Outline ·

[ Standard ] ·

Linear+

Threshold of Item's Declared Value - Customs Tax

|

TSryder_78

|

Oct 18 2025, 12:07 PM, updated 2 months ago Oct 18 2025, 12:07 PM, updated 2 months ago

|

|

Is there a guideline on the threshold of an item's declared value that is shipped from overseas into Malaysia before it is subjected to customs tax? Does it apply to any shipping service from Singapore, USA etc. and shipments via Shopee platform shipped from China?

Say if the item's value is RM2k, new item, and seller declared it as RM500, will the customs be smart enough to detect this discrepancy?

|

|

|

|

|

|

PaperClip224

|

Oct 18 2025, 12:29 PM Oct 18 2025, 12:29 PM

|

Getting Started

|

they have a list of item prices in their hand

unless its clothes from shopee etc that one you can run lar

but, high value, electronic items - hard to escape

|

|

|

|

|

|

knwong

|

Oct 18 2025, 07:04 PM Oct 18 2025, 07:04 PM

|

|

Buy what item?

I just paid RM20 two months ago for shipping a used Canon digital camera from Japan. Item is worth RM4xx.

|

|

|

|

|

|

rootbeer

|

Oct 18 2025, 07:06 PM Oct 18 2025, 07:06 PM

|

Getting Started

|

QUOTE(ryder_78 @ Oct 18 2025, 12:07 PM) Is there a guideline on the threshold of an item's declared value that is shipped from overseas into Malaysia before it is subjected to customs tax? Does it apply to any shipping service from Singapore, USA etc. and shipments via Shopee platform shipped from China? Say if the item's value is RM2k, new item, and seller declared it as RM500, will the customs be smart enough to detect this discrepancy? include shipping cannot be above rm500. else kena tax |

|

|

|

|

|

JimbeamofNRT

|

Oct 18 2025, 07:12 PM Oct 18 2025, 07:12 PM

|

|

QUOTE(ryder_78 @ Oct 18 2025, 12:07 PM) Is there a guideline on the threshold of an item's declared value that is shipped from overseas into Malaysia before it is subjected to customs tax? Does it apply to any shipping service from Singapore, USA etc. and shipments via Shopee platform shipped from China? Say if the item's value is RM2k, new item, and seller declared it as RM500, will the customs be smart enough to detect this discrepancy? bought ip 15 pro hong kong version ( that comes with 2 physical sim holder ) last year, new set, no tax kana |

|

|

|

|

|

andyng38

|

Oct 18 2025, 07:29 PM Oct 18 2025, 07:29 PM

|

|

QUOTE(JimbeamofNRT @ Oct 18 2025, 07:12 PM) bought ip 15 pro hong kong version ( that comes with 2 physical sim holder ) last year, new set, no tax kana did u have to send it for SIRIM inspection? if not, u r very fortunate. |

|

|

|

|

|

JimbeamofNRT

|

Oct 18 2025, 07:30 PM Oct 18 2025, 07:30 PM

|

|

QUOTE(andyng38 @ Oct 18 2025, 07:29 PM) did u have to send it for SIRIM inspection? if not, u r very fortunate. nope, straight away send to my house |

|

|

|

|

|

k!nex

|

Oct 18 2025, 09:04 PM Oct 18 2025, 09:04 PM

|

|

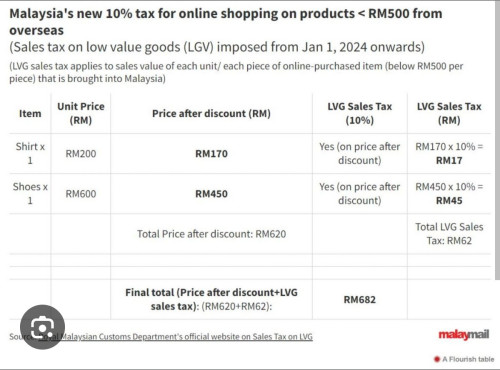

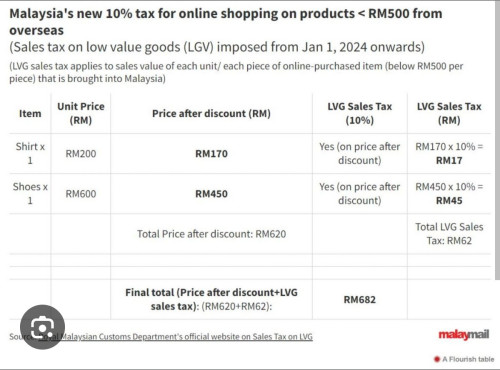

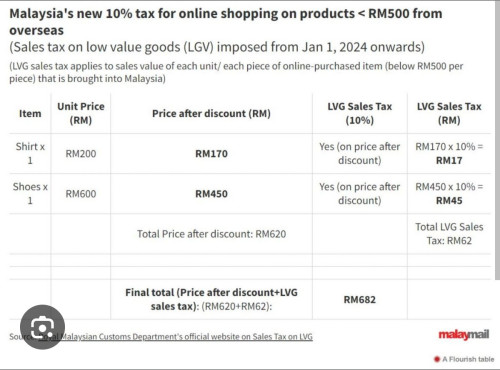

QUOTE(rootbeer @ Oct 18 2025, 07:06 PM) include shipping cannot be above rm500. else kena tax I thought last year everything kena tax already.  |

|

|

|

|

|

TRAZE99

|

Oct 18 2025, 09:09 PM Oct 18 2025, 09:09 PM

|

|

Now no more rm 500 exemption already .all low value good flate rate 10% tax.kastam also do random checking ,not everyone will kena .just few unlucky jer.

|

|

|

|

|

|

TSryder_78

|

Oct 18 2025, 10:03 PM Oct 18 2025, 10:03 PM

|

|

QUOTE(k!nex @ Oct 18 2025, 09:04 PM) I thought last year everything kena tax already.  Thanks for all responses. This is something new to me and it is good that I checked here. I am not aware of this latest regulation set in 2024 last year. For the past 25 years I have shipped many high priced items from overseas to KL, mostly hifi cables from USA back in the day and accessories from Singapore lately just after COVID-19 around 2022. The new item was priced above RM2k but was under-declared by the seller who is a registered shop with Carousel Singapore. No tax incurred. I am fortunate that many of the items shipped from overseas for the past 25 years have not been held by the customs. With this current rule with Low Goods Value tax it looks like everything below RM 500 will be subjected to 10% tax already. What about items above RM500? I presume more than 10% tax? Looks like we can forget about shipping anything from overseas into Malaysia already. What about shipping from China via Shopee platform? If the item is more than RM1k will it be held by customs and the buyer pay the tax, or Shopee will settle it? This post has been edited by ryder_78: Oct 18 2025, 10:06 PM |

|

|

|

|

|

TRAZE99

|

Oct 18 2025, 10:05 PM Oct 18 2025, 10:05 PM

|

|

QUOTE(ryder_78 @ Oct 18 2025, 10:03 PM) Thanks for all responses. This is something new to me and it is good that I checked here. I am not aware of this latest regulation set in 2024 last year. For the past 25 years I have shipped many high priced items from overseas to KL, mostly hifi cables from USA back in the day and accessories from Singapore lately just after COVID-19 around 2022. The new item was priced above RM2k but was under-declared by the seller who is a registered shop with Carousel Singapore. No tax incurred. I am fortunate that many of the items shipped from overseas for the past 25 years have been held by the customs. With this current rule with Low Goods Value tax it looks like everything below RM 500 will be subjected to 10% tax already. What about items above RM500? I presume more than 10% tax? Looks like we can forget about shipping anything from overseas into Malaysia already. What about shipping from China via Shopee platform? If the item is more than RM1k will it be held by customs and then buyer pay the tax, or Shopee will settle it? Most bigger online e platform from china already start collect 10% tax on behalf of our kastam ....so when you check out for payment ,you will notice the 10% tax.shopee ,lazada,AliExpress etc etc already implement it. But is also serve as a loophole .....buy more than rm500 also 10% shja. This post has been edited by TRAZE99: Oct 18 2025, 10:06 PM |

|

|

|

|

|

TSryder_78

|

Oct 18 2025, 10:09 PM Oct 18 2025, 10:09 PM

|

|

QUOTE(knwong @ Oct 18 2025, 07:04 PM) Buy what item? I just paid RM20 two months ago for shipping a used Canon digital camera from Japan. Item is worth RM4xx. A pair of earphones or DAC dongle though I can buy it locally or from China via Shopee, depending on the price and availability. |

|

|

|

|

|

TSryder_78

|

Oct 18 2025, 10:11 PM Oct 18 2025, 10:11 PM

|

|

QUOTE(TRAZE99 @ Oct 18 2025, 10:05 PM) Most bigger online e platform from china already start collect 10% tax on behalf of our kastam ....so when you check out for payment ,you will notice the 10% tax.shopee ,lazada,AliExpress etc etc already implement it. But is also serve as a loophole .....buy more than rm500 also 10% shja. 10% is a lot. Not worth it now to take the risk although checking can be random, especially with high priced items. I wonder how the customs will impose the tax if the item is used and not new. This post has been edited by ryder_78: Oct 18 2025, 10:13 PM |

|

|

|

|

|

TRAZE99

|

Oct 18 2025, 10:19 PM Oct 18 2025, 10:19 PM

|

|

QUOTE(ryder_78 @ Oct 18 2025, 10:11 PM) 10% is a lot. Not worth it now to take the risk although checking can be random, especially with high priced items. I wonder how the customs will impose the tax if the item is used and not new. They have the tax written book. Than you will forward and backward the email to provide documentation on your item. Process is slow might takes a few days for them to figure out the actual tax. If luckily you get very low tax ,but if opposite than can be very high taxed as well. 10% tax flate rate is to make their job easier 🤭, but if you want to risk it ,can use website that doesn't collect tax and might get through with 0% tax 😂😂. |

|

|

|

|

|

TSryder_78

|

Oct 18 2025, 10:22 PM Oct 18 2025, 10:22 PM

|

|

QUOTE(TRAZE99 @ Oct 18 2025, 10:19 PM) They have the tax written book. Than you will forward and backward the email to provide documentation on your item. Process is slow might takes a few days for them to figure out the actual tax. If luckily you get very low tax ,but if opposite than can be very high taxed as well. 10% tax flate rate is to make their job easier 🤭, but if you want to risk it ,can use website that doesn't collect tax and might get through with 0% tax 😂😂. Looks like the days of importing items without getting any tax are over. Not worth it already. Thanks |

|

|

|

|

|

k!nex

|

Oct 18 2025, 10:28 PM Oct 18 2025, 10:28 PM

|

|

QUOTE(ryder_78 @ Oct 18 2025, 10:22 PM) Looks like the days of importing items without getting any tax are over. Not worth it already. Thanks I remember i bought RAM from Amazon US. Around RM600+ , kena 5% tax . Typical for computer stuff except computer speaker all 5%. Speaker is 10% . |

|

|

|

|

|

GamersFamilia

|

Oct 18 2025, 10:45 PM Oct 18 2025, 10:45 PM

|

|

QUOTE(JimbeamofNRT @ Oct 18 2025, 07:12 PM) bought ip 15 pro hong kong version ( that comes with 2 physical sim holder ) last year, new set, no tax kana May i know how much does it cost for ip15 pro hong kong version? Bought from which selling platform? |

|

|

|

|

|

Ramjade

|

Oct 18 2025, 11:14 PM Oct 18 2025, 11:14 PM

|

|

QUOTE(ryder_78 @ Oct 18 2025, 10:22 PM) Looks like the days of importing items without getting any tax are over. Not worth it already. Thanks Just pay the tax. You cannot do anything. Pmx need our money. |

|

|

|

|

|

GHBZDK

|

Oct 18 2025, 11:55 PM Oct 18 2025, 11:55 PM

|

Getting Started

|

anything larger than the palm of your hand confirm will be detained, you need to bring invoice after that. so no, you cannot lie the price unless you collab with the seller. but the seller wont help to lie also because he cant lie to his country's inland revenue board.

you have close family in the other country then can declare anything you want...

This post has been edited by GHBZDK: Oct 18 2025, 11:57 PM

|

|

|

|

|

Oct 18 2025, 12:07 PM, updated 2 months ago

Oct 18 2025, 12:07 PM, updated 2 months ago

Quote

Quote

0.0162sec

0.0162sec

0.55

0.55

5 queries

5 queries

GZIP Disabled

GZIP Disabled