Outline ·

[ Standard ] ·

Linear+

Maybank Home Loan, Advance Payment available for Redraw

|

TSeClIpSe_R3tr0

|

Aug 20 2025, 03:17 PM, updated 4 months ago Aug 20 2025, 03:17 PM, updated 4 months ago

|

|

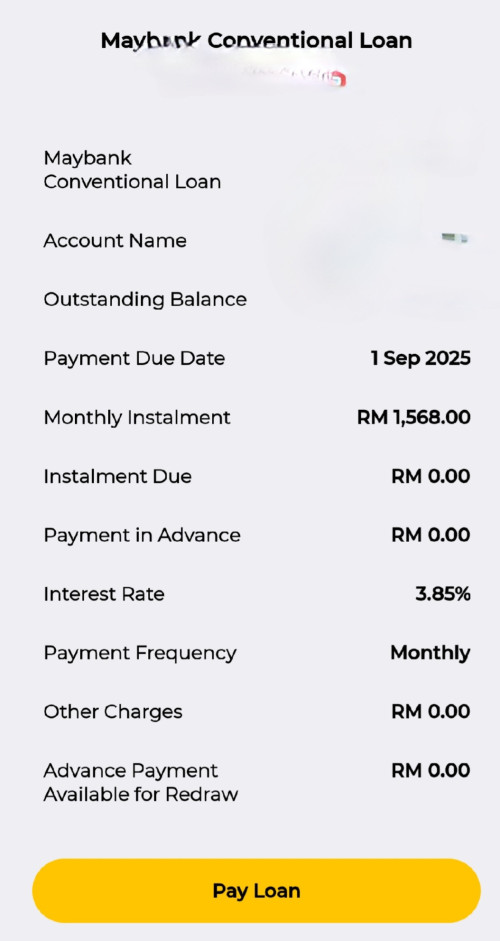

Hello all, I have took up a loan with Maybank for my house purchase. Just wanted to ask, what is this Advance Payment available for Redraw. Is this like where I pay more to reduce the interest ? Or do I need to go over to the counter to inform the banker there ? I have tried looking around before posting this question, but all seems vague. My loan is a semi flexi loan  This post has been edited by eClIpSe_R3tr0: Aug 22 2025, 01:09 PM This post has been edited by eClIpSe_R3tr0: Aug 22 2025, 01:09 PM |

|

|

|

|

|

Joe1997

|

Aug 20 2025, 03:35 PM Aug 20 2025, 03:35 PM

|

Getting Started

|

Im using PBB loan, but the full flexi loan is of similar concept.

If your mortgage is RM1580, and you pay RM2000 instead, then you'll have surplus of RM420. The extra payment will go to your loan principal, which reduces the interest.

Yes, this surplus amount can be withdrawn over the counter. I havent done it before, but i believe it needs to be done over the counter.

|

|

|

|

|

|

saintprayer

|

Aug 20 2025, 03:35 PM Aug 20 2025, 03:35 PM

|

Getting Started

|

Is this fully flexi loan? My fully flexi loan with Maybank comes in the form of current account and can withdraw anytime, without any charges.

My other semi flexi home loan account is shown same as on your screenshot. If need to withdraw can only be done at counter and there is withdrawal fee of RM50 each time withdraw. I assume the Advanced Payment are there to reduce interest though

|

|

|

|

|

|

TSeClIpSe_R3tr0

|

Aug 20 2025, 03:39 PM Aug 20 2025, 03:39 PM

|

|

QUOTE(saintprayer @ Aug 20 2025, 03:35 PM) Is this fully flexi loan? My fully flexi loan with Maybank comes in the form of current account and can withdraw anytime, without any charges. My other semi flexi home loan account is shown same as on your screenshot. If need to withdraw can only be done at counter and there is withdrawal fee of RM50 each time withdraw. I assume the Advanced Payment are there to reduce interest though Yes this is a full flexi loan (Maybank) ... if I remember correctly. Is your interface different ? |

|

|

|

|

|

TSeClIpSe_R3tr0

|

Aug 20 2025, 03:41 PM Aug 20 2025, 03:41 PM

|

|

QUOTE(Joe1997 @ Aug 20 2025, 03:35 PM) Im using PBB loan, but the full flexi loan is of similar concept. If your mortgage is RM1580, and you pay RM2000 instead, then you'll have surplus of RM420. The extra payment will go to your loan principal, which reduces the interest. Yes, this surplus amount can be withdrawn over the counter. I havent done it before, but i believe it needs to be done over the counter. Thanks for sharing the insights ! |

|

|

|

|

|

mini orchard

|

Aug 20 2025, 03:45 PM Aug 20 2025, 03:45 PM

|

|

Don't use the feature unless is near death situation. Otherwise, borrower will never finish repaying the loan 😂.

Another way for banks to earn money 🤭

|

|

|

|

|

|

Autocountstick

|

Aug 20 2025, 03:45 PM Aug 20 2025, 03:45 PM

|

|

my banker told me limited amount advance payment. if over the limit cannot reduce the interest. true?

withdraw can do online fee RM50 per transaction stated there

|

|

|

|

|

|

NooooB

|

Aug 20 2025, 03:47 PM Aug 20 2025, 03:47 PM

|

New Member

|

It looks exactly like mine, but my loan is a semi-flexi loan. Any extra amount you pay will show up as 'advance payment available to withdraw.' It will be directly deducted from your principal unless you choose to withdraw it. No need to inform them over the counter.

|

|

|

|

|

|

TSeClIpSe_R3tr0

|

Aug 20 2025, 03:51 PM Aug 20 2025, 03:51 PM

|

|

QUOTE(NooooB @ Aug 20 2025, 03:47 PM) It looks exactly like mine, but my loan is a semi-flexi loan. Any extra amount you pay will show up as 'advance payment available to withdraw.' It will be directly deducted from your principal unless you choose to withdraw it. No need to inform them over the counter. I see, thank you. If I were to do so, will my SI (Standing Instruction) continue ? or will it deduct from the advance payment ? Example my installment per month is RM 1568 - I will transfer RM 3136 -- there's a month's excess will go into advance payment Will this excess amount be used for next month's installment payment ? |

|

|

|

|

|

saintprayer

|

Aug 20 2025, 03:51 PM Aug 20 2025, 03:51 PM

|

Getting Started

|

QUOTE(eClIpSe_R3tr0 @ Aug 20 2025, 03:39 PM) Yes this is a full flexi loan (Maybank) ... if I remember correctly. Is your interface different ? Yes it does look different. My fully flexi flexi loan interface is exactly same as saving account, just that the Available Balance is my money, while Current Balance is the amount I owe (which is the outstanding loan minus the Available Balance) and is always negative. You can use the account like a normal saving account, like transfer or payment over the internet. (That is what fully flexi are for, btw) My semi flexi is just same interface with yours, just that I have some Payment in Advance there. There is no button for me to withdraw or transfer fund, and any money is locked there and I need go counter to do verification if I need to withdraw. (That is why it is “semi” flexi I guess). I didnt withdraw before though. |

|

|

|

|

|

funniman

|

Aug 20 2025, 06:28 PM Aug 20 2025, 06:28 PM

|

|

I used to have UOB fully flexible loan. There are 2 accounts, one for current account, the other is the loan account. They give you a cheque book. Basically if you extra money, just bank into current account to save loan interest. Whatever excess, you can withdraw at no interest just by writing a cheque. But if you withdraw from your loan account, then they will charge interest. It is like instant access to standby refinancing. But if you not disciplined, you be forever paying your loan.

This post has been edited by funniman: Aug 20 2025, 06:28 PM

|

|

|

|

|

|

rumahwip

|

Aug 20 2025, 08:39 PM Aug 20 2025, 08:39 PM

|

|

3.85% so low

|

|

|

|

|

|

TSeClIpSe_R3tr0

|

Aug 20 2025, 08:58 PM Aug 20 2025, 08:58 PM

|

|

QUOTE(saintprayer @ Aug 20 2025, 03:51 PM) Yes it does look different. My fully flexi flexi loan interface is exactly same as saving account, just that the Available Balance is my money, while Current Balance is the amount I owe (which is the outstanding loan minus the Available Balance) and is always negative. You can use the account like a normal saving account, like transfer or payment over the internet. (That is what fully flexi are for, btw) My semi flexi is just same interface with yours, just that I have some Payment in Advance there. There is no button for me to withdraw or transfer fund, and any money is locked there and I need go counter to do verification if I need to withdraw. (That is why it is “semi” flexi I guess). I didnt withdraw before though. By the way, just curious — for a full flexi loan, do you need to commit a fixed monthly payment? If that’s the case, then I think mine should be a semi flexi. Also, for your semi flexi loan, did the interest actually go down when you transferred in extra funds ? This post has been edited by eClIpSe_R3tr0: Aug 20 2025, 09:12 PM |

|

|

|

|

|

swing123

|

Aug 20 2025, 10:44 PM Aug 20 2025, 10:44 PM

|

Getting Started

|

Full flexi loan would come with a current account which mean extra monthly maintenance fee. Any deposit into the current account will be offset with loan principals for interest calculation, subject to a cap depending on banks, some can be up to 70%, 80% or even 100%. Withdrawal from current account has no restrictions that is why it is full flexi.

Semi flexi does not require a current account but only an independent savings account. You can transfer deposit to your mortgage account but unless you indicate it is for offsetting loan principal, or else the deposit will be just treated as advance payment to deduct your instalments due, ie not offset with loan principal for interest calculation. Also subject to offsetting cap ie 70/80/100% depends on banks. Withdrawal of deposits will be subject to terms and conditions of each bank. Also need to be mindful to monitor the deposits vs outstanding loan principal, once deposit equal to 100% then the bank will auto trigger early redemption of outstanding loan and you may incur early redemption charges depending on your loan terms. By then no reversal and if you need the loan willneed to apply for new mortgage.

I wonder if this is not cleared, ie either the mortgage officer has not explained all the facts clearly or the applicants had not ask all questions to clear doubt, why sign on loan fact sheets to accept loan offer?

|

|

|

|

|

|

swing123

|

Aug 20 2025, 10:49 PM Aug 20 2025, 10:49 PM

|

Getting Started

|

QUOTE(eClIpSe_R3tr0 @ Aug 20 2025, 08:58 PM) By the way, just curious — for a full flexi loan, do you need to commit a fixed monthly payment? If that’s the case, then I think mine should be a semi flexi. Also, for your semi flexi loan, did the interest actually go down when you transferred in extra funds ? Full or semi flexi, instalments amount remain the same. With deposit available to offset outstanding principal, interest will be lower (vs no principal offsetting deposits) and larger portion of the instalment will go to reduce your principal and assuming stagnant deposit amount and OPR, you will pay up your loan faster than original loan tenure. |

|

|

|

|

|

TSeClIpSe_R3tr0

|

Aug 21 2025, 02:14 PM Aug 21 2025, 02:14 PM

|

|

QUOTE(swing123 @ Aug 20 2025, 10:49 PM) Full or semi flexi, instalments amount remain the same. With deposit available to offset outstanding principal, interest will be lower (vs no principal offsetting deposits) and larger portion of the instalment will go to reduce your principal and assuming stagnant deposit amount and OPR, you will pay up your loan faster than original loan tenure. Thank you for the kind explanation! |

|

|

|

|

|

Joe1997

|

Aug 21 2025, 05:13 PM Aug 21 2025, 05:13 PM

|

Getting Started

|

QUOTE(eClIpSe_R3tr0 @ Aug 20 2025, 03:51 PM) Will this excess amount be used for next month's installment payment ? No, it does not. |

|

|

|

|

|

ahkit123

|

Aug 21 2025, 05:42 PM Aug 21 2025, 05:42 PM

|

|

QUOTE(eClIpSe_R3tr0 @ Aug 20 2025, 04:17 PM) Hello all, I have took up a loan with Maybank for my house purchase. Just wanted to ask, what is this Advance Payment available for Redraw. Is this like where I pay more to reduce the interest ? Or do I need to go over to the counter to inform the banker there ? I have tried looking around before posting this question, but all seems vague. My loan is a full flexi loan  don't worry, it will always be RM0.00 |

|

|

|

|

|

UncleRoger93

|

Aug 21 2025, 10:35 PM Aug 21 2025, 10:35 PM

|

Getting Started

|

QUOTE(Joe1997 @ Aug 21 2025, 05:13 PM) Let's say i have 10k in the advance payment and i skip payment for 1 month, it will automatically withdraw from the advance payment account right? |

|

|

|

|

|

swing123

|

Aug 21 2025, 11:20 PM Aug 21 2025, 11:20 PM

|

Getting Started

|

QUOTE(UncleRoger93 @ Aug 21 2025, 10:35 PM) Let's say i have 10k in the advance payment and i skip payment for 1 month, it will automatically withdraw from the advance payment account right? If full flexi and you hv 10k in current account, yes.... If semi flexi, you hv 10k in savings account that come with standing instructions for mortgage repayments, then yes. But if you have deposit the 10k to mortgage account for principal offset ie saving account balance is 0, then your skipped payment for one month wiill remain outstanding in arrears. |

|

|

|

|

Aug 20 2025, 03:17 PM, updated 4 months ago

Aug 20 2025, 03:17 PM, updated 4 months ago

Quote

Quote

0.0180sec

0.0180sec

0.90

0.90

5 queries

5 queries

GZIP Disabled

GZIP Disabled