Outline ·

[ Standard ] ·

Linear+

Bank caveat in auction property

|

mini orchard

|

Jul 26 2025, 09:23 PM Jul 26 2025, 09:23 PM

|

|

Are you sure is a caveat and not a Charge ?

Which is the foreclosure bank and which bank lodge the caveat ?

If you want better advise, upload the title search report here. You can blank out owner's details. Just want to read the 'caveat'

The foreclosure bank has the first right to the property being auction followed by the bank caveat.

The auctioned price will go towards settling the outstanding loan and if insufficient (in most cases), then the foreclosure bank will sue the borrower for the remaining and cancel the Charge so the bidder will get title to the property. This is without caveat.

The second bank caveat gets nothing, so they won't lift the caveat unless whatever money owed is settled. Meaning, the bidder must pay above the auction price to get title to the property.

This post has been edited by mini orchard: Jul 26 2025, 09:55 PM

|

|

|

|

|

|

mini orchard

|

Jul 26 2025, 09:43 PM Jul 26 2025, 09:43 PM

|

|

QUOTE(JoeYoung @ Jul 26 2025, 09:40 PM) If lodge by the same auction bank, its fine. If multiple banks then problem unless cash purchase. Ask for the Proclamation of Sales (POS) and engage agent. This guy does almost all auction(s) and his services are paid by the auctioning bank. You dont pay him anything. https://www.facebook.com/banklelong123Why would the same bank lodged a caveat ? |

|

|

|

|

|

mini orchard

|

Jul 26 2025, 10:57 PM Jul 26 2025, 10:57 PM

|

|

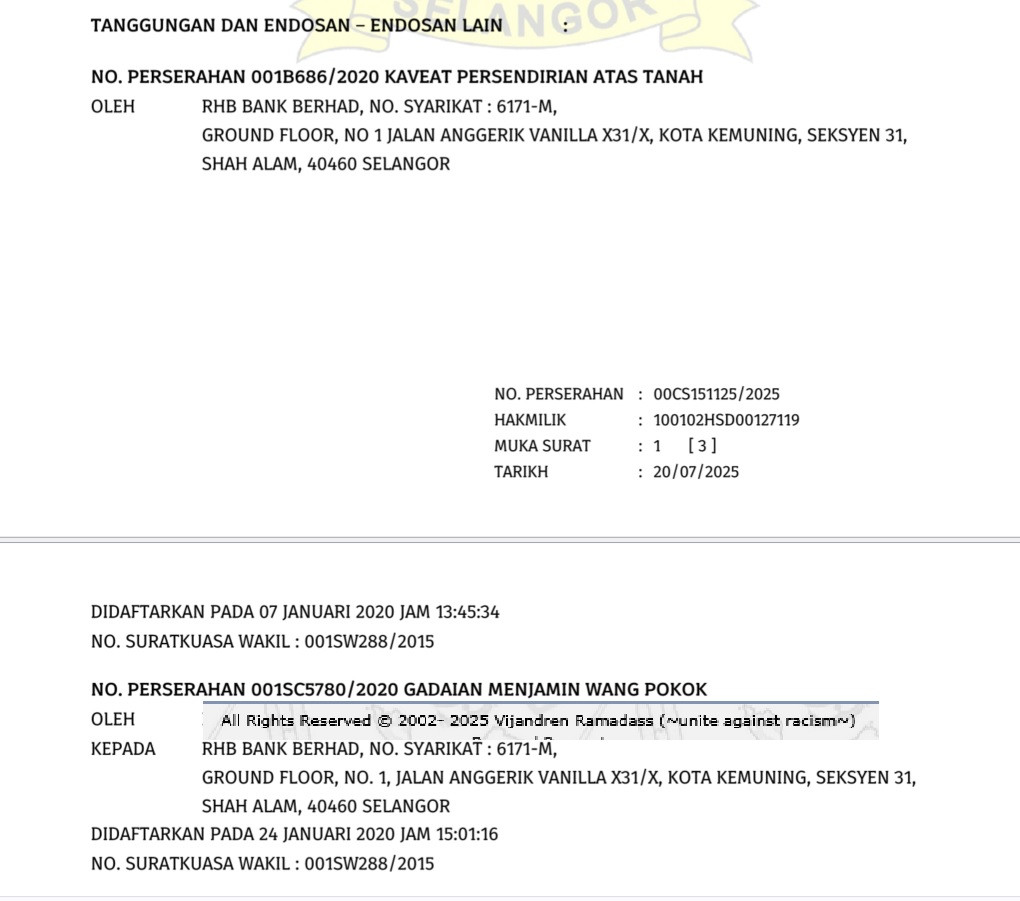

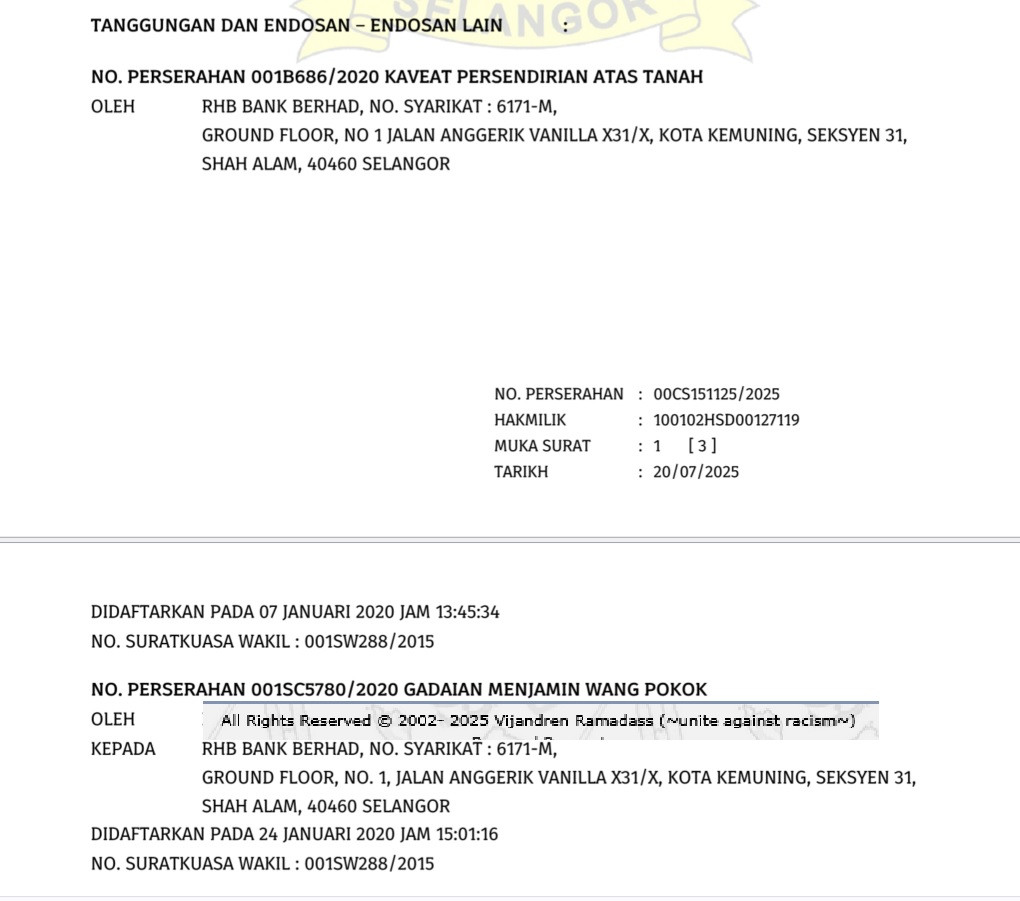

QUOTE(Porkycorgi5588 @ Jul 26 2025, 10:43 PM) this title search for current caveat owner name removed.  The caveat was lodged only few days ago. The charged is oredi a good hold on the property. When is the POS dated and the auction date ? |

|

|

|

|

|

mini orchard

|

Jul 26 2025, 11:07 PM Jul 26 2025, 11:07 PM

|

|

QUOTE(Porkycorgi5588 @ Jul 26 2025, 11:00 PM) auction date is 30 days from now. i first got POS from my property agent 19th july. what do you mean good hold on the property? A chargee (auction bank) get preference over others. Not sure why would the same bank refinance the same property when it is going into foreclosure as mentioned by another forumer's agent. Learning something new today. This post has been edited by mini orchard: Jul 26 2025, 11:38 PM |

|

|

|

|

|

mini orchard

|

Jul 26 2025, 11:30 PM Jul 26 2025, 11:30 PM

|

|

QUOTE(Porkycorgi5588 @ Jul 26 2025, 11:18 PM) If the caveator is not related to the chargee bank lar ... meaning of others 😅 This post has been edited by mini orchard: Jul 27 2025, 09:12 AM |

|

|

|

|

|

mini orchard

|

Jul 27 2025, 10:22 AM Jul 27 2025, 10:22 AM

|

|

My guess of the caveat is that the borrower might have another loan with the bank, maybe personal loan and is in default. The reason for the recent caveat, since the property is going under the hammer.

The foreclosure sum may only covers part of the housing loan and the bank has to sue the borrower for the remaining.

The caveat is indirectly asking the bid winner to settle the PL for the borrower 🤔

Unless, one can find out the outstanding PL, to bid or otherwise will be left to the bidder decision..

This post has been edited by mini orchard: Jul 27 2025, 10:33 AM

|

|

|

|

|

|

mini orchard

|

Jul 27 2025, 11:22 AM Jul 27 2025, 11:22 AM

|

|

QUOTE(Porkycorgi5588 @ Jul 27 2025, 11:15 AM) so, better call the foreclosing bank to confirm whether i need to settle their PL as well la Ask what is the reason for the caveat first because I am just guessing and what the bank wants before they remove it. This post has been edited by mini orchard: Jul 27 2025, 11:22 AM |

|

|

|

|

|

mini orchard

|

Jul 27 2025, 12:05 PM Jul 27 2025, 12:05 PM

|

|

Let me share what I did for my last auction.

It was a new vped property.

What I did ....

1. Received emailed from the developer to confirm a direct transfer to the new owner and also other money due to developer prior to handing over keys.

No title search done since still under master.

2. Received emailed confirmation from LPHS for approval to registered the property in new buyer's name prior to auction date.

3. Emailed the property mgmt to confirm outstanding maintenance fee.

4. Do site visit to confirm the actual unit no stated in the POS. Took photo of the unit front door with pos attached.

All confirmation received in writing prior to auction date.

Won the unit as a single bidder on the reserved price and was 20k above the developer's selling price.

Legal documents completed within the stipulated date in the POS but received the keys another 3 months later due to the passing the buck within depts of developer 😡

Whatever thing the bidder do with bank, developer or others, call and follow-up with email so that no disputes later.

I have to pay another 1k above the final price to the developer which is due from the first buyer before they handover the key.

For this unit, my budget for the final price is 30k above the reserved price. Luck was on my side as there was no other bidder. So use the 30k for reno 😅

Current asking price now for subsale is 60k above my purchase price. Is oredi 3.5 years now since I bought the unit. Small paper profit but most importantly no lose money 🤭

This post has been edited by mini orchard: Jul 27 2025, 12:27 PM

|

|

|

|

|

|

mini orchard

|

Jul 27 2025, 12:39 PM Jul 27 2025, 12:39 PM

|

|

QUOTE(JimbeamofNRT @ Jul 27 2025, 12:32 PM) for own stay or to flip? condo subsale price nowadays varied. but many dropped from dev's selling price Another small family home. |

|

|

|

|

Jul 26 2025, 09:23 PM

Jul 26 2025, 09:23 PM

Quote

Quote

0.0159sec

0.0159sec

0.76

0.76

6 queries

6 queries

GZIP Disabled

GZIP Disabled