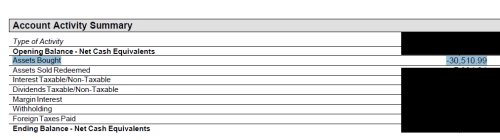

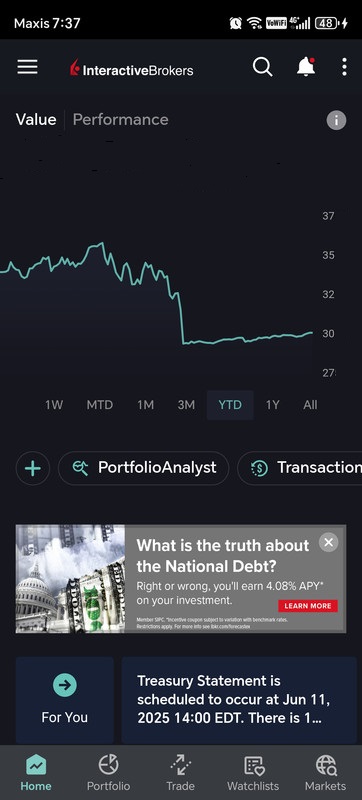

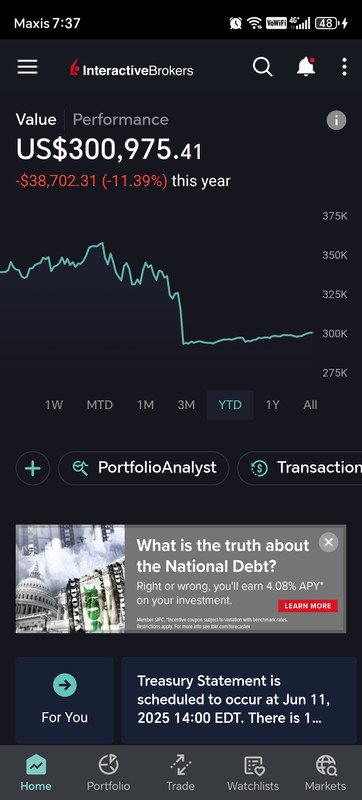

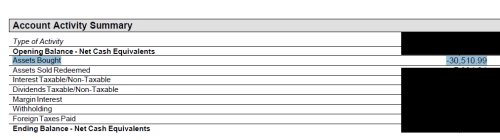

My own HUGE blunder in USD, i was walking around dazed for a week - those daze 2014 when i had a direct US trading account. Lesson learned = managed the risks and downsides, and the upsides will take care of themselves in time.

QUOTE(jay_y @ Jun 12 2025, 09:47 AM)

avoid klse stocks.. go for us stocks for better ROI

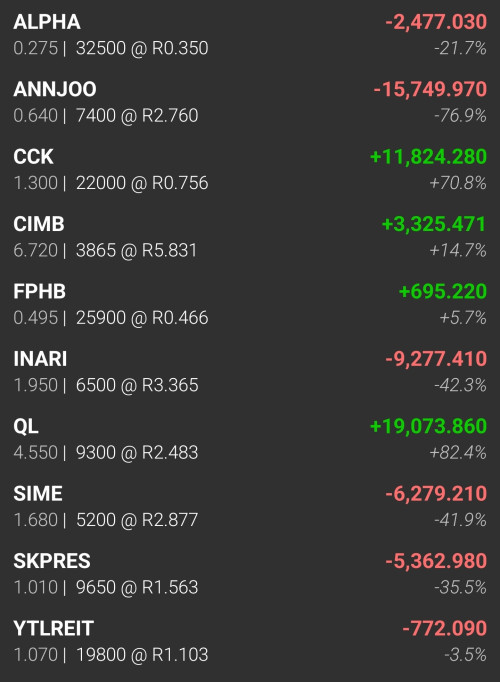

i invest in US, SG, BURSA, and HK exchanges - thus, IMHO, it depends. There are kaka hyped up stocks (Enron, WorldCom, WeWork, Theranos, SerbaDinamik, CapitalA, etc.) AND good fundamental/managed public listed businesses in any markets. Also depends on the price one pays for a good biz - over pay for good biz also can die standing

QUOTE(LDP @ Jun 18 2025, 03:40 PM)

Ur not a fool, I hv seen ppl spending 2x, 3x more than yrs on a single stock....

i'd wager it depends if the MYR50K to 200K = their monthly, yearly or multi-years' sweat and tears to build up. for some, minimum investment they make is >MYR50K, to some it's a maximum or even a far future goal.

This post has been edited by wongmunkeong: Jun 22 2025, 04:55 PM

Jun 9 2025, 11:01 PM, updated 6 months ago

Jun 9 2025, 11:01 PM, updated 6 months ago

Quote

Quote

0.0215sec

0.0215sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled