1.11x oversubscribed rates 😔

» Click to show Spoiler - click again to hide... «

A1 AK Koh Group Bhd saw weak demand for its shares, with certain portions of its Bursa Malaysia ACE Market initial public offering (IPO) undersubscribed.

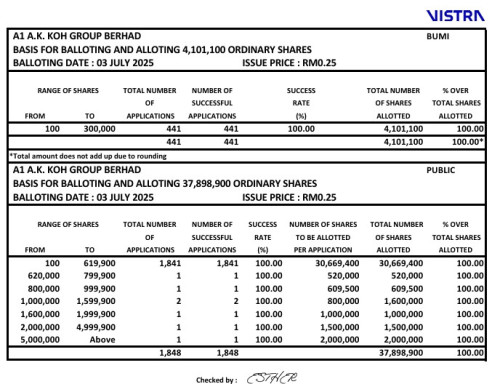

Overall demand from public investors were just slightly higher than the shares allocated, with applications totalling 46.80 million shares worth RM11.7 million, the company said in a statement. Based on 42 million shares on offer, the orders translate into an oversubscription rate of just 1.11 times.

Shares set aside for Bumiputera investors under the public portion were undersubscribed, receiving just 20% of set aside, which were then diverted to the other Malaysian public. Orders from non-Bumiputera, meanwhile, were twice the amount available for them.

Meanwhile, shares carved out for eligible persons were fully subscribed.

Private placement of new and existing shares for approved Bumiputera investors, institutional and select investors, were fully taken up after clawback and reallocation.

The notices of allotment will be posted to all successful applicants on July 10, and the listing of the company, largely known for its premixed soup spices, has been scheduled for July 11.

Founded in 1986 and based in Johor, A1 AK Koh manufactures and distributes over 340 processed food and beverage products, including snacks, noodles, seasonings, canned seafood, and drinks.

Priced at 25 sen per share, the IPO raised RM27.3 million for the company and another RM27.3 million for its sole selling shareholder A1 Koh Malaysia Sdn Bhd, the private vehicle of founder Koh Ah Kuan, his wife Lim Sok Huey, and their four children.

Upon listing, A1 AK Koh would have a market capitalisation of RM210 million, valuing the firm at nearly 18 times its most recent earnings.

The company plans to allocate RM5 million from its IPO proceeds to construct a new factory adjacent to its existing facility, and RM1.8 million to upgrade the current manufacturing plant in Senai.

A1 AK Koh will also use RM8 million of the proceeds for marketing and promotional activities, RM4 million for working capital, and RM4 million for repayment of bank borrowings. The remaining RM4.5 million will cover listing expenses.

AmInvestment Bank is the principal adviser, sponsor, underwriter, and placement agent for the IPO.

Jun 20 2025, 10:37 AM, updated 7 months ago

Jun 20 2025, 10:37 AM, updated 7 months ago

Quote

Quote

0.0204sec

0.0204sec

0.48

0.48

5 queries

5 queries

GZIP Disabled

GZIP Disabled