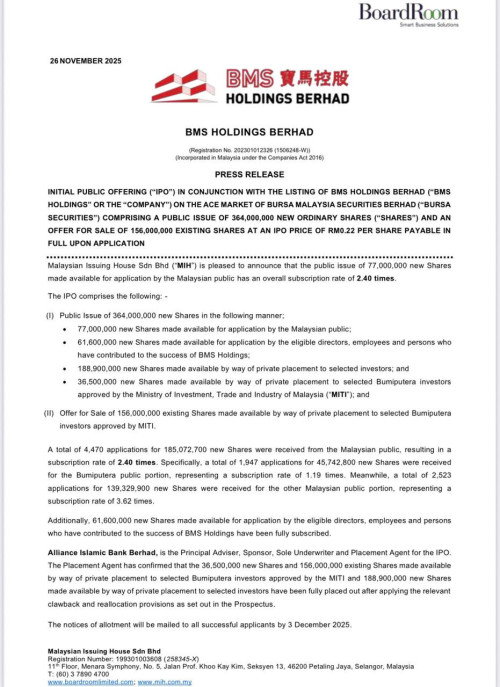

Malaysian public 77m shares up for grab.

|

|

|

|

|

|

nexona88

|

Nov 19 2025, 02:24 PM Nov 19 2025, 02:24 PM

|

|

QUOTE(kb2005 @ Nov 19 2025, 02:20 PM) Super duper quiet like no applicant at all. Undersub ? Probably only in lowyat forums Outside maybe got demand |

|

|

|

|

|

nikazwa

|

Nov 19 2025, 03:06 PM Nov 19 2025, 03:06 PM

|

|

Only one FV from TA

|

|

|

|

|

|

pisces88

|

Nov 19 2025, 04:11 PM Nov 19 2025, 04:11 PM

|

|

ok la try try 1000 lots

|

|

|

|

|

|

nikazwa

|

Nov 19 2025, 04:21 PM Nov 19 2025, 04:21 PM

|

|

Hi

Plz share number

Tqq

|

|

|

|

|

|

Halibut

|

Nov 19 2025, 04:28 PM Nov 19 2025, 04:28 PM

|

|

|

|

|

|

|

|

Halibut

|

Nov 19 2025, 04:29 PM Nov 19 2025, 04:29 PM

|

|

1493

This post has been edited by Halibut: Nov 19 2025, 04:29 PM

|

|

|

|

|

|

TSkb2005

|

Nov 19 2025, 05:01 PM Nov 19 2025, 05:01 PM

|

|

QUOTE(Halibut @ Nov 19 2025, 04:29 PM) Undersub  |

|

|

|

|

|

Halibut

|

Nov 19 2025, 05:09 PM Nov 19 2025, 05:09 PM

|

|

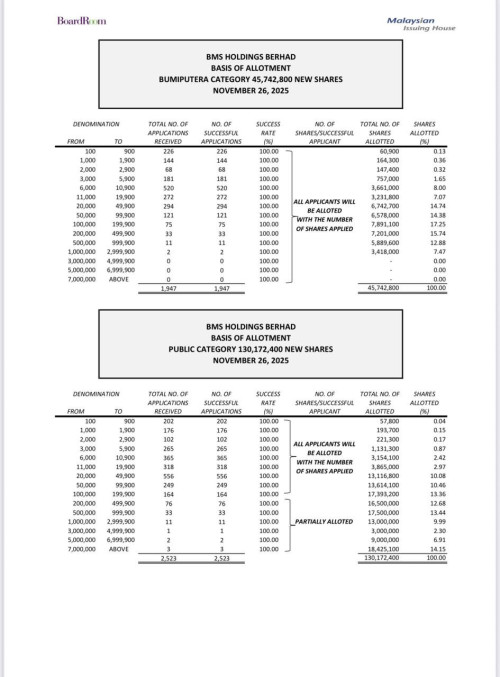

QUOTE(kb2005 @ Nov 19 2025, 05:01 PM) Undersub  Got clawback from miti. So possible full allotment for bumi. Nowadays many subscribe via mplus global and moomoo. |

|

|

|

|

|

TSkb2005

|

Nov 20 2025, 09:19 AM Nov 20 2025, 09:19 AM

|

|

QUOTE(Halibut @ Nov 19 2025, 05:09 PM) Got clawback from miti. So possible full allotment for bumi. Nowadays many subscribe via mplus global and moomoo. Like that will kena undersub if not many apply. So they will smartly distribute the allocation to make it oversub.  |

|

|

|

|

|

Halibut

|

Today, 04:26 PM Today, 04:26 PM

|

|

|

|

|

|

|

|

Halibut

|

Today, 04:26 PM Today, 04:26 PM

|

|

Edited

This post has been edited by Halibut: Today, 04:59 PM

|

|

|

|

|

Nov 13 2025, 03:57 PM, updated 7d ago

Nov 13 2025, 03:57 PM, updated 7d ago

Quote

Quote

0.0170sec

0.0170sec

0.69

0.69

5 queries

5 queries

GZIP Disabled

GZIP Disabled