none of my car shorter than 9 years loan... if can i prefer to longer loan...

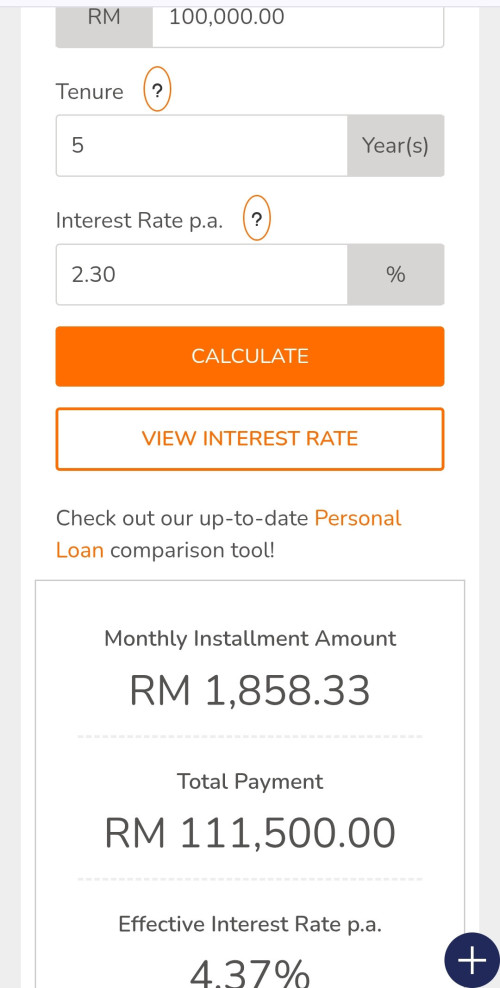

car loan interest are just 2.x% .. imagine you save in FD or EPF.. or flexi current account.. you earn more than paying back car...

that why , if loan lower than 6%, i will never go shorter... my flexi current account give me average 5~6% ... why should i go pay my loan faster???

the moment you buy car, it is depreciating... it not like house...

so your key is to lower the losses.... instead paying faster loan, keep the extra money in better return compare to your car loan...

unless you spend all without saving la

This post has been edited by stevenlee: Jun 16 2025, 03:29 PM

Jun 16 2025, 03:26 PM

Jun 16 2025, 03:26 PM

Quote

Quote

0.0255sec

0.0255sec

0.52

0.52

6 queries

6 queries

GZIP Disabled

GZIP Disabled