Outline ·

[ Standard ] ·

Linear+

IPO: PSP Energy Berhad, IPO PSP Energy Berhad

|

TSkb2005

|

Nov 13 2025, 01:36 PM, updated 2h ago Nov 13 2025, 01:36 PM, updated 2h ago

|

|

IPO PSP Energy Berhad

PSP Energy Berhad, through its subsidiaries, is principally involved in the trading and distribution of fuel and lubricant products in Malaysia. The Group's key business segments include the wholesale trading of fuel products; the distribution of fuel products using its own fleet of road tankers and bunker vessels; and the distribution of both third-party and its own brand of lubricant products. The company has over 13 years of operating history and serves a diverse customer base across industries like wholesale petroleum trading, transportation, logistics, utilities, energy, construction, and manufacturing. Its operations are supported by its own assets, including licensed storage plants, a fleet of road tankers, and bunker vessels for ship-to-ship bunkering services.

ACE Market

IPO Price: RM 0.16 per share

Closing: 21 November 2025

Balloting: 25 November 2025

Listing: 4 December 2025

Market Capitalisation: RM 171.0m

This post has been edited by kb2005: Nov 13 2025, 03:58 PM

|

|

|

|

|

|

IPO ADDICT

|

Nov 13 2025, 01:58 PM Nov 13 2025, 01:58 PM

|

|

QUOTE(kb2005 @ Nov 13 2025, 01:36 PM) IPO PSP Energy Berhad ACE Market IPO Price: RM 0.16 per share Closing: 21 November 2025 Balloting: 25 November 2025 Listing: 4 December 2025 Market Capitalisation: RM 171.0m Really ?...16 SEN for ENERGY SECTOR IPO ?.... DEM Cheap   This post has been edited by IPO ADDICT: Nov 13 2025, 01:59 PM This post has been edited by IPO ADDICT: Nov 13 2025, 01:59 PM |

|

|

|

|

|

tomjason

|

Nov 13 2025, 05:31 PM Nov 13 2025, 05:31 PM

|

|

I m in. Pls share ref number.TQ

|

|

|

|

|

|

TSkb2005

|

Nov 13 2025, 06:05 PM Nov 13 2025, 06:05 PM

|

|

QUOTE(tomjason @ Nov 13 2025, 05:31 PM) I m in. Pls share ref number.TQ Still very early bro. |

|

|

|

|

|

Halibut

|

Nov 13 2025, 07:00 PM Nov 13 2025, 07:00 PM

|

|

Pat too thin.

|

|

|

|

|

|

Pain4UrsinZ

|

Nov 13 2025, 07:44 PM Nov 13 2025, 07:44 PM

|

|

QUOTE(IPO ADDICT @ Nov 13 2025, 01:58 PM) Really ?...16 SEN for ENERGY SECTOR IPO ?.... DEM Cheap   but distributor/reseller only ? |

|

|

|

|

|

pileepalah

|

Nov 14 2025, 06:30 PM Nov 14 2025, 06:30 PM

|

|

what is the running number

still no fv

ok lah since no fv saya sendiri kasi

should be 0.20cts ok mor

|

|

|

|

|

|

IPO ADDICT

|

Nov 14 2025, 11:15 PM Nov 14 2025, 11:15 PM

|

|

QUOTE(pileepalah @ Nov 14 2025, 06:30 PM) what is the running number still no fv ok lah since no fv saya sendiri kasi should be 0.20cts ok mor IPO mania / IPO hungry lately ....Energy sector  50X Over subscribed ? so cheap  This post has been edited by IPO ADDICT: Nov 14 2025, 11:16 PM This post has been edited by IPO ADDICT: Nov 14 2025, 11:16 PM |

|

|

|

|

|

IPO ADDICT

|

Nov 15 2025, 12:30 AM Nov 15 2025, 12:30 AM

|

|

|

|

|

|

|

|

NiiM

|

Nov 17 2025, 07:38 AM Nov 17 2025, 07:38 AM

|

New Member

|

looks very cheap this one

|

|

|

|

|

|

nexona88

|

Nov 17 2025, 09:03 AM Nov 17 2025, 09:03 AM

|

|

16c IPO...

Sure it's Buy Buy Buy mode all the way 👍

|

|

|

|

|

|

Yipeegee

|

Nov 17 2025, 12:11 PM Nov 17 2025, 12:11 PM

|

|

QUOTE(NiiM @ Nov 17 2025, 07:38 AM) looks very cheap this one Nowadays, looks are deceiving.... maybe got plastic surgery & all   |

|

|

|

|

|

TSkb2005

|

Nov 17 2025, 02:08 PM Nov 17 2025, 02:08 PM

|

|

QUOTE(NiiM @ Nov 17 2025, 07:38 AM) looks very cheap this one Low price doesn't meant cheap. Need to look at PE and competitors price as well. |

|

|

|

|

|

state of abyssmal

|

Nov 17 2025, 02:11 PM Nov 17 2025, 02:11 PM

|

|

16sen , later we all out then opening 13sen  too many ipo lately. not enough bullet  |

|

|

|

|

|

IPO ADDICT

|

Nov 17 2025, 06:17 PM Nov 17 2025, 06:17 PM

|

|

QUOTE(Yipeegee @ Nov 17 2025, 12:11 PM) Nowadays, looks are deceiving.... maybe got plastic surgery & all   hmmm.....those risk averse - even with low risk IPO then ?... better opt for ?...  WORRY FREE ( guaranteed $ ) grandma old fashioned bank FD /Fixed Deposit for peanut 3 %   after 365 days / 1 yr  This post has been edited by IPO ADDICT: Nov 17 2025, 10:10 PM This post has been edited by IPO ADDICT: Nov 17 2025, 10:10 PM |

|

|

|

|

|

tomjason

|

Nov 19 2025, 07:54 PM Nov 19 2025, 07:54 PM

|

|

TA Fv is 17 sen only.

I think this ipo tarak laku, tommorrow closing, until now silent this ipo.

This post has been edited by tomjason: Nov 20 2025, 08:49 AM

|

|

|

|

|

|

TSkb2005

|

Nov 20 2025, 09:17 AM Nov 20 2025, 09:17 AM

|

|

QUOTE(tomjason @ Nov 19 2025, 07:54 PM) TA Fv is 17 sen only. I think this ipo tarak laku, tommorrow closing, until now silent this ipo. Too many IPOs in the list. Can skip this one since not popular. But again for 16c price, i guess still many will apply. |

|

|

|

|

|

IPO ADDICT

|

Nov 20 2025, 12:46 PM Nov 20 2025, 12:46 PM

|

|

QUOTE(kb2005 @ Nov 20 2025, 09:17 AM) Too many IPOs in the list. Can skip this one since not popular. But again for 16c price, i guess still many will apply. what a cheap dirt PSP IPO for ENERGY SECTOR..@ PEANUT 16 SEN .   hmmm...potential to be CORNERED & GOLENGGG liao this ACE IPO  where as main border ORKIM IPO - ENERGY SECTOR too is PRICEY 92 SEN   This post has been edited by IPO ADDICT: Nov 20 2025, 12:53 PM This post has been edited by IPO ADDICT: Nov 20 2025, 12:53 PM |

|

|

|

|

|

tomjason

|

Nov 20 2025, 01:42 PM Nov 20 2025, 01:42 PM

|

|

QUOTE(IPO ADDICT @ Nov 20 2025, 12:46 PM) what a cheap dirt PSP IPO for ENERGY SECTOR..@ PEANUT 16 SEN .   hmmm...potential to be CORNERED & GOLENGGG liao this ACE IPO  where as main border ORKIM IPO - ENERGY SECTOR too is PRICEY 92 SEN   I think both Psp & Orkim are good quality ipo. Psp supply fuel tanker industry & bunker vessel to tanker ship eventhou PAT is low they are expanding to buy more vessel, the ipo fund not use pay bank borrowing. Orkim is main board that why mahal, the biggest logistic in msia to carry fuel for its customer PETRONAS,PETRON,Nippon gas japan etc. PNB hold 60% share when Equinas sold 40% share to become ipo.Keyfield (more or less same sector)ipo in making i think, fly on listing.. Just my 2 cent comment haha... This post has been edited by tomjason: Nov 20 2025, 02:12 PM |

|

|

|

|

|

nasT

|

Nov 20 2025, 04:13 PM Nov 20 2025, 04:13 PM

|

|

I believe fund managers are direly looking for good quality main markets companies and these coming ipo newcomers will be a boon.

|

|

|

|

|

|

IPO ADDICT

|

Nov 20 2025, 09:27 PM Nov 20 2025, 09:27 PM

|

|

MQ Trader View   Opportunities The company owns and operates the company’s own storage plants, road tankers, and bunker vessels The company has a proven track record in the industry |

|

|

|

|

|

pileepalah

|

Nov 21 2025, 11:14 AM Nov 21 2025, 11:14 AM

|

|

very quiet...ticket below 2000,

still got half day for you to consider

hope can dapat one plate of chee cheong fun

|

|

|

|

|

|

tnang

|

Nov 21 2025, 11:46 AM Nov 21 2025, 11:46 AM

|

|

i will skip all the ipo for sometime........waste the time/cash flow

|

|

|

|

|

|

nikazwa

|

Nov 21 2025, 02:46 PM Nov 21 2025, 02:46 PM

|

|

QUOTE(pileepalah @ Nov 21 2025, 11:14 AM) very quiet...ticket below 2000, still got half day for you to consider hope can dapat one plate of chee cheong fun Better than Geohan ipo right ? |

|

|

|

|

|

tomjason

|

Nov 21 2025, 03:16 PM Nov 21 2025, 03:16 PM

|

|

This ipo offer dividen 10% to 20% i read in propectus.correct me if i m wrong.

This post has been edited by tomjason: Nov 21 2025, 03:17 PM

|

|

|

|

|

|

TSkb2005

|

Nov 21 2025, 03:32 PM Nov 21 2025, 03:32 PM

|

|

QUOTE(tnang @ Nov 21 2025, 11:46 AM) i will skip all the ipo for sometime........waste the time/cash flow I have the same feeling. No mood to apply. |

|

|

|

|

|

opah1991

|

Nov 21 2025, 03:33 PM Nov 21 2025, 03:33 PM

|

New Member

|

2072 @1506hrs

|

|

|

|

|

|

IPO ADDICT

|

Nov 21 2025, 03:38 PM Nov 21 2025, 03:38 PM

|

|

QUOTE(opah1991 @ Nov 21 2025, 03:33 PM) ..is counting steadily.. Remember ....? " IPO JACKPOT to strike when LEAST EXPECTED "   This post has been edited by IPO ADDICT: Nov 21 2025, 03:38 PM This post has been edited by IPO ADDICT: Nov 21 2025, 03:38 PM |

|

|

|

|

|

TSkb2005

|

Nov 21 2025, 03:52 PM Nov 21 2025, 03:52 PM

|

|

applied some in CIMB. No is 36xx

|

|

|

|

|

|

pileepalah

|

Nov 21 2025, 04:09 PM Nov 21 2025, 04:09 PM

|

|

instead of apply 50,000 share

change my mind going for 20,000 only

no buy no hope, ada beli ada harapan

|

|

|

|

|

|

TSkb2005

|

Nov 21 2025, 04:19 PM Nov 21 2025, 04:19 PM

|

|

QUOTE(pileepalah @ Nov 21 2025, 04:09 PM) instead of apply 50,000 share change my mind going for 20,000 only no buy no hope, ada beli ada harapan I apply more and skipped Geohan. |

|

|

|

|

|

8_valensi_8

|

Nov 21 2025, 04:28 PM Nov 21 2025, 04:28 PM

|

Getting Started

|

2338

|

|

|

|

|

|

IPO ADDICT

|

Nov 22 2025, 04:49 AM Nov 22 2025, 04:49 AM

|

|

|

|

|

|

|

|

IPO ADDICT

|

Nov 22 2025, 04:49 AM Nov 22 2025, 04:49 AM

|

|

|

|

|

|

|

|

Halibut

|

Yesterday, 05:17 PM Yesterday, 05:17 PM

|

|

You need bumi friends if wanna high chance of success This post has been edited by Halibut: Yesterday, 05:18 PM |

|

|

|

|

|

TSkb2005

|

Yesterday, 05:41 PM Yesterday, 05:41 PM

|

|

No result yet?

|

|

|

|

|

|

TSkb2005

|

Yesterday, 05:42 PM Yesterday, 05:42 PM

|

|

QUOTE(Stephen_Chow @ Nov 25 2025, 02:50 PM) 5X at 16c? Gone case!  |

|

|

|

|

|

TSkb2005

|

Yesterday, 06:27 PM Yesterday, 06:27 PM

|

|

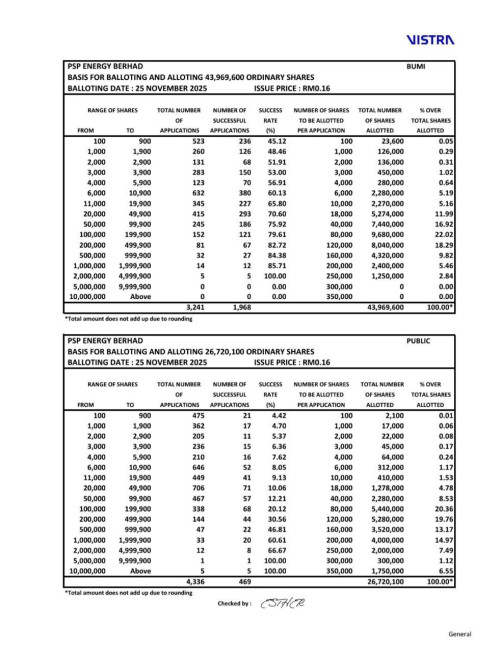

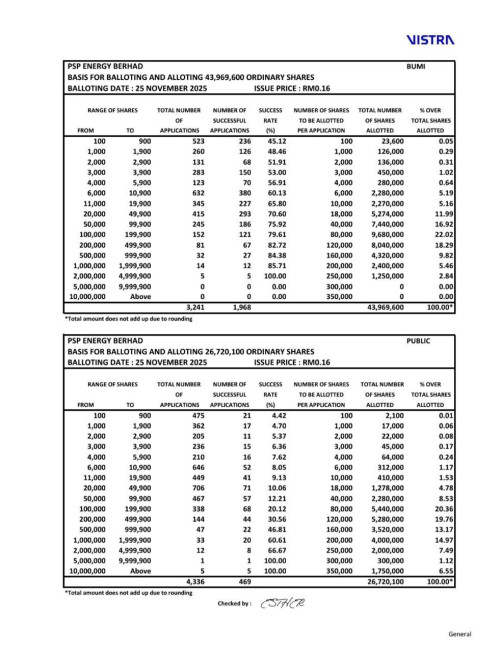

Tricor Investor & Issuing House Services Sdn Bhd wishes to announce that the 53,440,200 Issue Shares made available for application to the Malaysian Public have been oversubscribed. A total of 6,670 applications for 367,026,400 Issue Shares with a value of RM58,724,224.00 were received from the Malaysian Public, which represents an overall oversubscription rate of 5.87 times. For the Bumiputera portion, a total of 3,241 applications for 112,571,300 Issue Shares were received, which represents an oversubscription rate of 3.21 times. For the public portion, a total of 3,429 applications for 254,455,100 Issue Shares were received, which represents an oversubscription rate of 8.52 times.

|

|

|

|

|

|

TSkb2005

|

Yesterday, 06:28 PM Yesterday, 06:28 PM

|

|

|

|

|

|

|

|

pileepalah

|

Yesterday, 08:50 PM Yesterday, 08:50 PM

|

|

dunno lah tak dapat

dunno is lucky or unlucky

now applying ipo is like buying big or small

now you see and now you dont

|

|

|

|

|

|

TSkb2005

|

Yesterday, 08:57 PM Yesterday, 08:57 PM

|

|

Not alloted. Should be happy  |

|

|

|

|

|

NiiM

|

Today, 06:31 AM Today, 06:31 AM

|

New Member

|

No allocation, damn!

|

|

|

|

|

|

nasT

|

Today, 07:42 AM Today, 07:42 AM

|

|

applied within 82.7% bucket also gagal.. mesti ada game ni.

|

|

|

|

|

|

TSkb2005

|

Today, 08:58 AM Today, 08:58 AM

|

|

QUOTE(nasT @ Nov 26 2025, 07:42 AM) applied within 82.7% bucket also gagal.. mesti ada game ni. A bit strange. Big allocation and very high % but still can't get. From Bumi table, i think Miti undersub. |

|

|

|

|

Nov 13 2025, 01:36 PM, updated 2h ago

Nov 13 2025, 01:36 PM, updated 2h ago

Quote

Quote

0.0180sec

0.0180sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled